Statement Of Changes In Stockholders Equity

The intricate dance of corporate finance, often veiled in complexity, occasionally reveals itself through documents like the Statement of Changes in Stockholders' Equity. This financial statement offers a crucial glimpse into the movements affecting a company's ownership structure over a specific period, providing insights that can inform investment decisions and strategic analyses.

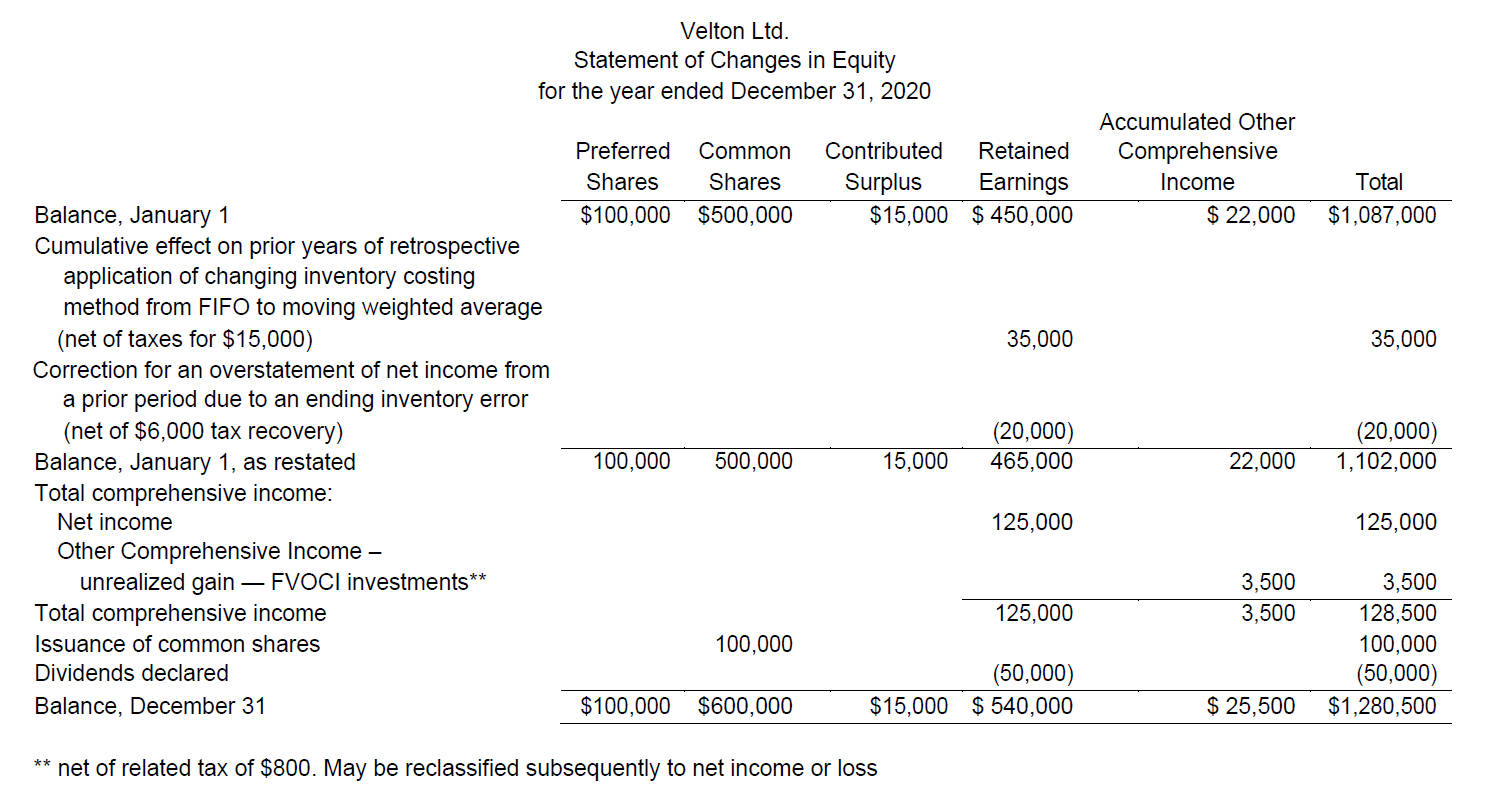

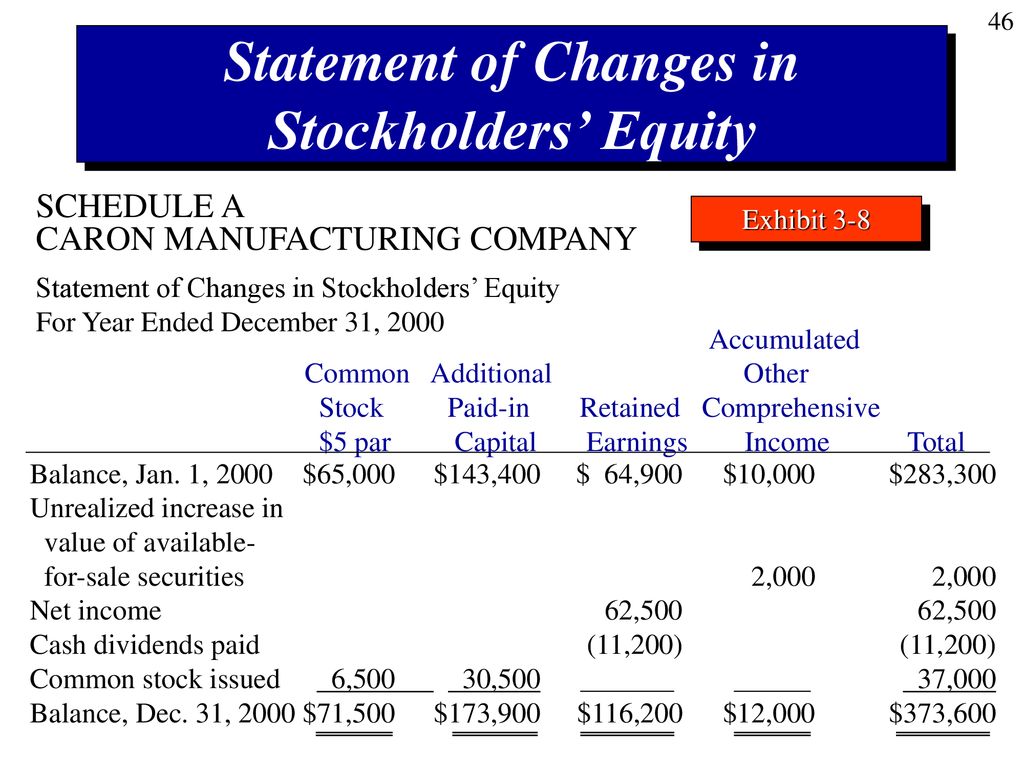

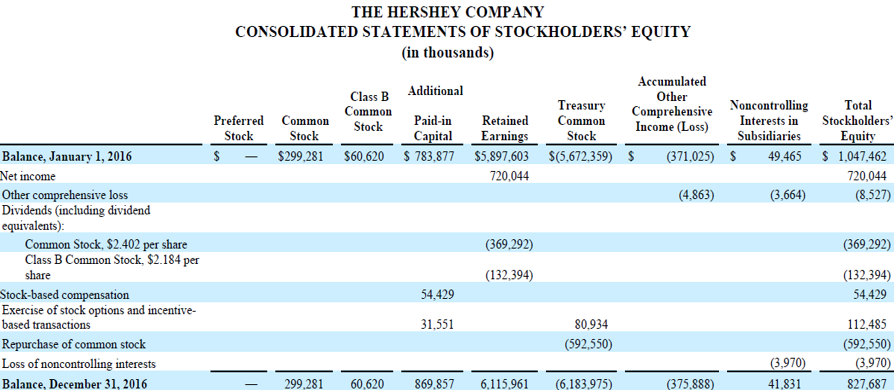

