Sq Square Inc San Francisco Cash App

/square-5bfc302946e0fb00265cc49f.jpg)

San Francisco-based Block, Inc., formerly known as Square, and its flagship product, Cash App, are facing increasing scrutiny regarding user safety, security vulnerabilities, and compliance with financial regulations. Concerns range from fraudulent activities exploiting the platform to questions about the company's ability to protect user data effectively.

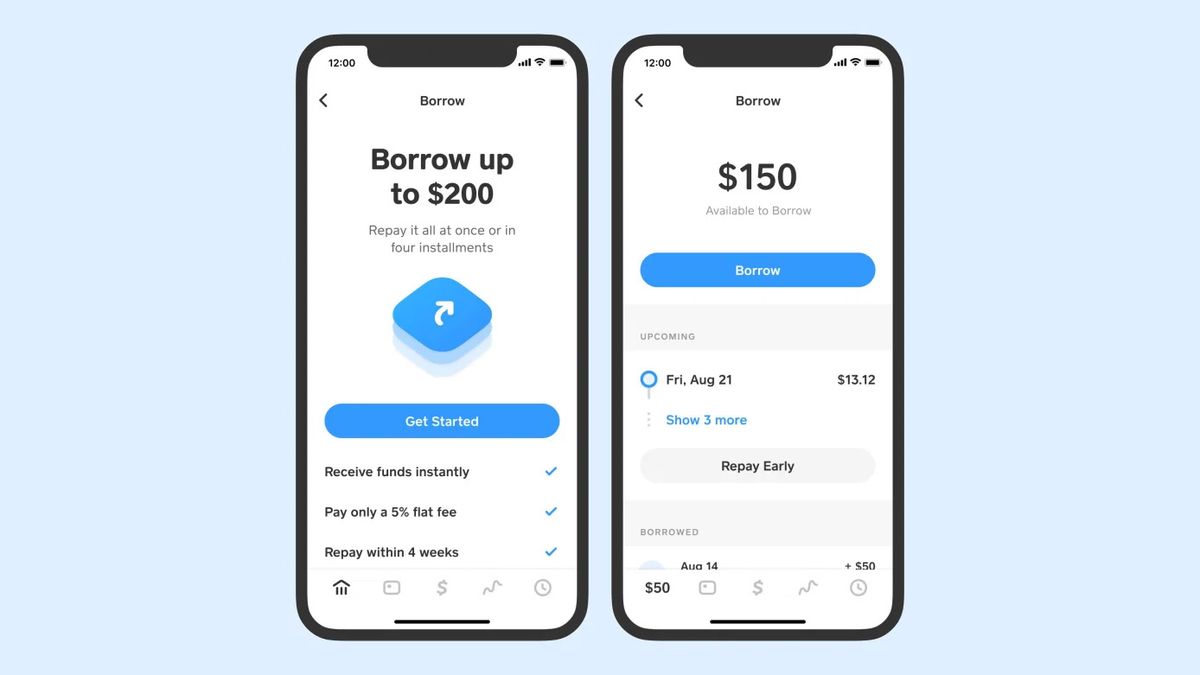

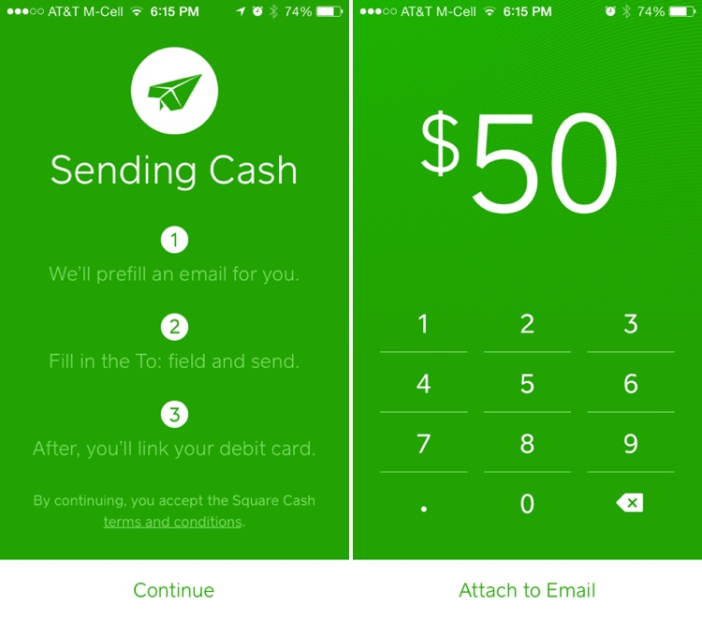

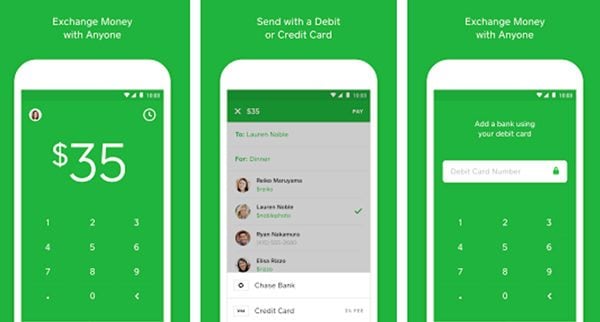

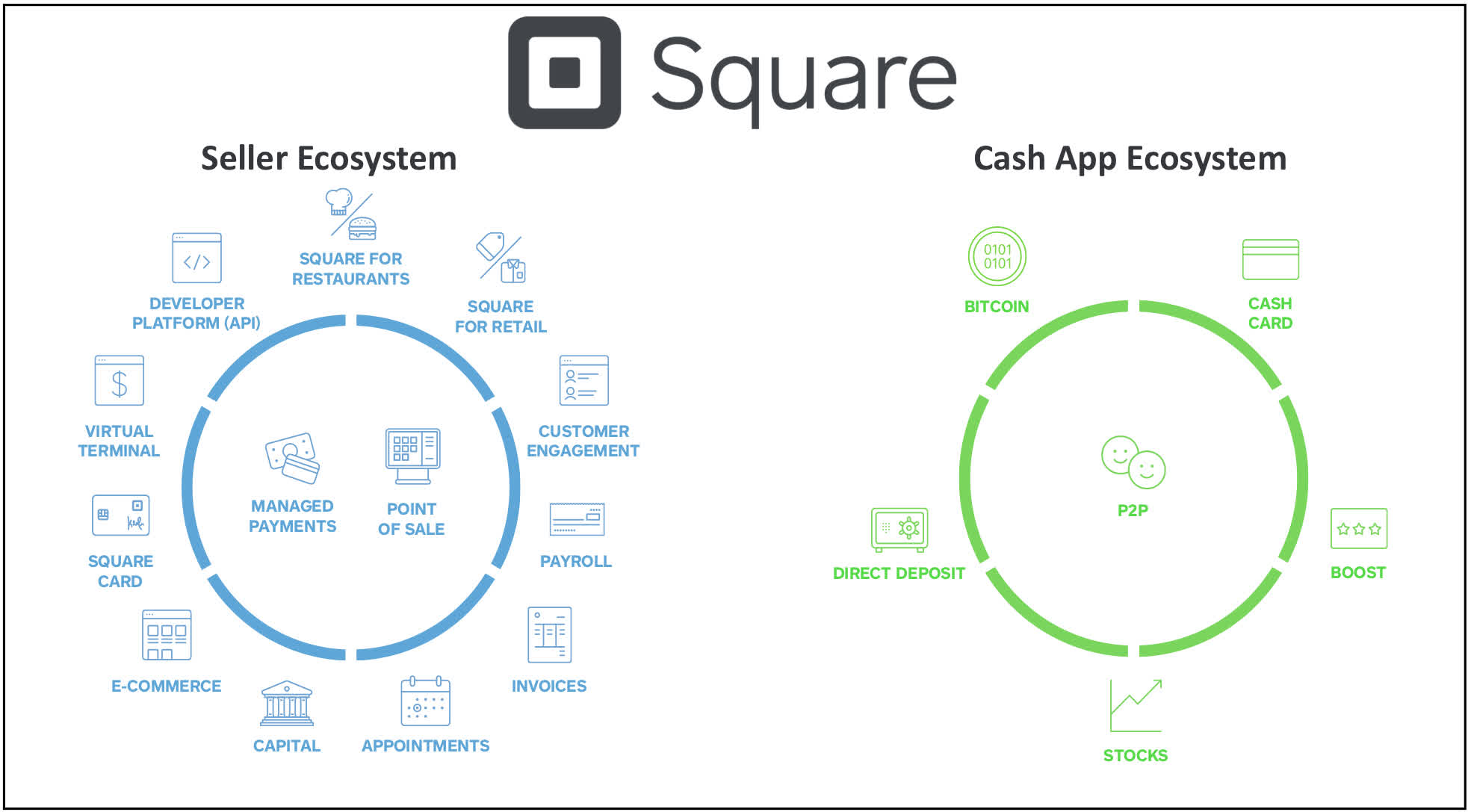

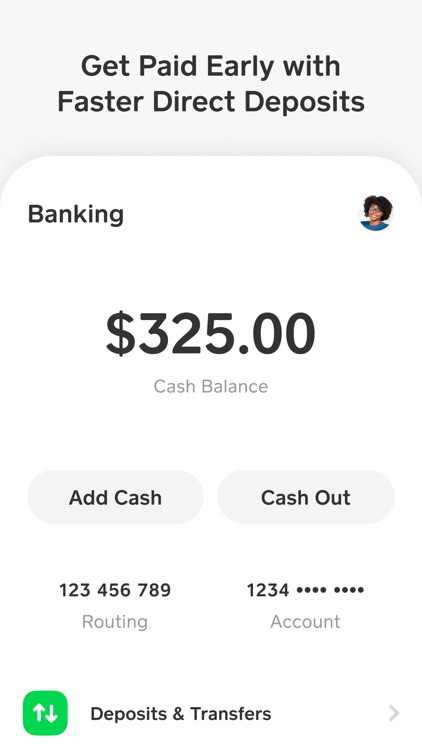

Cash App, a mobile payment service that allows users to transfer money to one another, has experienced explosive growth in recent years. The app’s accessibility and ease of use have made it a popular tool, particularly among younger demographics. However, this rapid expansion has also brought increased attention to the platform's potential risks and shortcomings, raising serious questions about its long-term sustainability and impact on the financial landscape.

User Safety and Fraud Concerns

A primary concern surrounding Cash App revolves around the prevalence of fraud and scams. Reports of users being targeted by phishing schemes, romance scams, and fake investment opportunities are increasingly common. These scams often exploit the platform's instant transfer capabilities, making it difficult for victims to recover lost funds.

Law enforcement agencies and consumer protection groups have issued warnings about the risks associated with using Cash App for transactions with unknown individuals. The lack of robust verification processes and insufficient customer support infrastructure further exacerbate these issues.

