Secure Choice Lending Credit Score Requirements

Imagine Sarah, a young teacher with dreams of owning her first home. She diligently saves, researches neighborhoods, and even picks out paint colors in her mind. The one hurdle looming large? Her credit score.

Like many aspiring homeowners, Sarah finds herself navigating the complex world of mortgage lending, a journey often dictated by a three-digit number. What credit score does she need to unlock the door to her dream? Secure Choice Lending, like many lenders, has specific criteria, and understanding these requirements is crucial for anyone hoping to secure a loan.

This article delves into Secure Choice Lending's credit score requirements, exploring the factors that influence these policies and providing insights for potential borrowers.

Understanding Credit Scores: The Key to Unlocking Homeownership

A credit score is essentially a financial report card, summarizing your credit history and predicting your likelihood of repaying debt. Lenders, including Secure Choice Lending, rely heavily on these scores to assess risk.

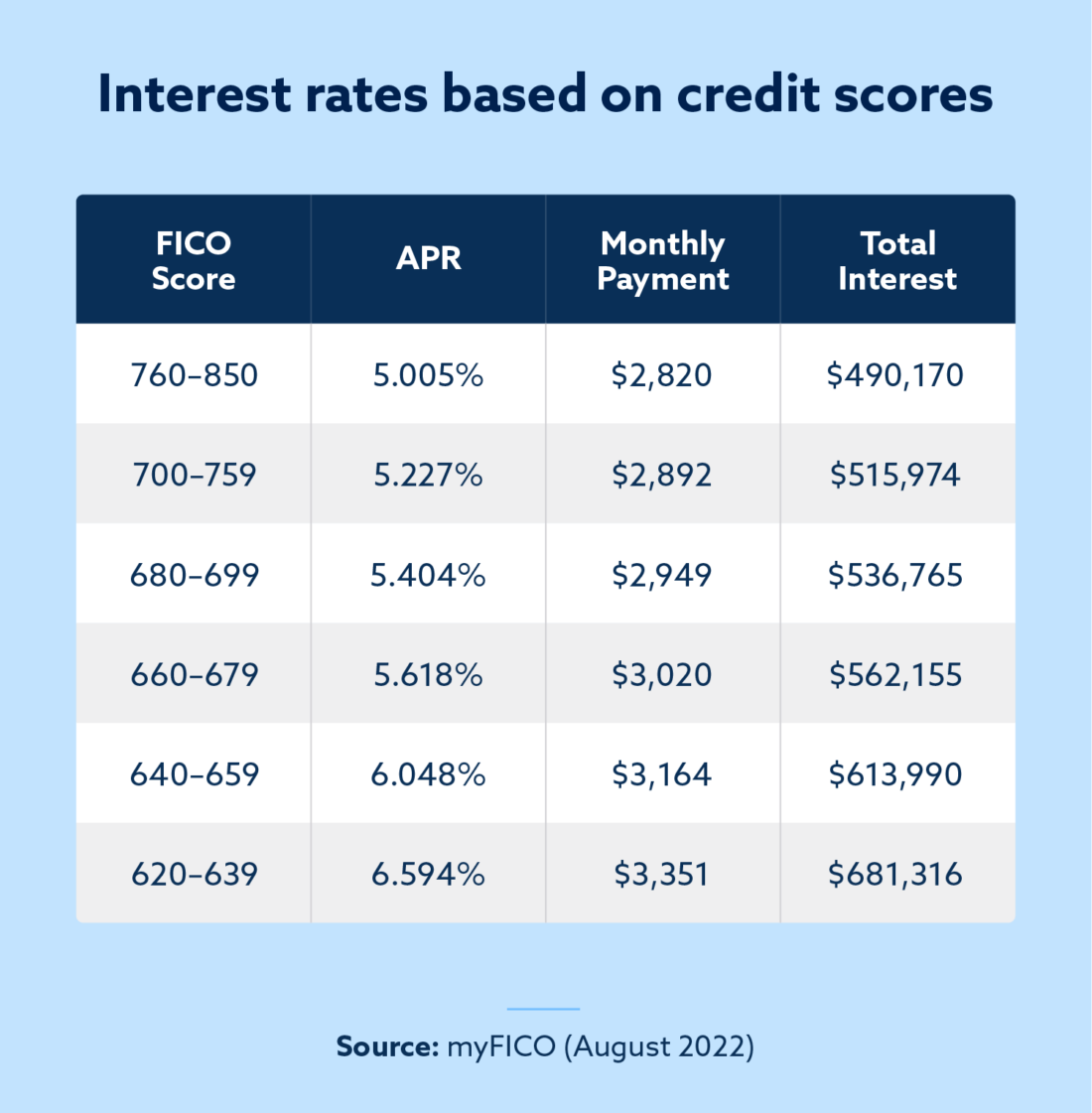

The most widely used credit scoring model is FICO, which ranges from 300 to 850. A higher score generally translates to better loan terms, such as lower interest rates.

