Small Business Cash Flow Management

Small businesses are facing a cash flow crunch, with a recent study revealing that 82% experience cash flow problems that threaten their solvency. Immediate action is crucial for survival.

This article will offer practical advice to small business owners grappling with cash flow management. It highlights key strategies and resources to navigate these turbulent times.

Understanding the Cash Flow Crisis

The National Federation of Independent Business (NFIB) reports that inflation and supply chain disruptions are major contributors.

According to a QuickBooks study, the average small business has only 27 days of cash reserves.

This lack of a cash cushion makes them exceptionally vulnerable to unexpected expenses or revenue dips.

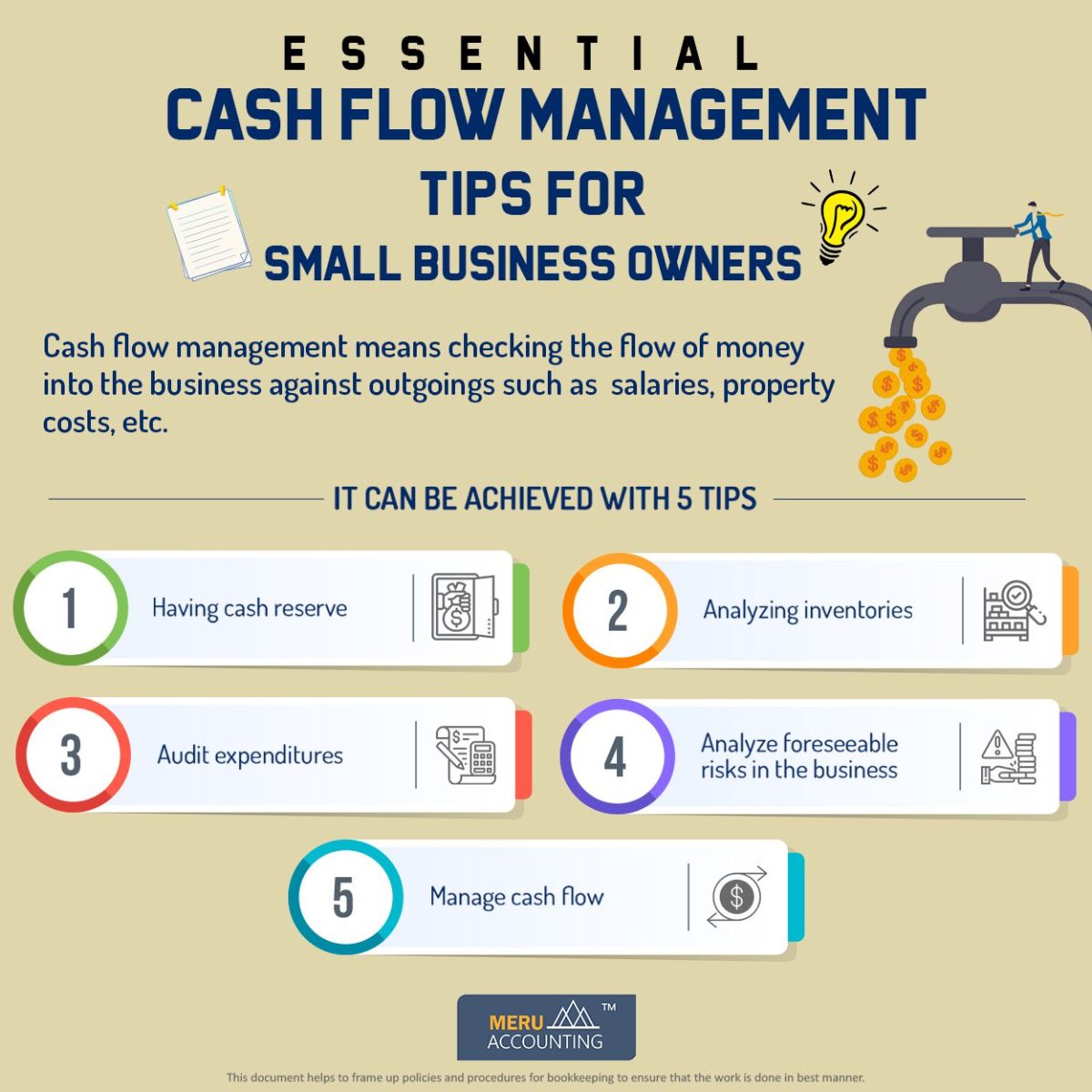

Key Strategies for Improvement

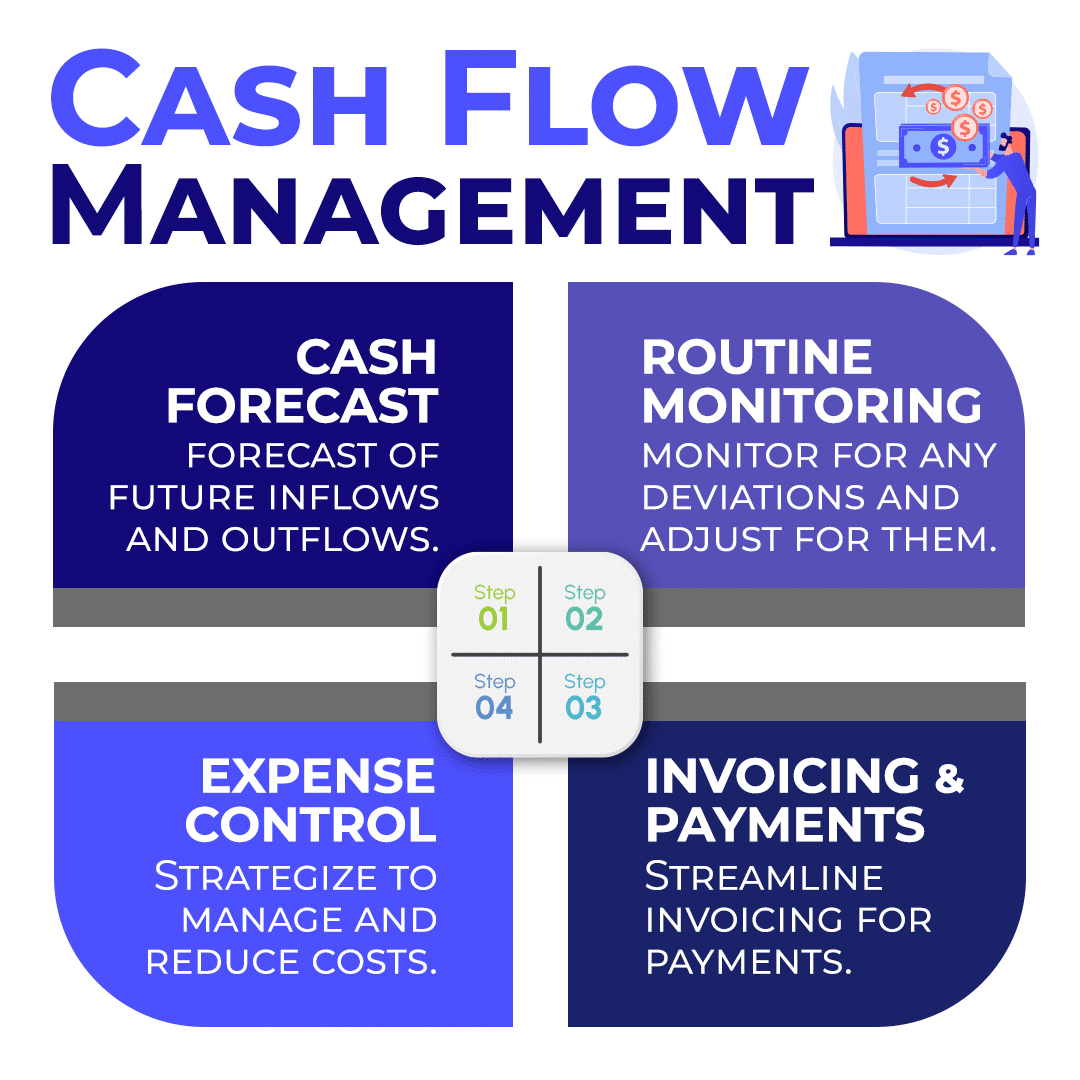

1. Invoice Promptly and Persistently

Faster payments are essential. Implement systems to generate invoices immediately after service delivery or product shipment.

Offer early payment discounts and set clear payment terms. Follow up on overdue invoices immediately.

2. Manage Inventory Effectively

Overstocking ties up cash. Implement a system to track inventory accurately and avoid over-ordering.

Consider just-in-time inventory management or consignment agreements. Reduce your financial burden.

