Simple Small Business Accounting Software

Small business owners are scrambling to adopt simpler accounting software amid rising inflation and economic uncertainty. User-friendly platforms are now crucial for survival, not just growth.

This surge in demand highlights a critical shift: small businesses need accessible, affordable, and efficient tools to manage finances, track cash flow, and make informed decisions in real-time.

The Rise of Simple Accounting Solutions

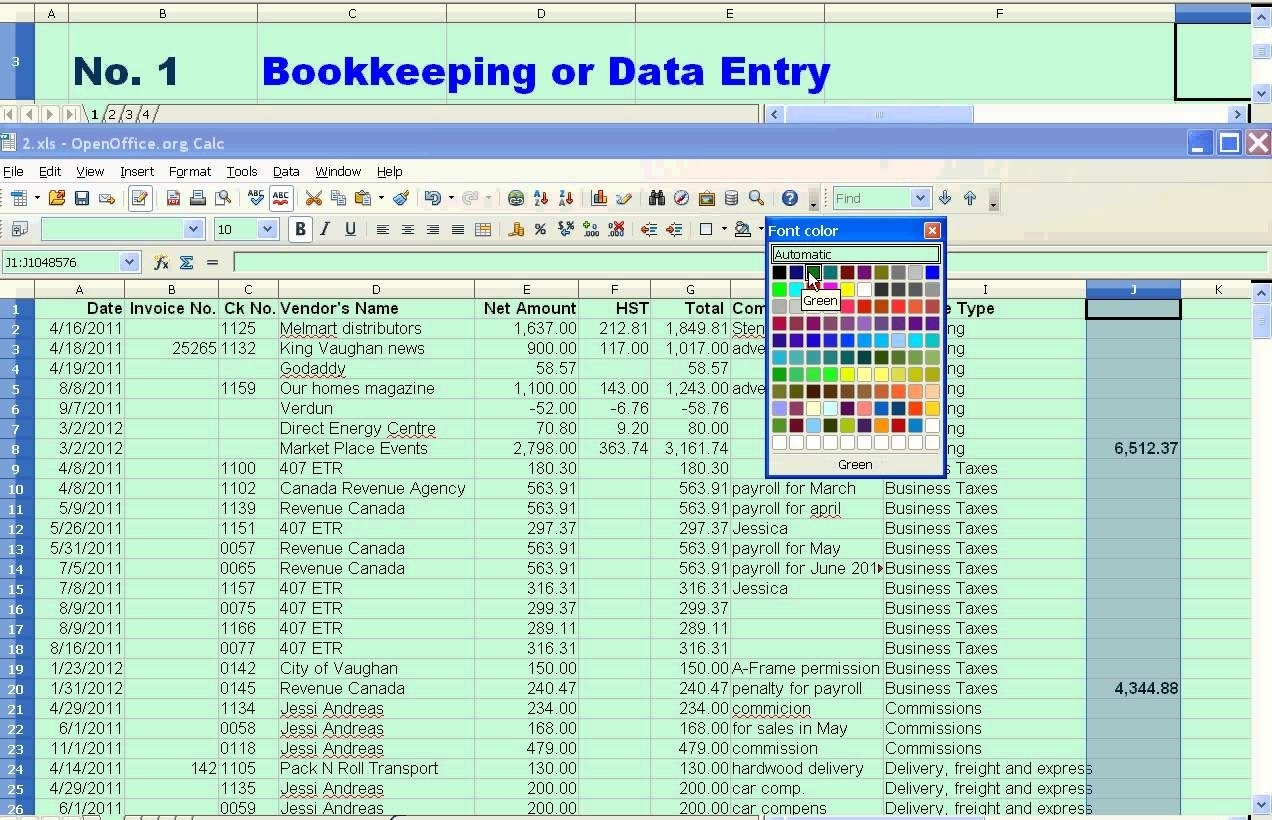

Traditional accounting software, often complex and expensive, is proving unsustainable for many small ventures. Simplified solutions are filling the void.

