Should I Use My Credit Card To Build Credit

Imagine this: you’re standing at the precipice of a bright future, ready to lease your dream apartment, finance that reliable car, or even secure a mortgage for your first home. But then, a looming question hangs in the air - your credit score. It's not just a number; it's a key that unlocks financial opportunities. The question is, how do you build it, and should you use a credit card to do it?

The core question we're tackling is simple: Is using a credit card a smart strategy for building credit? The short answer is a resounding yes, but with crucial caveats. Used responsibly, a credit card is a powerful tool. Mismanaged, it can quickly become a financial burden.

Understanding the Credit Landscape

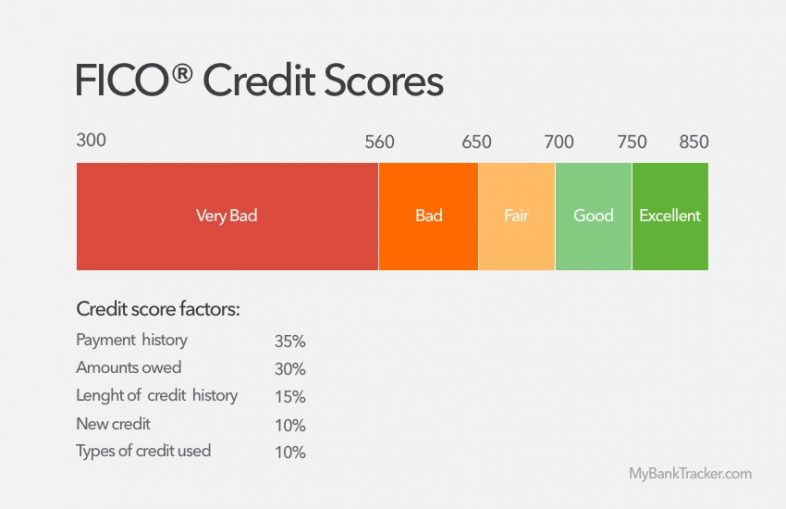

Before diving into the pros and cons, let’s understand why credit scores matter. Lenders use them to assess your creditworthiness. A good credit score signals reliability, influencing loan interest rates, insurance premiums, and even rental applications.

According to Experian, one of the major credit bureaus, credit scores range from 300 to 850. Generally, a score of 700 or higher is considered good, opening doors to better financial products and terms. Building good credit takes time and discipline.

Credit Cards as Credit Builders

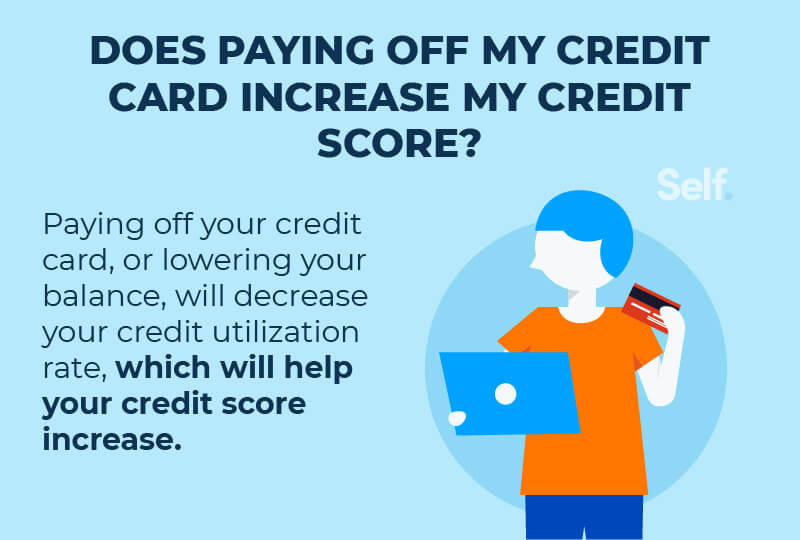

Credit cards offer a straightforward path to building credit. Every month, card issuers report your payment activity to credit bureaus. Consistent on-time payments demonstrate responsible credit management.

