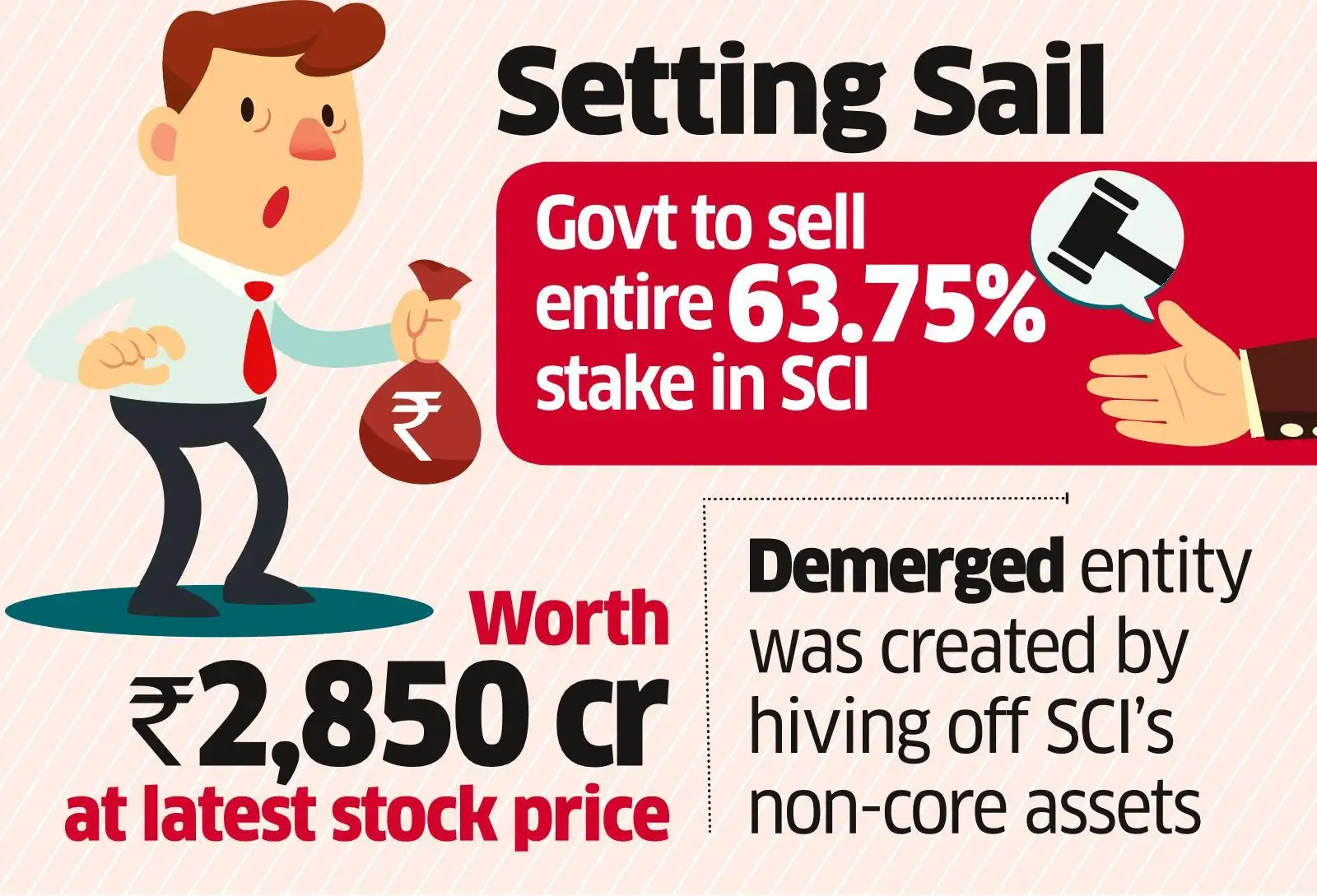

Sci Land And Assets Share Price

The fortunes of Sci Land and Assets, a prominent player in the global biotechnology real estate sector, are hanging in the balance as its share price experiences unprecedented volatility. Recent weeks have been marked by a dramatic decline, raising concerns about the company's financial stability and future prospects. Investors and analysts alike are scrambling to understand the underlying causes and potential ramifications of this turbulent period.

