Sunbit Ollie's Credit Card Application Online

Imagine browsing the aisles of Ollie's Bargain Outlet, the thrill of the hunt palpable as you unearth hidden treasures – a discounted power tool, a quirky kitchen gadget, or maybe that perfect throw rug to tie your living room together. But then, reality bites: your wallet's feeling a little light this month. Enter Sunbit, stage right, with a potential solution to bridge that gap between desire and affordability.

This article explores the recent integration of Sunbit's technology with Ollie's online credit card application process, offering shoppers a more accessible and transparent pathway to financing their purchases. It delves into the background of both companies, examines the potential benefits and drawbacks of this partnership, and considers the broader implications for the retail landscape.

The Power of "Good Stuff Cheap" Meets Flexible Financing

Ollie's Bargain Outlet, a retailer known for its "Good Stuff Cheap" mantra, has carved a niche by offering closeout merchandise and surplus inventory at deeply discounted prices. Its appeal lies in the thrill of discovery and the promise of unbeatable deals, attracting a broad spectrum of shoppers seeking value.

However, even deeply discounted items can strain budgets, particularly during unexpected needs or larger purchases. This is where the partnership with Sunbit comes into play.

Sunbit: Democratizing Access to Financing

Sunbit is a technology company that specializes in point-of-sale financing solutions. They are particularly known for their accessible approval rates and transparent terms.

Unlike traditional credit cards or loans, Sunbit focuses on providing installment payment plans tailored to individual needs and credit profiles. This approach aims to make financing more inclusive, reaching customers who may have limited or no credit history.

Sunbit's core mission revolves around providing fair, transparent, and accessible financial solutions. Their technology assesses creditworthiness quickly and efficiently, offering personalized payment plans that fit within a customer's budget.

The Online Application Integration: A Closer Look

The integration of Sunbit's technology into Ollie's online credit card application process marks a significant step in enhancing the customer experience. Shoppers can now apply for financing directly through the Ollie's website.

This seamless integration allows for near-instant credit decisions, providing customers with clarity on their purchasing power before they even reach the checkout. This pre-approval process can empower shoppers to make more informed decisions about their purchases.

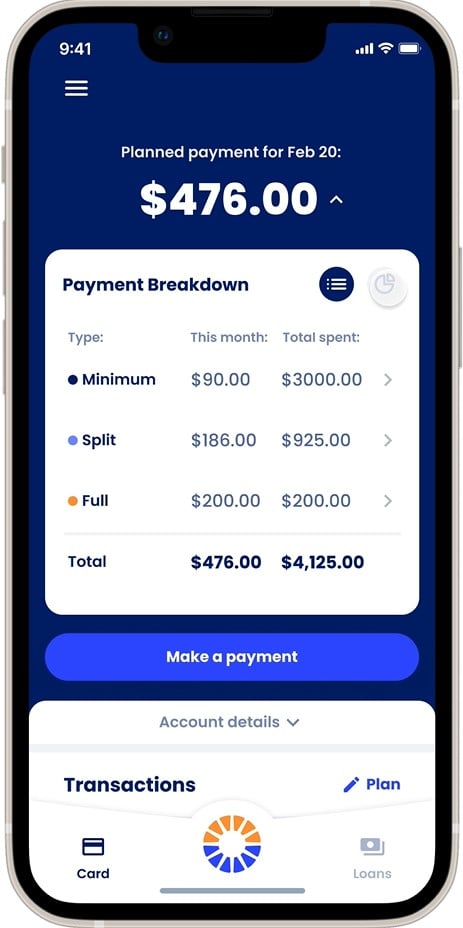

The application process is designed to be user-friendly and transparent. Customers are presented with clear terms and conditions, including interest rates, payment schedules, and any associated fees.

Benefits for Ollie's Shoppers

The partnership with Sunbit offers several potential benefits for Ollie's customers. It allows them to spread out the cost of purchases over time, making larger or unexpected expenses more manageable.

For those with limited credit history, Sunbit's more inclusive approval process can provide access to financing that might not be available through traditional channels. Sunbit emphasizes transparency.

Furthermore, the instant credit decisions offered through the online application can save time and eliminate the uncertainty often associated with financing applications.

Potential Drawbacks and Considerations

While the partnership offers numerous benefits, it's crucial to acknowledge potential drawbacks. Any form of credit carries the risk of overspending and accumulating debt if not managed responsibly.

Interest rates associated with Sunbit financing, while potentially lower than some traditional credit cards, may still be higher than other financing options available to customers with strong credit scores. It is important to compare offers carefully.

It's essential for shoppers to carefully consider their ability to repay the loan according to the agreed-upon terms before committing to a payment plan. Defaulting on payments can negatively impact credit scores.

Industry Perspective and Impact

The collaboration between Ollie's and Sunbit reflects a broader trend in the retail industry towards offering more flexible and accessible financing options. As consumers increasingly demand convenience and affordability, retailers are seeking innovative ways to meet those needs.

According to a report by Experian, point-of-sale financing is gaining significant traction, particularly among younger consumers and those with limited credit history. This trend suggests a growing demand for alternative financing solutions that offer more personalized and transparent terms.

By integrating Sunbit's technology, Ollie's is positioning itself as a forward-thinking retailer that is responsive to the evolving needs of its customer base. It enables more consumers to access the "Good Stuff Cheap".

The Future of Retail Financing

The Ollie's and Sunbit partnership may serve as a model for other retailers looking to enhance their customer experience and expand their reach. As technology continues to evolve, we can expect to see even more innovative financing solutions emerge in the retail landscape.

The key to success will lie in providing consumers with access to transparent, affordable, and responsible financing options that empower them to make informed purchasing decisions. The trend in retail suggests a preference for ease and transparency in credit options.

By prioritizing customer education and promoting responsible borrowing practices, retailers and financial technology companies can work together to create a more inclusive and sustainable financial ecosystem.

A Reflection on Affordability and Choice

The Ollie's-Sunbit integration represents a potentially positive step towards making affordability more accessible in the retail world. By providing a seamless online application and transparent payment options, this partnership aims to empower customers to make informed choices.

However, it is important to approach financing options with caution and a clear understanding of the terms and conditions. While the allure of "Good Stuff Cheap" is strong, responsible financial planning should always be the top priority.

Ultimately, the success of this partnership hinges on the ability of both Ollie's and Sunbit to provide a truly beneficial service to their customers – one that promotes both affordability and responsible financial management. The partnership will need to demonstrate that it promotes responsible spending.