Small Businesses Accounting Software

For countless small business owners, the phrase "tax season" evokes a sense of dread, a culmination of disorganized receipts and frantic spreadsheet entries. But the tide is turning. Increasingly sophisticated yet user-friendly accounting software is democratizing financial management, offering a lifeline to entrepreneurs seeking to navigate the complexities of modern business.

This shift isn’t just about convenience; it's about survival. Accounting software provides real-time insights, automates tedious tasks, and helps small businesses maintain compliance, ultimately freeing up valuable time and resources to focus on growth and innovation.

The Nut Graf: Empowering Small Businesses Through Technology

Accounting software for small businesses is rapidly evolving, providing affordable and accessible tools to manage finances efficiently. From basic bookkeeping to advanced financial analysis, these platforms are leveling the playing field, enabling small businesses to compete more effectively in today's dynamic market. These platforms are transforming the way small businesses operate, offering features tailored to their unique needs and budgets.

Benefits Beyond Bookkeeping

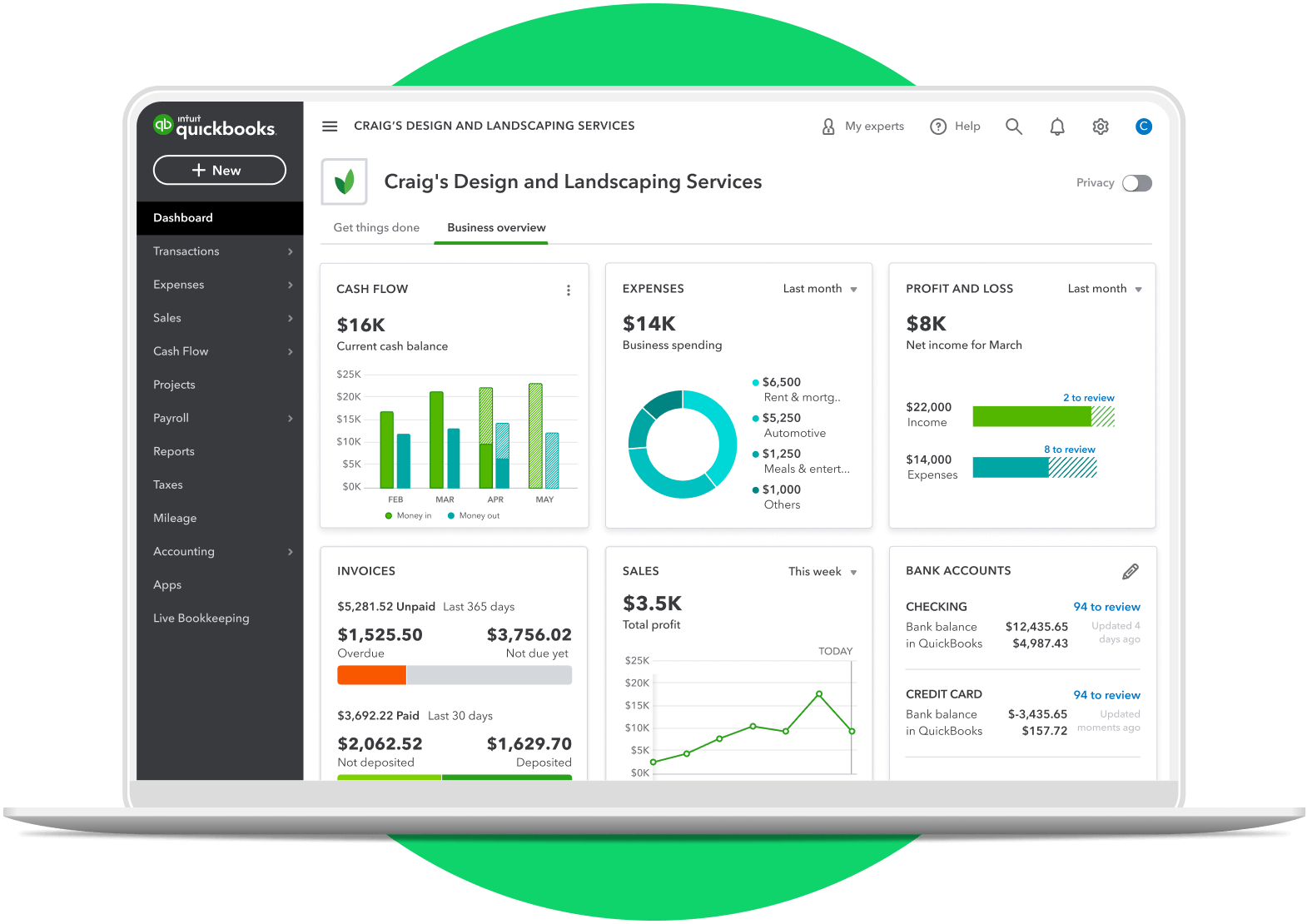

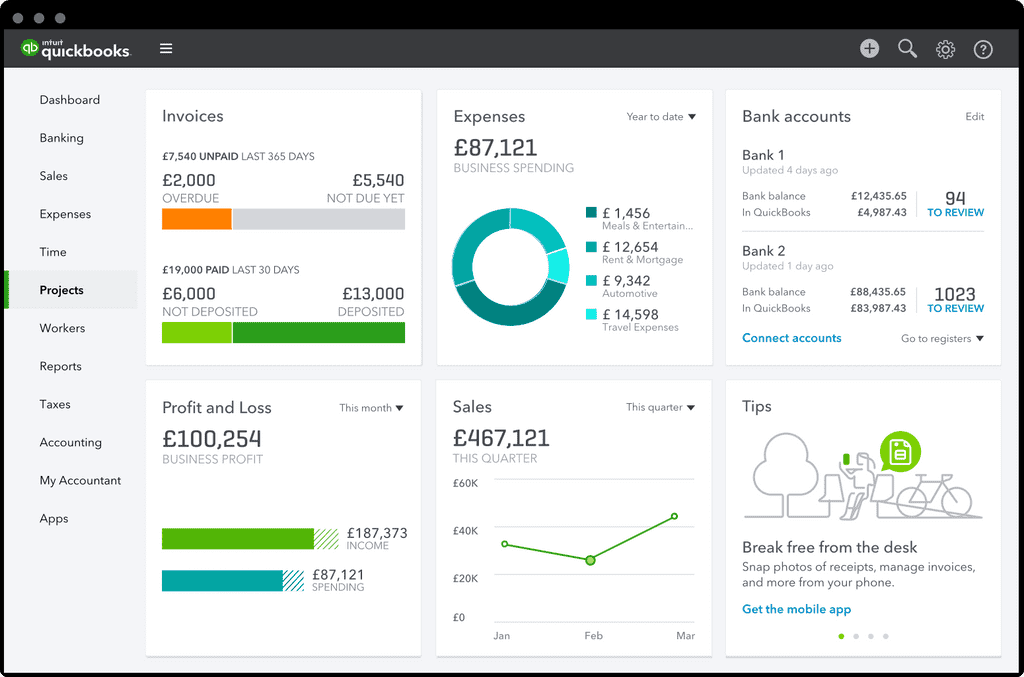

Modern accounting software offers far more than just simple bookkeeping. Cloud-based solutions provide accessibility from anywhere with an internet connection, a critical advantage for today's mobile workforce. Features like automated bank reconciliation, invoice generation, and expense tracking significantly reduce manual effort, minimizing the risk of errors and freeing up staff time.

According to a recent report by Intuit QuickBooks, businesses using accounting software spend up to 50% less time on bookkeeping tasks. This efficiency allows business owners to focus on strategic decision-making, product development, and customer acquisition – all essential for sustained success.

Navigating the Software Landscape

Choosing the right accounting software can feel overwhelming, given the plethora of options available. Solutions range from basic, entry-level programs suitable for freelancers and sole proprietors to more robust platforms designed for growing businesses with multiple employees.

Popular options include Xero, Sage Accounting, and Zoho Books, each offering different pricing models and feature sets. Factors to consider when selecting software include the size and complexity of the business, the level of accounting expertise required, and the integration capabilities with other business tools.