According to Experian, a score of 700 or above is generally considered good, while scores above 740 are considered very good.

The Significance of Credit Scores in Mortgage Lending

For mortgage lenders, credit scores are paramount. They provide a quick and relatively reliable way to gauge a borrower's financial responsibility.

A strong credit history indicates a consistent pattern of on-time payments and responsible credit management, making lenders more confident in the borrower's ability to repay the loan.

Conversely, a low credit score might signal a higher risk of default, leading to higher interest rates or even loan denial.

Secure Choice Lending: Credit Score Requirements Unveiled

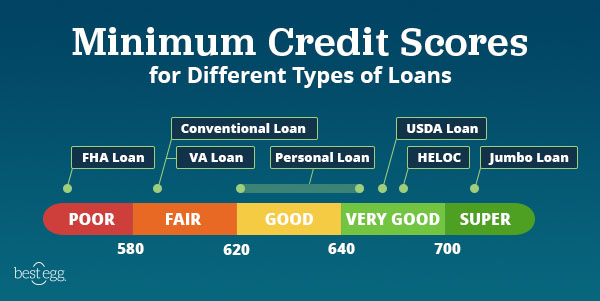

While specific credit score requirements can vary based on loan type and individual circumstances, Secure Choice Lending generally adheres to industry standards. As a result, minimum credit scores vary.

For conventional loans, which are not backed by government agencies, a credit score of 620 or higher is often required. However, a score of 740 or higher will generally qualify an individual for the best interest rates.

Government-backed loans, such as FHA loans, often have more lenient credit score requirements.

FHA Loans: A Path to Homeownership for Borrowers with Lower Credit Scores

FHA loans are insured by the Federal Housing Administration, making them a popular option for first-time homebuyers and those with less-than-perfect credit.

Secure Choice Lending, like other FHA-approved lenders, typically requires a minimum credit score of 500 for borrowers to qualify for an FHA loan with a 10% down payment.

For a 3.5% down payment, a credit score of 580 or higher is generally needed.

VA Loans: Honoring Service Members with Flexible Credit Criteria

VA loans, guaranteed by the Department of Veterans Affairs, are another attractive option for eligible veterans, active-duty service members, and surviving spouses.

While the VA itself doesn't set a minimum credit score, lenders like Secure Choice Lending typically require a score of 620 or higher.

VA loans often come with no down payment requirement, making them an especially appealing option for those who qualify.

USDA Loans: Supporting Rural Homeownership

USDA loans, backed by the U.S. Department of Agriculture, are designed to help low- and moderate-income individuals purchase homes in eligible rural areas.

Secure Choice Lending generally requires a credit score of 620 or higher for USDA loans. However, the credit score needed to qualify can vary based on the specific program requirements.

USDA loans often come with no down payment requirements.

Factors Influencing Credit Score Requirements at Secure Choice Lending

Beyond the type of loan, several other factors can influence the credit score requirements at Secure Choice Lending.

These include: down payment amount, debt-to-income ratio (DTI), and overall financial profile.

A larger down payment can often offset a slightly lower credit score, as it reduces the lender's risk.

The Role of Down Payment and Debt-to-Income Ratio

A substantial down payment demonstrates a borrower's commitment and reduces the loan amount, making the loan less risky for the lender. As a result, lenders often have better interest rates and/or are more flexible with credit score guidelines.

The debt-to-income ratio (DTI), which compares a borrower's monthly debt payments to their gross monthly income, is another crucial factor. A lower DTI indicates that the borrower has more disposable income and is less likely to struggle with repayments.

Secure Choice Lending, like most lenders, prefers borrowers with lower DTIs.

The Importance of a Strong Financial Profile

Lenders assess the overall financial profile of the borrower. This includes factors such as employment history, savings, and assets.

A stable employment history demonstrates a consistent income stream, while healthy savings and assets provide a financial cushion in case of unexpected expenses.

A strong financial profile can often compensate for a slightly lower credit score.

Improving Your Credit Score: Paving the Way to Homeownership

For those with credit scores that fall below Secure Choice Lending's requirements, there are steps they can take to improve their creditworthiness.

These include: paying bills on time, reducing credit card balances, and disputing errors on their credit reports.

Building a positive credit history takes time and effort, but it's an investment that can pay off significantly in the long run.

