Small Cap Oil And Gas Stocks

Small-cap oil and gas stocks are experiencing a surge in volatility as geopolitical tensions and fluctuating commodity prices create a high-stakes environment for investors. Several companies have announced significant production cuts and strategic shifts in response to the shifting market landscape.

This article breaks down the current state of these high-risk, high-reward energy plays, pinpointing key factors impacting their performance and highlighting critical developments investors need to monitor.

Production Cuts and Strategic Shifts

Several small-cap oil and gas producers have announced production cuts in recent weeks. Northern Oil and Gas, for example, recently reduced its Q3 production guidance by approximately 5%, citing operational delays and revised capital expenditure plans.

Whiting Petroleum announced a similar adjustment, attributing the decision to prioritize capital efficiency over maximizing near-term output.

These cuts reflect a growing focus on profitability amid concerns about sustained low oil prices and increased regulatory scrutiny.

Geopolitical Instability Fuels Uncertainty

Geopolitical events are having an outsized impact on small-cap oil and gas stocks. Recent unrest in key oil-producing regions has sent shockwaves through the market, creating both opportunities and risks.

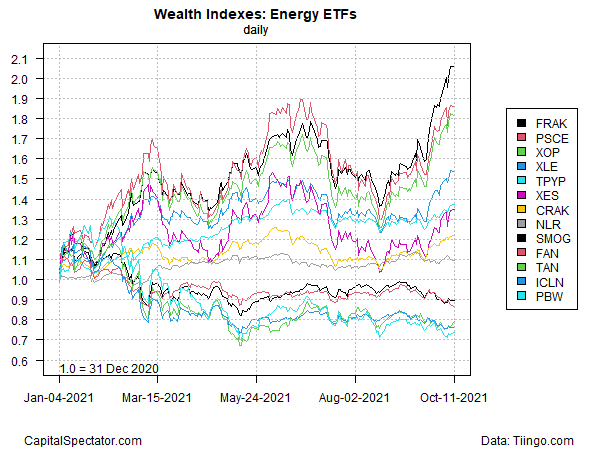

The Energy Select Sector SPDR Fund (XLE), a benchmark for the energy sector, has experienced significant fluctuations in response to these events, mirroring the volatility seen in small-cap stocks.

Investors are closely monitoring the situation, as any further escalation could trigger a sharp increase in oil prices, benefiting companies with significant production capacity, but also raising concerns about global economic stability.

Financial Performance and Investor Sentiment

The financial performance of small-cap oil and gas companies remains a mixed bag. Some firms, particularly those with strong balance sheets and efficient operations, have managed to weather the storm.

