Sandia Laboratory Federal Credit Union Phone Number

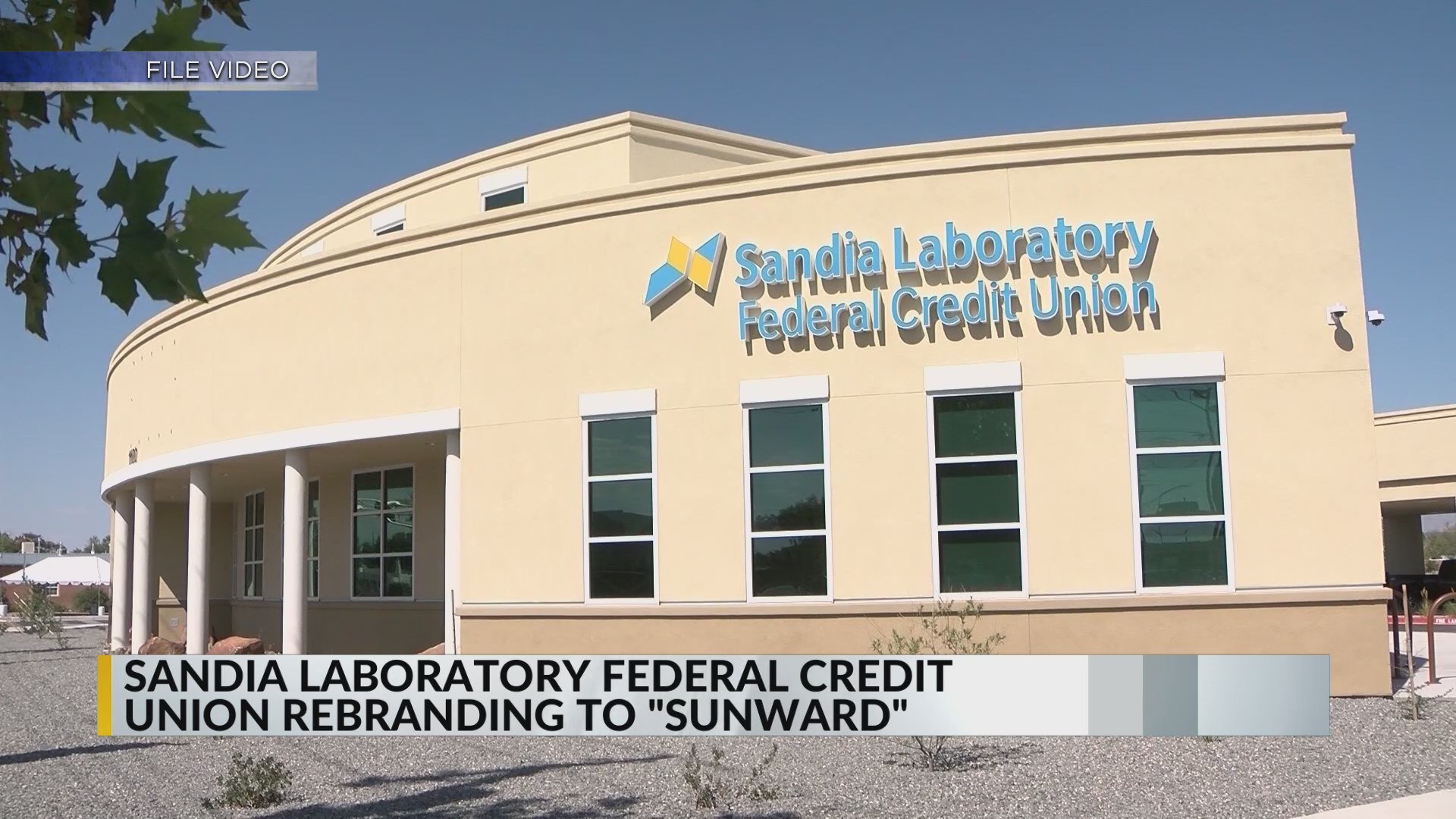

In an era dominated by digital banking and online resources, the simple act of finding a reliable phone number for a financial institution can still prove surprisingly crucial. Members of Sandia Laboratory Federal Credit Union (SLFCU), and those looking to become members, occasionally find themselves needing direct phone assistance for various banking needs.

The need for a direct line of communication to SLFCU remains significant. This article aims to clarify the currently available phone numbers for SLFCU, explain the reasons behind potential difficulties in reaching the credit union via phone, and highlight alternative methods for members to access assistance.

Navigating SLFCU's Phone System

The primary phone number for Sandia Laboratory Federal Credit Union is widely listed as (505) 292-6343 or 1-800-947-5328. These numbers serve as the gateway to a range of services, from basic account inquiries to more complex loan applications.

However, accessing the appropriate department or specialist through the automated phone system can sometimes be a source of frustration for members. Call volume and the complexity of the menu options can lead to longer wait times.

Why the Difficulty?

Several factors contribute to potential challenges in reaching SLFCU by phone. Increased call volume, particularly during peak hours and periods of economic uncertainty, can strain the system.

Additionally, the rise in sophisticated fraud attempts has led financial institutions to implement more stringent security protocols, which may inadvertently add steps to the phone authentication process. Outdated contact information listed on third-party websites can also contribute to confusion.

SLFCU has publicly acknowledged the importance of improving member accessibility. They have invested in technological upgrades to streamline the phone system and have also expanded their online support resources.

Alternative Channels for Support

Recognizing the limitations of relying solely on phone communication, SLFCU has actively promoted alternative channels for member support. Their website offers a comprehensive FAQ section addressing common inquiries, alongside secure messaging options for personalized assistance.

The credit union also encourages members to utilize their online banking platform and mobile app for routine transactions, such as checking balances, transferring funds, and paying bills. These self-service options often provide a faster and more convenient alternative to phone calls.

Furthermore, SLFCU operates several branch locations throughout New Mexico, providing members with in-person assistance for more complex issues or those who prefer face-to-face interactions. Branch locations and hours of operation are readily available on their website.

The Human Element

Despite the increasing reliance on technology, the need for human interaction in banking remains crucial. For many members, especially those facing complex financial situations or experiencing technological difficulties, speaking directly with a representative provides reassurance and personalized guidance.

One SLFCU member, Maria Rodriguez, shared her experience: "I was having trouble understanding some fees on my account. The online explanations weren't clear, but when I called and spoke to a representative, they were able to walk me through everything step-by-step. It made a huge difference."

This anecdote underscores the importance of maintaining accessible phone support, even as digital options continue to evolve. It highlights the value of combining technological advancements with human expertise to ensure a positive member experience.

Future Directions

SLFCU continues to explore innovative ways to improve member communication. This includes investing in AI-powered chatbots to handle routine inquiries and expanding their video conferencing capabilities for remote consultations.

By embracing a multi-channel approach, SLFCU aims to provide members with a seamless and convenient experience, regardless of their preferred method of communication. Ongoing monitoring of call volume and member feedback will be crucial in refining their strategies.

Ultimately, the goal is to balance the efficiency of digital solutions with the personalized attention that members expect from a community-focused financial institution like Sandia Laboratory Federal Credit Union.

For the most up-to-date information on SLFCU's phone numbers, services, and support options, members and prospective members are encouraged to visit the official SLFCU website or contact them directly through one of the channels mentioned above. Ensuring accurate contact information is paramount to effective communication and a positive banking experience.