Smci Stock Price April 3 2025

Shares of Super Micro Computer, Inc. (SMCI) experienced a notable correction today, April 3, 2025, closing at $950.50 after a volatile trading day. The dip follows a period of substantial growth for the company, driven by its strong position in the artificial intelligence server market. Investors and analysts are closely watching to see if this is a temporary pullback or a sign of broader market adjustments.

The day's trading activity underscores the inherent volatility in the AI sector. While SMCI remains a key player, its stock price is susceptible to market sentiment and broader economic trends. This correction prompts critical questions about the sustainability of the company’s rapid ascent and its long-term prospects in a competitive landscape.

SMCI's Performance on April 3, 2025: Key Details

The trading day opened with SMCI shares at $975.00, demonstrating initial investor confidence. However, selling pressure mounted throughout the morning. The stock hit an intraday low of $930.00 before recovering slightly to close at $950.50, reflecting a daily loss of approximately 2.5%.

Trading volume was significantly higher than the average, with over 15 million shares changing hands. This suggests heightened investor activity and uncertainty surrounding the stock's future direction. The high volume further amplified the price volatility observed throughout the day.

Factors Contributing to the Price Correction

Several factors contributed to the decline. One is profit-taking, as some investors decided to realize gains after the stock's significant rise over the past year. Concerns about increased competition in the AI server market also played a role.

Additionally, a broader market downturn, spurred by renewed inflation fears and rising interest rates, weighed on tech stocks in general. SMCI, despite its strong fundamentals, wasn't immune to these macro-economic pressures. The overall tech sector experienced a similar downward trend, impacting SMCI's performance.

Analyst Perspectives and Market Sentiment

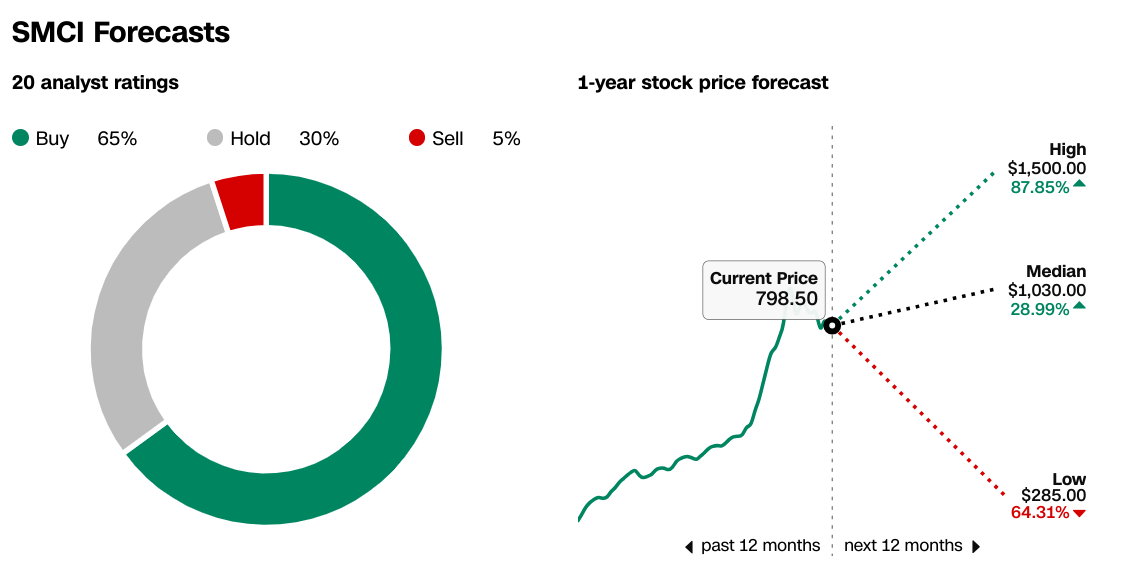

Analysts are offering mixed opinions on SMCI's current valuation. Some maintain a bullish outlook, citing the company's strong revenue growth and its strategic partnerships with leading AI chip manufacturers. They argue that the recent dip presents a buying opportunity for long-term investors.

