Revenues And Expenses Are Reported In The:

The accurate and transparent portrayal of financial health is the cornerstone of any organization, be it a multinational corporation or a local non-profit. A single misstep in reporting can trigger a cascade of consequences, eroding investor confidence, inviting regulatory scrutiny, and ultimately threatening the very survival of the entity.

The process by which revenues and expenses are communicated dictates how stakeholders perceive the organization’s performance and its ability to fulfill its obligations.

Failure to adhere to established guidelines can lead to severe repercussions, undermining the trust that is fundamental to successful business operations.

Understanding Financial Reporting Documents

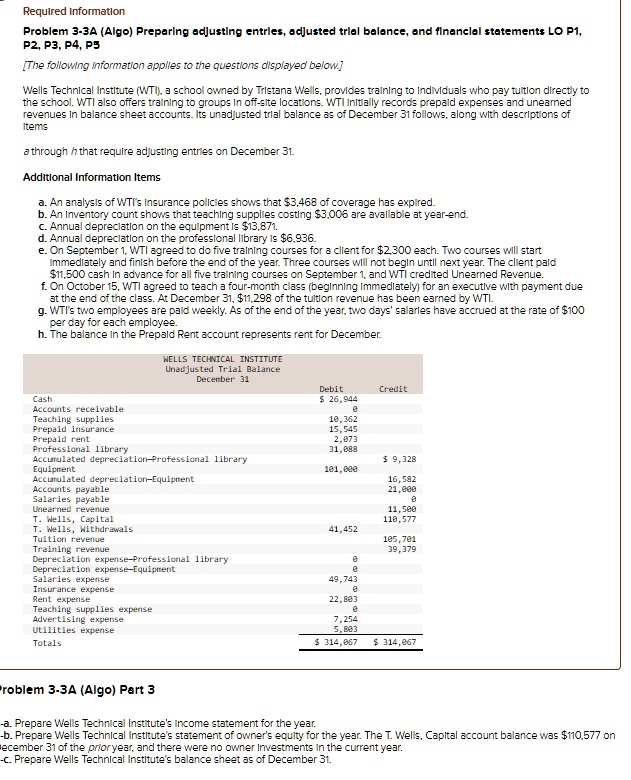

The central question guiding this article revolves around the documents in which revenues and expenses are reported. The answer lies in a constellation of financial statements, each providing a unique lens through which to assess an organization's financial standing.

The primary documents are the income statement, the balance sheet, and the statement of cash flows.

These reports are governed by established accounting principles and are typically audited by independent firms to ensure accuracy and reliability.

