Stockholders Equity Is Not Affected By All

Corporate finance professionals are on high alert: A growing misconception is spreading regarding the factors that influence stockholders' equity. Not all company transactions directly impact this vital component of the balance sheet.

This article clarifies common misunderstandings about stockholders' equity, highlighting specific scenarios where company activities do not cause a direct change. It is crucial for investors and analysts to grasp the nuances involved.

Understanding Stockholders' Equity

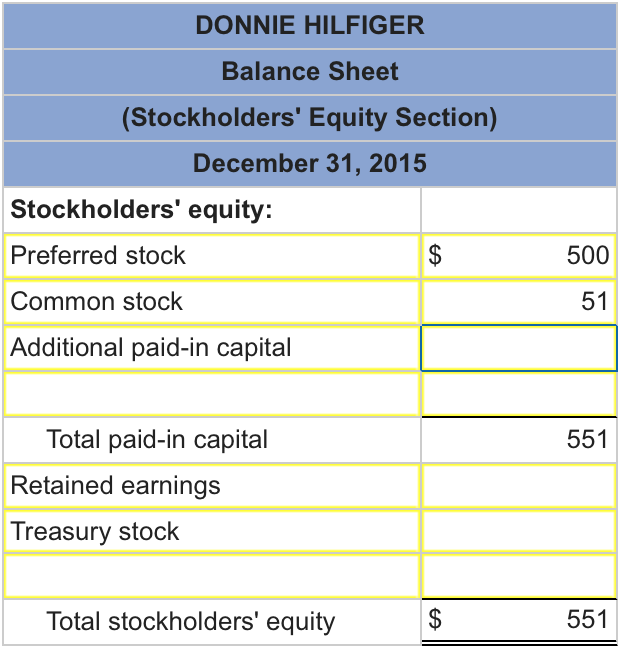

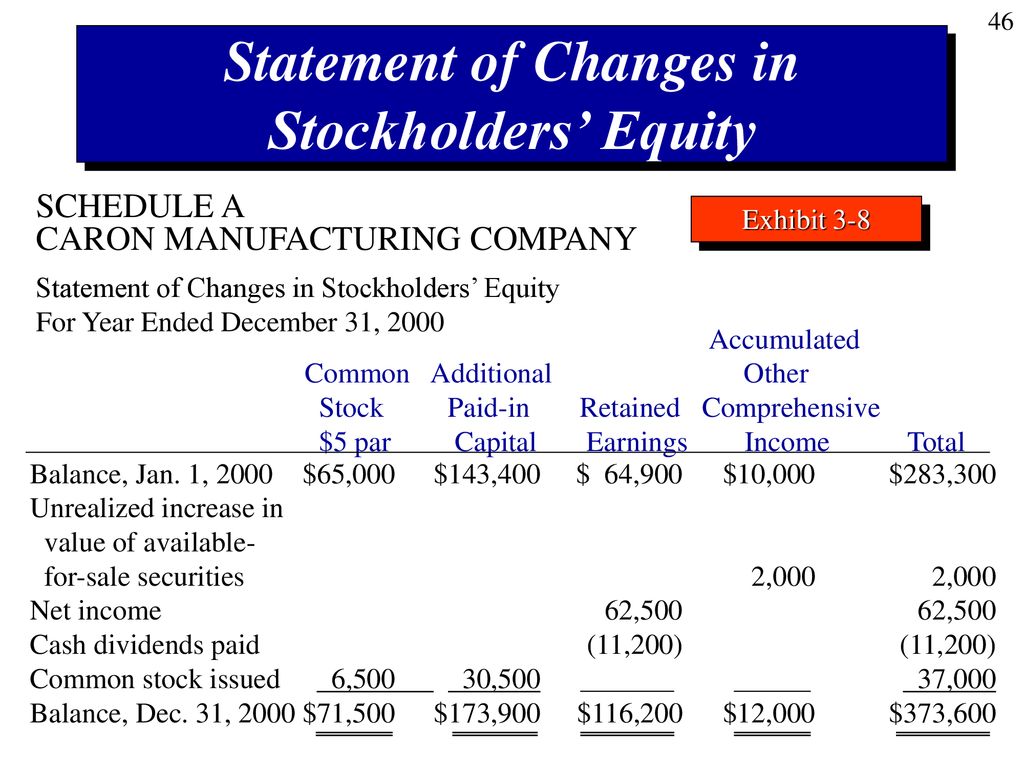

Stockholders' equity, also known as shareholders' equity or net worth, represents the owners' residual claim on the assets of a company after deducting liabilities. It is a core metric for assessing a company's financial health.