G2, a leading software review platform, provides comparative data and user reviews to help businesses make informed decisions. These resources offer valuable insights into the strengths and weaknesses of various accounting software solutions.

The Cloud Advantage and Security Concerns

The majority of modern accounting software is cloud-based, offering numerous advantages over traditional desktop applications. These advantages include automatic backups, data security enhancements, and real-time collaboration capabilities.

However, cloud-based solutions also raise concerns about data security and privacy. Businesses must carefully evaluate the security protocols and data protection policies of their chosen software provider to mitigate these risks.

Reputable providers like FreshBooks invest heavily in security infrastructure and comply with industry standards to protect sensitive financial data. It's essential to research and select a provider with a proven track record of security and reliability.

The Future of Small Business Accounting

The future of small business accounting is increasingly automated and data-driven. Artificial intelligence (AI) and machine learning (ML) are being integrated into accounting software to further streamline processes and provide more insightful financial analysis. Imagine an AI assistant that automatically categorizes transactions, predicts cash flow, and identifies potential risks – this is becoming a reality.

Deloitte predicts that AI will play an increasingly significant role in accounting over the next decade, automating routine tasks and freeing up accountants to focus on more strategic advisory roles. For small businesses, this translates to even greater efficiency and improved financial decision-making.

The integration of accounting software with other business systems, such as CRM and e-commerce platforms, will further enhance efficiency and provide a holistic view of the business. This seamless data flow will enable businesses to gain deeper insights into their performance and make more informed decisions.

Embracing Technology for Success

In today's competitive business environment, small businesses must embrace technology to thrive. Accounting software is no longer a luxury but a necessity, providing the tools and insights needed to manage finances effectively, make informed decisions, and achieve sustainable growth. By carefully selecting and implementing the right accounting software, small business owners can unlock their full potential and build a more prosperous future.

![Small Businesses Accounting Software 11 BEST Small Business Accounting Software [TOP SELECTIVE]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2021/01/Small-Business-Accounting-Software.png)