The Income Statement: A Snapshot of Profitability

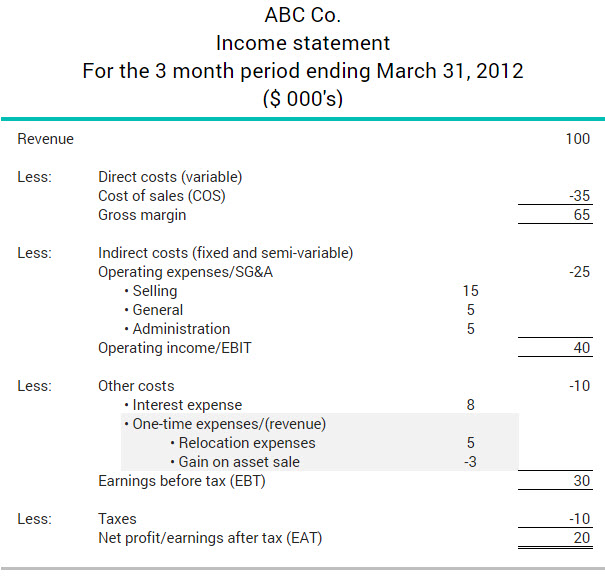

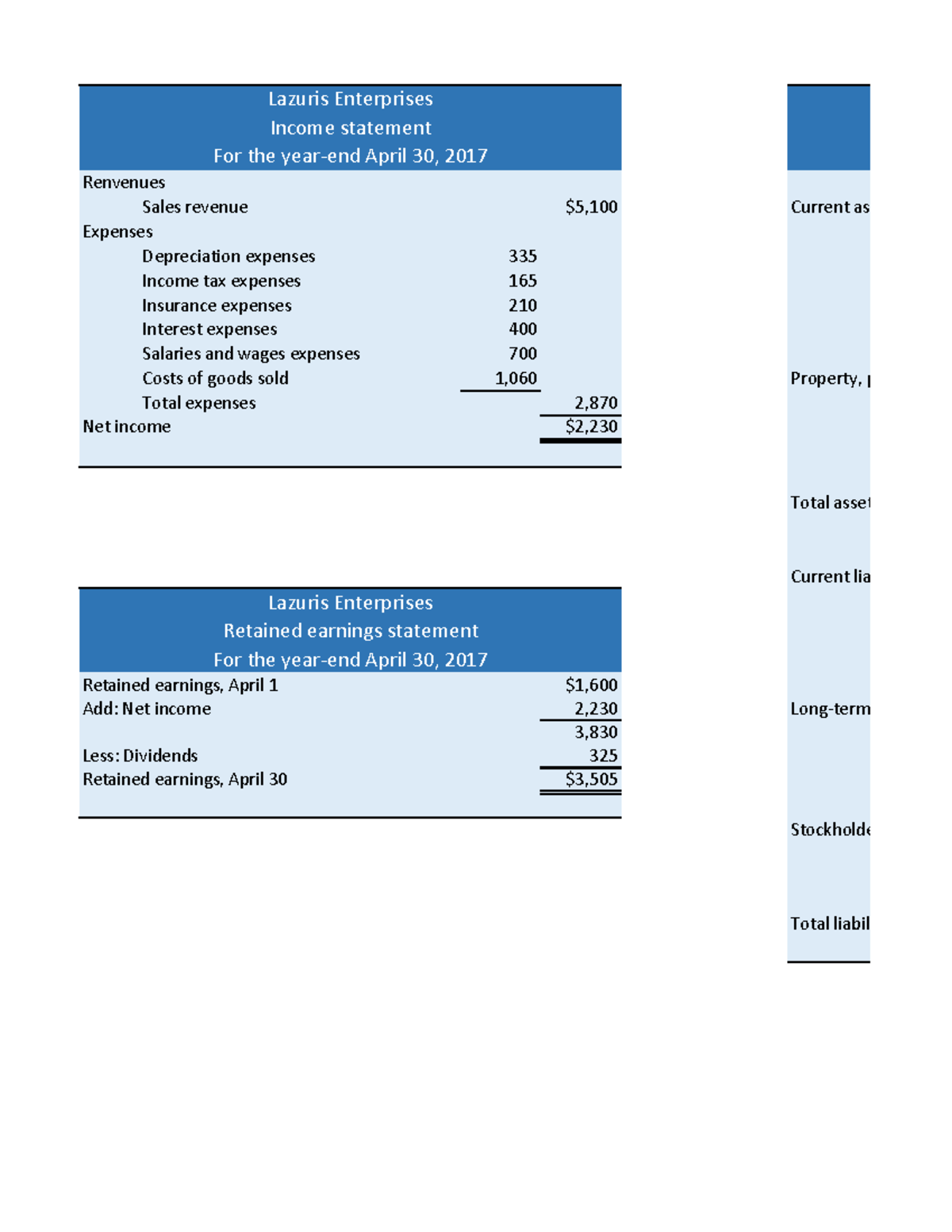

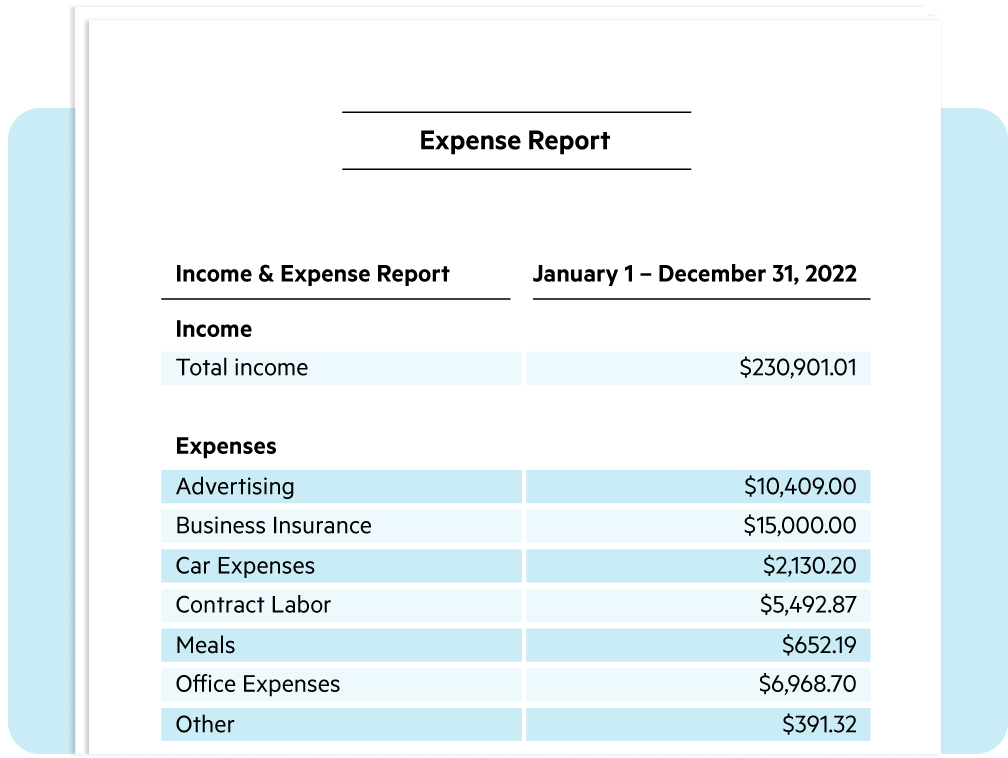

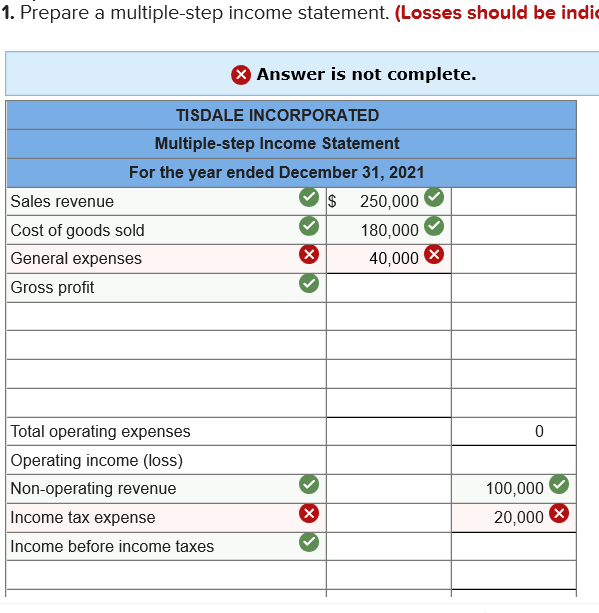

The income statement, also known as the profit and loss (P&L) statement, presents a company's financial performance over a specific period. It meticulously details the revenues earned and the expenses incurred to generate those revenues.

The formula is simple: Revenues - Expenses = Net Income (or Net Loss).

This resulting figure, whether a profit or a loss, serves as a key indicator of a company's ability to generate wealth for its owners or shareholders.

Revenues are reported at the top, showcasing the total income generated from the company's primary business activities. Common revenue streams include sales of goods, provision of services, interest income, and royalties.

Expenses are then listed, categorized by their nature, such as cost of goods sold (COGS), salaries and wages, rent, utilities, depreciation, and interest expense.

COGS represents the direct costs associated with producing the goods or services sold, and is a critical factor in determining gross profit.

The income statement typically follows a multi-step format, beginning with gross profit (Revenues - COGS), then deducting operating expenses to arrive at operating income. Interest expense and taxes are subsequently deducted to arrive at net income.

This structured approach allows stakeholders to analyze different aspects of profitability, such as operational efficiency and the impact of financing decisions.

Generally Accepted Accounting Principles (GAAP) dictate the specific formatting and content of the income statement, ensuring consistency and comparability across different companies.

The Balance Sheet: A Picture of Assets, Liabilities, and Equity

While the income statement paints a picture of financial performance over a period, the balance sheet provides a snapshot of a company's financial position at a specific point in time.

It adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

It lists what the company owns (assets), what it owes to others (liabilities), and the owners' stake in the company (equity).

Revenues and expenses indirectly impact the balance sheet through their influence on retained earnings, a component of equity. Net income from the income statement is added to retained earnings, while net losses are deducted.