This positive payment history contributes significantly to your credit score, according to FICO, which is a widely used credit scoring model. A missed payment, on the other hand, can negatively impact your score.

The Responsible Use Equation

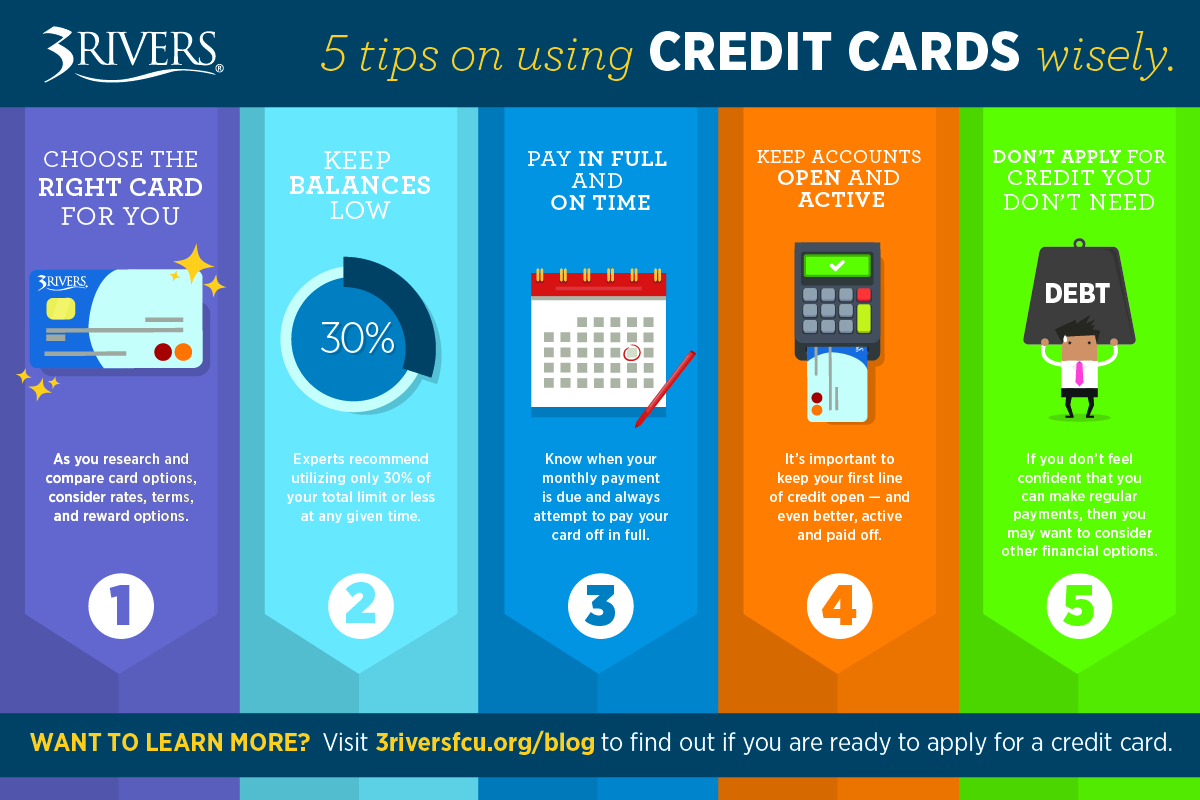

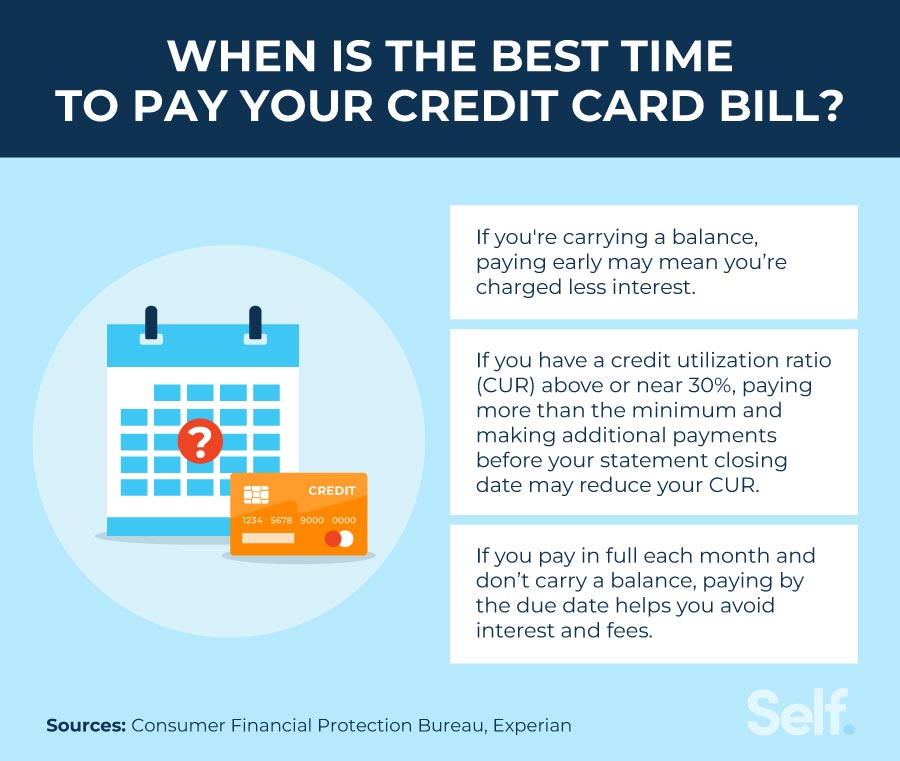

However, simply owning a credit card isn't enough. Responsible usage is paramount. Experts recommend keeping your credit utilization ratio (the amount of credit you're using compared to your total credit limit) below 30%.

