Sp Funds S&p 500 Sharia Industry Exclusions Etf

Imagine the bustling souks of Marrakech, the serene mosques of Istanbul, the innovative tech hubs of Dubai. These diverse locales, united by a shared commitment to Islamic principles, represent a significant and growing segment of the global financial landscape. Now, investors seeking to align their portfolios with these values have a new tool: the SP Funds S&P 500 Sharia Industry Exclusions ETF, a fund designed to navigate the complexities of ethical investing while tracking the performance of the S&P 500.

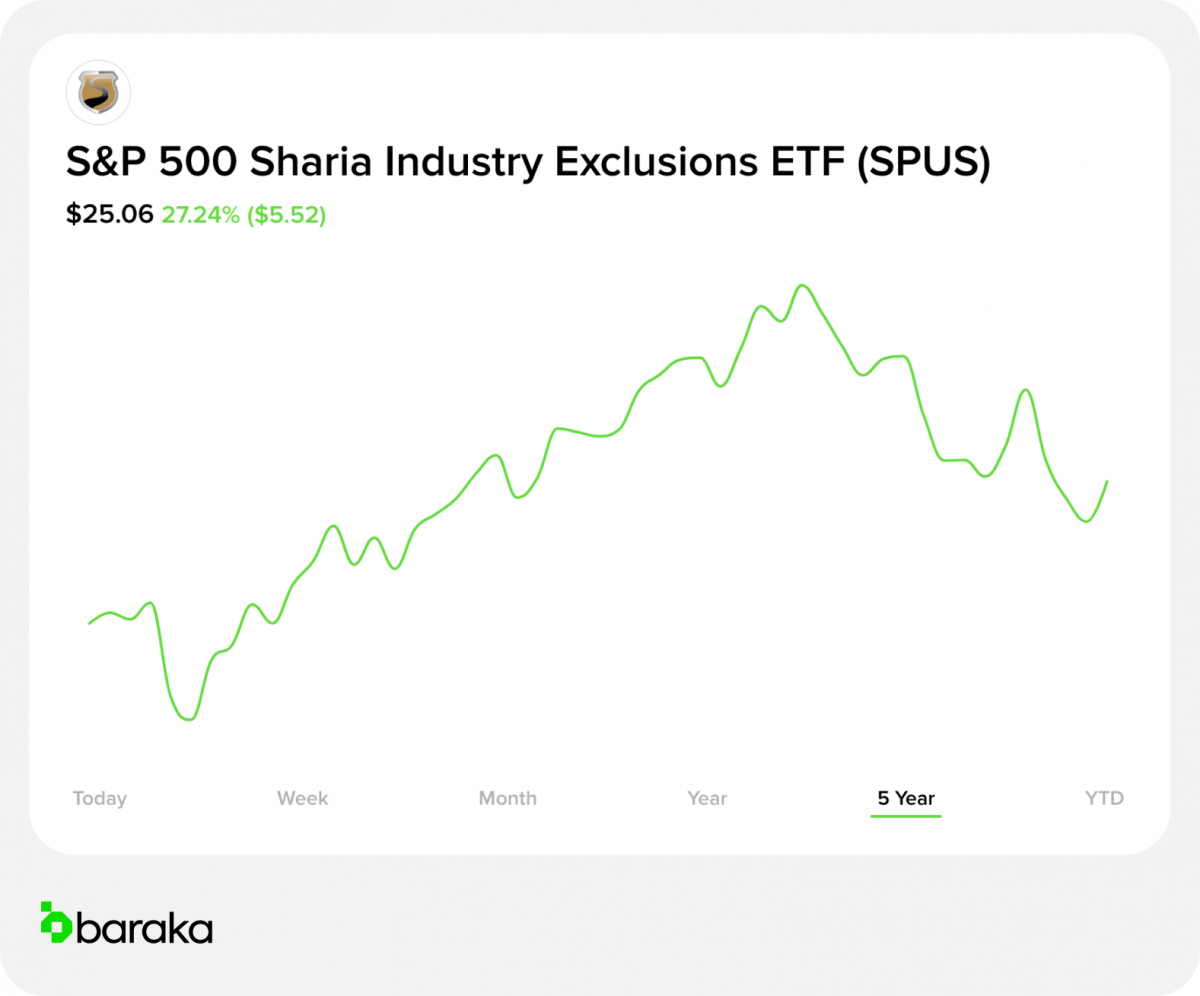

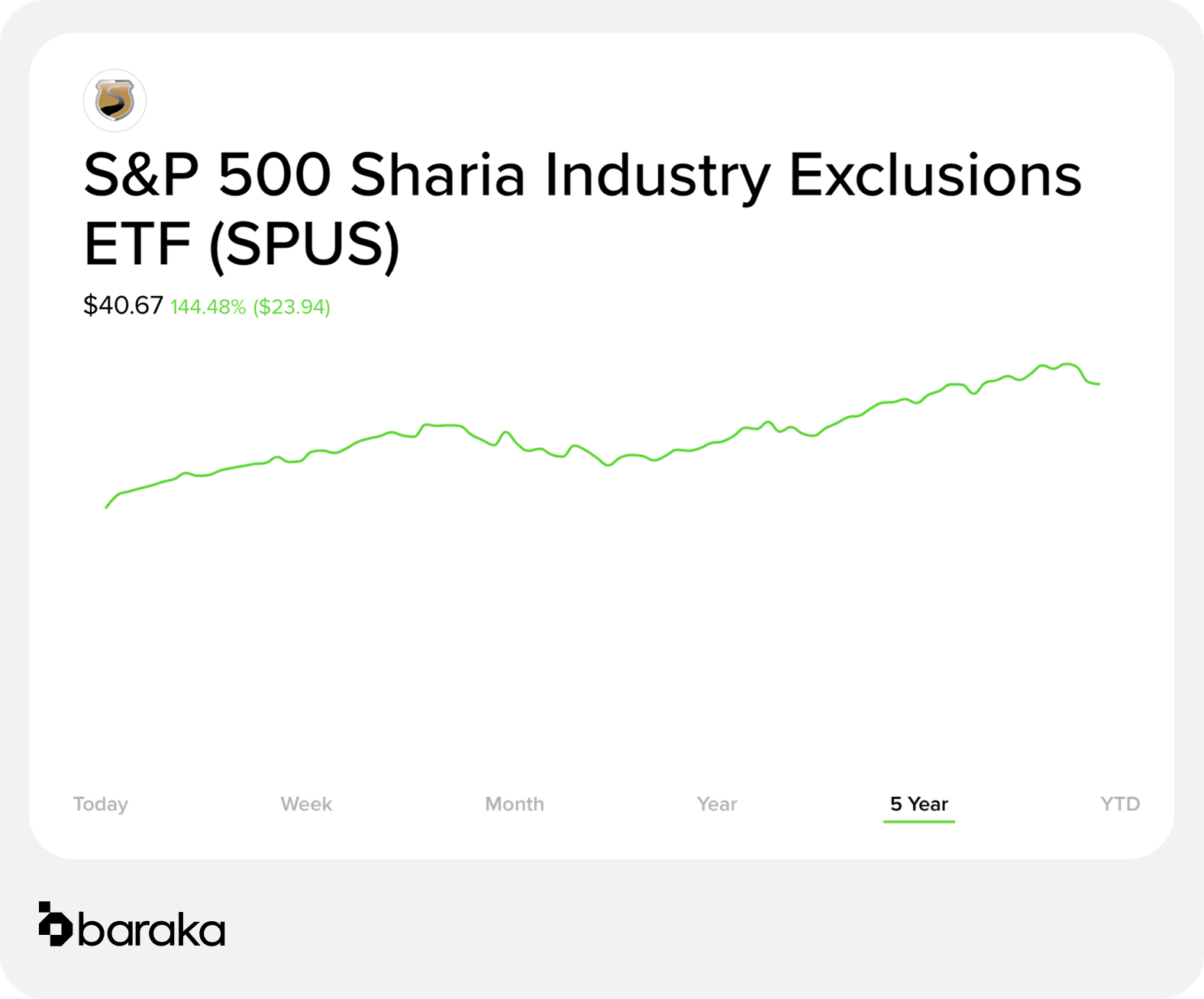

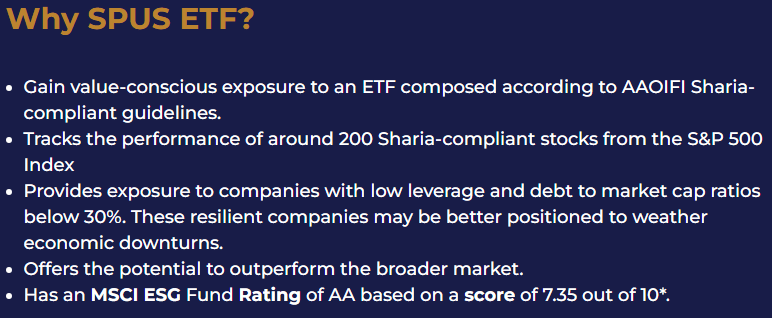

The SP Funds S&P 500 Sharia Industry Exclusions ETF (ticker symbol: SPUS) offers investors a unique opportunity to participate in the potential growth of