Sam Adams Beers For Cheers 2024

The Samuel Adams brewery, a name synonymous with Boston's brewing heritage and a ubiquitous presence in American bars, is facing a challenging 2024. Reports of declining sales and shifting consumer preferences are casting a shadow over the brand, prompting a reevaluation of its marketing strategies and product portfolio.

The question on many lips is: can Sam Adams recapture the magic that made it a craft beer pioneer, or will it continue to lose ground in an increasingly competitive and fragmented market? The answer to this question will not only impact the brewery's bottom line but also reflect the broader trends shaping the American beer industry.

The Nut Graf: A Brewing Challenge

Boston Beer Company, the parent company of Samuel Adams, is navigating a complex landscape marked by evolving consumer tastes, increased competition from smaller craft breweries, and the growing popularity of alternative alcoholic beverages. The company's flagship Boston Lager, once a dominant force, is facing headwinds as drinkers explore new styles and brands.

This article delves into the specific challenges confronting Samuel Adams, analyzing the factors contributing to its recent performance, and examining the strategies the company is employing to revitalize its brand and regain market share. We will explore expert opinions and market data to provide a comprehensive picture of the brewery's current situation and its prospects for the future.

Declining Sales and Shifting Tastes

Recent financial reports from Boston Beer Company indicate a concerning trend: a decrease in shipments and depletions (sales from distributors to retailers). According to the company's Q3 2023 earnings report, Sam Adams experienced a volume decline, contributing to an overall revenue decrease for the period.

This decline reflects a broader shift in consumer preferences. Consumers are increasingly drawn to innovative and experimental craft beers, hard seltzers, ready-to-drink cocktails, and non-alcoholic options, fragmenting the market and diluting the dominance of established brands like Sam Adams.

"The beer market is incredibly dynamic right now," said Neil Reid, a professor at the University of Toledo specializing in the geography of beer. "Consumers are demanding variety, and brands that fail to adapt risk being left behind."

Competition Heats Up

The craft beer scene is no longer a niche market; it's a crowded battlefield with thousands of breweries vying for shelf space and consumer attention. Smaller, more agile breweries are often better positioned to respond to changing tastes, releasing new and innovative beers that capture the imagination of adventurous drinkers.

Sam Adams, while still a major player, now faces competition from a multitude of local and regional breweries, each with its own unique identity and loyal following. The rise of hyper-local breweries, focusing on serving their immediate communities, further erodes the market share of national brands.

The rise of hard seltzers, particularly Truly Hard Seltzer, also owned by Boston Beer Company, cannibalized some of Sam Adams' market share. This internal competition highlights the need for Boston Beer Company to carefully manage its portfolio and avoid diluting its brand equity.

Strategies for Revival

Boston Beer Company is actively working to address these challenges and revitalize the Sam Adams brand. The company is investing in marketing campaigns, product innovation, and strategic partnerships to regain lost ground and appeal to a new generation of beer drinkers.

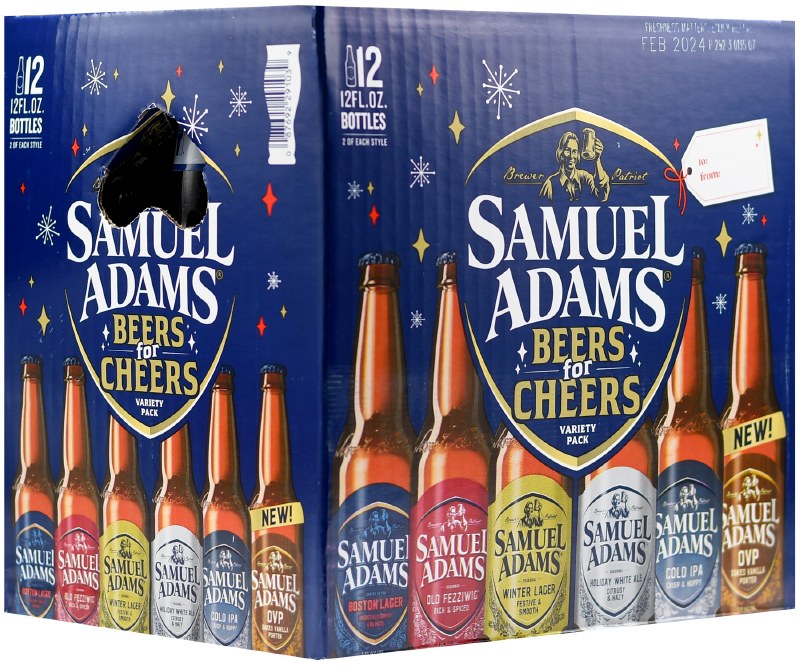

One key strategy is expanding the Sam Adams product portfolio beyond its traditional offerings. The brewery has introduced new beers in popular styles like hazy IPAs and session beers, attempting to cater to current trends and attract consumers seeking more contemporary flavors. Seasonal beers are another avenue for Sam Adams, offering limited-time releases that create excitement and drive sales.

Another approach involves emphasizing the brand's history and authenticity. Sam Adams has a rich legacy as a pioneer of the American craft beer movement, and the company is leveraging this heritage in its marketing efforts, reminding consumers of the brewery's commitment to quality and craftsmanship.

Expert Opinions and Market Analysis

Industry analysts offer varied perspectives on Sam Adams' prospects. Some believe the brand can successfully adapt and regain its footing, while others are more skeptical, citing the challenging market dynamics and the difficulty of competing with smaller, more nimble breweries.

“Sam Adams has a strong brand recognition and distribution network," said Maria Romano, a beverage industry consultant. "If they can successfully innovate and connect with younger consumers, they have the potential to turn things around."

However, other experts caution that the market has fundamentally changed, and Sam Adams may need to accept a smaller market share. "The days of one or two dominant craft beer brands are over," said David Thompson, a market research analyst. "The market is now fragmented, and brands need to focus on carving out specific niches."

Looking Ahead: 2024 and Beyond

The year 2024 will be a critical year for Samuel Adams. The company's success will depend on its ability to execute its turnaround strategies effectively, adapt to changing consumer preferences, and navigate the increasingly competitive landscape.

Boston Beer Company's leadership will need to make strategic decisions about its product portfolio, marketing investments, and distribution channels to ensure the long-term viability of the Sam Adams brand. The company must balance its commitment to its heritage with the need to innovate and appeal to a new generation of beer drinkers.

Ultimately, the future of Sam Adams will depend on its ability to recapture the spirit of innovation and craftsmanship that made it a craft beer pioneer, while also embracing the challenges and opportunities of the modern beer market. The journey will be complex, but the outcome will shape not only the future of Sam Adams but also the broader landscape of the American beer industry.