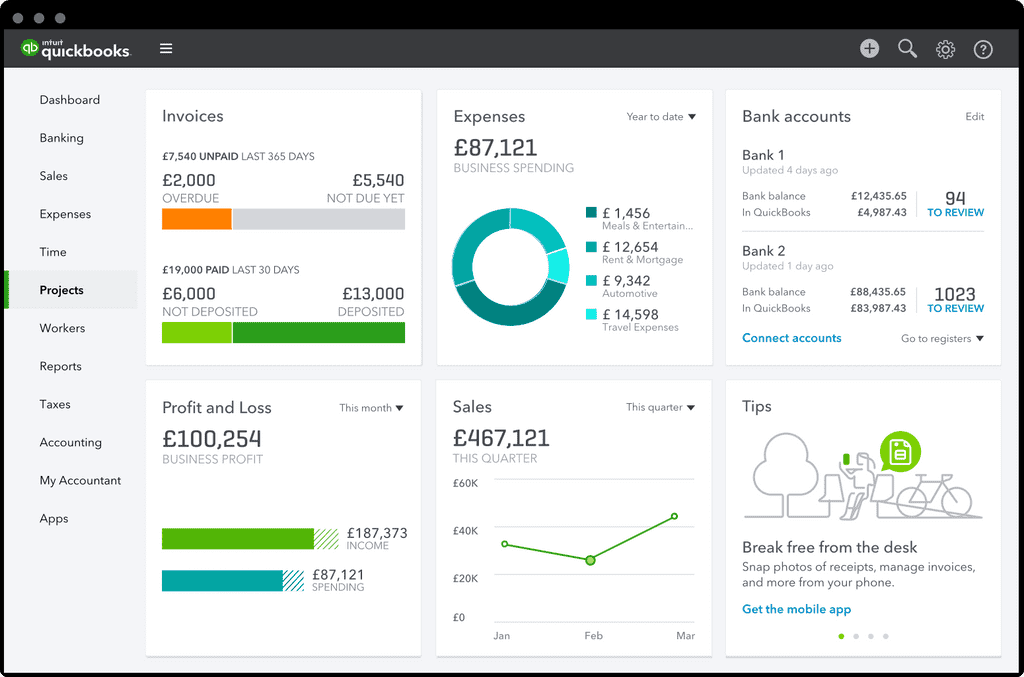

These platforms offer features like automated bank reconciliation, invoice generation, expense tracking, and basic financial reporting, all accessible from a user-friendly interface. The goal is ease of use, even for those without extensive accounting knowledge.

Key Features and Benefits

A primary advantage is affordability. Many simple accounting solutions offer tiered pricing, with basic plans starting as low as $10-$20 per month, significantly cheaper than traditional software that can cost hundreds or even thousands annually.

Time savings are also substantial. Automated features streamline tasks, freeing up business owners to focus on core operations rather than getting bogged down in bookkeeping.

Improved financial visibility is another critical benefit. Real-time insights into cash flow, revenue, and expenses empower owners to make smarter, data-driven decisions.

Who is Benefiting?

The adoption rate is highest among startups, freelancers, and small businesses with fewer than 10 employees. These entities typically lack dedicated accounting staff and need accessible, easy-to-understand financial tools.

E-commerce businesses, in particular, are seeing significant value. The ability to integrate with popular online sales platforms, such as Shopify and Etsy, streamlines transaction tracking and inventory management.

Service-based businesses, like consultants and contractors, also find simplified accounting software essential for managing invoices, tracking billable hours, and monitoring project profitability.

Where to Find These Solutions

The market is flooded with options. Prominent players include QuickBooks Simple Start, Xero, Zoho Books, and FreshBooks. Each offers a slightly different mix of features and pricing, so careful comparison is essential.

Online reviews and user testimonials are valuable resources for evaluating different platforms. Seek insights from other small business owners in similar industries.

Free trials are also common, allowing businesses to test out software before committing to a paid subscription. Take advantage of these opportunities to ensure a platform aligns with specific needs.

When to Make the Switch

The time to switch is now. Delaying adoption can lead to missed opportunities for cost savings, improved efficiency, and better financial control.

Businesses struggling with manual bookkeeping, spreadsheet overload, or lack of real-time financial insights should prioritize the transition. The investment in simple accounting software will quickly pay for itself in time savings and improved decision-making.

"We were drowning in paperwork before switching to a cloud-based solution," says Sarah Miller, owner of a small online retail business. "Now, everything is automated, and I have a clear picture of my finances at all times."

How to Choose the Right Software

Consider key factors: ease of use, integration with existing business systems, scalability, and customer support. Prioritize features that directly address your specific business needs.

Read online reviews and compare pricing plans, focusing on long-term value rather than initial cost. Remember, the best software is the one that helps you make informed decisions and grow your business.

Implement the software gradually. Start with basic features and gradually expand your usage as you become more comfortable. Seek support from the software provider or a qualified accountant if needed.

Next Steps

Industry experts predict continued growth in the simple accounting software market, with more advanced features and integrations on the horizon. Ongoing development will focus on artificial intelligence and machine learning to automate even more tasks.

Small business owners should stay informed about these advancements and proactively explore new solutions that can further improve their financial management capabilities. Don't be left behind.