Stockholders Can Best Be Defined As Which Of The Following

The definition of a stockholder, seemingly straightforward, often blurs amidst the complexities of corporate governance and financial markets. Are they simply owners, or do their roles extend to active participants in shaping a company’s future? Understanding this fundamental concept is crucial for investors, policymakers, and anyone seeking to navigate the intricate world of publicly traded companies.

At its core, a stockholder, also known as a shareholder, is an individual or entity that owns shares of a company's stock. This ownership grants them certain rights and privileges, but the exact nature and extent of these rights are often debated and depend on various factors including the type of stock held and the specific laws governing the corporation. This article delves into the multifaceted definition of stockholders, exploring their rights, responsibilities, and the evolving perception of their role in the modern corporate landscape.

Defining the Stockholder: Ownership and Beyond

The most basic definition of a stockholder centers on ownership. Holding stock represents a claim on a portion of the company’s assets and earnings.

This ownership stake entitles stockholders to certain rights, most notably the right to vote on key corporate matters.

However, the extent of these rights can vary depending on the type of stock owned.

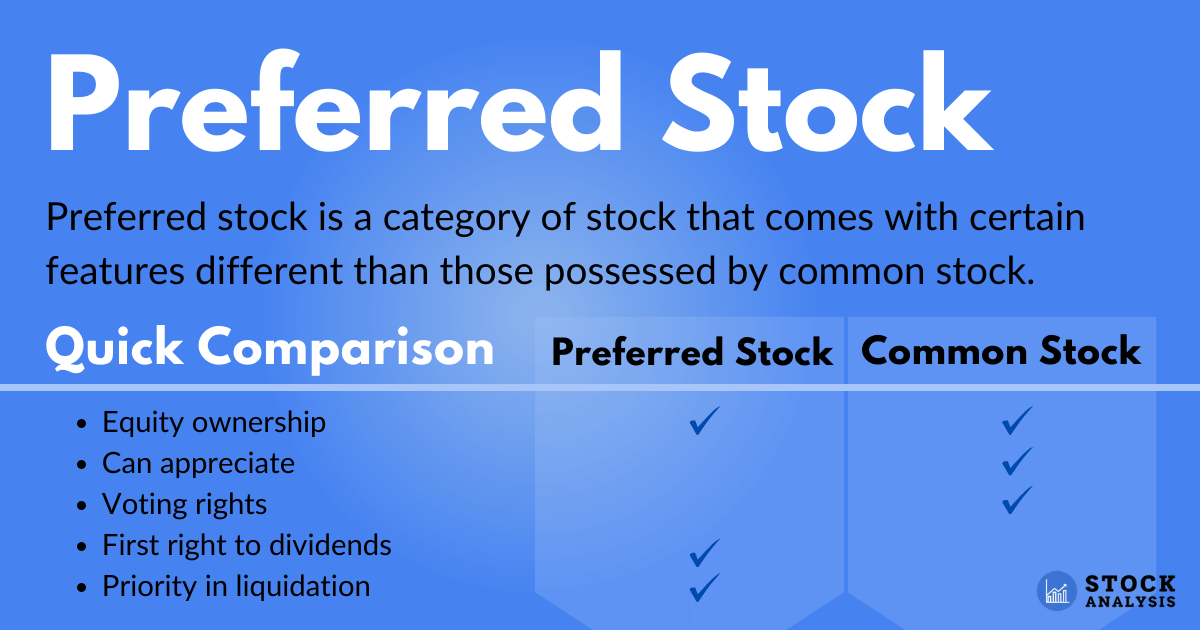

