Safeguard Card Reviews Consumer Reports Complaints

A wave of discontent is building around Safeguard Card, a service promising protection against credit card fraud and identity theft. Consumers are increasingly voicing concerns, and recent reports from Consumer Reports have amplified these complaints, painting a picture of potentially misleading marketing and questionable value.

This article delves into the heart of the controversy surrounding Safeguard Card. It examines the specific criticisms highlighted in Consumer Reports, analyzes the nature of consumer complaints, and explores whether the service delivers on its promises of robust protection, offering a balanced perspective and assessing the future of Safeguard Card in the face of mounting scrutiny.

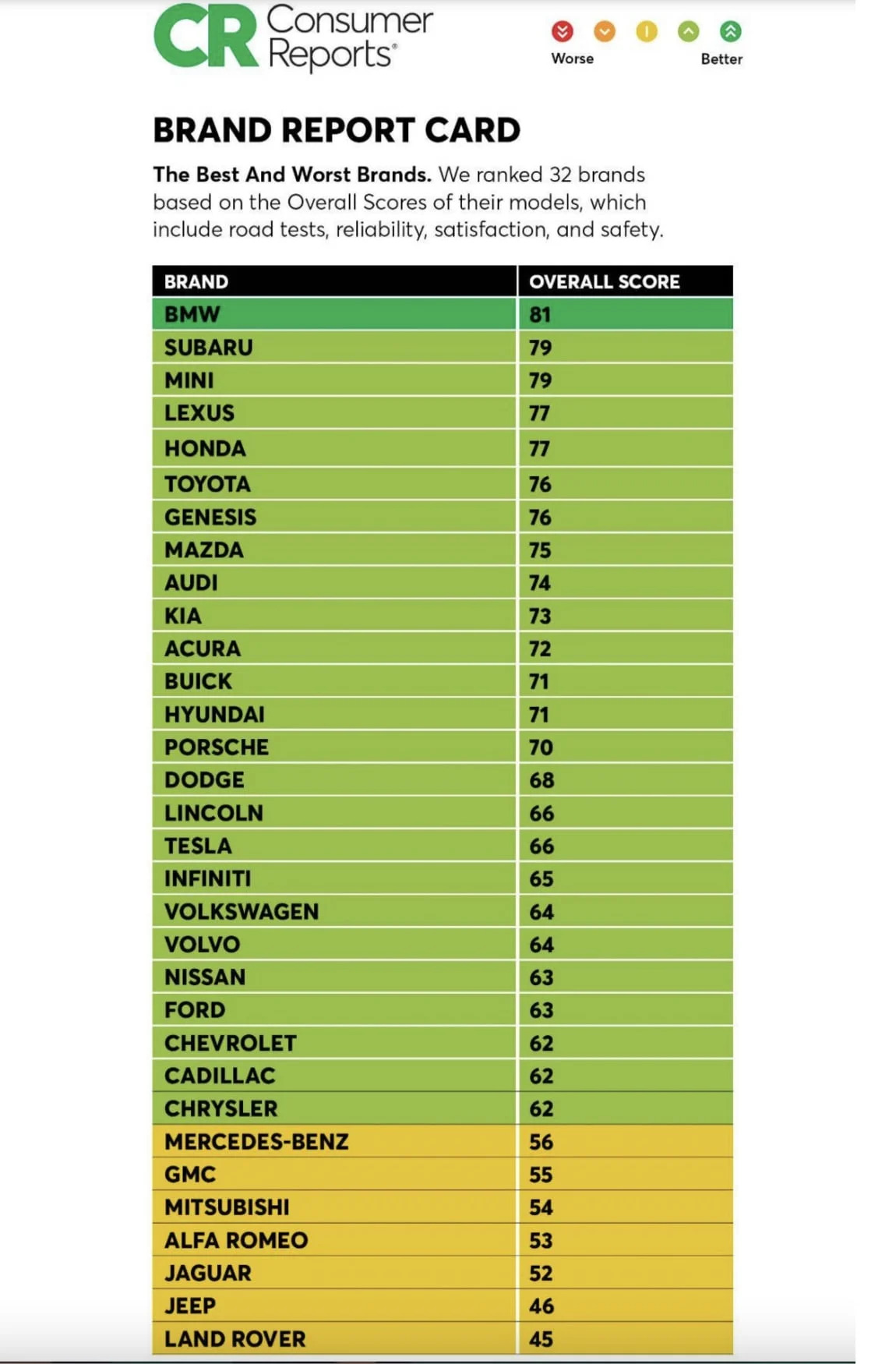

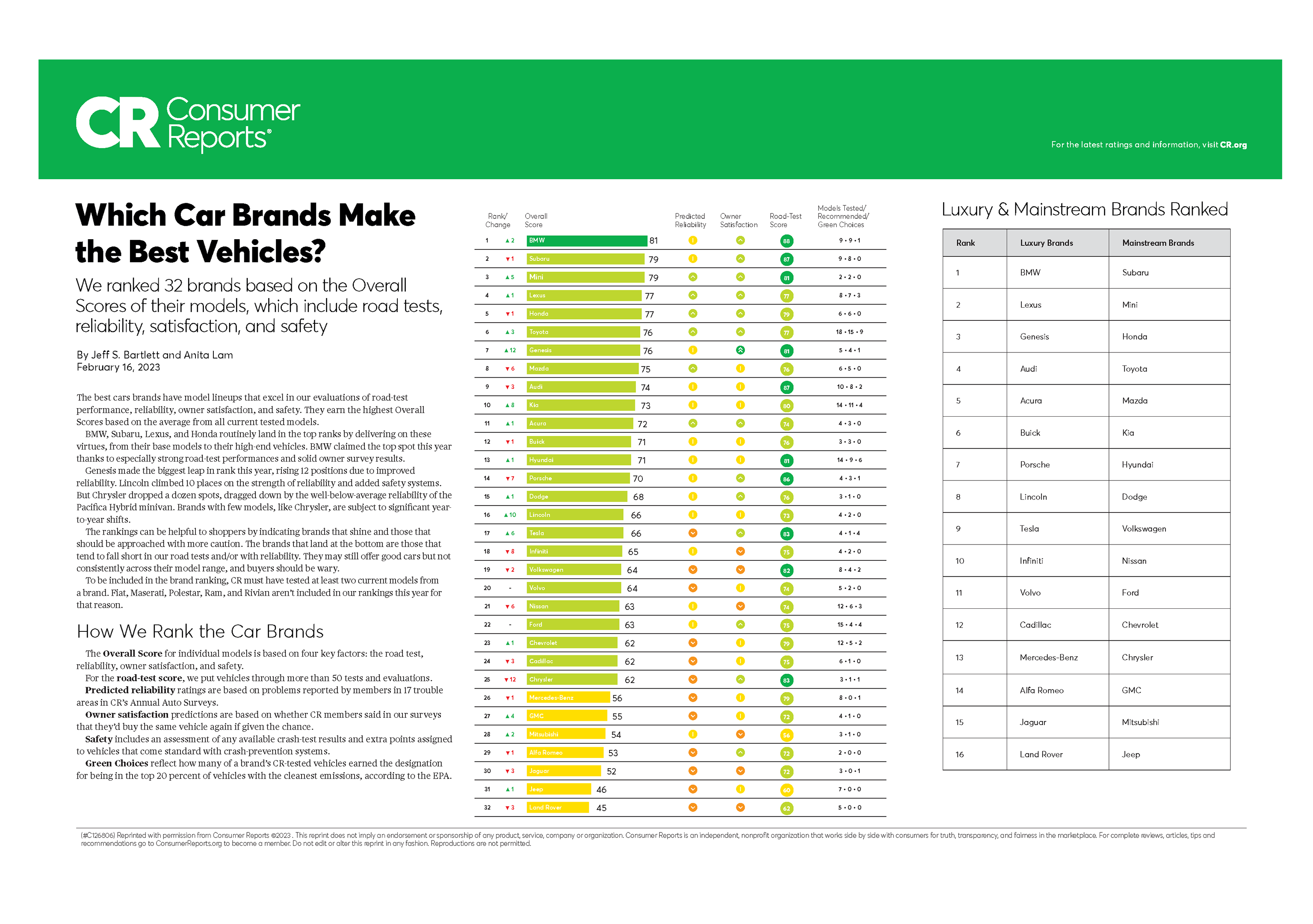

Consumer Reports' Findings: A Critical Assessment

Consumer Reports, a non-profit organization renowned for its objective product testing and consumer advocacy, recently published a scathing review of Safeguard Card. The report questions the necessity of the service, given the existing protections offered by credit card companies and federal law.

