Software For Accounting Small Business

Imagine a bustling artisan bakery, the aroma of freshly baked bread mingling with the crisp scent of digital efficiency. No longer are flour-dusted ledgers and late nights spent wrestling with spreadsheets the norm. Instead, a sleek tablet displays a user-friendly interface, effortlessly tracking invoices, expenses, and profits. This isn't a scene from a futuristic fantasy; it's the reality for a growing number of small businesses leveraging the power of accounting software.

At the heart of this quiet revolution is the realization that user-friendly and affordable accounting software can be a game-changer for small businesses. Accounting software allows owners to focus on their core business, instead of spending excessive time on complicated finance tracking. By automating tasks, providing real-time financial insights, and ensuring compliance, these digital tools are empowering entrepreneurs to make informed decisions and achieve sustainable growth.

The Evolution of Accounting for Small Businesses

Traditionally, managing finances for small businesses involved manual record-keeping, often relying on paper ledgers and basic spreadsheets. While this system worked for some, it was often prone to errors, time-consuming, and lacked the depth of analysis needed for strategic decision-making. The cost of hiring a professional accountant further strained the resources of many fledgling businesses.

The advent of personal computers and spreadsheet software offered a slight improvement, but these tools still required significant manual input and expertise. It wasn't until the rise of cloud-based accounting software that a true paradigm shift occurred.

Cloud-Based Solutions: Accessibility and Affordability

Cloud-based accounting software has democratized access to sophisticated financial management tools. Unlike traditional software that required expensive licenses and local installation, cloud-based solutions operate on a subscription model, making them significantly more affordable for small businesses with limited budgets.

According to a report by Intuit QuickBooks, businesses using cloud accounting software experience a 21% increase in revenue on average. Furthermore, the accessibility of these platforms from any device with an internet connection empowers business owners to manage their finances on the go, fostering greater flexibility and responsiveness.

Key Benefits of Accounting Software

The benefits of implementing accounting software extend far beyond mere cost savings. These tools offer a wide range of features designed to streamline financial processes and provide valuable insights.

