Tax Accounting Software For Small Business

Imagine Sarah, a passionate baker, her small bakery filled with the aroma of freshly baked bread and sweet pastries. Her hands, dusted with flour, create magic every day, but when it comes to taxes, the magic fades. Spreadsheets become her nemesis, and the thought of deductions and compliance sends shivers down her spine. Sound familiar?

For small business owners like Sarah, juggling passion and profits can be overwhelming. Fortunately, tax accounting software is changing the game, offering a lifeline to navigate the complex world of taxes efficiently and confidently.

For many small businesses, tax season used to be a time of dread, marked by late nights poring over receipts and confusing forms. The sheer complexity of tax laws, constantly evolving regulations, and the pressure of avoiding penalties often led to errors and missed opportunities.

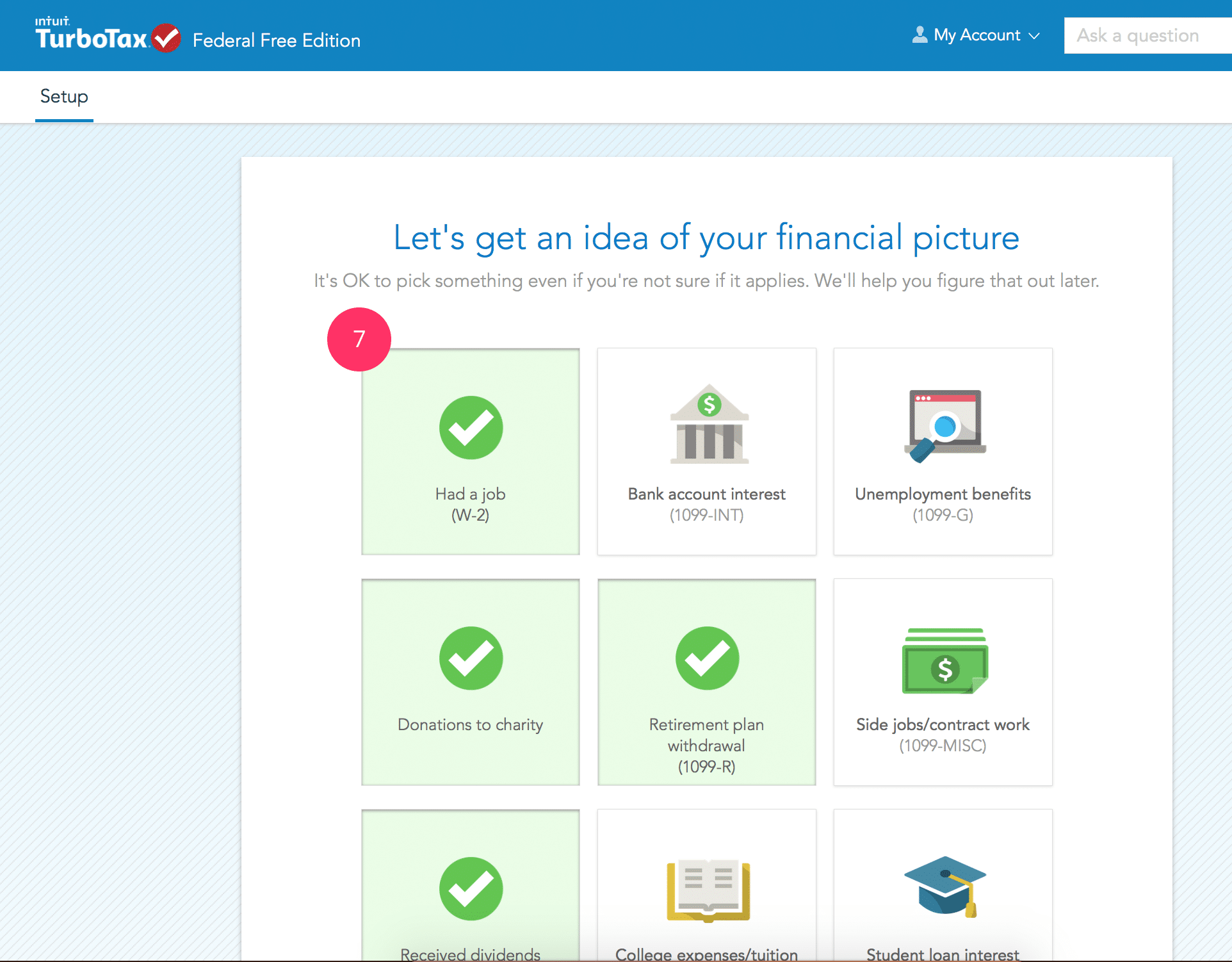

This is where tax accounting software steps in, acting as a virtual accountant and providing a centralized platform for managing finances, tracking expenses, and preparing tax returns. According to a recent survey by the National Small Business Association (NSBA), businesses that utilize accounting software report a significant reduction in tax preparation time and a lower risk of audit.