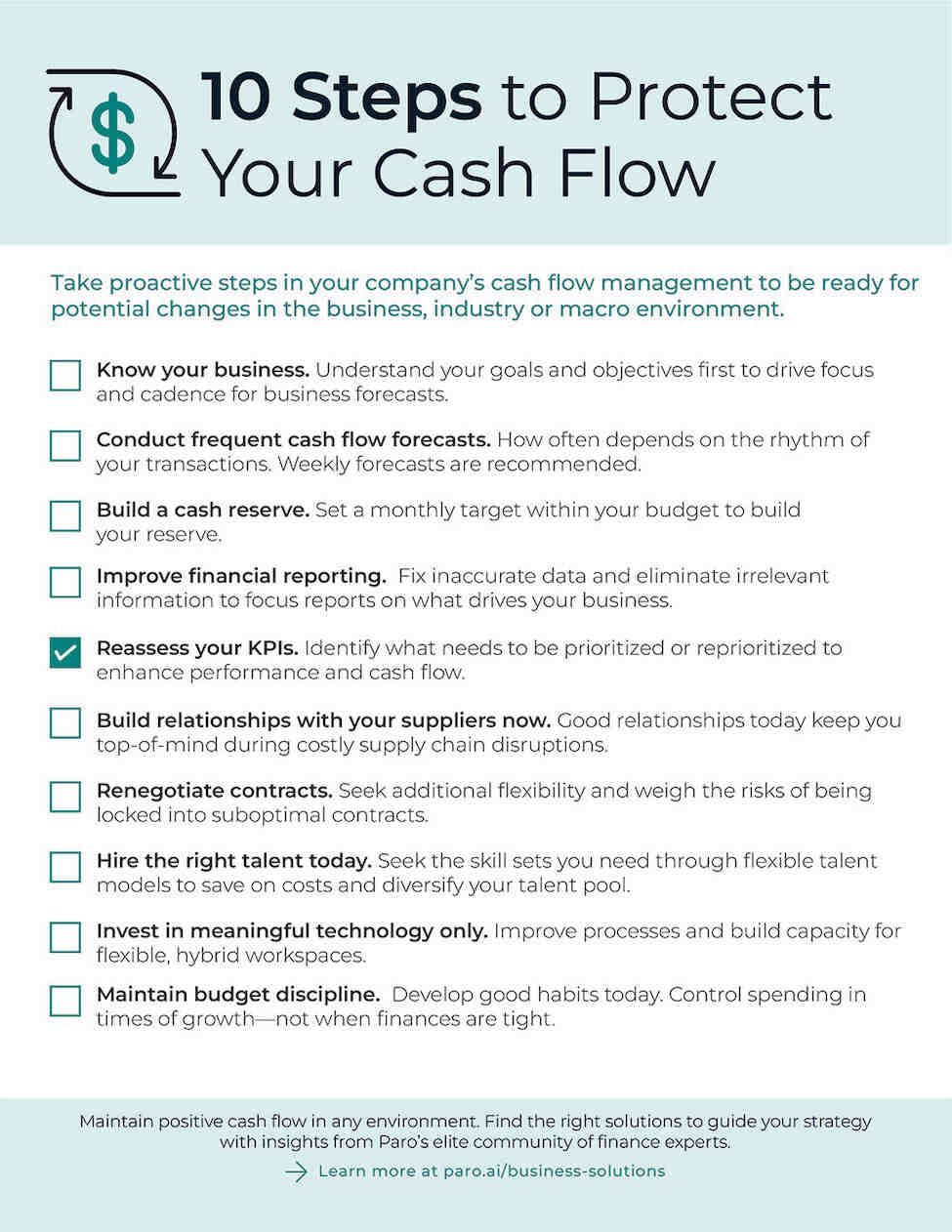

3. Control Expenses Ruthlessly

Review all expenses and identify areas for reduction. Negotiate with suppliers and vendors for better terms.

Consider outsourcing non-core functions to reduce overhead costs. Cloud-based accounting software can help track and manage expenses effectively.

4. Explore Financing Options

When a cash shortfall occurs explore funding options such as lines of credit. Apply for a Small Business Administration (SBA) loan or a microloan.

Factoring invoices can provide immediate access to cash. However, carefully evaluate the costs and terms associated with these options.

5. Build a Cash Flow Forecast

Project your future cash inflows and outflows. A cash flow forecast provides insight into potential shortfalls.

Use this forecast to make informed decisions about spending, investment, and financing.

Available Resources and Support

The SBA offers free counseling and training resources to small businesses. Take advantage of programs from organizations like SCORE.

Consult with a financial advisor or accountant. They can offer tailored advice and help develop a robust cash flow management plan.

Real-World Examples

Joe’s Coffee Shop implemented a loyalty program that incentivizes customers to pre-pay for coffee, improving cash flow.

Sarah’s Boutique negotiated extended payment terms with her key suppliers, providing greater payment flexibility.

These examples demonstrate the power of proactive cash flow management.

The Clock is Ticking

Ignoring cash flow problems can be fatal. Small business owners must act swiftly to protect their bottom line and their business's future.

The next step involves assessing your current cash flow situation and implementing at least one of the strategies mentioned. Seek help from financial professionals and relevant organizations.