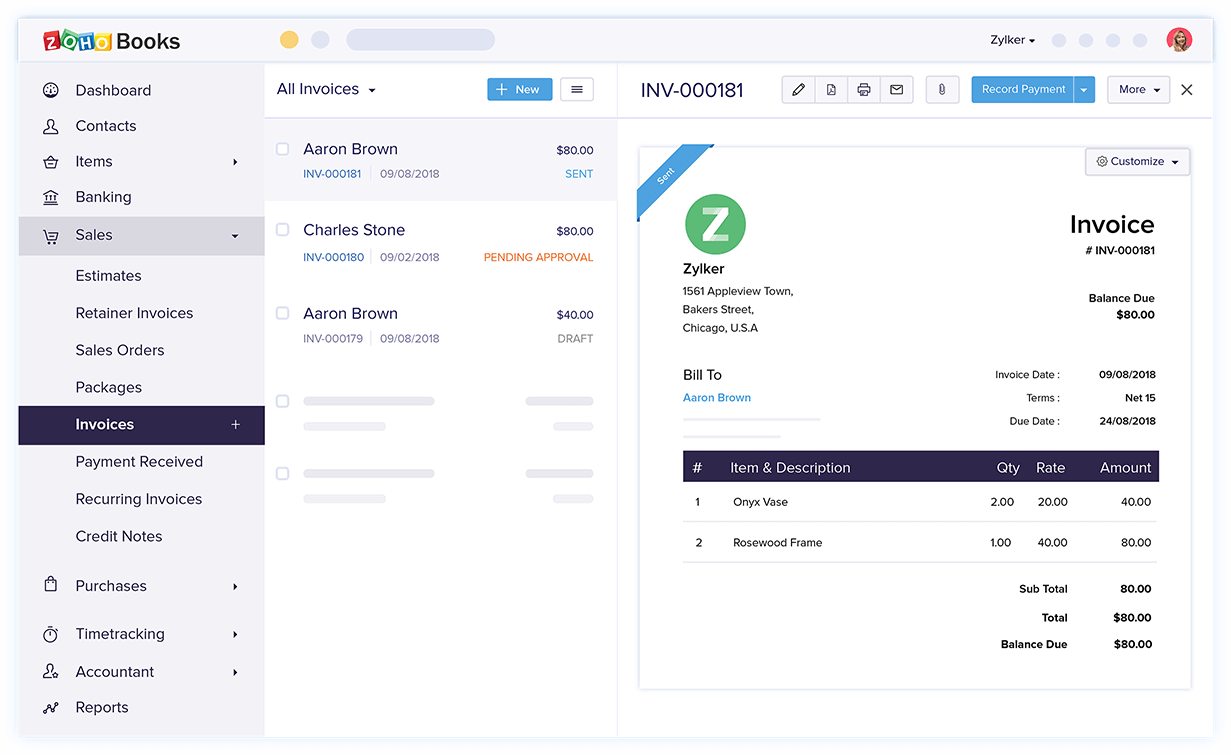

Firstly, accounting software automates many of the routine tasks associated with bookkeeping, such as invoicing, expense tracking, and bank reconciliation. This automation frees up valuable time for business owners to focus on other critical aspects of their operations, such as product development, marketing, and customer service.