the U.S. equity market while adhering to Sharia-compliant investment principles. This means excluding companies involved in industries deemed impermissible under Islamic law, such as alcohol, tobacco, gambling, and conventional finance. SPUS provides a compelling option for those seeking both financial returns and ethical alignment.

The Rise of Sharia-Compliant Investing

The demand for Sharia-compliant investment products has surged in recent years, fueled by a growing awareness of ethical considerations and a desire among Muslim investors to align their financial activities with their faith. This trend reflects a broader global movement towards socially responsible investing (SRI) and environmental, social, and governance (ESG) factors.

Sharia-compliant investing adheres to a set of principles derived from Islamic law. These principles prohibit investments in businesses involved in activities considered unethical or harmful. This includes interest-based financial services (riba), excessive uncertainty (gharar), and the production or sale of prohibited goods and services.

The S&P 500: A Foundation for Growth

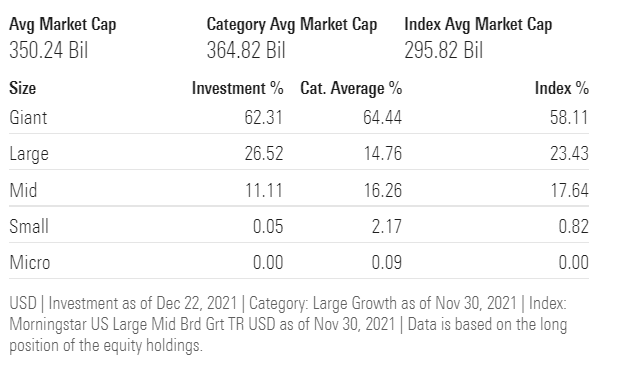

The S&P 500 is a widely recognized benchmark of U.S. equity market performance. It represents the 500 largest publicly traded companies in the United States. Many investors use it as a core holding in their portfolios, seeking broad diversification and exposure to the overall economic health of the nation.

By tracking an index derived from the S&P 500, SPUS offers a blend of familiarity and ethical alignment. Investors gain access to the potential upside of the U.S. market while remaining true to their values.

