Scott Credit Union Skip A Payment

Imagine a crisp autumn evening, the scent of woodsmoke hanging in the air, and the gentle hum of a household settling in for the night. Bills sit on the kitchen counter, a stack of monthly obligations that can sometimes feel overwhelming. But tonight, there's a sense of ease, a quiet confidence, because for some, that car payment or personal loan has been temporarily lifted, thanks to a program designed with community in mind.

The Scott Credit Union Skip A Payment program offers eligible members a chance to free up cash for unexpected expenses, holiday spending, or simply a little breathing room in their budget. It is a testament to a financial institution that prioritizes its members' well-being, recognizing that sometimes, life throws curveballs.

A History of Community Support

Scott Credit Union (SCU) has deep roots in the communities it serves, tracing its origins back to 1948. Established to serve the financial needs of civil service employees at Scott Air Force Base, the credit union has expanded its reach and membership over the decades.

Their commitment to financial education, personalized service, and community involvement has solidified their reputation as a trusted partner for individuals and families across Illinois and Missouri.

From offering competitive loan rates to providing comprehensive financial planning resources, SCU strives to empower its members to achieve their financial goals.

The Genesis of Skip A Payment

The Skip A Payment program wasn't conceived overnight. It emerged from a genuine desire to alleviate financial stress for members facing temporary hardships or seeking extra flexibility.

SCU leadership recognized that even the most carefully planned budgets can be derailed by unforeseen circumstances.

The program was designed as a responsible and accessible option for those moments when a little extra cash flow can make a big difference.

How Skip A Payment Works

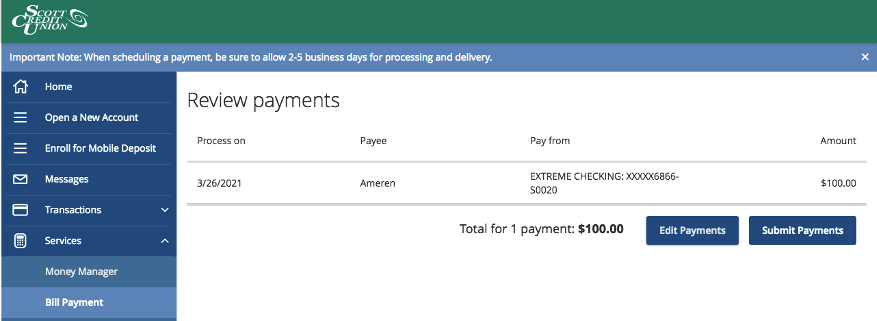

The application process for Skip A Payment is straightforward and user-friendly, typically accessible online or through a branch representative. Eligibility requirements vary depending on the type of loan and the member's account history.

Generally, loans must be in good standing, with no recent delinquencies. A small processing fee is usually associated with skipping a payment.

It's important to note that while the payment is deferred, interest continues to accrue, potentially extending the loan term slightly.

Responsible Borrowing and Program Guidelines

Scott Credit Union emphasizes responsible borrowing and encourages members to carefully consider the implications of skipping a payment. The potential impact on the loan term and overall interest paid is clearly communicated.

The program is not intended as a long-term solution for financial difficulties, but rather as a short-term relief option.

SCU also offers resources and counseling services to members facing ongoing financial challenges, helping them develop sustainable strategies for managing their finances.

The Impact on Members and the Community

The Skip A Payment program has had a tangible positive impact on countless SCU members, providing a safety net during challenging times. Stories abound of families using the extra funds to cover unexpected medical bills, make necessary home repairs, or simply enjoy a more comfortable holiday season.

Beyond individual benefits, the program contributes to the overall economic well-being of the communities SCU serves. By providing financial flexibility, it helps prevent defaults and foreclosures, stabilizing local economies.

The credit union's commitment to community extends beyond financial products and services.

"We believe in giving back to the communities that support us," says a representative from Scott Credit Union. "Our Skip A Payment program is just one way we demonstrate that commitment."

Beyond Financial Relief

The benefits of Skip A Payment extend beyond simply freeing up cash. It offers peace of mind, reducing stress and anxiety associated with financial burdens.

This can lead to improved mental and emotional well-being, allowing individuals and families to focus on other important aspects of their lives.

By demonstrating its commitment to member well-being, SCU fosters a strong sense of loyalty and trust within its membership base.

A Reflection on Community Banking

In an era of large, impersonal financial institutions, Scott Credit Union stands out as a beacon of community-focused banking. Their Skip A Payment program exemplifies their commitment to understanding and responding to the needs of their members.

It's a reminder that banking can be more than just transactions and profits; it can be about building relationships and supporting the financial health of the community.

SCU’s approach suggests that fostering trust and providing genuine support can be a sustainable business model, creating a win-win scenario for both the institution and its members.

Looking Ahead

As the financial landscape continues to evolve, Scott Credit Union remains dedicated to adapting and innovating to meet the changing needs of its members. The success of the Skip A Payment program serves as a valuable lesson: empathy and understanding are crucial ingredients for building strong, resilient communities.

By prioritizing member well-being and fostering financial literacy, SCU is paving the way for a more equitable and prosperous future for the individuals and families it serves. The credit union constantly evaluates and refines the program, always seeking to improve its effectiveness and accessibility.

The future likely holds more innovative solutions and community-focused initiatives, solidifying SCU's position as a leader in responsible and compassionate banking.