Sales Revenues Are Usually Considered Earned When

Imagine a bustling bakery, the aroma of freshly baked bread swirling in the air. Customers line up, eager to exchange their hard-earned money for a taste of the baker's artistry. But when exactly does the bakery "earn" that revenue? Is it when the customer places the order, when the bread is pulled from the oven, or when the money changes hands? The answer, in the world of accounting, is more nuanced than you might think.

Understanding when sales revenues are considered earned is a cornerstone of financial accounting. This principle, central to accurate financial reporting, dictates when a company can recognize revenue on its income statement. It's not merely about receiving cash; it's about the transfer of goods or services and the associated risks and rewards.

The Core Principle: Revenue Recognition

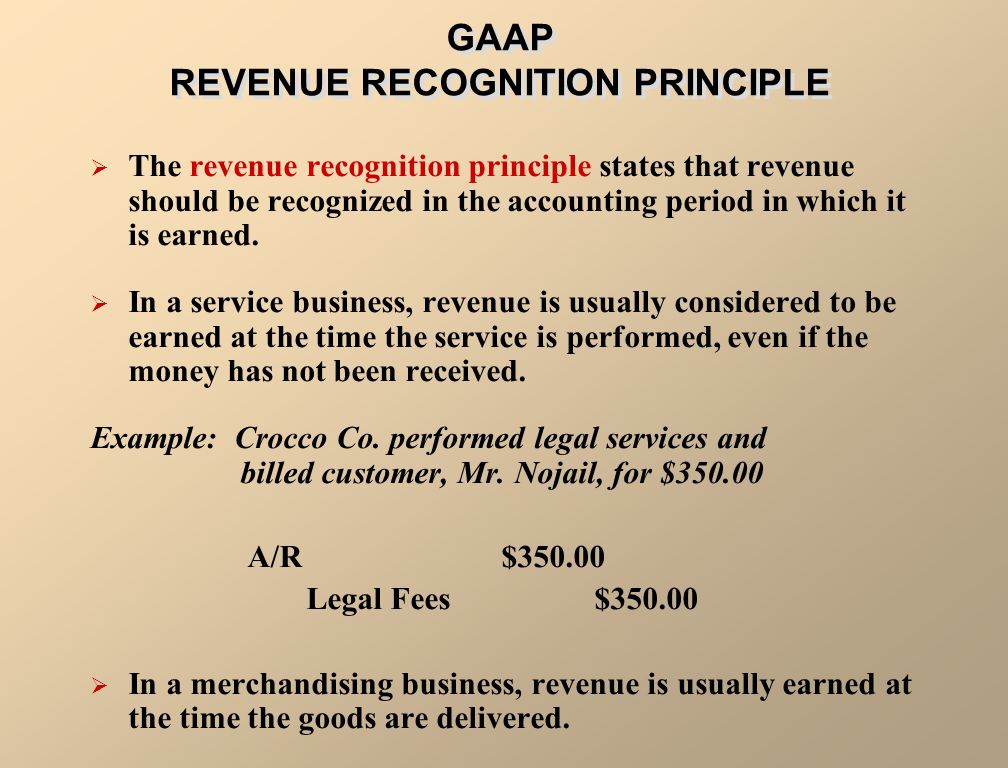

The timing of revenue recognition is governed by accounting standards, primarily established by organizations like the Financial Accounting Standards Board (FASB) in the United States, and the International Accounting Standards Board (IASB) globally. These standards aim to provide a consistent and reliable framework for reporting financial performance.

The overarching principle, enshrined in these standards, is that revenue should be recognized when a company has substantially performed its obligations and transferred control of the goods or services to the customer. This is often referred to as the performance obligation being satisfied.

Delving Deeper: The Five-Step Model

The FASB's Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers, provides a five-step model for revenue recognition. This model is designed to ensure consistent application of the revenue recognition principle across various industries.