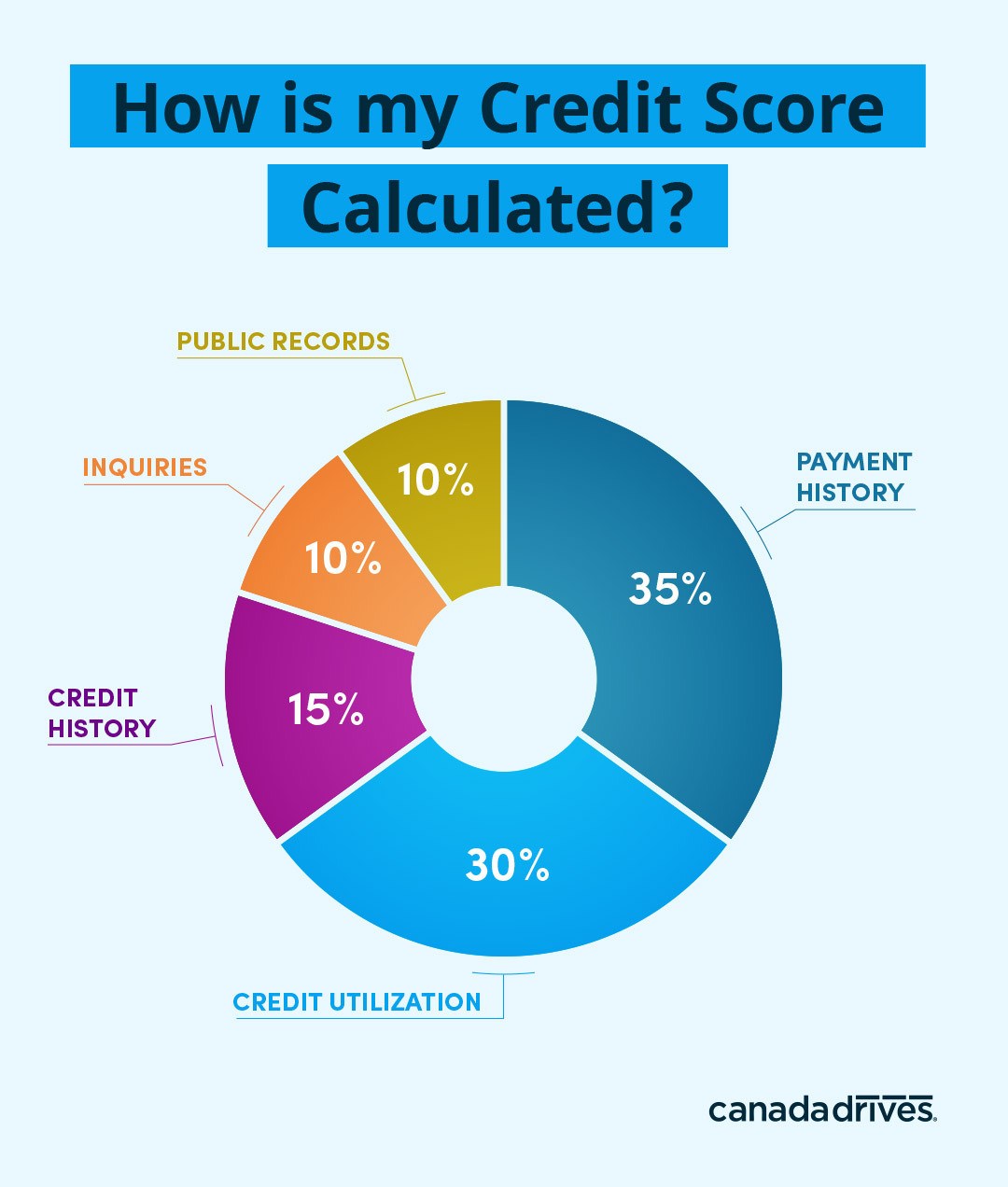

Practical Steps to Boost Your Credit Score

One of the most effective ways to improve your credit score is to pay all bills on time, every time. Payment history is the single biggest factor in determining your credit score.

Reducing credit card balances, ideally to below 30% of your credit limit, can also have a positive impact. This demonstrates responsible credit utilization.

Regularly reviewing your credit reports for errors and disputing any inaccuracies can prevent unfair negative marks from dragging down your score.

Credit Counseling: Seeking Professional Guidance

For those struggling to manage their debt or understand their credit, seeking professional guidance from a credit counseling agency can be beneficial.

Certified credit counselors can provide personalized advice on budgeting, debt management, and credit repair.

They can also help you develop a plan to improve your credit score and achieve your financial goals.

The Future of Credit Scoring in Mortgage Lending

The landscape of credit scoring is constantly evolving, with new models and alternative data sources emerging. The VantageScore model, for instance, is becoming increasingly popular as an alternative to FICO.

Some lenders are also exploring the use of alternative data, such as rent payments and utility bills, to assess creditworthiness, particularly for those with limited credit histories. These alternative scoring models can help those with "thin" credit files build a credit history.

As technology advances, we can expect to see even more innovative approaches to credit scoring in the mortgage lending industry.

Conclusion: Navigating the Path to Homeownership with Secure Choice Lending

Understanding Secure Choice Lending's credit score requirements is essential for anyone aspiring to become a homeowner. While minimum scores exist, the overall financial profile plays a crucial role.

By focusing on improving their creditworthiness, potential borrowers can increase their chances of securing a loan and realizing their dream of homeownership.

Like Sarah, with careful planning and diligence, you can navigate the complexities of mortgage lending and unlock the door to your future home.