Block's official statements acknowledge the existence of fraudulent activities on the platform and outline measures taken to combat them. These measures include enhanced security protocols, educational resources for users, and collaboration with law enforcement. However, critics argue that these efforts are insufficient to address the scale and sophistication of the problem.

Security Vulnerabilities and Data Protection

Another area of concern relates to the security vulnerabilities within Cash App's infrastructure and the protection of user data. Data breaches and unauthorized access to accounts pose a significant threat to the privacy and financial security of millions of users.

Independent cybersecurity researchers have identified potential weaknesses in the app's security architecture that could be exploited by malicious actors. These vulnerabilities range from inadequate encryption protocols to weaknesses in the authentication process.

Block maintains that it employs industry-leading security practices to safeguard user data and protect against unauthorized access. The company emphasizes its commitment to regularly updating its security systems and conducting thorough risk assessments. However, transparency regarding specific security protocols and breach mitigation strategies remains limited.

Regulatory Scrutiny and Compliance

Cash App is also facing increasing scrutiny from regulatory bodies regarding its compliance with financial regulations, including anti-money laundering (AML) laws and know-your-customer (KYC) requirements. Concerns have been raised about the platform's ability to effectively identify and prevent illicit financial activities.

Regulators are investigating whether Cash App's user verification processes are adequate to prevent the platform from being used for money laundering or other illegal purposes. Fines and other penalties could be imposed if the company is found to be in violation of these regulations.

Block asserts that it is committed to complying with all applicable laws and regulations and that it is working closely with regulatory agencies to address their concerns. The company has invested in enhanced compliance programs and improved its AML/KYC processes. Despite this, the regulatory environment remains challenging and could pose significant risks to the company's future growth.

Future Outlook and Challenges

The future of Cash App hinges on its ability to address the challenges related to user safety, security vulnerabilities, and regulatory compliance. Failure to do so could erode user trust and lead to significant financial and reputational damage.

Block must prioritize investments in enhanced security measures, improved fraud prevention strategies, and robust compliance programs. Building a culture of security and transparency will be crucial for restoring confidence in the platform.

The company's success will also depend on its ability to adapt to the evolving regulatory landscape and to proactively address emerging threats. Cash App must demonstrate a commitment to protecting its users and ensuring the integrity of the platform if it hopes to maintain its position as a leading mobile payment service.

/square-5bfc30f2c9e77c0026315fa4.jpg)

:fill(white):max_bytes(150000):strip_icc()/Cash_App-1de91ae80d2f428b869bc75074f005dd.jpg)