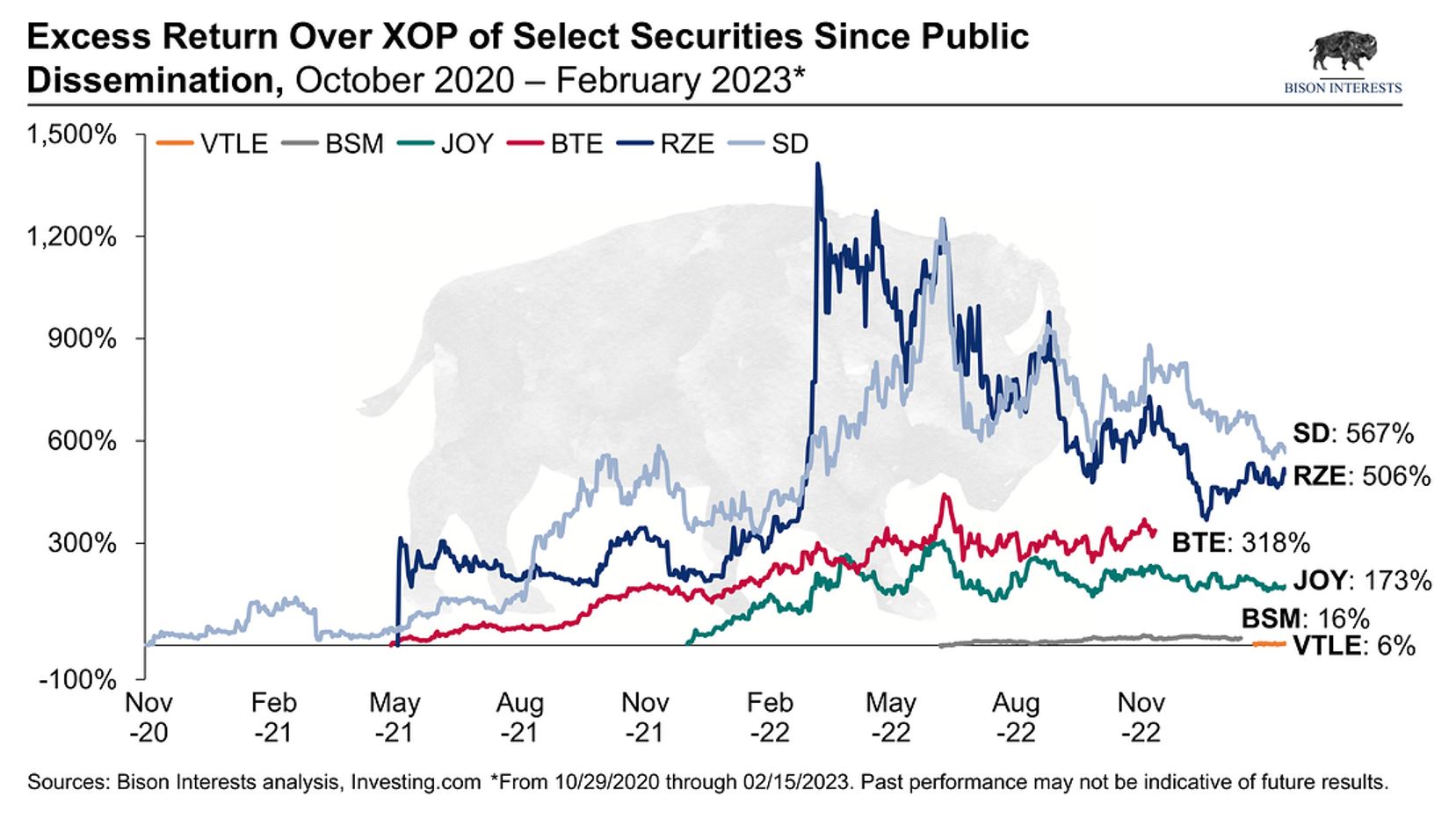

Riley Exploration Permian recently reported strong earnings, driven by cost-cutting measures and increased production efficiency.

However, others are struggling under the weight of debt and dwindling cash reserves, facing the prospect of restructuring or even bankruptcy. Investor sentiment is highly sensitive to news flow, with stock prices reacting sharply to any indication of financial distress or operational challenges.

Regulatory Landscape and Environmental Concerns

The regulatory landscape continues to pose a significant challenge for small-cap oil and gas companies. Stricter environmental regulations are increasing compliance costs and limiting access to new drilling sites.

The Environmental Protection Agency (EPA) is currently reviewing permitting processes, which could further delay or impede new projects.

This regulatory uncertainty is weighing on investor sentiment and making it more difficult for these companies to attract capital.

Technological Advancements and Operational Efficiency

Despite the challenges, some small-cap oil and gas companies are leveraging technological advancements to improve operational efficiency and reduce costs. Innovations in drilling techniques and data analytics are helping them to optimize production and minimize environmental impact.

Companies like Laredo Petroleum have invested heavily in these technologies, resulting in improved well performance and lower operating expenses.

However, the adoption of these technologies requires significant capital investment, which may be a barrier for smaller, financially constrained companies.

Analyst Ratings and Market Outlook

Analyst ratings on small-cap oil and gas stocks are highly divergent, reflecting the inherent uncertainty of the sector. Some analysts are optimistic about the long-term prospects for these companies, citing the potential for higher oil prices and increased demand.

Others are more cautious, warning of the risks associated with debt, regulatory uncertainty, and geopolitical instability. The overall market outlook remains clouded, with conflicting signals about the future direction of oil prices and the global economy.

Key Players and Their Strategies

Several key players are shaping the landscape of small-cap oil and gas stocks. These include independent producers, private equity firms, and institutional investors.

