Starting Capital For A Small Business

Small business dreams often stall before they begin. Access to initial capital remains a critical hurdle for aspiring entrepreneurs nationwide.

This article breaks down the key avenues for securing that crucial starting capital, offering a roadmap for navigating the financial landscape and launching a successful venture. We will answer the 5W and 1H of small business capital, prioritizing clarity and immediacy.

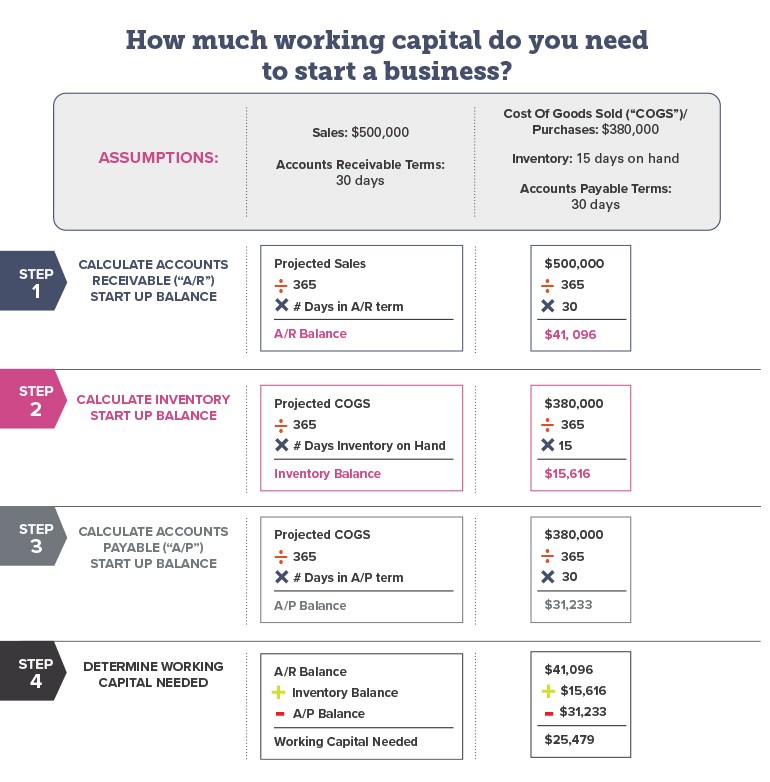

Understanding Your Funding Needs

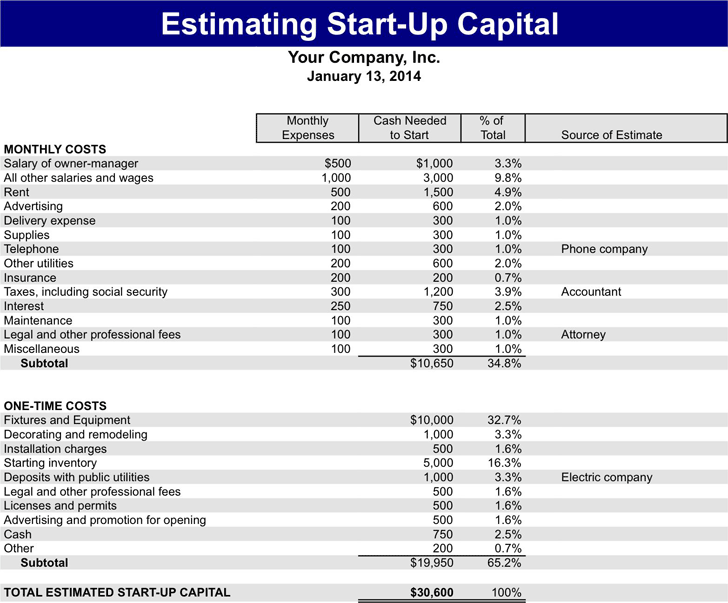

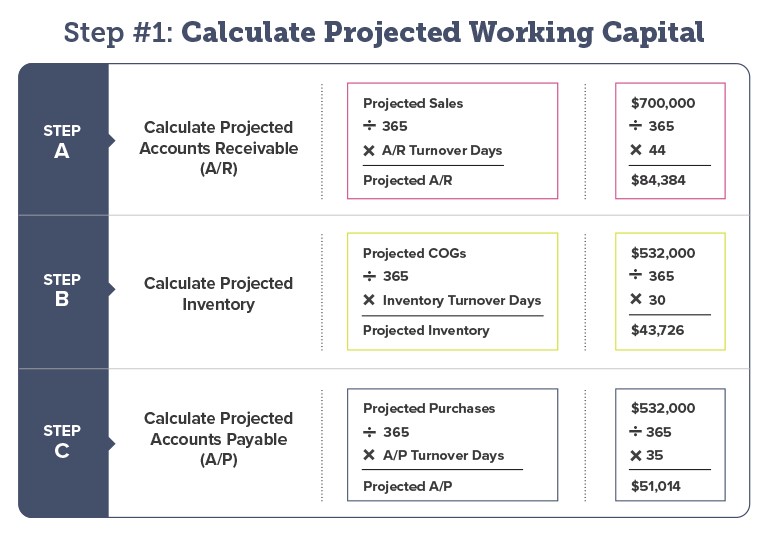

Before seeking funding, meticulously calculate your required capital. Consider all expenses, from initial inventory and equipment to marketing and operational costs for the first few months. Underestimating your needs is a common and potentially fatal mistake.