How SPUS Works: A Deep Dive

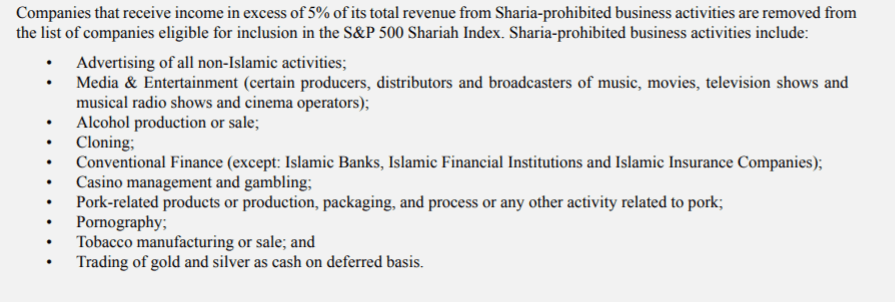

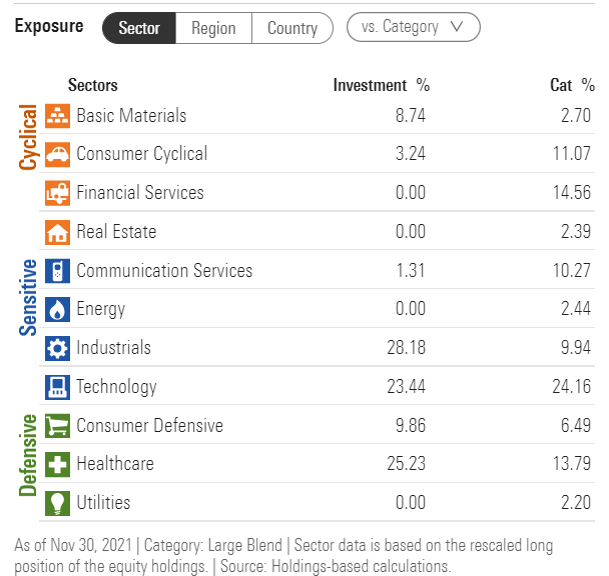

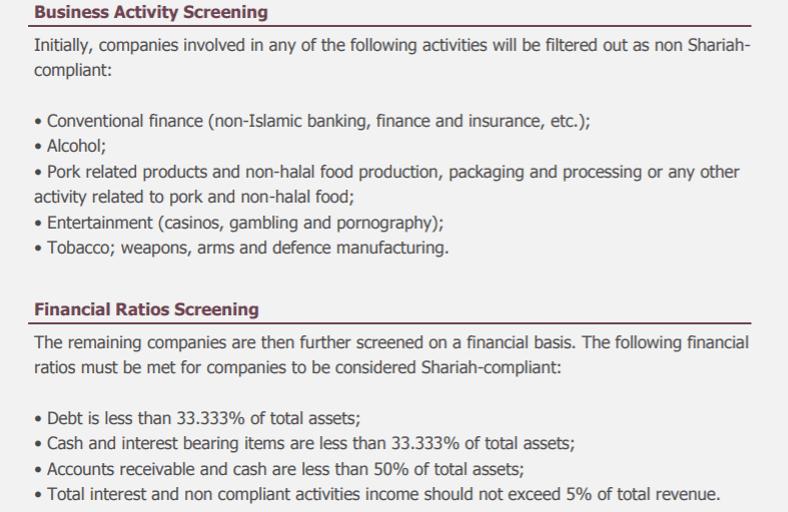

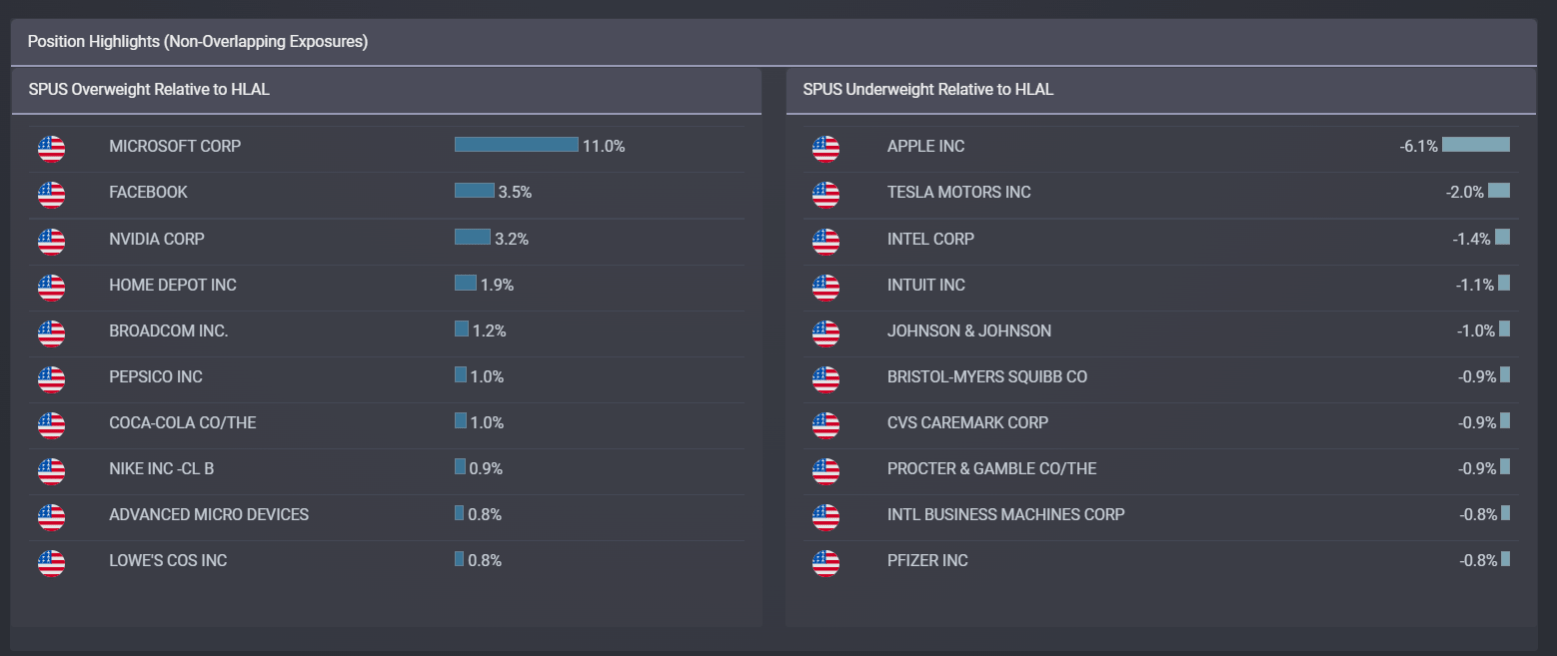

The SP Funds S&P 500 Sharia Industry Exclusions ETF employs a rigorous screening process to ensure compliance with Sharia principles. The fund utilizes an index that is derived from the S&P 500 but excludes companies engaged in prohibited industries.

The screening process is typically overseen by a Sharia advisory board, comprised of Islamic scholars who provide guidance on acceptable and unacceptable investments. This board ensures that the fund adheres to the highest standards of Sharia compliance.

Beyond industry exclusions, the fund also incorporates financial ratio screens to ensure that companies meet certain debt-to-equity thresholds. This is done to further mitigate the risk of interest-based financing within the portfolio companies.

Key Features and Benefits of SPUS

One of the primary advantages of SPUS is its accessibility. It allows investors to access a Sharia-compliant portfolio through a simple, exchange-traded fund (ETF) structure. This eliminates the need for individual stock picking and provides instant diversification.

Furthermore, SPUS offers transparency. The fund's holdings are typically disclosed on a regular basis, allowing investors to see exactly which companies are included in the portfolio. This transparency is crucial for building trust and ensuring that the fund aligns with investors' values.

Compared to actively managed Sharia-compliant funds, SPUS generally has a lower expense ratio. This makes it a cost-effective option for investors looking to build a long-term, ethically aligned portfolio.

The Investment Landscape: Opportunities and Considerations

The introduction of the SP Funds S&P 500 Sharia Industry Exclusions ETF reflects a growing sophistication in the Sharia-compliant investment market. Investors now have access to a wider range of products that cater to their specific needs and preferences.