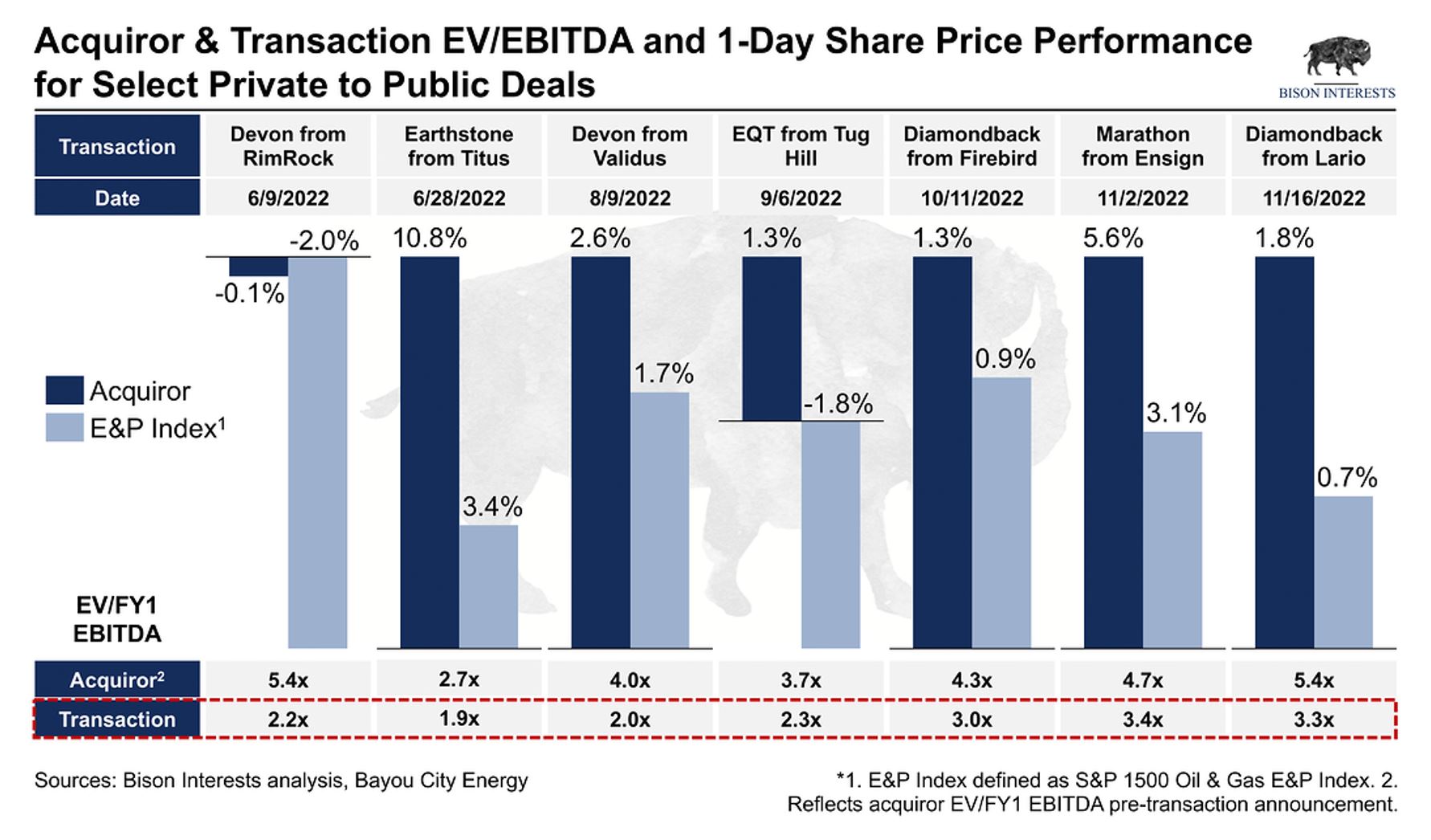

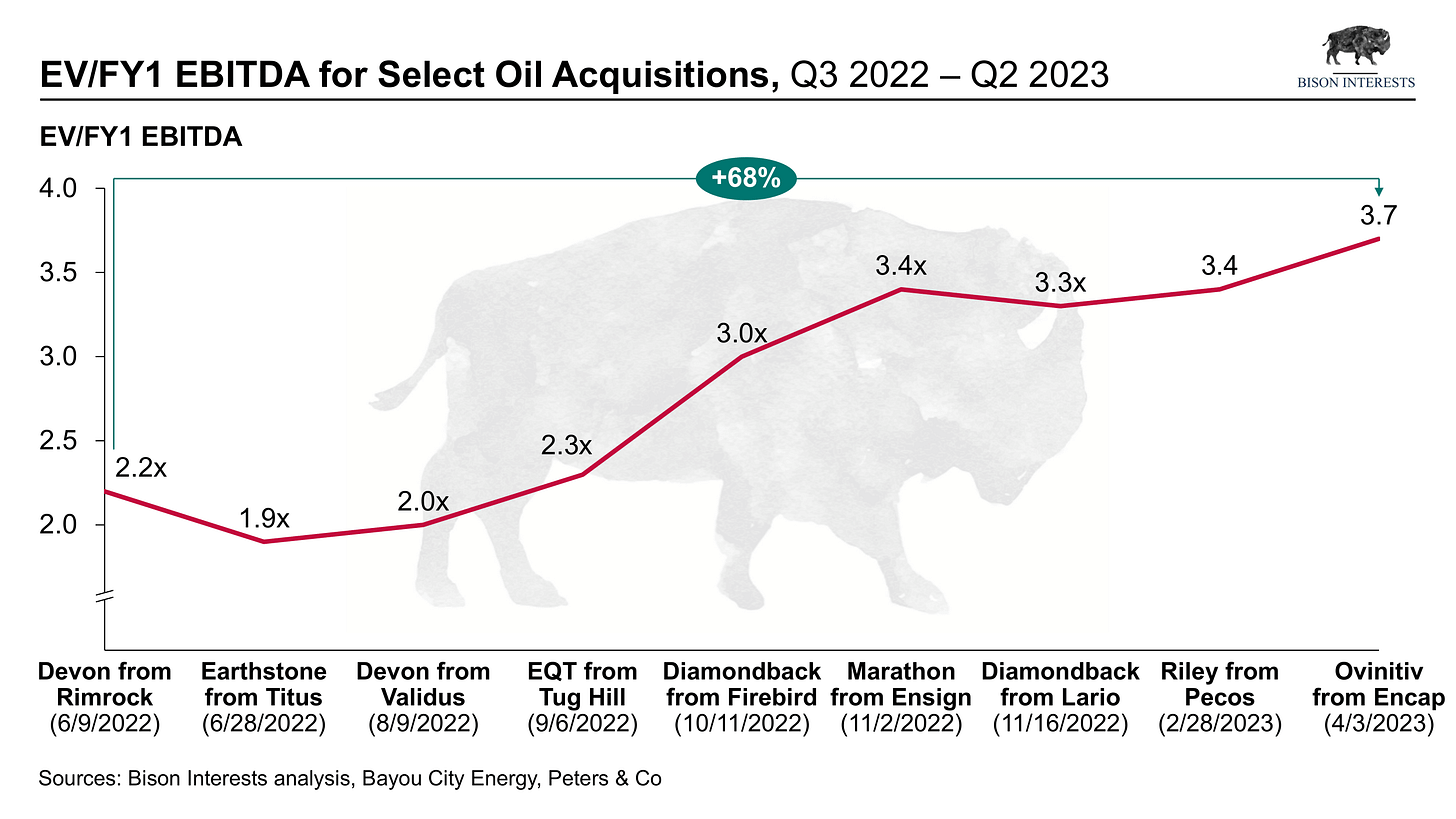

Earthstone Energy is actively pursuing acquisitions to expand its footprint in key shale basins. Private equity firms are playing an increasingly important role, providing capital to companies that are struggling to access traditional financing.

These strategies are reshaping the competitive landscape and creating new opportunities for investors.

Looking Ahead: Monitoring Key Indicators

Investors in small-cap oil and gas stocks should closely monitor several key indicators. These include oil prices, production levels, financial performance, regulatory developments, and geopolitical events.

The West Texas Intermediate (WTI) crude oil price serves as a crucial benchmark. Any significant shift in these indicators could have a material impact on the performance of these stocks.

Staying informed and adapting to changing market conditions is essential for success in this volatile sector.

:max_bytes(150000):strip_icc()/smalloil-621fe891322446898f02647593dbd46b.png)