Experts recommend creating a detailed business plan outlining your financial projections. This plan serves as a roadmap for your business and a key document for potential investors and lenders.

Where to Find Funding: The Avenues Available

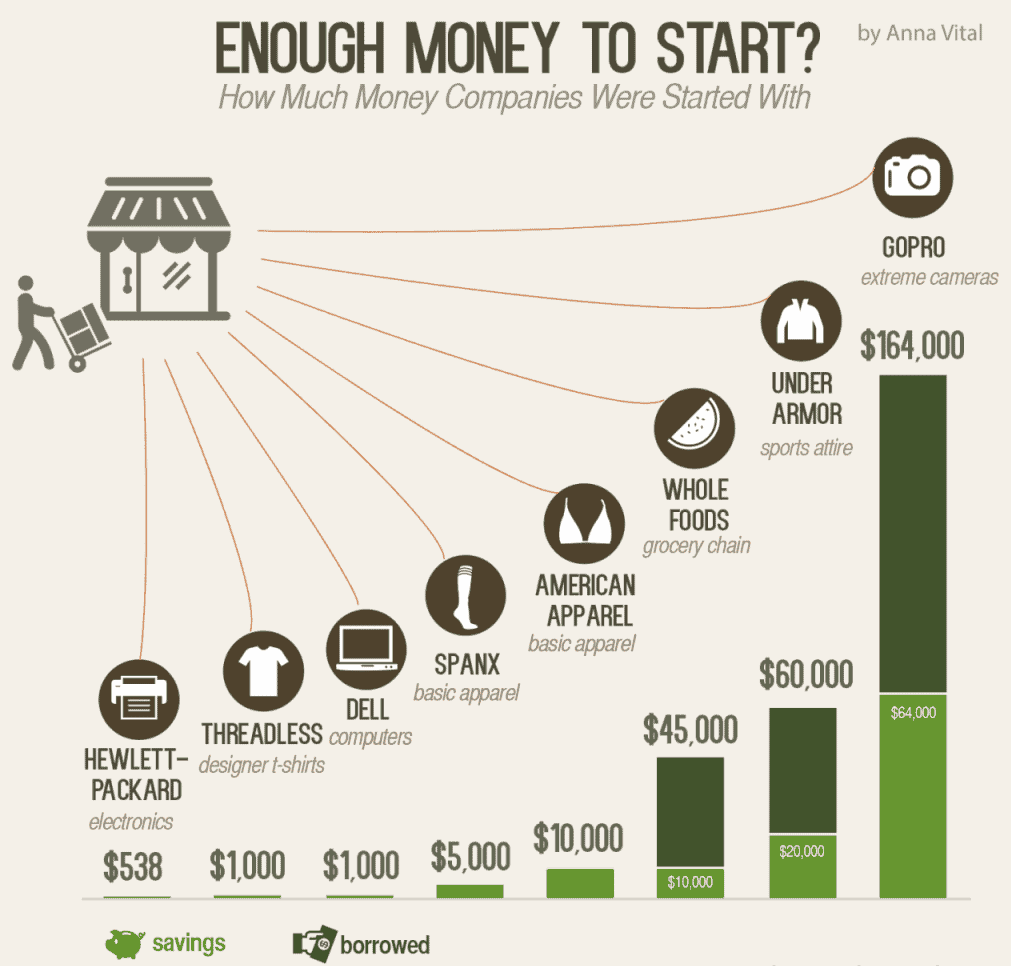

Personal Savings: The First Line of Defense

Many entrepreneurs initially rely on their own savings. While this minimizes debt, it also puts your personal finances at risk. Consider the pros and cons carefully.

Friends and Family: A Double-Edged Sword

Borrowing from loved ones can be easier than traditional lending. However, be sure to formalize the agreement in writing to avoid potential relationship strain. Clearly define repayment terms and interest, if any.