This updating of retained earnings ensures that the balance sheet reflects the cumulative impact of past financial performance.

For instance, an increase in accounts receivable, an asset, could be the direct result of increased revenue from sales on credit. Similarly, an increase in accounts payable, a liability, might reflect an increase in expenses such as raw materials purchased on credit.

The balance sheet is divided into two sides. On the left, assets are listed in order of liquidity, from cash and cash equivalents to long-term assets such as property, plant, and equipment (PP&E). On the right side, liabilities are listed in order of maturity, from current liabilities such as accounts payable to long-term debt.

Equity typically includes common stock, preferred stock, and retained earnings.

Analyzing the balance sheet allows stakeholders to assess a company's solvency (ability to meet its long-term obligations), liquidity (ability to meet its short-term obligations), and financial leverage (the extent to which it relies on debt financing).

The Statement of Cash Flows: Tracking Cash Inflows and Outflows

The statement of cash flows complements the income statement and balance sheet by providing a detailed account of all cash inflows (cash coming into the company) and cash outflows (cash leaving the company) during a specific period.

It categorizes cash flows into three main activities: operating activities, investing activities, and financing activities.

This statement is crucial because it highlights a company's ability to generate cash, which is essential for funding operations, investing in growth, and repaying debt.

Cash flows from operating activities reflect the cash generated from the company's core business operations. This section starts with net income (from the income statement) and then adjusts for non-cash items such as depreciation and changes in working capital accounts (accounts receivable, inventory, accounts payable).

Cash flows from investing activities relate to the purchase and sale of long-term assets, such as PP&E and investments in other companies.

Cash flows from financing activities involve transactions related to debt and equity financing, such as borrowing money, repaying debt, issuing stock, and paying dividends.

The statement of cash flows provides insights into a company's cash management practices and its ability to generate sufficient cash to meet its obligations. It reveals whether the company is generating cash from its operations or relying on external financing to fund its activities.

A healthy company typically generates positive cash flow from operating activities, indicating that it can sustain its operations and invest in future growth. Negative cash flow from operations may signal financial distress.

The statement of cash flows is particularly useful for assessing a company's financial flexibility and its ability to adapt to changing economic conditions.

Regulatory Oversight and Compliance

The reporting of revenues and expenses is not merely a matter of internal bookkeeping. It is subject to rigorous regulatory oversight and compliance requirements.

In the United States, the Securities and Exchange Commission (SEC) is the primary regulatory body responsible for overseeing financial reporting by publicly traded companies.

The SEC requires these companies to file periodic reports, including annual reports (Form 10-K) and quarterly reports (Form 10-Q), which include audited financial statements prepared in accordance with GAAP.

The Public Company Accounting Oversight Board (PCAOB) oversees the audits of public companies to ensure that they are conducted independently and objectively.

These regulations are designed to protect investors by ensuring that financial statements are accurate, reliable, and transparent.

Failure to comply with these regulations can result in severe penalties, including fines, sanctions, and even criminal charges.

The Future of Financial Reporting

The landscape of financial reporting is constantly evolving, driven by technological advancements, globalization, and changing investor expectations.

There is a growing emphasis on incorporating non-financial information, such as environmental, social, and governance (ESG) factors, into financial reporting.

This reflects the increasing recognition that these factors can have a material impact on a company's long-term value and sustainability.

XBRL (eXtensible Business Reporting Language) is increasingly being used to standardize and automate the reporting of financial data, making it easier for investors and analysts to access and analyze information.

Real-time reporting and continuous auditing are also gaining traction, enabling stakeholders to monitor a company's financial performance more closely.

As technology continues to advance, the future of financial reporting will likely be characterized by greater transparency, accuracy, and timeliness.

Conclusion

The income statement, balance sheet, and statement of cash flows are the cornerstone documents where revenues and expenses are meticulously reported. These reports are not just internal documents but vital communication tools that provide a clear picture of financial health to stakeholders, informing critical decisions and fostering trust.

By adhering to established accounting principles and regulatory requirements, organizations can ensure that their financial reporting is accurate, reliable, and transparent, ultimately contributing to a more stable and efficient economy.

As the business environment evolves, adapting to new reporting standards and embracing technological advancements will be crucial for maintaining the integrity and relevance of financial reporting in the years to come.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)