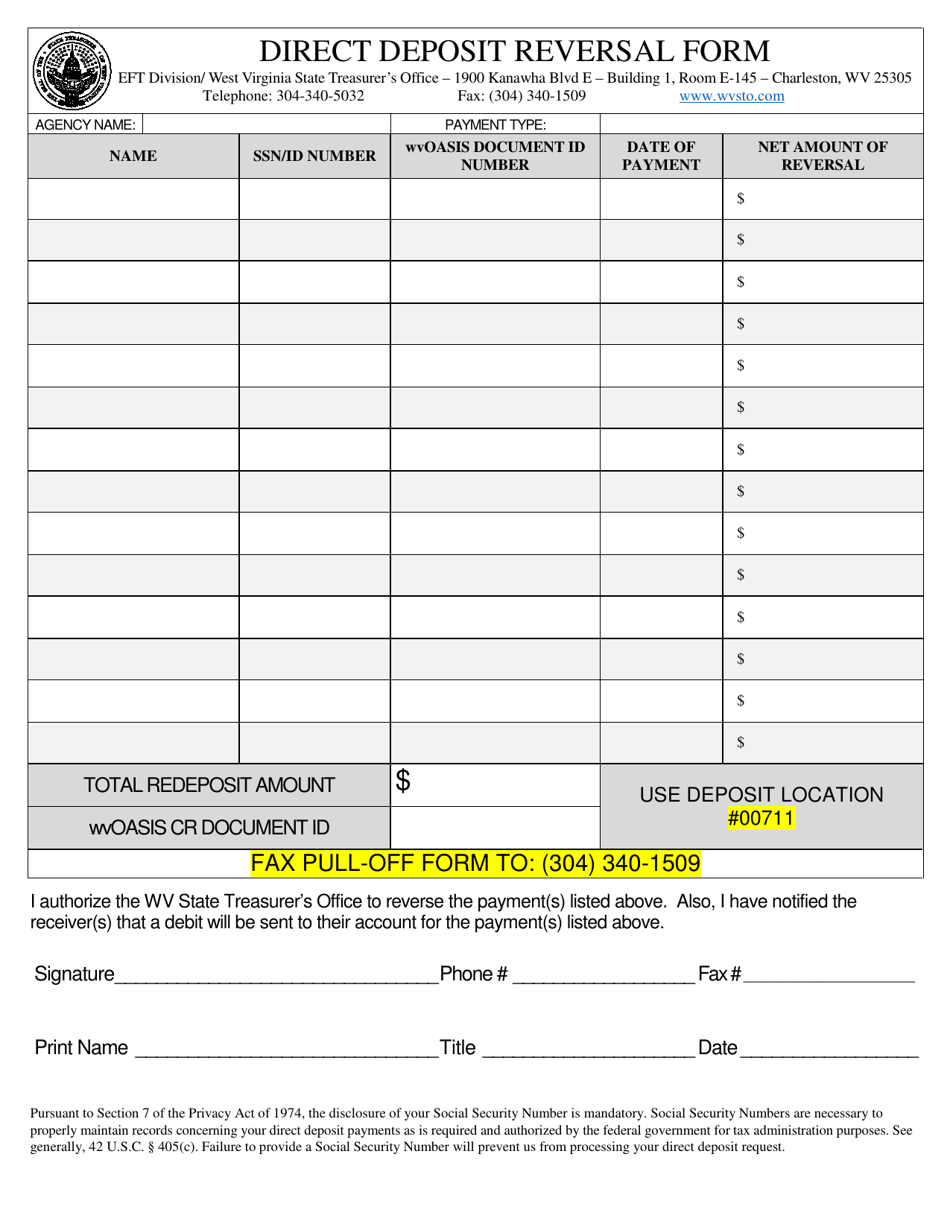

States Where Direct Deposit Reversals Are Restricted

Imagine Sarah, a single mother in Ohio, suddenly facing an unexpected car repair. She's meticulously budgeted her finances, relying on her direct deposit paycheck to cover rent and groceries. Then, a chilling notification: a reversal on her direct deposit, leaving her scrambling to understand why and how she'll make ends meet this month. This scenario, while unsettling, is a reality for many Americans, but in some states, protections exist to prevent such disruptive reversals.