Common vs. Preferred Stock

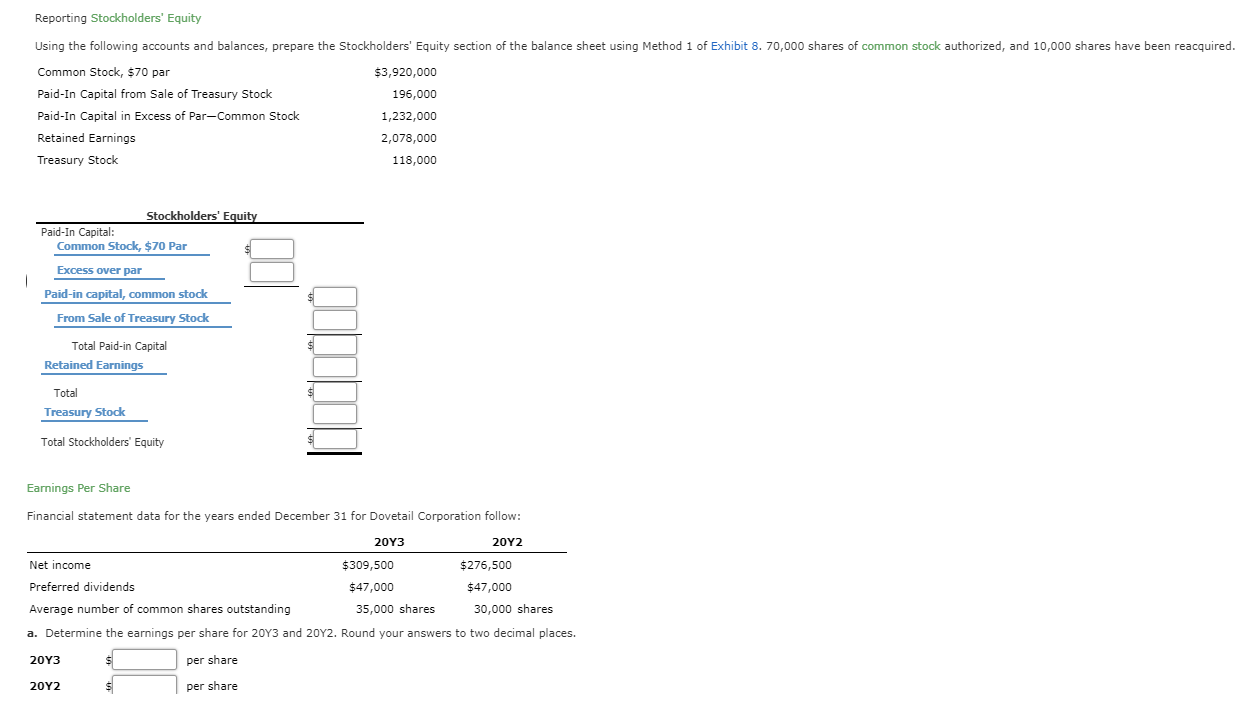

The two primary types of stock are common stock and preferred stock. Common stockholders typically have voting rights, allowing them to elect the board of directors and influence major corporate decisions.

In contrast, preferred stockholders often forgo voting rights in exchange for preferential treatment regarding dividends. They are typically paid dividends before common stockholders and have a higher claim on assets in the event of liquidation.

This distinction highlights that being a stockholder doesn't automatically equate to having significant control over a company.

Rights and Responsibilities

Beyond voting rights, stockholders have other rights, including the right to receive financial information about the company. They are also entitled to a share of the company's profits, typically in the form of dividends.

However, stockholders also bear certain responsibilities, albeit limited ones. They are not directly liable for the company’s debts or obligations, a principle known as limited liability.

Their risk is generally limited to the amount of their investment.

The Evolving Role of Stockholders

The traditional view of stockholders as passive investors is increasingly being challenged. Activist investors, for example, take a more proactive approach, using their ownership stake to push for changes in corporate strategy and governance.