This article delves into the factors contributing to Sci Land and Assets' current share price woes, analyzing market trends, recent announcements, and expert opinions to provide a comprehensive overview of the situation. We will explore potential future scenarios and assess the company's strategies for navigating these challenging times. This includes an analysis of key financial metrics and consideration of alternative viewpoints on the company's long-term viability.

Factors Contributing to the Share Price Decline

Market Sentiment and Sector Performance

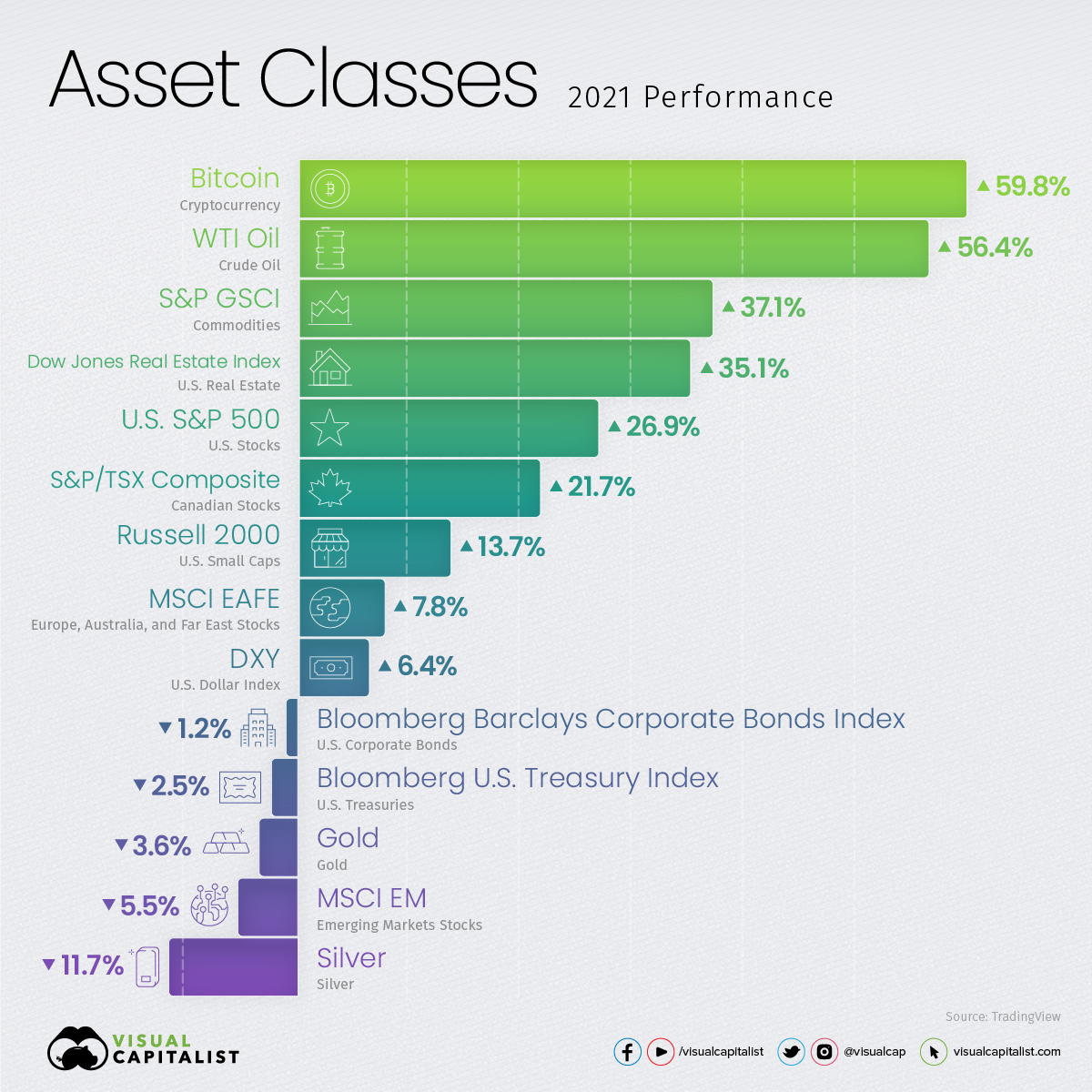

The biotechnology sector, while often lucrative, is inherently susceptible to market fluctuations and investor sentiment. Recent regulatory changes and concerns about interest rate hikes have impacted investment in biotech companies generally. This has particularly affected those relying heavily on new construction and development, like Sci Land and Assets.

Broader economic uncertainties, including inflation and potential recessionary pressures, are also contributing to investor anxiety. This has led to a flight to safety, with investors shifting away from riskier assets like biotechnology real estate.

Company-Specific Challenges

Beyond the broader market trends, Sci Land and Assets faces its own unique challenges. A recent announcement regarding delays in several key development projects sent shockwaves through the investment community. These delays, attributed to supply chain disruptions and labor shortages, have raised concerns about the company's ability to meet its financial projections.

Furthermore, a recent lawsuit filed by a competitor alleging patent infringement has added to the negative sentiment surrounding the company. This legal battle introduces an element of uncertainty that further deters potential investors.

Financial Performance and Key Metrics

A closer look at Sci Land and Assets' financial performance reveals some concerning trends. The company's debt-to-equity ratio has been steadily increasing, indicating a greater reliance on debt financing. This raises questions about the company's long-term solvency, especially in a rising interest rate environment.

Revenue growth has also slowed in recent quarters, falling short of analysts' expectations. This slowdown is primarily attributed to the aforementioned project delays and a general decline in demand for biotechnology real estate.

"The financial metrics are painting a concerning picture. While the company has historically been strong, these trends cannot be ignored," stated Dr. Anya Sharma, a leading financial analyst specializing in the biotech sector.

Company Response and Strategies