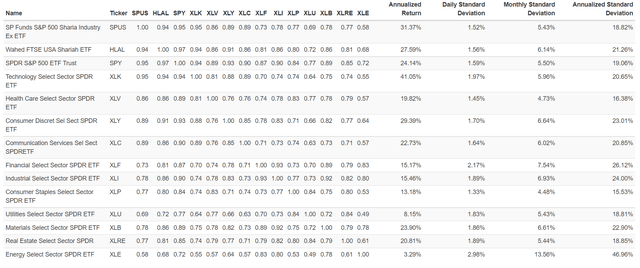

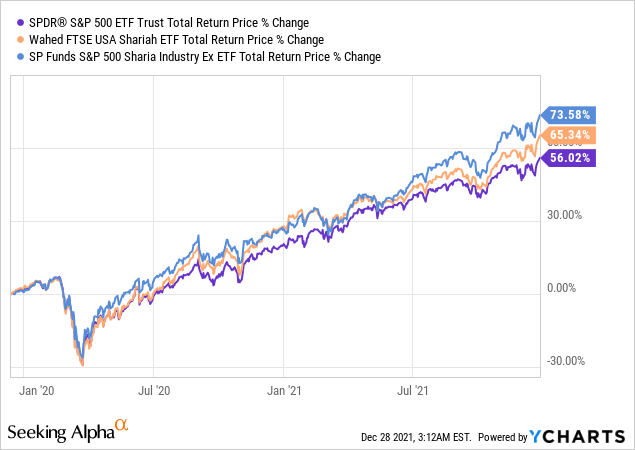

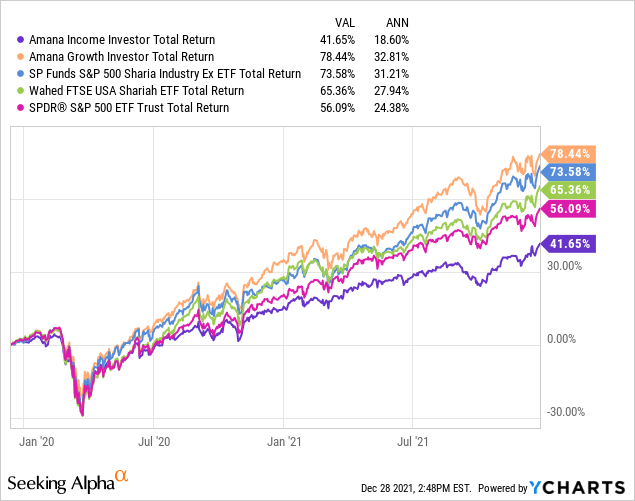

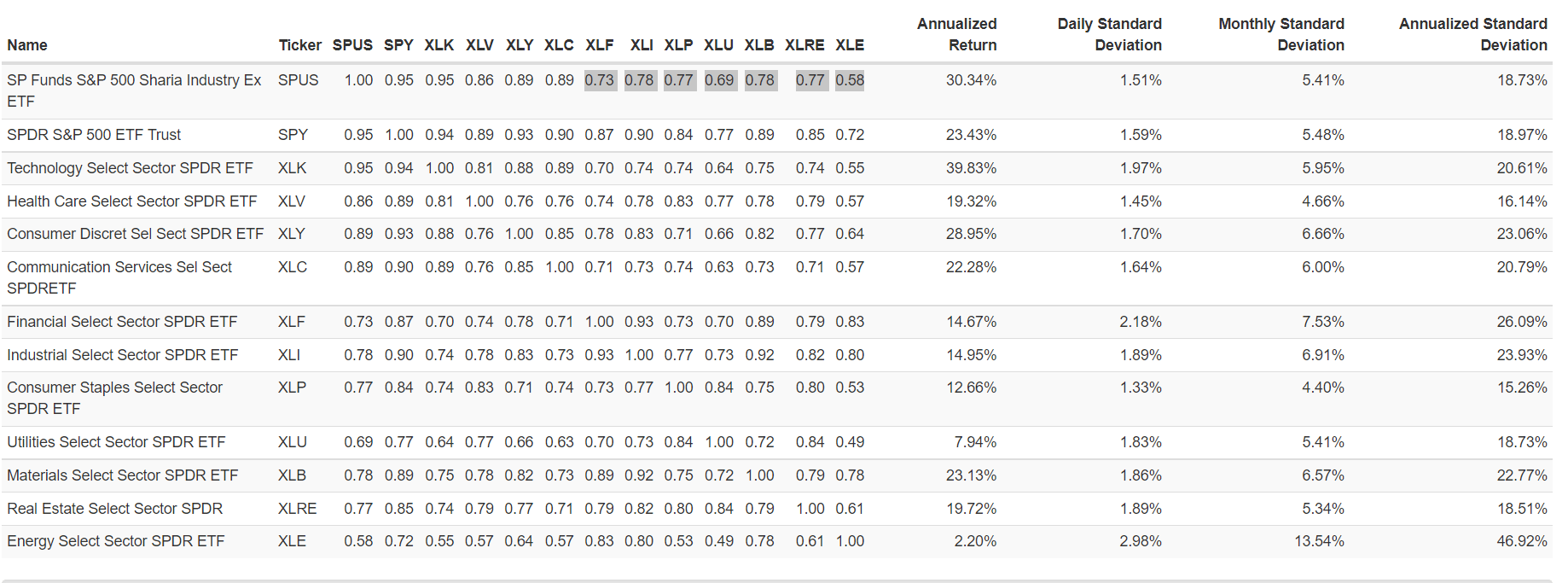

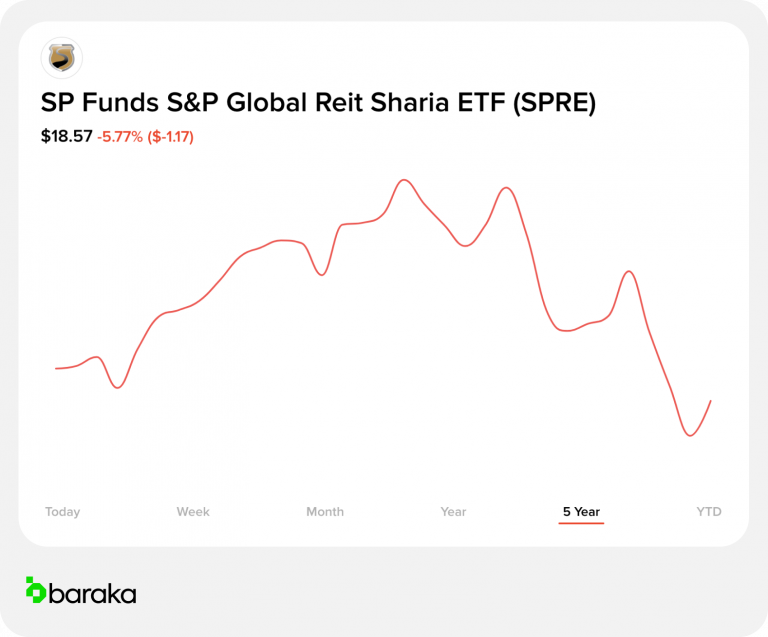

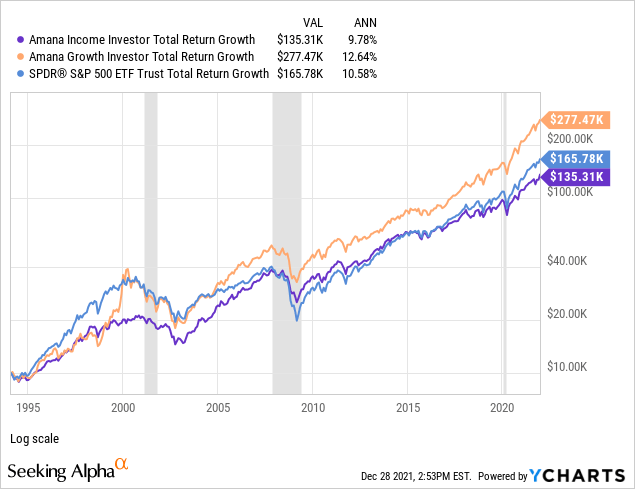

However, it's important to note that Sharia-compliant investing may involve certain trade-offs. By excluding certain industries, the investment universe is narrowed, which could potentially impact performance relative to a broader, non-Sharia-compliant index.

Investors should carefully consider their individual risk tolerance, investment goals, and ethical preferences before investing in SPUS or any other Sharia-compliant fund. Consulting with a qualified financial advisor is always recommended.

Beyond Financial Returns: Investing with Purpose

For many investors, Sharia-compliant investing is about more than just financial returns. It's about aligning their investments with their values and contributing to a more just and ethical world.

By investing in companies that adhere to Sharia principles, investors can support businesses that prioritize ethical practices, fair labor standards, and responsible environmental stewardship. This can lead to a greater sense of purpose and satisfaction from their investments.

The SP Funds S&P 500 Sharia Industry Exclusions ETF offers a compelling example of how financial markets can evolve to meet the changing needs and values of investors. As the demand for ethical and socially responsible investment options continues to grow, we can expect to see even more innovative and impactful products emerge in the years to come.

Looking Ahead: The Future of Ethical Investing

The future of ethical investing is bright. With increasing awareness of social and environmental issues, more and more investors are seeking to align their portfolios with their values. The SP Funds S&P 500 Sharia Industry Exclusions ETF represents a step forward in making ethical investing more accessible and mainstream.

As technology advances and data becomes more readily available, it will become easier to assess the ethical impact of investments. This will empower investors to make more informed decisions and drive positive change through their capital.

Ultimately, the growth of Sharia-compliant and other forms of ethical investing has the potential to create a more sustainable and equitable financial system. A system where profits are not pursued at any cost, but rather are generated in a manner that benefits both people and the planet. SP Funds and their offering of SPUS are aiming to bring that reality closer.

![Sp Funds S&p 500 Sharia Industry Exclusions Etf 7 Best Halal Dividend Stocks & ETFs [2024] | Dollar Bureau](https://dollarbureau.com/wp-content/uploads/2022/05/spus-performance.webp)