Robotic Surgical Systems Pipeline Product Market

The robotic surgical systems market is undergoing a seismic shift, fueled by innovation and increasing demand. New players and next-generation technologies are poised to disrupt the dominance of established companies.

This article provides a snapshot of the robotic surgical systems pipeline, examining key product developments, market trends, and competitive dynamics shaping the future of minimally invasive surgery.

Market Overview

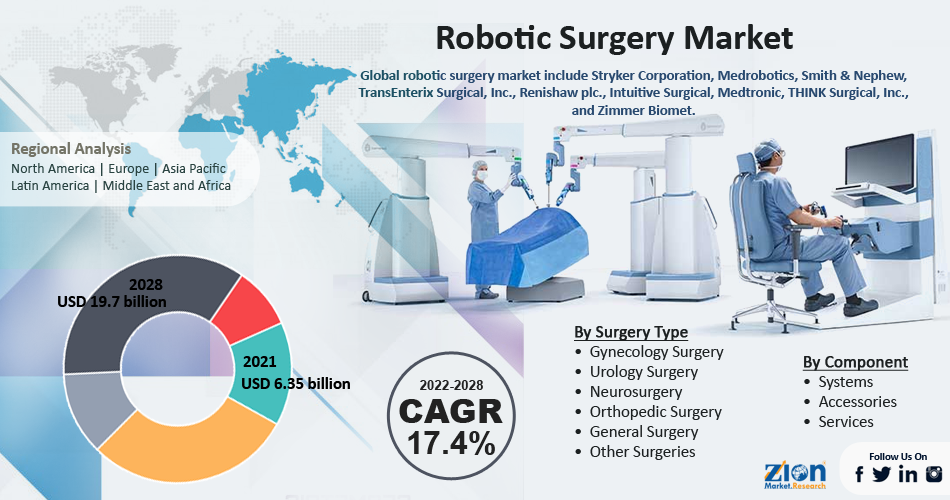

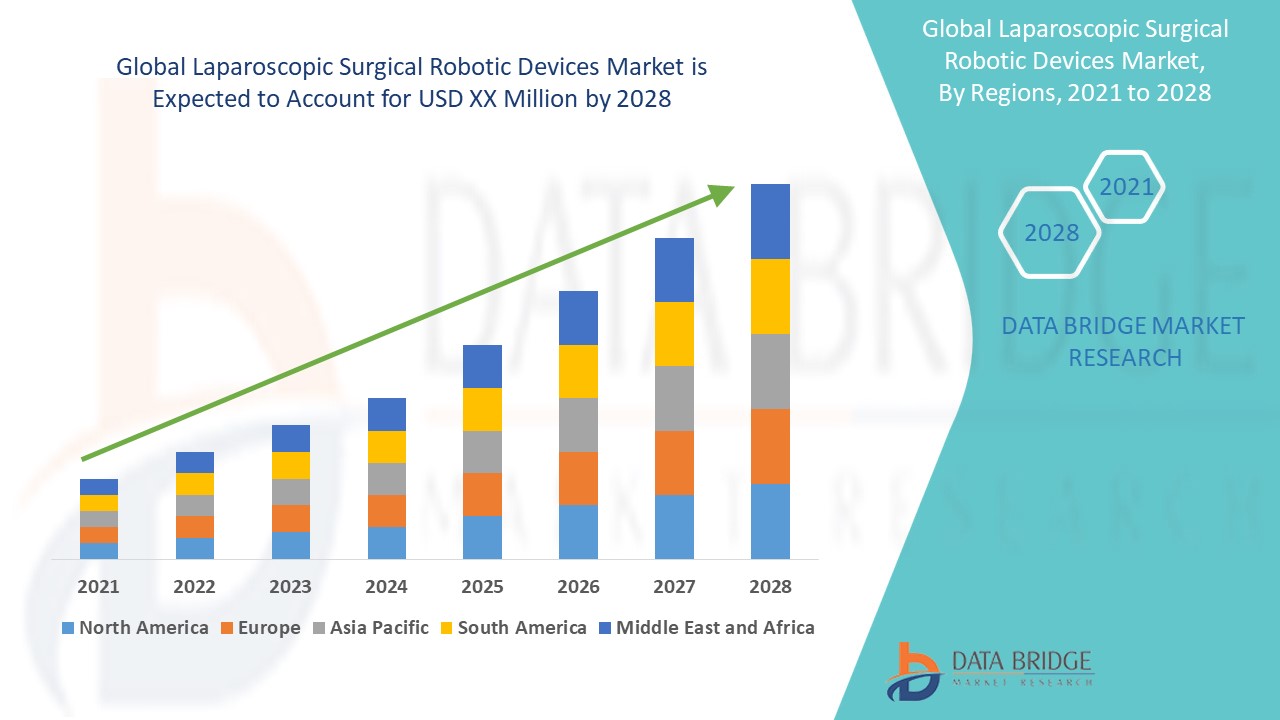

The global robotic surgical systems market is projected to reach $18.7 billion by 2028, growing at a CAGR of 9.8% from 2021, according to a report by MarketsandMarkets. This growth is driven by factors such as the rising prevalence of chronic diseases, increasing adoption of minimally invasive procedures, and technological advancements in robotics.

Intuitive Surgical, with its Da Vinci Surgical System, currently holds a significant market share. However, emerging competitors are challenging its position with innovative platforms and specialized applications.

Key Pipeline Products and Innovations

Medtronic Hugo RAS System

Medtronic's Hugo robotic-assisted surgery (RAS) system represents a major challenge to Intuitive Surgical. Hugo features independent robotic arms, offering surgeons greater flexibility and a more open surgical field.

The system has gained regulatory approvals in several regions, including Europe, Australia, and Canada. Medtronic is strategically positioning Hugo to compete in markets where Da Vinci's penetration is lower.

Johnson & Johnson Ottava

