Sole Proprietorship Paying Yourself

Navigating the financial landscape of a sole proprietorship often presents unique challenges, particularly when it comes to the owner's compensation. Unlike employees who receive a regular salary, or corporations that distribute dividends, sole proprietors have a more direct, yet often complex, relationship with their business earnings.

Understanding how sole proprietors "pay themselves" is crucial for both financial planning and legal compliance. This article delves into the mechanics of owner's draws, their tax implications, and the importance of sound record-keeping for individuals operating under this business structure.

Owner's Draws: The Basics

A sole proprietorship, by definition, is a business owned and run by one person, where there is no legal distinction between the owner and the business. Consequently, the owner does not receive a traditional salary.

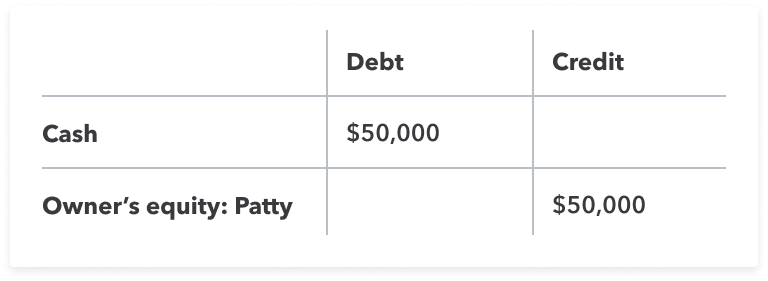

Instead, the owner takes money out of the business for personal use through owner's draws. These draws represent a withdrawal of profits from the business, and are not considered a business expense.

The amount and frequency of owner's draws can vary significantly, depending on the profitability of the business and the owner's personal financial needs.

Tax Implications

The key tax consideration for sole proprietors is that they are taxed on the profit of the business, not on the amount they withdraw. This is a critical distinction.

According to the Internal Revenue Service (IRS), profits from a sole proprietorship are reported on Schedule C of Form 1040 and are subject to both income tax and self-employment tax (Social Security and Medicare taxes).

Even if the owner chooses not to take any draws during the year, they are still liable for taxes on the net profit of the business. Sound financial planning requires anticipating these tax obligations and setting aside funds accordingly.

Self-Employment Tax

Self-employment tax is a significant factor. As explained by the Small Business Administration (SBA), sole proprietors are responsible for paying both the employer and employee portions of Social Security and Medicare taxes, which are collectively known as self-employment tax.

The self-employment tax rate is typically 15.3% (12.4% for Social Security up to a certain income limit and 2.9% for Medicare).

Half of the self-employment tax is deductible from gross income, reducing the overall tax burden, but it's crucial to factor this into financial planning.

Estimated Taxes

Sole proprietors are generally required to pay estimated taxes throughout the year, rather than waiting until the end of the tax year.

The IRS requires estimated tax payments if you expect to owe at least $1,000 in taxes for the year. These payments are typically made quarterly.

Failure to pay estimated taxes can result in penalties, making it essential to accurately project income and tax liabilities.

Record-Keeping and Financial Planning

Meticulous record-keeping is paramount for sole proprietors. Accurate tracking of income, expenses, and owner's draws is essential for determining profitability and calculating tax obligations.

Using accounting software or working with a qualified accountant can greatly simplify this process and ensure compliance with tax regulations.

Furthermore, separating personal and business finances is strongly recommended. Opening a separate business bank account and using dedicated credit cards for business expenses can help maintain clear financial records and simplify tax preparation.

Avoiding Common Pitfalls

One common mistake is failing to differentiate between owner's draws and legitimate business expenses. Only expenses that are directly related to the business are deductible.

Another pitfall is neglecting to plan for taxes. Underestimating tax liabilities can lead to financial strain and potential penalties.

Finally, inadequate record-keeping can make it difficult to track profitability and ensure compliance with tax regulations.

Conclusion

Effectively managing finances as a sole proprietor requires a solid understanding of owner's draws, their tax implications, and the importance of accurate record-keeping.

By proactively planning for taxes, maintaining clear financial records, and seeking professional advice when needed, sole proprietors can navigate the complexities of business ownership and achieve long-term financial stability.

The ability to draw from business profits is a perk of being a sole proprietor, but it comes with the responsibility of managing those finances wisely and ethically.