This article explores the growing movement to restrict direct deposit reversals, safeguarding workers from unexpected financial setbacks. We delve into the states leading the charge in employee protection, examining the rationale behind these regulations and their impact on both employers and employees. Understanding these safeguards is crucial for ensuring financial stability and fairness in the modern workplace.

The Wild West of Direct Deposit: A Need for Regulation

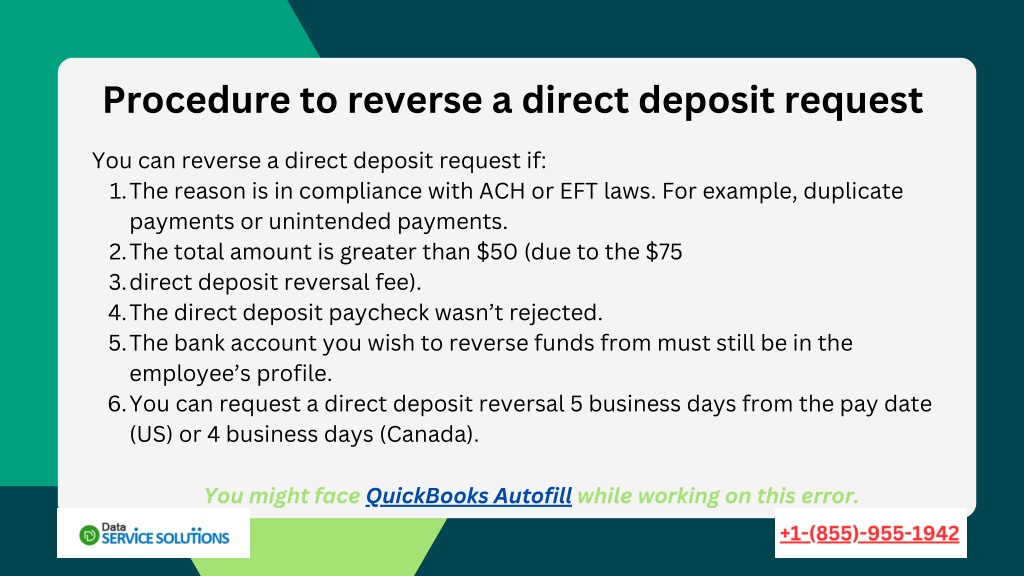

Direct deposit has become the norm for payroll, offering convenience and efficiency. However, the ease with which employers can initiate reversals has created vulnerabilities. Without clear regulations, employees can face significant hardship due to unexpected deductions or errors.

These reversals, sometimes due to administrative errors or disputes, can trigger overdraft fees, late payment penalties, and even jeopardize an individual's credit score. The lack of transparency and recourse in many states leaves employees feeling powerless.

States Stepping Up: A Patchwork of Protections

Several states have recognized the need for stronger protections against unauthorized or erroneous direct deposit reversals. While a comprehensive federal law is still lacking, these states are leading the way with their own legislation and regulations.

California: Championing Employee Rights

California stands out with its robust labor laws, offering significant protection against wage deductions and reversals. The state requires employers to obtain explicit written authorization from employees for any deductions from their wages, including direct deposit reversals.

This authorization must clearly state the reason for the deduction and the amount. This ensures that employees are informed and agree to the reversal before it occurs.

Furthermore, California law prohibits employers from deducting wages for business losses or shortages unless they can prove the employee was directly responsible due to dishonesty or gross negligence.

