Small Business Financial Management

The lifeblood of any economy, small businesses, are facing an unprecedented financial storm. Rising inflation, supply chain disruptions, and a looming recession are creating a perfect storm that threatens their survival. For many entrepreneurs, mastering financial management is no longer just about growth; it's about staying afloat.

This article delves into the critical financial management challenges confronting small businesses today. It examines strategies for navigating these turbulent times. The article will also explore the resources available to support their financial stability and future prospects. The stakes are high: the resilience of small businesses will significantly impact the overall economic health.

Navigating the Current Economic Landscape

The current economic climate is posing significant financial challenges for small businesses. Inflation is driving up the cost of goods and services, squeezing profit margins. Supply chain disruptions are making it difficult to obtain necessary inventory, leading to delays and lost sales.

According to a recent report by the National Federation of Independent Business (NFIB), inflation remains the top concern for small business owners. The NFIB reported that a significant percentage of owners are raising their prices to offset rising input costs. But this tactic risks alienating customers in a price-sensitive market.

The potential for a recession adds another layer of complexity. Consumer spending may decline, further impacting small business revenues. Effective financial planning and risk management are paramount in this uncertain environment.

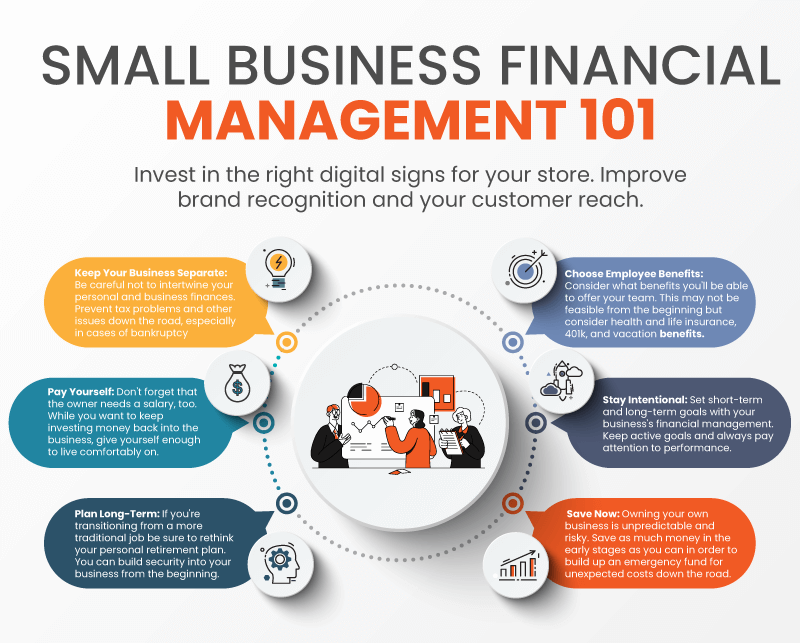

Key Financial Management Strategies

Effective cash flow management is crucial for small business survival. This involves accurately forecasting income and expenses, and proactively managing accounts receivable and payable. Implementing tools and strategies for better cash flow visibility can be a game changer.

Budgeting is another essential financial management tool. Creating a realistic budget helps small businesses track their spending. The businesses also need to identify areas where they can cut costs.

Careful inventory management can also improve profitability. Optimizing inventory levels minimizes storage costs and reduces the risk of obsolescence. Technology can play a role in streamlining these processes.

Accessing Capital and Financial Resources

Access to capital remains a significant hurdle for many small businesses. Traditional lending institutions may be hesitant to provide loans in the current economic climate. Exploring alternative financing options, such as microloans or crowdfunding, can be crucial.

The Small Business Administration (SBA) offers various programs to support small business financing. These programs include loan guarantees, which can make it easier for businesses to secure funding. The SBA also provides counseling and training services to help small businesses improve their financial management skills.

Government grants and tax incentives can also provide much-needed financial relief. Small businesses should research available programs to determine their eligibility. Consulting with a financial advisor can help navigate these complex options.

The Role of Technology

Technology plays an increasingly important role in small business financial management. Cloud-based accounting software simplifies bookkeeping and provides real-time financial data. This allows business owners to make informed decisions quickly.

Financial planning and analysis (FP&A) tools can help small businesses forecast future performance. These tools can identify potential risks and opportunities. They allow business owners to develop proactive strategies.

Adopting digital payment solutions can improve cash flow and streamline transactions. These solutions can also enhance the customer experience. This ultimately can contribute to increased sales and customer loyalty.

Looking Ahead: Building Financial Resilience

The challenges facing small businesses are likely to persist in the near term. Building financial resilience is essential for long-term survival and success. This involves developing a strong financial foundation. It also requires adapting to changing market conditions.

Investing in financial literacy is crucial for small business owners. Understanding financial statements and key performance indicators (KPIs) enables informed decision-making. Seeking guidance from financial professionals can provide valuable insights and support.

By prioritizing sound financial management practices, small businesses can weather the current storm. They can also position themselves for future growth and prosperity. The future of the small business sector depends on their ability to adapt and thrive.