Specifically, the report argues that many of the benefits touted by Safeguard Card are already provided to consumers free of charge. These include zero-liability policies for unauthorized credit card charges and free credit reports.

Consumer Reports further suggests that the cost of Safeguard Card outweighs its potential benefits for most consumers. They emphasize that consumers should carefully consider whether the service offers any additional value beyond what they already receive.

Mounting Consumer Complaints: A Common Thread

Beyond the Consumer Reports assessment, a significant number of consumers have filed complaints regarding Safeguard Card. These complaints, often shared on online forums and with consumer protection agencies, reveal a consistent pattern of dissatisfaction.

Many consumers allege that they were misled about the true cost of the service. They claim to have been enrolled without explicit consent or with unclear explanations of recurring charges.

Another frequent complaint concerns the difficulty of canceling the service. Consumers report facing obstacles and delays when attempting to terminate their subscriptions, leading to continued unwanted charges.

"I was charged for a service I never authorized," claims one disgruntled customer. "And when I tried to cancel, they made it nearly impossible."

Analyzing Safeguard Card's Offerings: Value or Redundancy?

To understand the validity of these criticisms, it is essential to analyze the specific services offered by Safeguard Card. The company typically promises protection against credit card fraud, identity theft monitoring, and assistance with resolving fraudulent charges.

While these services may sound appealing, it is crucial to remember that credit card companies are legally required to protect consumers from unauthorized charges. Under the Fair Credit Billing Act, consumers are generally only liable for a maximum of $50 in fraudulent charges, and most companies waive this fee entirely.

Furthermore, free credit monitoring services are readily available from various sources, including credit bureaus and financial institutions. These services often provide similar alerts and protection as Safeguard Card, but without the additional cost.

Identity theft monitoring is another common offering, but its effectiveness is often debated. While some services may alert consumers to potential threats, they cannot prevent identity theft from occurring in the first place. Prevention is key.

Perspectives: Safeguard Card's Response

In response to the criticisms, Safeguard Card has generally maintained that its services offer valuable protection and peace of mind. The company argues that its proactive monitoring and assistance can help consumers detect and resolve fraudulent activity more quickly and efficiently.

Safeguard Card may also emphasize its customer service capabilities, claiming that its representatives provide personalized support and guidance to victims of fraud. This support is a key differentiator.

However, the company has faced challenges in substantiating these claims and addressing the concerns raised by Consumer Reports and individual consumers. Transparency is crucial.

The Role of Regulation and Consumer Advocacy

The controversy surrounding Safeguard Card highlights the importance of consumer protection regulations and the role of advocacy organizations. These entities play a vital part in holding companies accountable and ensuring that consumers are treated fairly.

Consumer protection agencies, such as the Federal Trade Commission (FTC), have the authority to investigate and prosecute companies engaged in deceptive or unfair business practices. These agencies can levy fines and require companies to modify their practices.

Consumer advocacy groups, like Consumer Reports, also play a crucial role by providing independent research and educating consumers about their rights. This ensures the consumers are always aware.

Looking Ahead: The Future of Safeguard Card

The future of Safeguard Card remains uncertain in the face of mounting criticism and regulatory scrutiny. The company may need to make significant changes to its marketing practices and service offerings to regain consumer trust.

It is crucial for consumers to carefully evaluate the benefits and costs of any subscription service, including Safeguard Card, before enrolling. Understanding existing credit card protections and exploring free alternatives is essential.

Ultimately, the success of Safeguard Card will depend on its ability to demonstrate genuine value to consumers and address the concerns raised by Consumer Reports and the broader public. Rebuilding trust is key.