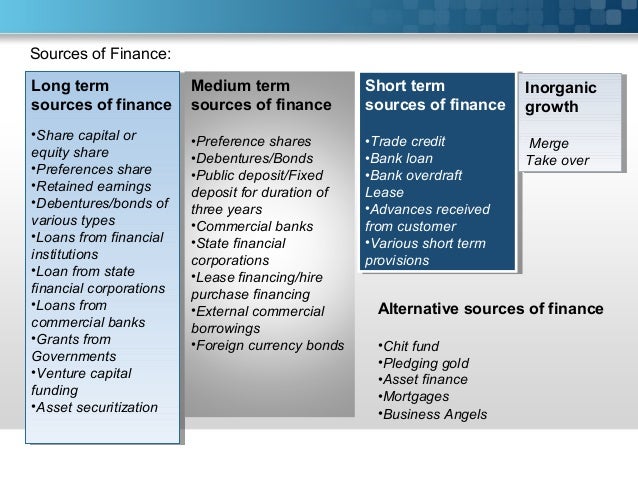

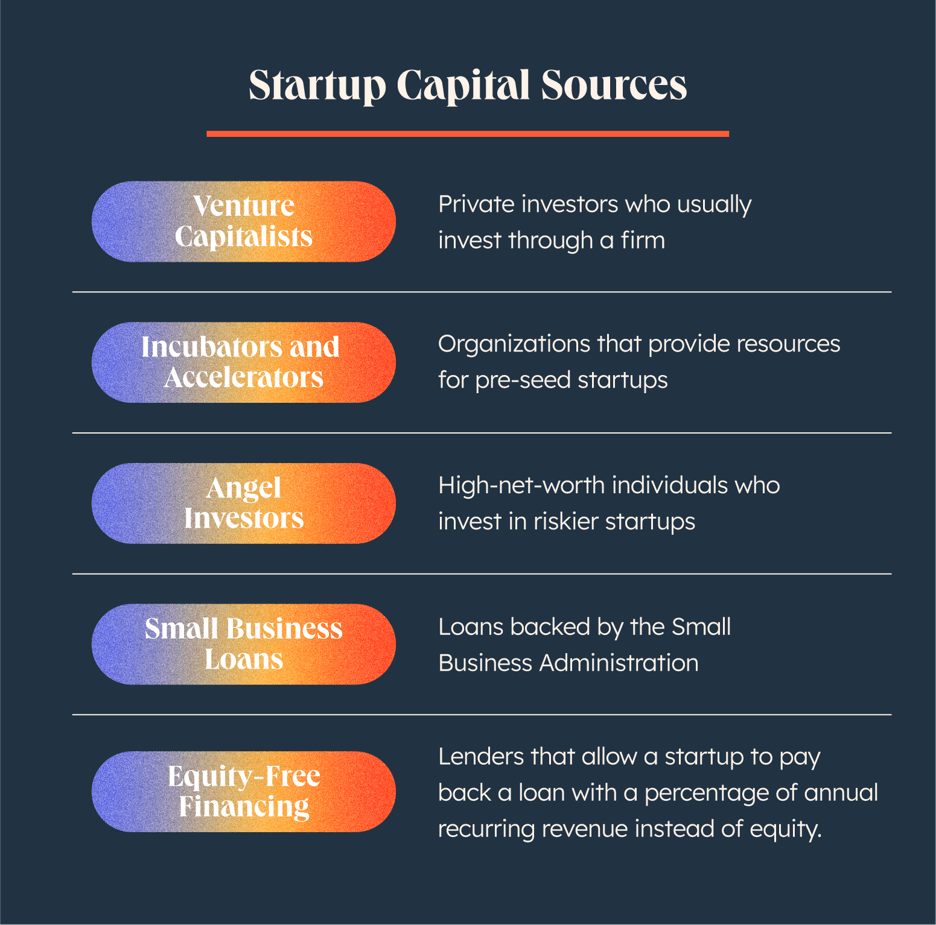

Small Business Loans: A Formal Route

The Small Business Administration (SBA) offers various loan programs. These loans typically require collateral and a strong credit history. SBA data shows that loan amounts commonly vary based on the region of the business.

Traditional banks also offer business loans. Be prepared to present a comprehensive business plan and financial statements.

Grants: Free Money, Fierce Competition

Government agencies and private organizations offer grants for small businesses. Grants are highly competitive and often targeted at specific demographics or industries. Research eligibility requirements carefully.

Angel Investors and Venture Capitalists: High-Risk, High-Reward

Angel investors and venture capitalists provide funding in exchange for equity. This option is best suited for businesses with high-growth potential. Be prepared to relinquish some control of your company.

According to the National Venture Capital Association (NVCA), the median deal size for seed-stage funding is increasing. This reflects a growing appetite for early-stage ventures with promising technology and innovative business models.

Crowdfunding: Leveraging the Power of the Crowd

Crowdfunding platforms allow you to raise capital from a large number of individuals. This option can be effective for businesses with a strong online presence and a compelling story.

Who Can Help? Resources Available

The SBA provides counseling and training to aspiring entrepreneurs. Local Small Business Development Centers (SBDCs) offer free or low-cost assistance. Take advantage of these resources to improve your chances of success.

Many online platforms also offer resources for small business owners. Research and compare different options to find the best fit for your needs.

When to Seek Funding: Timing is Key

Start seeking funding well in advance of your launch date. The application process can take several weeks or even months. Be prepared for delays and unexpected hurdles.

How to Increase Your Chances of Success

Develop a strong business plan. Build a solid credit history. Network with potential investors and lenders. These are all crucial steps to securing the capital you need. Demonstrating a clear understanding of your market and a well-defined business model is essential.

Next Steps: Securing Your Future

Research your funding options carefully. Prepare a compelling business plan. Network with potential investors and lenders. The journey to securing starting capital can be challenging, but with persistence and preparation, you can achieve your small business dreams.