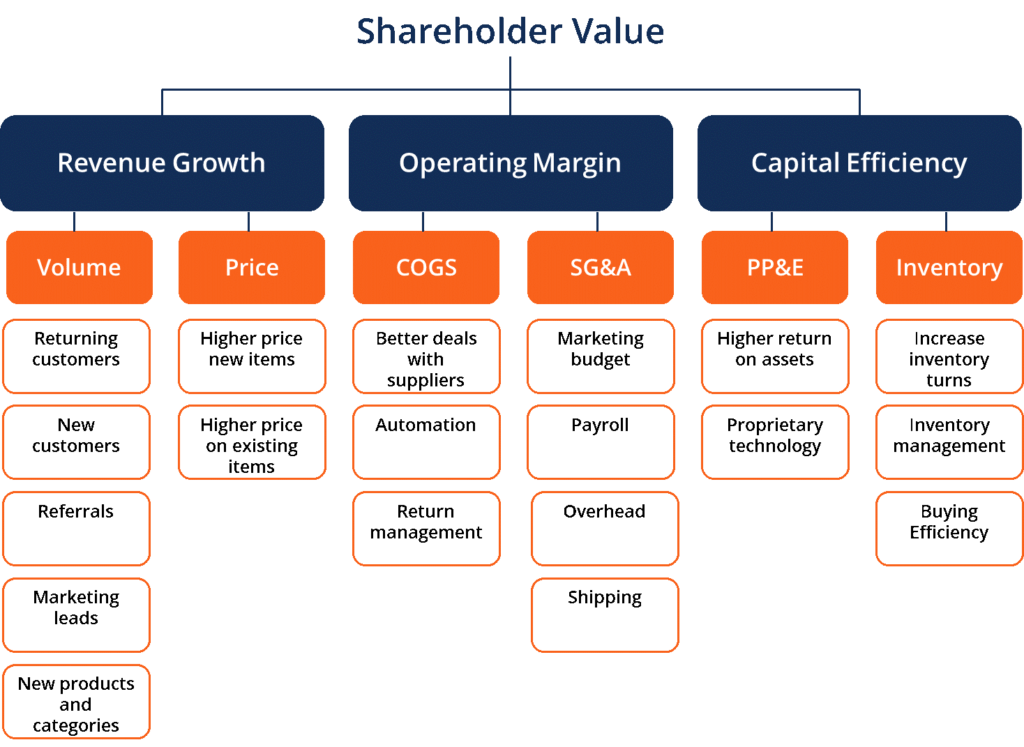

These activists often target companies they believe are undervalued or poorly managed, seeking to unlock shareholder value. Their tactics can range from public campaigns to proxy fights, aiming to influence the board of directors and corporate policy.

The rise of environmental, social, and governance (ESG) investing further complicates the definition of a stockholder.

ESG and Stakeholder Capitalism

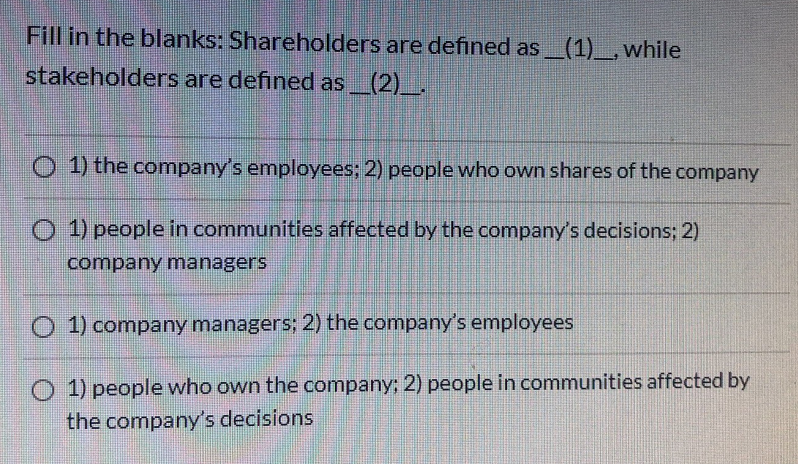

ESG investing considers factors beyond financial performance, incorporating environmental impact, social responsibility, and corporate governance practices into investment decisions. This approach reflects a growing recognition that companies have a broader responsibility to stakeholders beyond just stockholders, including employees, customers, and the communities in which they operate.

This shift towards what is often called "stakeholder capitalism" argues that companies should prioritize the interests of all stakeholders, not just stockholders, in order to achieve long-term sustainable success.

This perspective broadens the definition of a stockholder, suggesting they should also consider the ethical and social implications of their investments.

Legal and Regulatory Framework

The rights and responsibilities of stockholders are largely defined by legal and regulatory frameworks, which vary across jurisdictions. In the United States, state corporate laws, such as those of Delaware, play a significant role in governing corporate governance and shareholder rights.

Federal securities laws, enforced by the Securities and Exchange Commission (SEC), also protect investors and ensure fair and transparent markets.

These laws provide stockholders with remedies for corporate wrongdoing, such as securities fraud, and empower them to hold directors and officers accountable.

The Future of Stockholder Definition

The definition of a stockholder continues to evolve in response to changing economic, social, and technological forces. The increasing prominence of institutional investors, such as pension funds and mutual funds, has further concentrated shareholder power.

These institutions often have a fiduciary duty to act in the best interests of their beneficiaries, which can lead them to take a more active role in corporate governance.

Technological advancements, such as online proxy voting and shareholder communication platforms, are also empowering individual investors to participate more easily in corporate decision-making.

Ultimately, a stockholder is more than just an owner of stock. They are a part of a complex ecosystem of corporate governance, financial markets, and societal expectations.

The definition of a stockholder encompasses both rights and responsibilities, and it is constantly being shaped by legal, economic, and social forces. As the corporate landscape continues to evolve, understanding the role of the stockholder will remain essential for navigating the ever-changing world of business and investment.

:max_bytes(150000):strip_icc()/SHAREHOLDER-FINAL-6e2f06cd0b2e41f5b774d2b889bb80f2.jpg)