Johnson & Johnson's Ottava is another highly anticipated robotic surgical system. Ottava, utilizing a modular design, integrates advanced visualization, instrumentation, and artificial intelligence (AI).

While Ottava's development timeline experienced delays, Johnson & Johnson remains committed to its launch. Clinical trials are underway, with a focus on general surgery and gynecological procedures.

CMR Surgical Versius

CMR Surgical's Versius is a smaller, more versatile robotic system designed for a wider range of surgical procedures. Versius utilizes a unique bio-mimicking wrist joint, providing surgeons with enhanced dexterity and control.

Versius is commercially available in Europe, Australia, and parts of Asia. The company is actively expanding its global presence and focusing on high-volume procedures, such as hernia repair and colorectal surgery.

Other Notable Players

Several other companies are developing innovative robotic surgical systems. These include Titan Medical, Asensus Surgical (formerly TransEnterix), and smaller startups focused on niche applications.

Titan Medical is developing the Enos single-access robotic surgical system. Asensus Surgical is promoting its Senhance surgical system, emphasizing augmented intelligence and haptic feedback.

Market Trends and Challenges

The robotic surgical systems market is witnessing a shift towards smaller, more versatile systems. The shift makes these systems accessible to a wider range of hospitals and surgeons.

There's also an increasing focus on integrating AI and machine learning into robotic surgery. AI enables real-time image analysis and surgical guidance.

Despite the positive outlook, challenges remain. High initial costs, the need for specialized training, and limited reimbursement policies can hinder adoption.