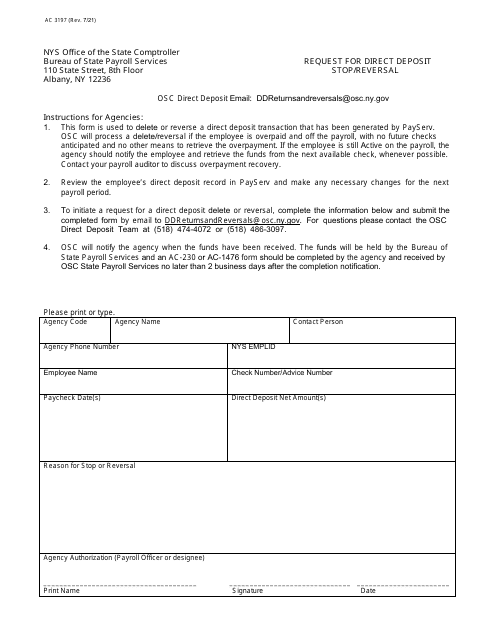

New York: A Balanced Approach

New York also has regulations in place that aim to protect employees from unlawful deductions. While not as stringent as California's, New York law requires employers to provide clear and timely notice to employees before making any deductions from their wages.

This notice must include the reason for the deduction and the amount to be deducted. This allows employees to challenge the deduction if they believe it is unwarranted.

Other States Making Strides

Several other states, including Massachusetts and Maryland, have laws addressing wage deductions, which indirectly provide some protection against unauthorized direct deposit reversals. These laws often require employers to obtain employee consent for any deductions and to provide detailed pay stubs that clearly explain all deductions.

The specific regulations vary from state to state, creating a complex patchwork of protections across the country. Employees should familiarize themselves with the laws in their own state to understand their rights.

The Ripple Effect: Impact on Employers and Employees

The implementation of stricter regulations on direct deposit reversals has a multifaceted impact on both employers and employees. For employers, it necessitates greater accuracy in payroll processing and a more transparent communication process regarding wage deductions.

This may require investing in better payroll software and training staff on compliance requirements. However, the long-term benefits include reduced legal risks and improved employee morale.

For employees, these regulations provide greater financial security and peace of mind. Knowing that their wages are protected from arbitrary deductions empowers them to plan their finances with confidence.

Furthermore, clear procedures for addressing erroneous reversals ensure that employees have a fair and accessible recourse if they encounter problems.

The Road Ahead: Towards National Standards

The current patchwork of state laws highlights the need for a more comprehensive federal approach to regulating direct deposit reversals. A national standard would provide consistent protection for workers across the country, regardless of where they live.

Advocates argue that a federal law should include requirements for written authorization, clear notification procedures, and a mechanism for employees to challenge disputed reversals. This would create a level playing field for both employers and employees.

Furthermore, a national standard could help to streamline payroll processes and reduce the compliance burden for businesses operating in multiple states.

The Human Cost: Why These Protections Matter

Beyond the legal and economic considerations, the issue of direct deposit reversals touches on the fundamental principles of fairness and economic security. For many low-wage workers, even a small unexpected deduction can have devastating consequences.

It can mean the difference between paying rent and facing eviction, or between putting food on the table and going hungry. Protecting workers from unauthorized or erroneous reversals is not just a matter of compliance, but a matter of social justice.

It acknowledges the dignity of work and the right of every individual to earn a fair wage and to have their earnings protected from arbitrary deductions.

A Call to Action: What You Can Do

Understanding your rights is the first step towards advocating for fair labor practices. Research the direct deposit and wage deduction laws in your state. Contact your state representatives to voice your support for stronger employee protections.

If you experience an unauthorized or erroneous direct deposit reversal, document everything and seek legal advice. Organizations like the National Employment Law Project (NELP) and the U.S. Department of Labor can provide valuable resources and assistance.

By raising awareness and demanding accountability, we can create a more equitable and just workplace for all.

Looking Ahead: A Brighter Future for Workers

The movement to restrict direct deposit reversals is gaining momentum, fueled by a growing recognition of the need to protect workers' rights. As more states enact stricter regulations and as awareness of the issue grows, we can expect to see further progress in the coming years.

The ultimate goal is to create a system where direct deposit is not only convenient but also fair and transparent, where employees can trust that their wages will be protected from arbitrary deductions, and where employers are held accountable for their actions.

This will require a collective effort from policymakers, employers, and employees, all working together to create a more just and equitable economy.

:max_bytes(150000):strip_icc()/how-to-set-up-direct-deposit-315294-EN_FINAL-fac7d02f61e944a389d0ebe23c97e2f4.jpg)