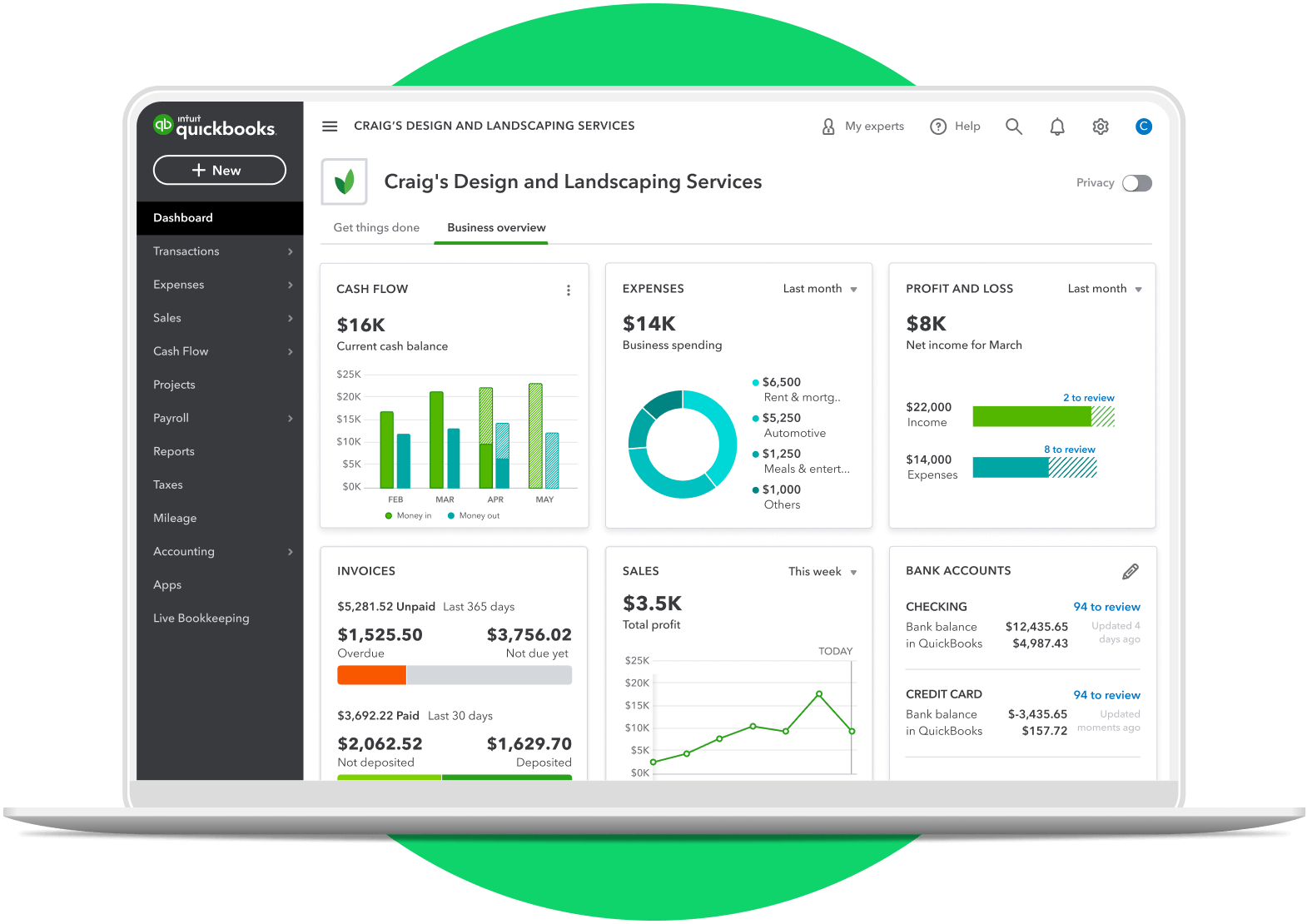

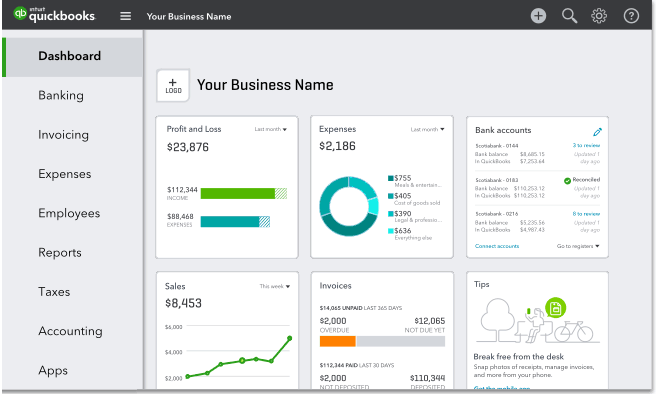

Secondly, these platforms provide real-time financial insights through customizable reports and dashboards. Business owners can easily track key performance indicators (KPIs), identify trends, and make data-driven decisions to optimize their business performance.

"Access to real-time financial data is crucial for small business success," says Jane Doe, a small business consultant. "It allows owners to make informed decisions quickly and proactively address any potential challenges."

Finally, accounting software helps small businesses maintain compliance with tax regulations. Many platforms offer features such as automated tax calculations, e-filing capabilities, and integration with tax preparation software, simplifying the tax filing process and reducing the risk of errors.

Choosing the Right Software

Selecting the right accounting software requires careful consideration of a business's specific needs and budget. Factors to consider include the size of the business, the complexity of its operations, and the level of technical expertise of its staff.

Popular options for small businesses include QuickBooks Online, Xero, and FreshBooks. Each platform offers a different set of features and pricing plans, so it's important to research and compare options before making a decision.

Many software providers offer free trials or demos, allowing business owners to test the platform and ensure it meets their needs. It is important that the selected software can integrate smoothly with other software to avoid double data entries.

The Future of Accounting for Small Businesses

The future of accounting for small businesses is likely to be shaped by advancements in artificial intelligence (AI) and machine learning (ML). These technologies have the potential to further automate tasks, provide even more sophisticated insights, and personalize the user experience.

AI-powered accounting software could potentially automate tasks such as invoice processing, fraud detection, and financial forecasting. Moreover, they could deliver more accurate financial predictions.

As small businesses increasingly embrace these digital tools, they are poised to become more efficient, profitable, and competitive. The aroma of success, like that of freshly baked bread, is now inextricably linked to the crisp efficiency of accounting software.