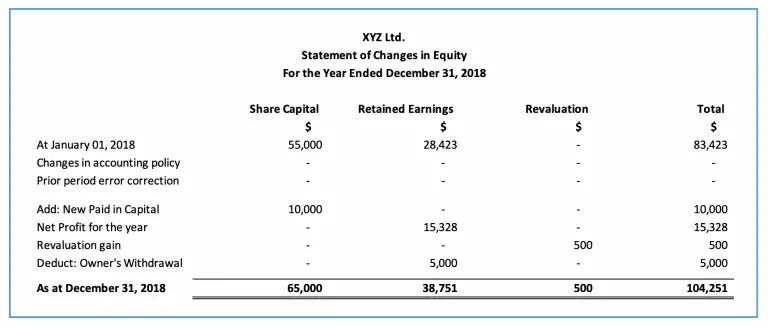

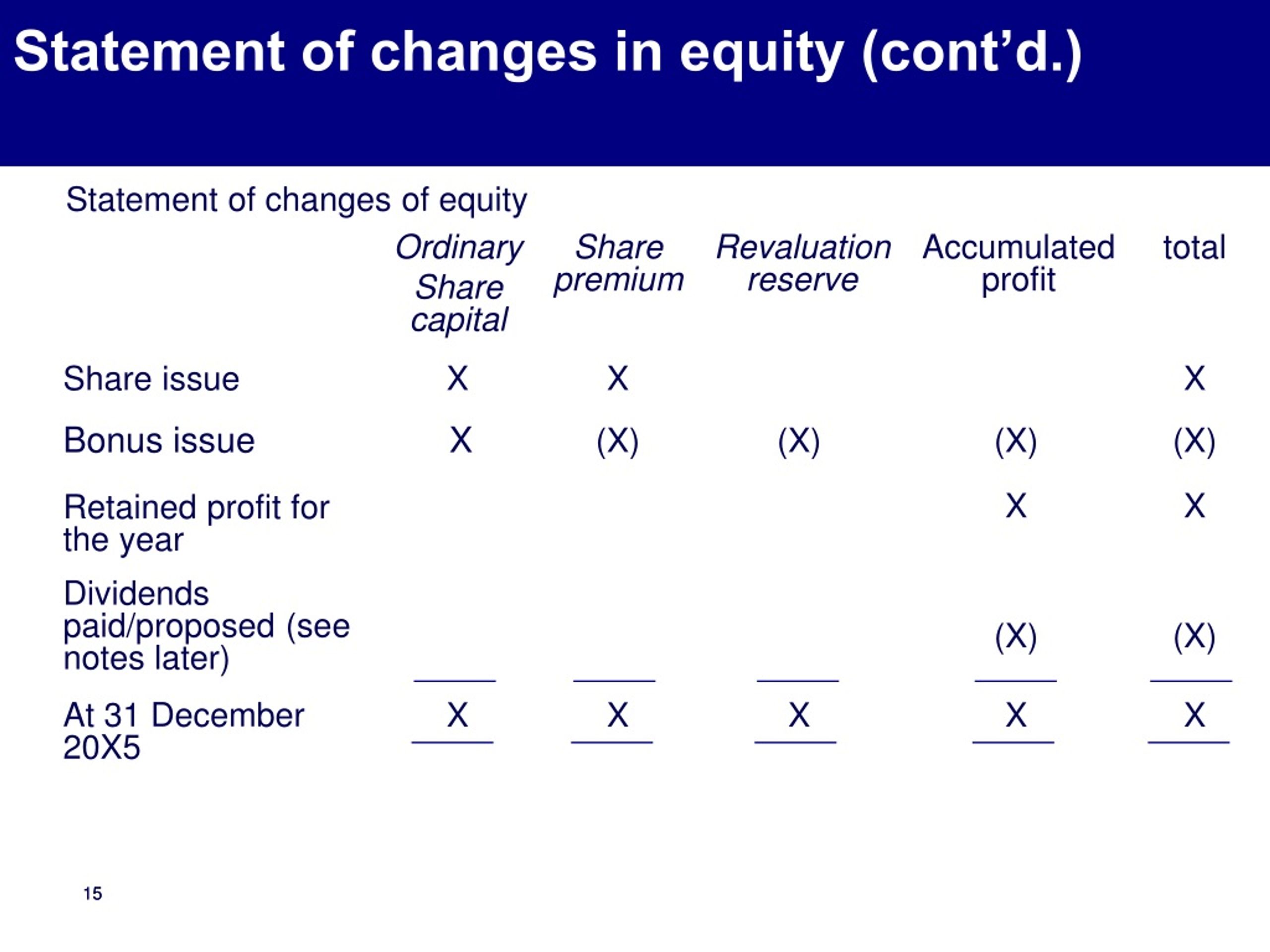

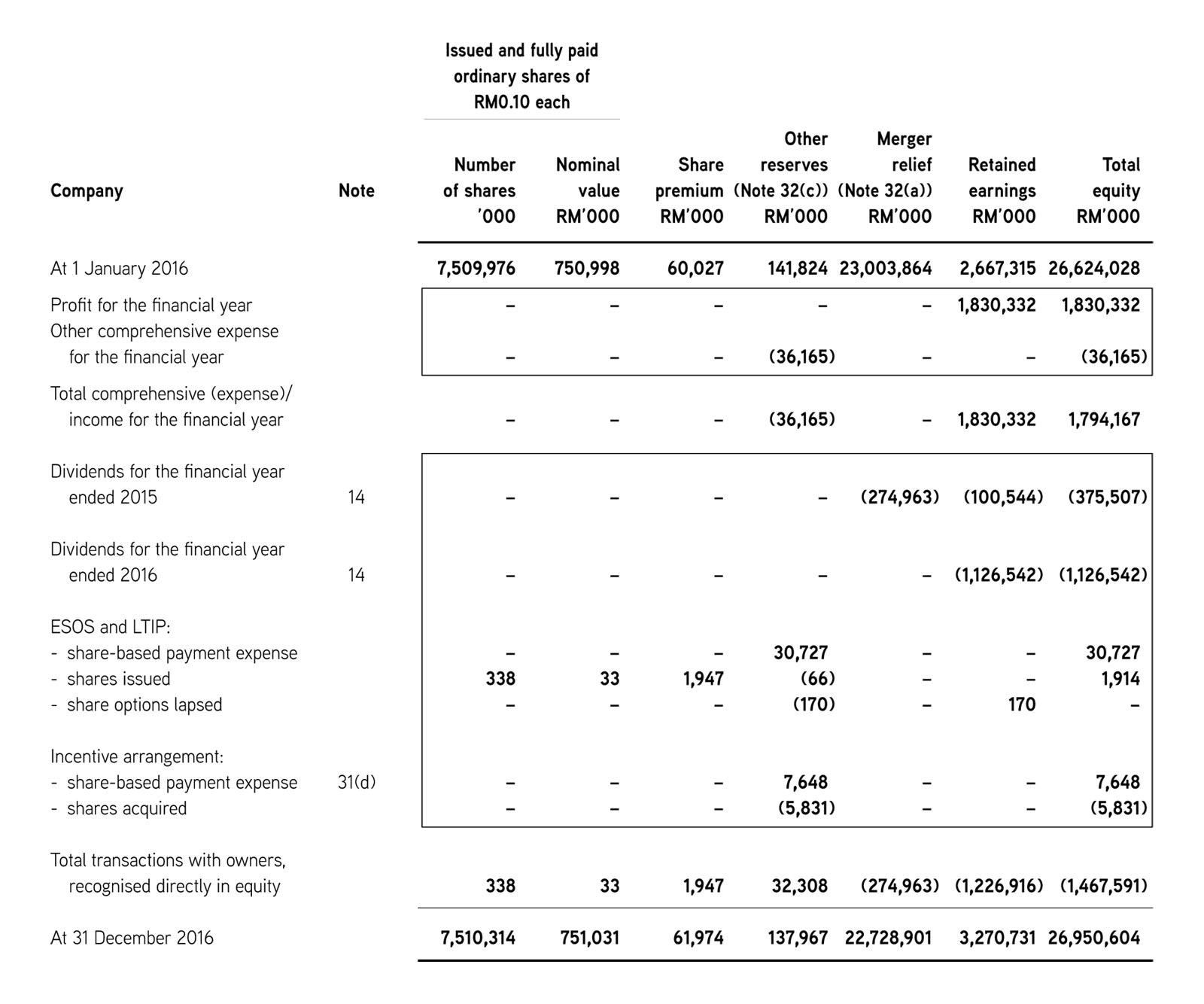

The Statement of Changes in Stockholders' Equity, a fundamental component of a company's financial reports, meticulously tracks all alterations in the equity section of the balance sheet. This includes items such as retained earnings, common stock, preferred stock, and additional paid-in capital. Analyzing these changes provides stakeholders with a clear understanding of how a company is managing its ownership structure and reinvesting its profits.