Sci Land and Assets has acknowledged the challenges it faces and has outlined a series of strategies to address the situation. These include cost-cutting measures, streamlining operations, and focusing on its most profitable projects.

The company is also exploring alternative financing options, including strategic partnerships and asset sales. Management has expressed confidence in its ability to weather the storm and restore investor confidence.

"We are taking decisive action to address the current challenges and are confident in our long-term prospects," said Mr. Ben Carter, CEO of Sci Land and Assets, in a recent press release.

Expert Opinions and Alternative Perspectives

Analysts are divided on the future prospects of Sci Land and Assets. Some believe that the company's strong fundamentals and experienced management team will enable it to overcome the current challenges.

Others are more pessimistic, citing the company's high debt levels and the uncertain outlook for the biotechnology sector. Emily Chen, a portfolio manager at a major investment firm, expressed caution, stating, "While a turnaround is possible, it is contingent on successful execution of their strategic plan and a more favorable market environment."

However, it is important to note that some see opportunity in the decline, with analysts suggesting that the company's assets could be undervalued. This could lead to potential acquisition interest.

Potential Future Scenarios

Several potential scenarios could play out in the coming months. One possibility is that Sci Land and Assets successfully executes its turnaround plan and restores investor confidence, leading to a rebound in its share price.

Another possibility is that the company continues to struggle and is forced to take more drastic measures, such as asset sales or a restructuring. A third scenario involves a potential acquisition by a larger player in the real estate or biotechnology sectors.

The future of Sci Land and Assets remains uncertain, but the company's ability to adapt to the changing market conditions and address its financial challenges will ultimately determine its fate.

Conclusion

The recent turbulence in Sci Land and Assets' share price reflects a complex interplay of market forces, company-specific challenges, and investor sentiment. While the company faces significant headwinds, it also possesses valuable assets and a experienced leadership team.

Whether it can successfully navigate these challenges and emerge stronger remains to be seen. Investors will be closely watching the company's financial performance and strategic execution in the coming quarters. The next few months will be crucial in determining the long-term viability of Sci Land and Assets and its position within the competitive biotechnology real estate landscape.