Statements On Standards For Accounting And Review Services

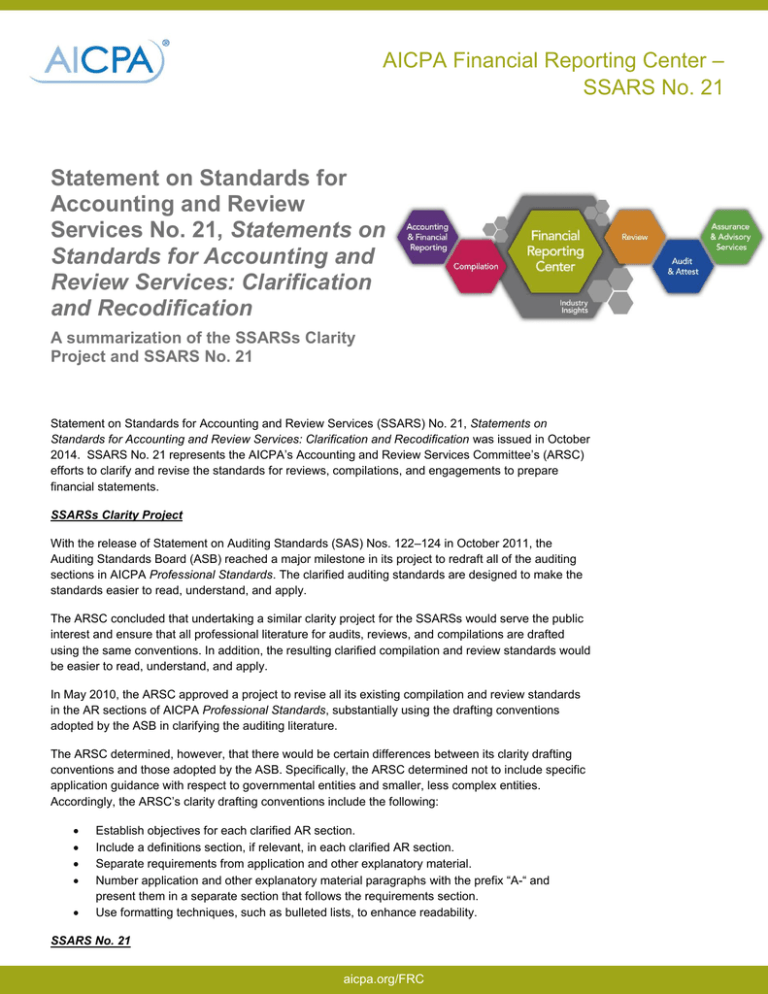

Sweeping changes are coming to accounting and review services. The Accounting and Review Services Committee (ARSC) has released significant updates to the Statements on Standards for Accounting and Review Services (SSARS), impacting practitioners nationwide.

These revisions aim to modernize and clarify existing standards. The updates are intended to enhance the quality and consistency of non-audit services performed by accountants.

Key Updates to SSARS

Clarification of Compilation Engagements

The most significant change involves a sharper definition of compilation engagements. The revised standards provide clearer guidance on the accountant's responsibilities. This will reduce ambiguity and improve the quality of compiled financial statements.

Accountants must now explicitly document their understanding of the client's industry. They must also assess whether the financial statements are free from obvious material misstatements.

Emphasis on Management's Responsibilities

The updated SSARS place greater emphasis on management's responsibilities. Management is responsible for the accuracy and completeness of the financial statements.

Accountants are required to obtain a representation letter from management. This letter confirms management's understanding of their responsibilities.

Enhanced Documentation Requirements

The revised standards include enhanced documentation requirements. Accountants must maintain detailed records of their work.

This documentation should include the scope of the engagement, the procedures performed, and the conclusions reached. Proper documentation is crucial for demonstrating compliance with the standards.