Understanding the Statement

At its core, the Statement of Changes in Stockholders' Equity reconciles the beginning and ending balances of each equity account. It's essentially a ledger that details all the transactions impacting ownership. This statement is typically presented alongside the balance sheet, income statement, and cash flow statement, completing the picture of a company's financial performance.

Key Components

The statement breaks down the changes into several key categories. These include: Net Income/Loss, which is the primary driver of changes in retained earnings. It also includes Dividends, distributions to shareholders that reduce retained earnings.

Stock Issuances, which increase common or preferred stock and additional paid-in capital, are a key component as well. Lastly, Stock Repurchases, which decrease common or preferred stock and potentially treasury stock, also fall under the key categories.

Other crucial aspects are Stock Options and Warrants, the exercise of which impacts various equity accounts. And, Other Comprehensive Income (OCI), encompassing items like unrealized gains or losses on certain investments.

Significance for Investors

For investors, the Statement of Changes in Stockholders' Equity offers a wealth of information. It reveals how a company is using its profits. Is it reinvesting in growth, or distributing dividends? Understanding these dynamics is crucial for evaluating a company's long-term sustainability and investment potential.

Changes in equity can signal strategic shifts. A large stock repurchase program might indicate the company believes its stock is undervalued. Conversely, a significant stock issuance could suggest the company is raising capital for expansion or acquisitions.

Moreover, a consistent pattern of dividend payments can attract income-seeking investors. In contrast, a decision to suspend or reduce dividends may raise concerns about the company's financial health.

Impact on Corporate Strategy

The information presented in the statement is not only valuable for external stakeholders but also crucial for internal decision-making. Management uses this data to assess the effectiveness of their capital allocation strategies. It helps them determine the optimal balance between reinvesting in the business, returning capital to shareholders, and maintaining financial stability.

For instance, a company might analyze its dividend payout ratio. Are they retaining enough earnings to fund future growth? Or, they might evaluate the impact of stock-based compensation on equity dilution.

Furthermore, monitoring changes in OCI can provide insights into the volatility of certain investments and their potential impact on the company's overall financial position. These analyses inform decisions related to risk management and financial planning.

Real-World Example

Consider a hypothetical tech company, TechForward Inc., that experienced significant growth in the past year. Their Statement of Changes in Stockholders' Equity would reflect a substantial increase in retained earnings due to strong net income.

The statement would also detail any stock options exercised by employees, increasing both common stock and additional paid-in capital. If TechForward Inc. initiated a stock repurchase program, this would be reflected as a decrease in common stock and an increase in treasury stock.

Investors analyzing TechForward's statement would gain a comprehensive understanding of how the company's growth translated into increased shareholder value. They would also observe the impact of employee compensation and capital allocation decisions on the company's equity structure.

Challenges and Limitations

Despite its value, the Statement of Changes in Stockholders' Equity has certain limitations. It provides a historical overview of changes but does not necessarily predict future performance. It is also essential to analyze the statement in conjunction with other financial reports to gain a complete understanding of a company's financial health.

Furthermore, interpreting the statement requires a degree of financial literacy. Investors may need to consult with financial advisors or conduct thorough research to fully grasp the implications of the changes in equity.

Conclusion

The Statement of Changes in Stockholders' Equity serves as a vital tool for understanding the intricate financial dealings of a company. By carefully analyzing the components of this statement, investors and stakeholders can gain valuable insights into a company's capital structure, dividend policy, and strategic decisions.

Ultimately, this understanding contributes to more informed investment decisions and a deeper appreciation of the forces shaping a company's long-term financial performance. The statement remains an indispensable resource for anyone seeking to navigate the complex world of corporate finance.