Step 1: Identify the contract(s) with a customer. This involves determining whether a legally enforceable agreement exists that creates rights and obligations for both parties.

Step 2: Identify the performance obligations in the contract. A performance obligation is a promise to transfer a distinct good or service to the customer. In our bakery example, each loaf of bread represents a separate performance obligation.

Step 3: Determine the transaction price. This is the amount of consideration the company expects to receive in exchange for transferring the goods or services. This might include discounts, rebates, or other variable considerations.

Step 4: Allocate the transaction price to the performance obligations. If the contract includes multiple performance obligations, the transaction price needs to be allocated to each obligation based on its relative standalone selling price.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation. This is the crucial step where revenue is recognized when the company transfers control of the goods or services to the customer. This can occur at a single point in time or over a period of time.

What Does "Control" Mean?

The concept of control is central to determining when a performance obligation is satisfied. Control essentially means the customer has the ability to direct the use of the asset and obtain substantially all of the remaining benefits from it.

Indicators of control include the customer having legal title to the asset, physical possession, the risks and rewards of ownership, and the ability to accept the asset. If the customer has these characteristics, it is generally accepted that control has been transferred.

Examples in Different Industries

The application of revenue recognition principles can vary significantly across different industries. Let's examine a few examples.

Software as a Service (SaaS): For a SaaS company providing subscription-based software, revenue is typically recognized ratably over the subscription period. This is because the company provides a service continuously over time, rather than transferring a discrete good at a single point.