For instance, if your credit limit is $1,000, aim to keep your balance below $300. High credit utilization can signal financial instability to lenders, even if you're making timely payments.

Choosing the Right Card

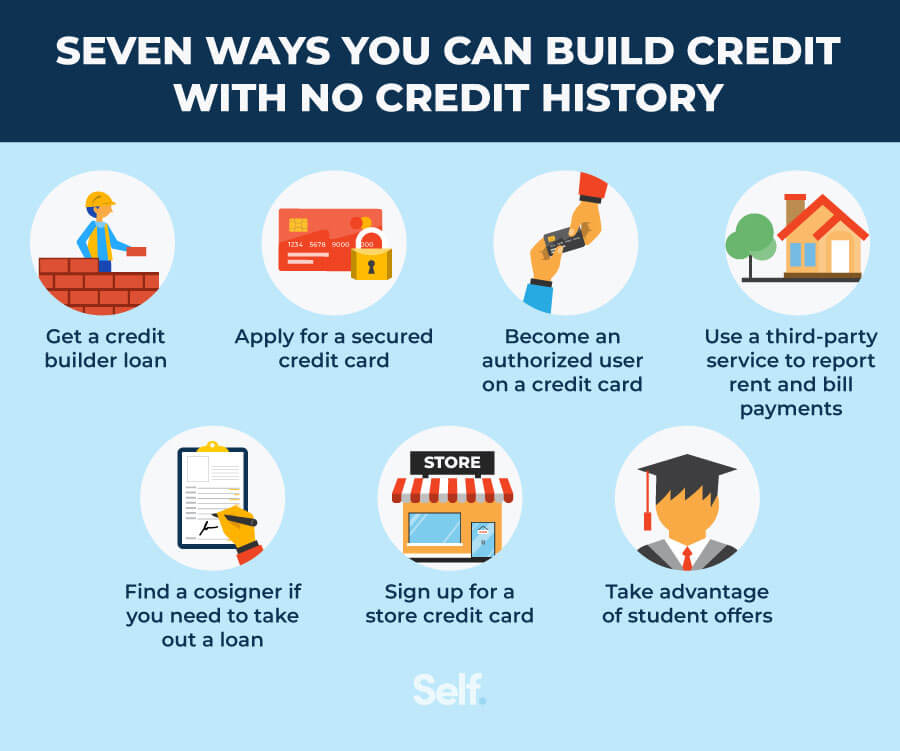

Selecting the right credit card is crucial, especially if you're new to credit. Secured credit cards are often a good starting point. These cards require a cash deposit that serves as your credit limit, reducing risk for the issuer.