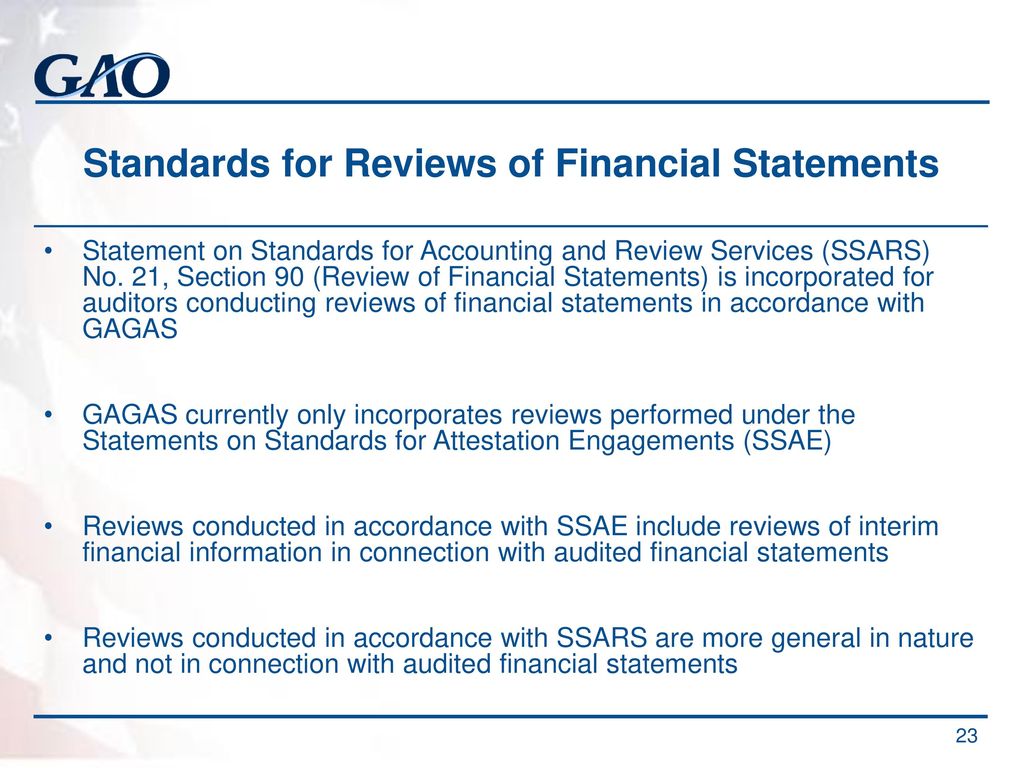

Expanded Guidance on Preparation Engagements

SSARS now offers expanded guidance on preparation engagements. These engagements involve preparing financial statements without providing any assurance.

The updates provide clearer direction on the accountant's responsibilities in these types of engagements. This helps ensure that accountants are performing these services appropriately.

Applicability and Effective Dates

The revised SSARS are generally effective for engagements beginning after December 15, 2024. Early implementation is permitted.

Practitioners should familiarize themselves with the new standards and update their procedures accordingly. Compliance is essential to avoid potential issues.

Impact on Practitioners

These changes will affect all practitioners who perform accounting and review services. Accountants must invest time in understanding the new requirements.

Firms may need to update their training programs and engagement letters. This ensures compliance with the revised SSARS.

"These revisions represent a significant step forward in improving the quality of accounting and review services," said Jane Doe, a partner at XYZ Accounting Firm. "Practitioners must act now to prepare for these changes."

Potential Challenges

Some practitioners may find the new documentation requirements challenging. Implementing these changes may require additional resources and training.

It is crucial for accountants to proactively address these challenges. This ensures a smooth transition to the revised standards.

Resources and Training

The AICPA is offering a variety of resources to help practitioners comply with the new standards. These resources include webinars, publications, and practice aids.

Accountants are encouraged to take advantage of these resources. This will ensure they are well-prepared for the changes.

Additionally, many state CPA societies are offering training programs on the revised SSARS. Attending these programs can be a valuable way to stay informed and compliant.

Expert Commentary

"The enhanced documentation requirements are a key aspect of these revisions," said John Smith, a professor of accounting at ABC University. "Accountants need to prioritize documentation to demonstrate compliance and protect themselves from potential liability."

Dr. Smith added that the clarification of compilation engagements is particularly important. This will reduce the risk of misunderstandings between accountants and their clients.

Next Steps

Accountants should begin reviewing their current procedures and practices. They should identify areas where changes are needed to comply with the revised SSARS.

Attend training sessions and consult with experts to gain a deeper understanding of the new requirements. Proactive preparation is the key to success.

The ARSC will continue to monitor the implementation of these standards. Further guidance and clarifications may be issued in the future.