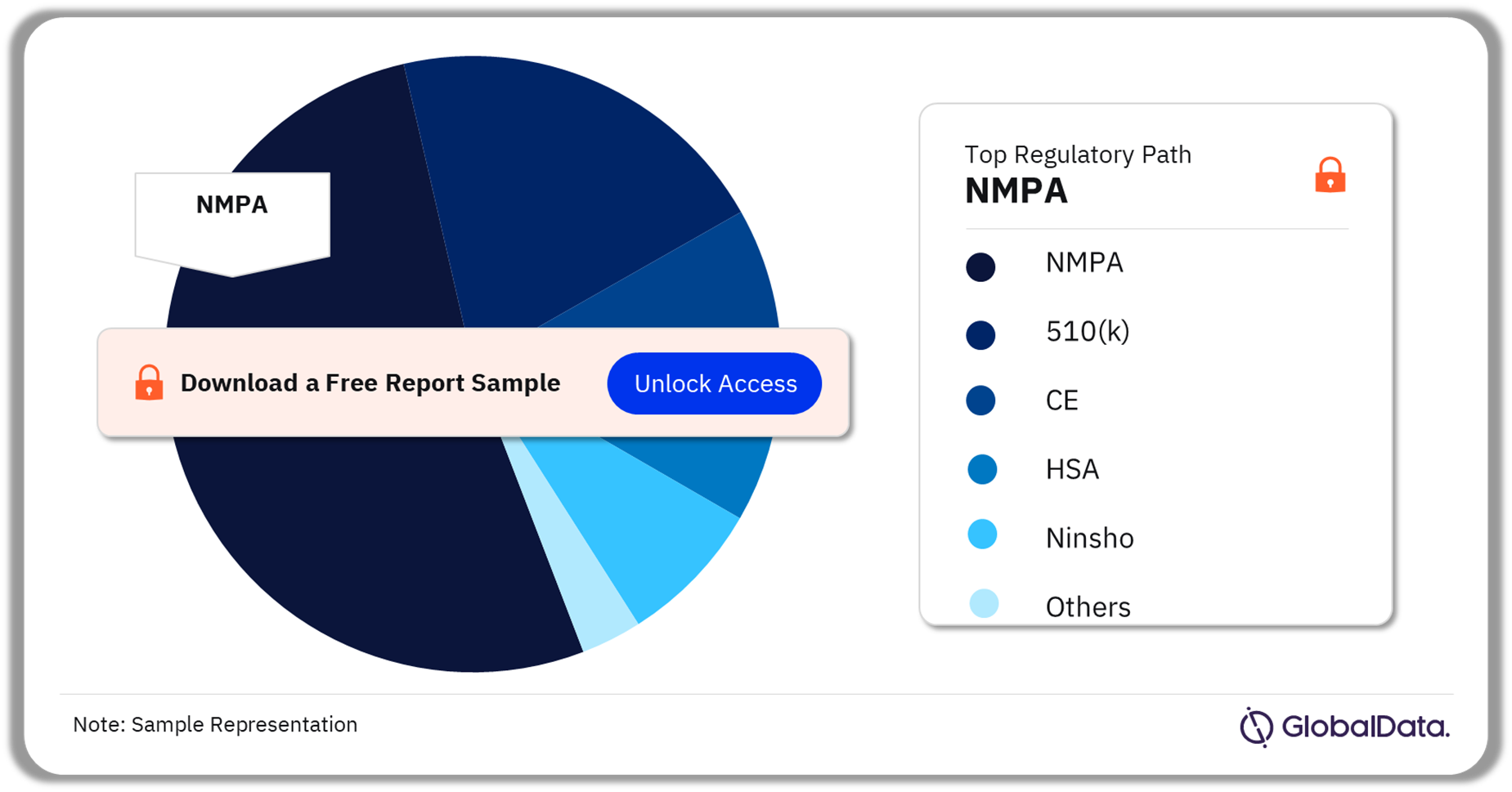

Regulatory Landscape

The regulatory pathway for robotic surgical systems varies across different regions. The FDA in the United States and the EMA in Europe require rigorous clinical trials and premarket approval.

Companies must demonstrate the safety and efficacy of their systems. They also need to show that they meet stringent quality control standards.

Competitive Dynamics

The robotic surgical systems market is becoming increasingly competitive. New players are entering the market, challenging the dominance of Intuitive Surgical.

Competition is driving innovation and price pressures. This dynamic ultimately benefits patients and healthcare providers.

Conclusion

The robotic surgical systems pipeline is robust, with numerous innovative products poised to enter the market. These technologies promise to enhance surgical precision, improve patient outcomes, and expand access to minimally invasive procedures.

Ongoing clinical trials and regulatory reviews will determine the timeline for commercialization. The industry expects continued innovation and market disruption in the years to come.