Student credit cards are another option, designed for college students with limited credit history. These cards typically offer lower credit limits and may come with rewards programs tailored to student spending.

Alternatives to Consider

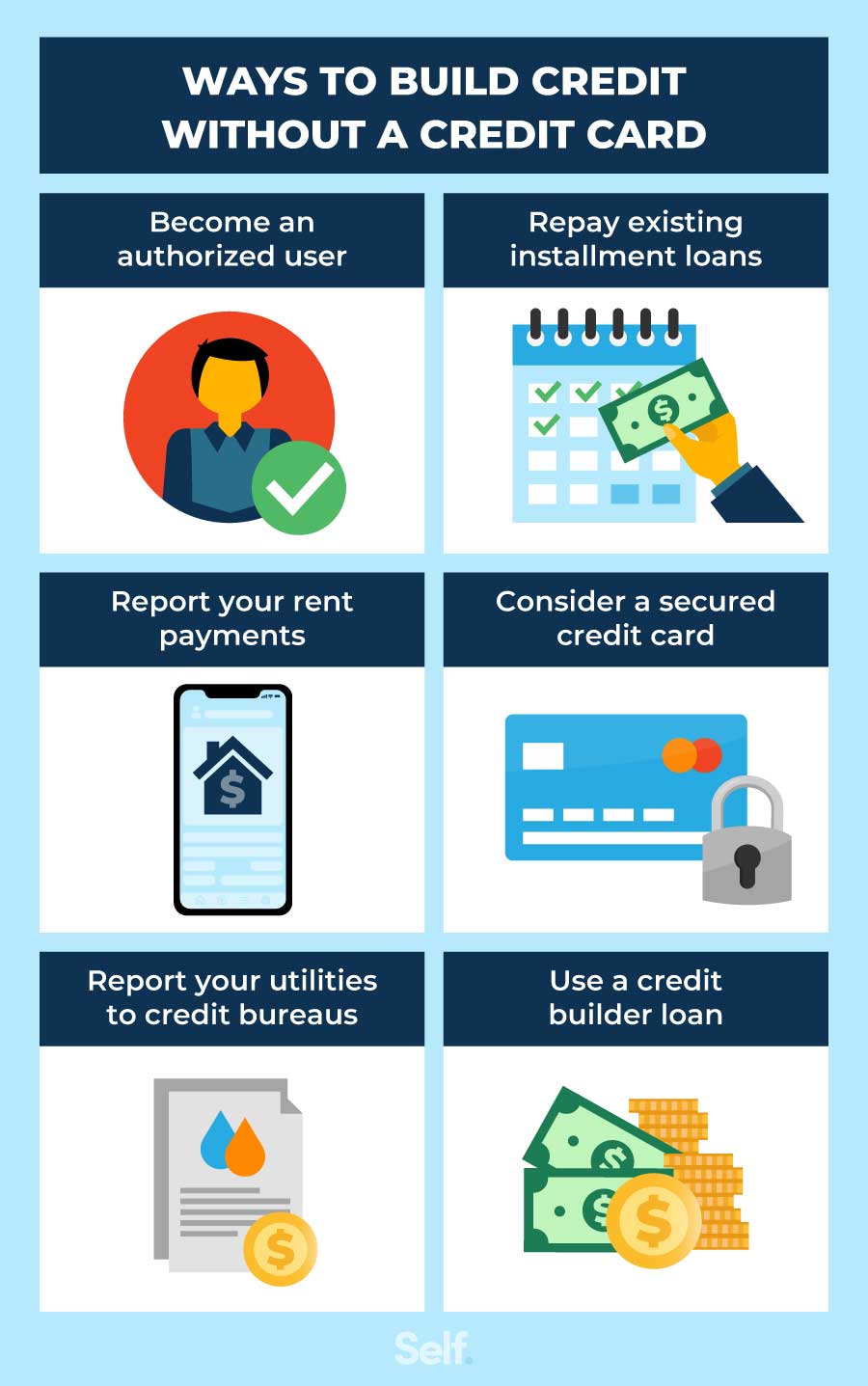

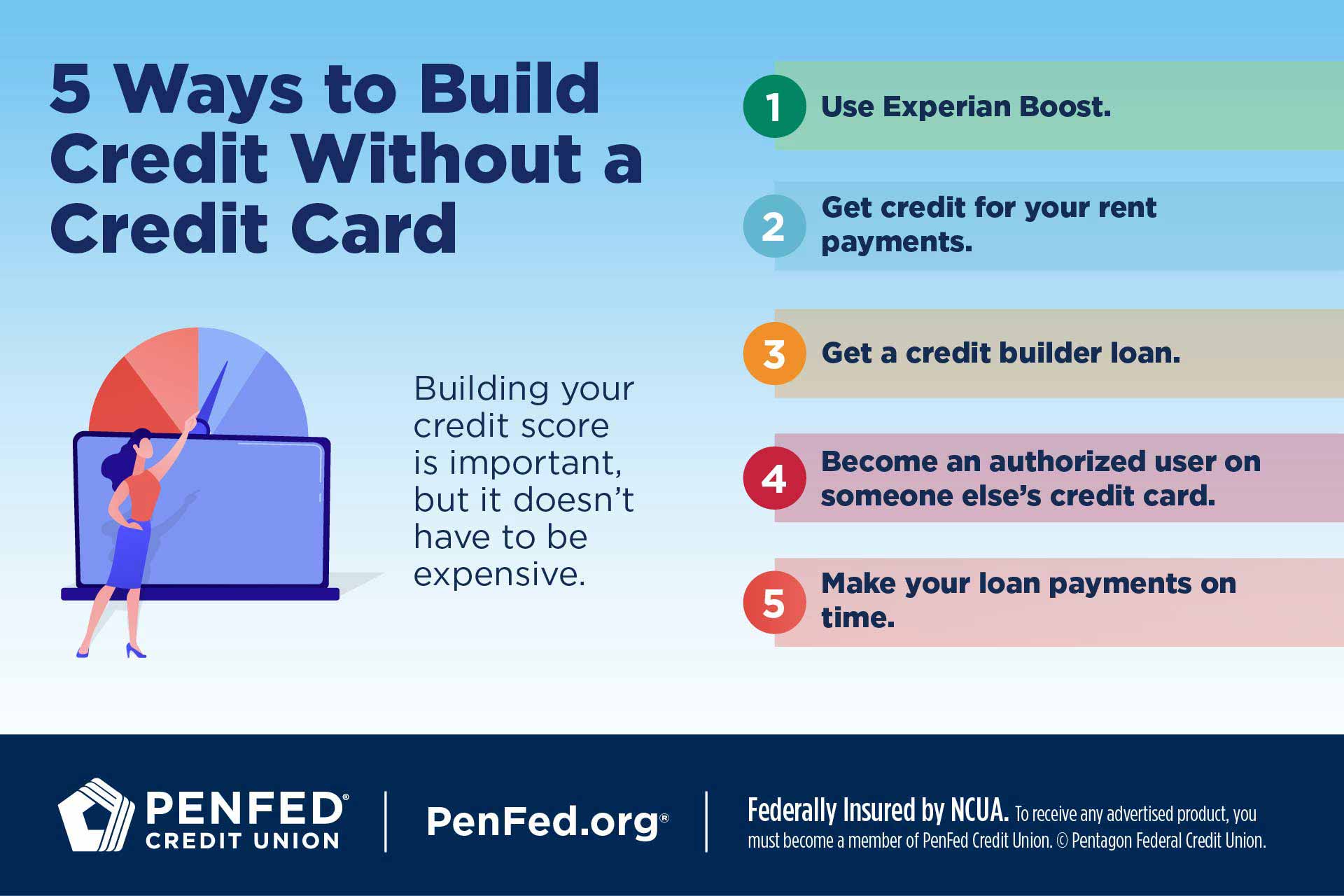

While credit cards are a popular option, they aren't the only way to build credit. Credit-builder loans are small loans designed to help you establish a positive payment history.

