Steps To Becoming Financially Stable

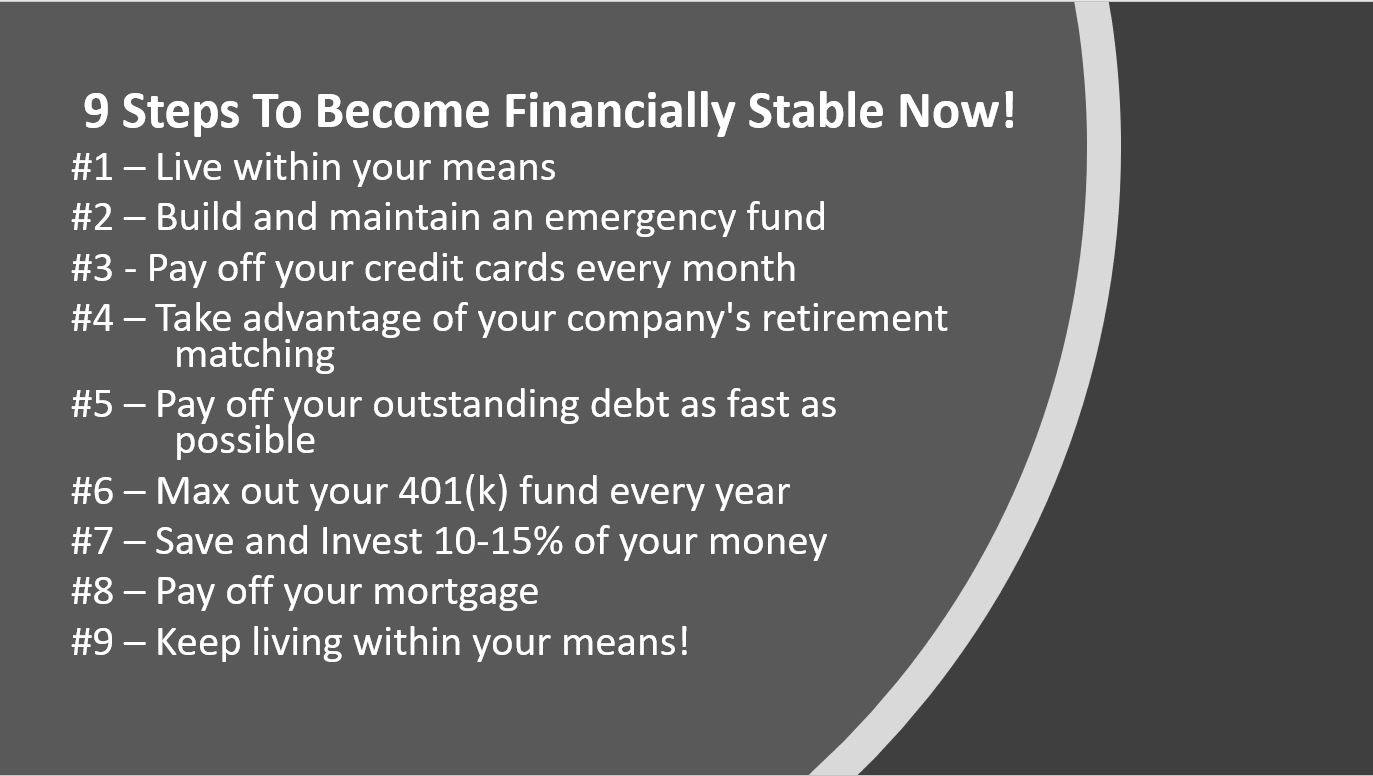

The path to financial stability can seem daunting, a labyrinth of budgeting, saving, and investing that many find overwhelming. Millions grapple with debt, struggle to save, and live paycheck to paycheck, making the prospect of long-term financial security feel like a distant dream.

However, financial stability is achievable with a structured approach and dedicated effort. This article outlines actionable steps, backed by expert advice and research, to guide individuals towards a more secure financial future, empowering them to take control of their money and build lasting wealth.

Understanding Your Current Financial Situation

Before embarking on any financial journey, it's crucial to assess your current standing. This involves taking stock of your income, expenses, assets, and liabilities.

Start by creating a detailed budget. Track your spending for a month or two to identify where your money is going; use budgeting apps, spreadsheets, or a simple notebook to meticulously record every expense.

Next, calculate your net worth by subtracting your total liabilities (debts) from your total assets (savings, investments, property). Understanding these numbers provides a baseline for measuring progress and identifying areas for improvement.

Creating a Realistic Budget

A budget is the cornerstone of financial stability. It's not about restriction but about conscious allocation of resources.

Employ the 50/30/20 rule as a starting point: allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment.

Prioritize essential expenses and identify areas where you can cut back. Small adjustments, such as reducing dining out or canceling unused subscriptions, can add up significantly over time.

Tackling Debt

High-interest debt, such as credit card debt, can be a major obstacle to financial stability. Develop a debt repayment strategy.

Consider the debt avalanche method, focusing on paying off debts with the highest interest rates first. Alternatively, the debt snowball method, which prioritizes paying off the smallest debts first, can provide psychological momentum.

Explore options like balance transfers or debt consolidation loans to potentially lower interest rates. Consumer Credit Counseling Services (CCCS) can provide guidance and support in developing a debt management plan.

Building an Emergency Fund

An emergency fund is crucial for weathering unexpected financial storms. Aim to save three to six months' worth of living expenses in a readily accessible account.

Start small and gradually increase your savings each month. Automate transfers from your checking account to a high-yield savings account to make saving effortless.

This fund acts as a safety net, preventing you from going into debt when faced with unforeseen expenses like medical bills or job loss. According to Fidelity Investments, having an emergency fund can significantly reduce financial stress.

Investing for the Future

Investing is essential for long-term financial growth. Start by understanding your risk tolerance and investment goals.

Consider diversifying your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. Explore options like 401(k)s, IRAs, and taxable brokerage accounts.

Index funds and ETFs (exchange-traded funds) offer a cost-effective way to diversify and track broad market indexes. Seek advice from a qualified financial advisor to create an investment strategy tailored to your individual circumstances.

Protecting Your Finances

Insurance plays a crucial role in protecting your finances from unforeseen events. Ensure you have adequate health, life, and disability insurance coverage.

Review your insurance policies regularly to ensure they meet your current needs. Consider additional coverage, such as umbrella insurance, to protect against large liability claims.

Protect yourself from identity theft by monitoring your credit reports regularly and being cautious about sharing personal information online. Report any suspicious activity immediately.

Continuously Learning and Adapting

Financial stability is an ongoing journey, not a destination. Stay informed about financial trends, new investment opportunities, and changes in tax laws.

Read books, articles, and blogs on personal finance. Attend workshops and seminars to enhance your financial literacy. The Financial Planning Association (FPA) offers resources and referrals to qualified financial advisors.

Regularly review and adjust your financial plan as your circumstances change. Life events such as marriage, children, or career changes may necessitate adjustments to your budget, savings goals, and investment strategy.

The Path Forward

Achieving financial stability requires discipline, patience, and a willingness to learn. By implementing these steps, individuals can take control of their finances and build a more secure future.

Remember that progress is incremental, and setbacks are inevitable. Stay focused on your goals, celebrate small victories, and seek support when needed. Building wealth and achieving financial freedom is within reach for anyone willing to put in the effort.