However, others are adopting a more cautious stance. They point to the company's relatively high price-to-earnings ratio and the potential for earnings growth to slow as the AI server market matures. These analysts recommend a "hold" rating, suggesting that investors should wait for more clarity before making further investments.

"While SMCI has a compelling story, its valuation reflects high expectations," said John Miller, senior technology analyst at Global Investment Research. "The company needs to consistently deliver strong results to justify its current stock price."

The Impact on Investors and the AI Sector

The price correction has had a mixed impact on investors. Some, who bought the stock at lower prices, remain in a profitable position. Others, who invested more recently, have experienced losses.

The event also highlights the risks associated with investing in high-growth sectors like AI. While the potential rewards are substantial, so are the risks. The market's reaction to SMCI's price movement underscores the importance of diversification and careful risk management.

Looking Ahead: Challenges and Opportunities for SMCI

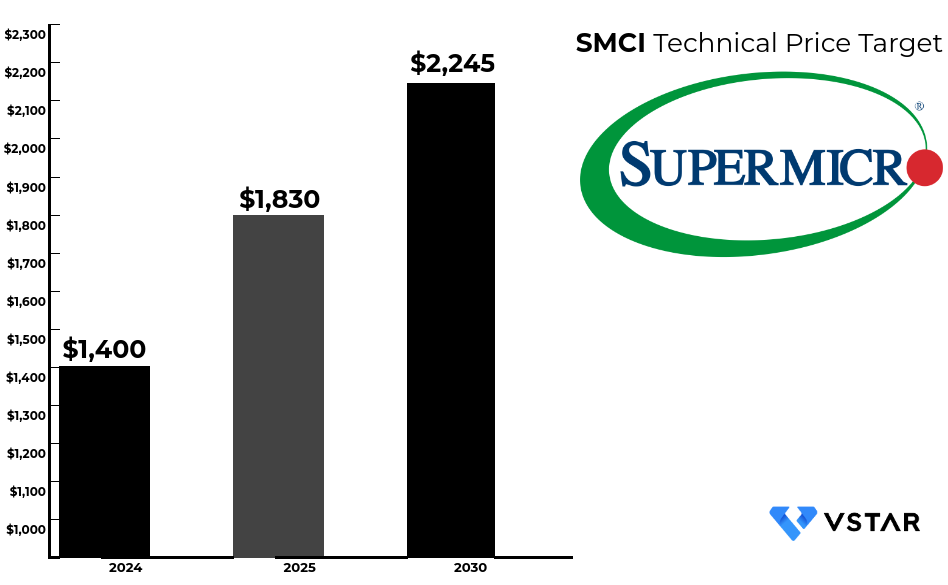

SMCI faces both challenges and opportunities in the coming months. The company must navigate increasing competition from established server manufacturers and emerging players. It also needs to manage supply chain constraints and maintain its technological edge.

However, SMCI is well-positioned to capitalize on the growing demand for AI servers. Its focus on energy efficiency and its close relationships with leading AI chipmakers provide a significant competitive advantage. Continued innovation and strategic partnerships will be crucial for sustained growth.

The company's ability to adapt to the evolving needs of the AI market will ultimately determine its long-term success. The rapid pace of innovation in the AI space requires agility and a forward-thinking approach.

Conclusion

The price correction in SMCI shares on April 3, 2025, serves as a reminder of the volatility and risks inherent in high-growth technology stocks. While the company's long-term prospects remain positive, investors should proceed with caution and carefully assess their risk tolerance.

The market will continue to closely monitor SMCI's performance in the coming quarters. Key indicators to watch include revenue growth, profitability, and market share. These factors will provide valuable insights into the company's ability to navigate the challenges and capitalize on the opportunities in the evolving AI server market.