Rent and utility payments can also be reported to credit bureaus, although this often requires using a third-party service. Paying these bills on time consistently can also help you build your credit worthiness.

Navigating the Pitfalls

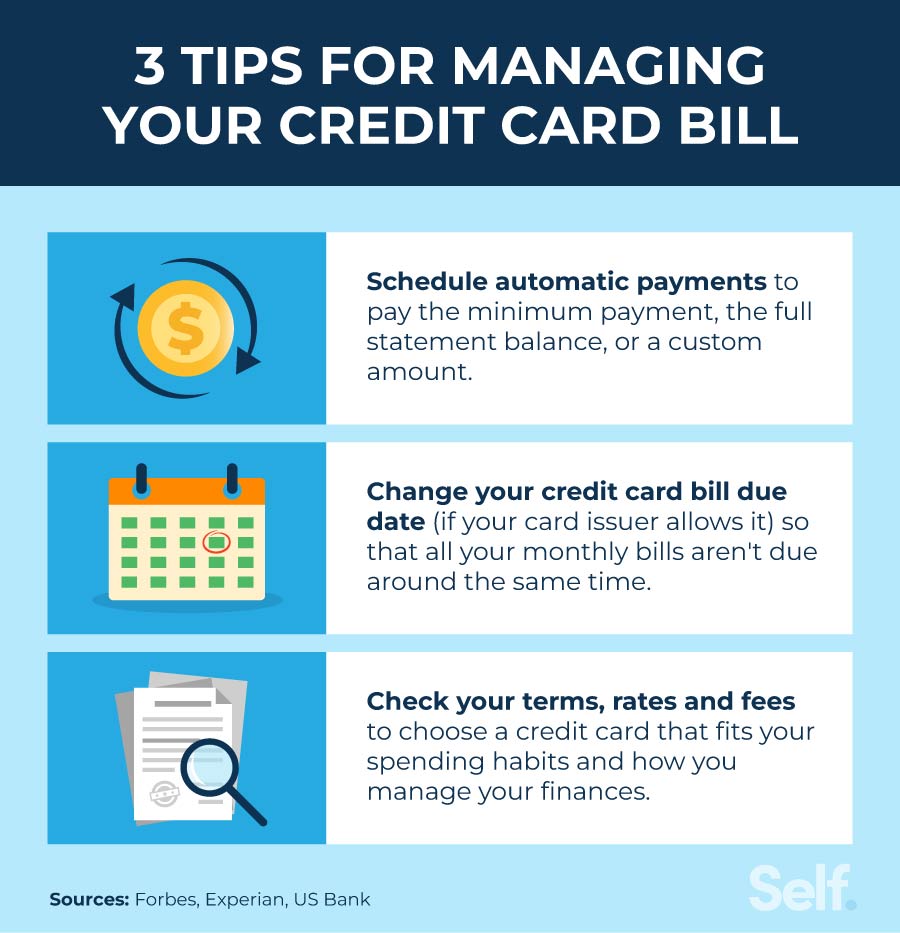

The lure of instant gratification with a credit card can be tempting. Overspending and racking up debt is a common pitfall. High interest rates can quickly make debt unmanageable.

Missing payments can lead to late fees and a significant drop in your credit score.

"A single late payment can stay on your credit report for up to seven years," warns the Consumer Financial Protection Bureau (CFPB).

It’s essential to create a budget and stick to it. Treat your credit card like a debit card, only spending what you can afford to repay in full each month. This will help you avoid interest charges and build a solid credit history.

A Word of Caution

Be wary of applying for too many credit cards at once. Each application results in a hard inquiry on your credit report, which can temporarily lower your score. Focus on building a positive history with one or two cards before expanding your credit portfolio.

Avoid cash advances on your credit card. They typically come with high fees and interest rates. Building a healthy emergency fund is a better way to handle unexpected expenses.

In conclusion, using a credit card to build credit can be a powerful and effective strategy, but it requires discipline, careful planning, and a commitment to responsible spending habits. It's a marathon, not a sprint, so start slowly, stay informed, and watch your credit score flourish.