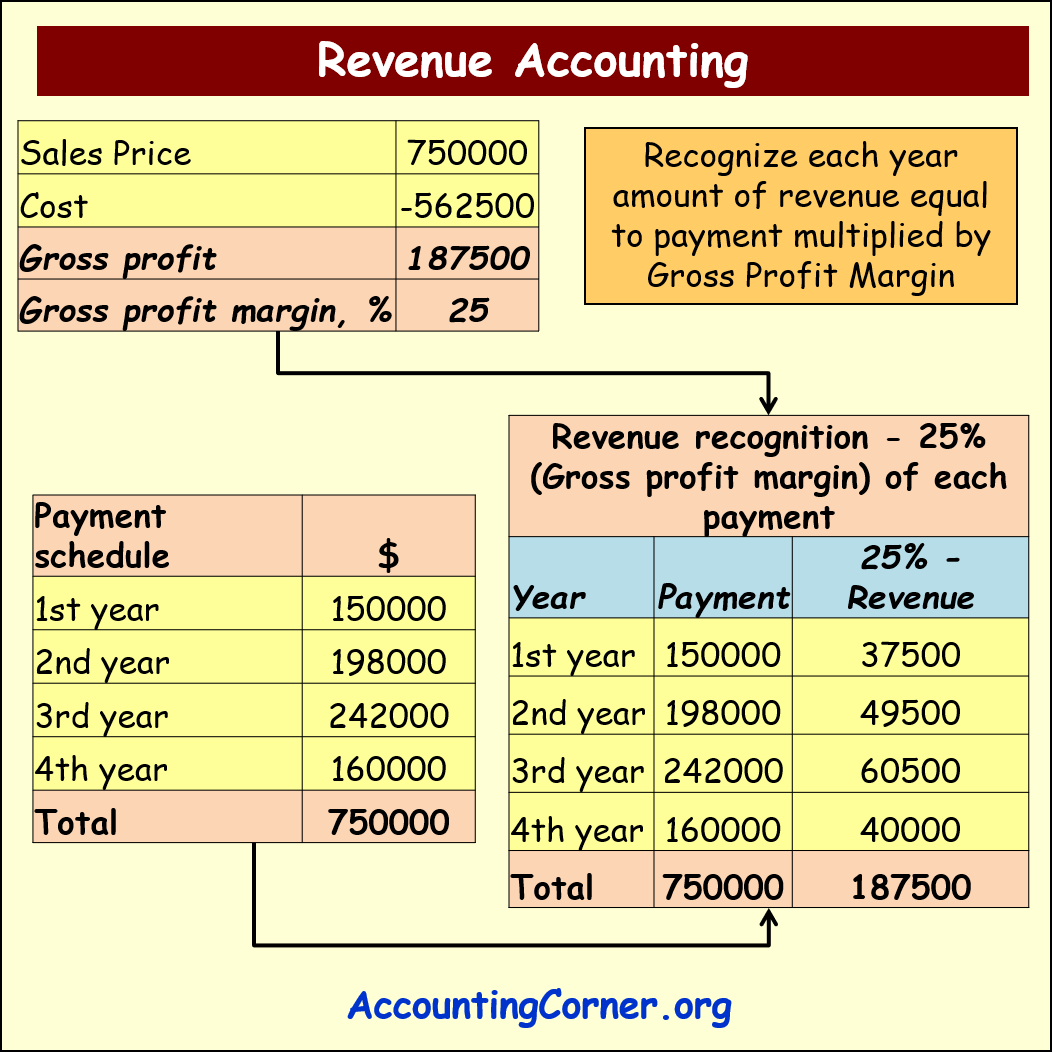

Construction: In the construction industry, revenue may be recognized over time as the project progresses. This method, known as percentage-of-completion accounting, recognizes revenue based on the proportion of work completed.

Retail: For a traditional retailer, like our bakery, revenue is typically recognized at the point of sale, when the customer takes possession of the goods. This is a straightforward application of the principle of transferring control.

Why is Accurate Revenue Recognition Important?

Accurate revenue recognition is crucial for several reasons. First and foremost, it provides a true and fair view of a company's financial performance. This allows investors, creditors, and other stakeholders to make informed decisions about the company's financial health.

Moreover, it impacts key financial metrics like profitability and earnings per share. Misstating revenue can lead to misleading financial reports and potential legal consequences. This can significantly damage a company's reputation and investor confidence.

According to a 2023 report by the Securities and Exchange Commission (SEC), a significant percentage of financial reporting violations involve improper revenue recognition. This underscores the importance of adhering to accounting standards and maintaining strong internal controls.

The Impact of Technology

The rise of cloud computing and subscription-based business models has significantly impacted revenue recognition. These models often involve complex contracts and variable considerations, requiring careful analysis to determine the appropriate timing of revenue recognition.

Companies are increasingly relying on specialized software and expert consultants to navigate these complexities. Technology can help automate the revenue recognition process, improving accuracy and efficiency.

For example, software solutions can track performance obligations, allocate transaction prices, and generate revenue recognition schedules automatically. This minimizes the risk of errors and ensures compliance with accounting standards.

Ethical Considerations

Beyond the technical aspects, ethical considerations play a crucial role in revenue recognition. Companies must act with integrity and avoid any practices that could be perceived as misleading or manipulative.

Aggressive revenue recognition practices, such as prematurely recognizing revenue or overstating the transaction price, can erode trust and undermine the integrity of financial reporting. A strong ethical culture is essential for maintaining accurate and reliable financial information.

Accountants and auditors have a responsibility to exercise professional skepticism and challenge management's assumptions when necessary. This ensures that revenue is recognized in accordance with accounting standards and that financial statements accurately reflect the company's performance.

Conclusion

The seemingly simple question of when sales revenues are considered earned is actually a complex and nuanced issue. It requires a thorough understanding of accounting standards, contract terms, and the specific characteristics of the goods or services being provided.

By adhering to the principles of revenue recognition, companies can ensure that their financial statements are accurate, reliable, and transparent. This, in turn, fosters trust and confidence among investors, creditors, and other stakeholders.

Ultimately, accurate revenue recognition is not just a matter of compliance; it is a fundamental aspect of responsible corporate governance. It reflects a commitment to integrity, transparency, and a true and fair presentation of financial performance. As the business world continues to evolve, staying informed about the latest developments in revenue recognition will remain crucial for success.

.jpg)