It's primarily affected by profits, losses, share issuances, share repurchases, and dividend payouts. However, certain transactions leave it untouched.

Transactions That Do NOT Affect Stockholders' Equity

Several common business activities do not directly alter the total stockholders' equity. These often involve movements within asset or liability accounts.

1. Cash Purchase of Assets: When a company uses cash to buy an asset, the total equity remains constant. Cash decreases, and the asset account increases by the same amount, resulting in no net change.

2. Paying Off Liabilities: Similarly, paying off a liability with cash does not change stockholders' equity. Cash decreases, and the liability decreases; the balance sheet equation remains balanced, and equity is unaffected.

3. Accrued Expenses: Simply accruing an expense, like wages payable, increases liabilities and expenses (which reduces net income eventually when paid). However, this initial recording does not affect equity until the expense impacts net income.

4. Revenue Recognition (Deferred Revenue): Receiving cash for services to be provided in the future creates deferred revenue, a liability. While cash increases, deferred revenue increases correspondingly, leaving stockholders' equity unchanged until the revenue is actually earned.

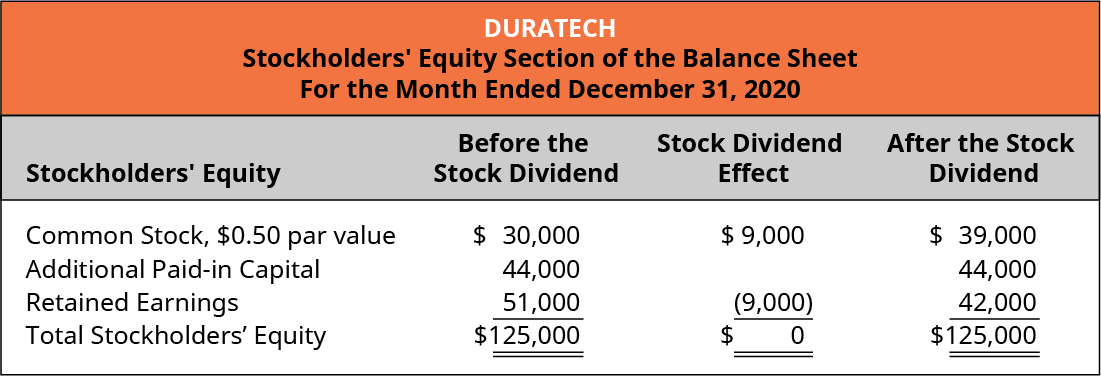

5. Stock Splits: A stock split increases the number of outstanding shares while proportionally decreasing the price per share. While increasing the number of shares outstanding, the accounting value of the equity does not change.

6. Treasury Stock Transactions (Repurchase and Reissuance - Initial): The initial repurchase of shares into treasury stock reduces stockholders' equity. However, subsequent reissuance of these shares *will* affect equity when reissued above or below the original repurchase price.

Why This Matters

Misinterpreting the impact of these transactions can lead to flawed financial analysis. Investors might inaccurately assess a company's financial stability or growth potential.

For instance, assuming that any increase in assets automatically boosts stockholders' equity could paint an incomplete picture. A company might be acquiring assets through debt, increasing leverage rather than actual equity.

Confusing the impact of stock splits could mislead investors about the true value creation within a company.

Examples in Practice

Consider a company, TechCorp, buying new equipment for $500,000 in cash. TechCorp's cash decreases by $500,000, and its fixed assets increase by $500,000. The total stockholders' equity remains the same. The transaction balances within the assets side of the accounting equation.

Another company, RetailGiant, collects $1 million in advance for annual subscriptions. RetailGiant records $1 million as deferred revenue (a liability). The equity will only increase when RetailGiant recognizes the revenue.

Finally, suppose a company declares a stock split. This will only affect the par value of stock if changed, not the overall total stockholders' equity balance.

The Path Forward

Financial analysts and investors must rigorously analyze financial statements to understand the *true* drivers of stockholders' equity. Overreliance on superficial indicators can lead to misinformed investment decisions.

Companies should ensure transparent financial reporting. Further guidelines on the reporting and analysis of stockholders’ equity are expected from accounting standard-setters.

Continuing professional development for financial professionals is crucial. The emphasis should be on a deep understanding of accounting principles and their implications for equity analysis. We will continue to monitor developments and provide updates.

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)

.jpg)

:max_bytes(150000):strip_icc():format(webp)/Stockholdersequity_Sketch_final-5230009146b749cc85d8b57339a52dad.png)

.jpg)

.jpg)

.jpg)