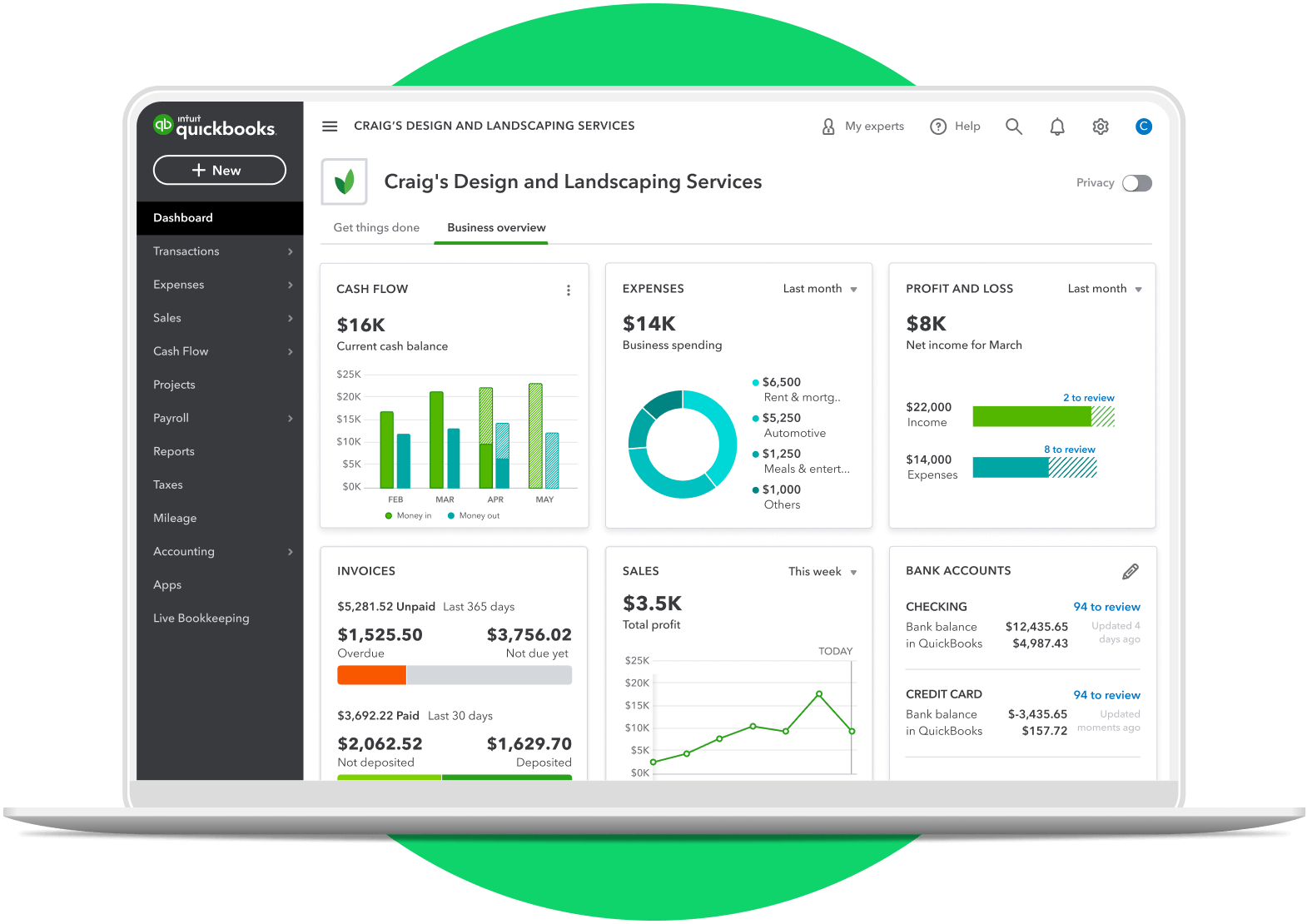

The evolution of these software solutions has been remarkable. Early versions were often clunky and difficult to navigate. Today’s platforms offer intuitive interfaces, cloud-based accessibility, and robust features tailored to the specific needs of various industries.

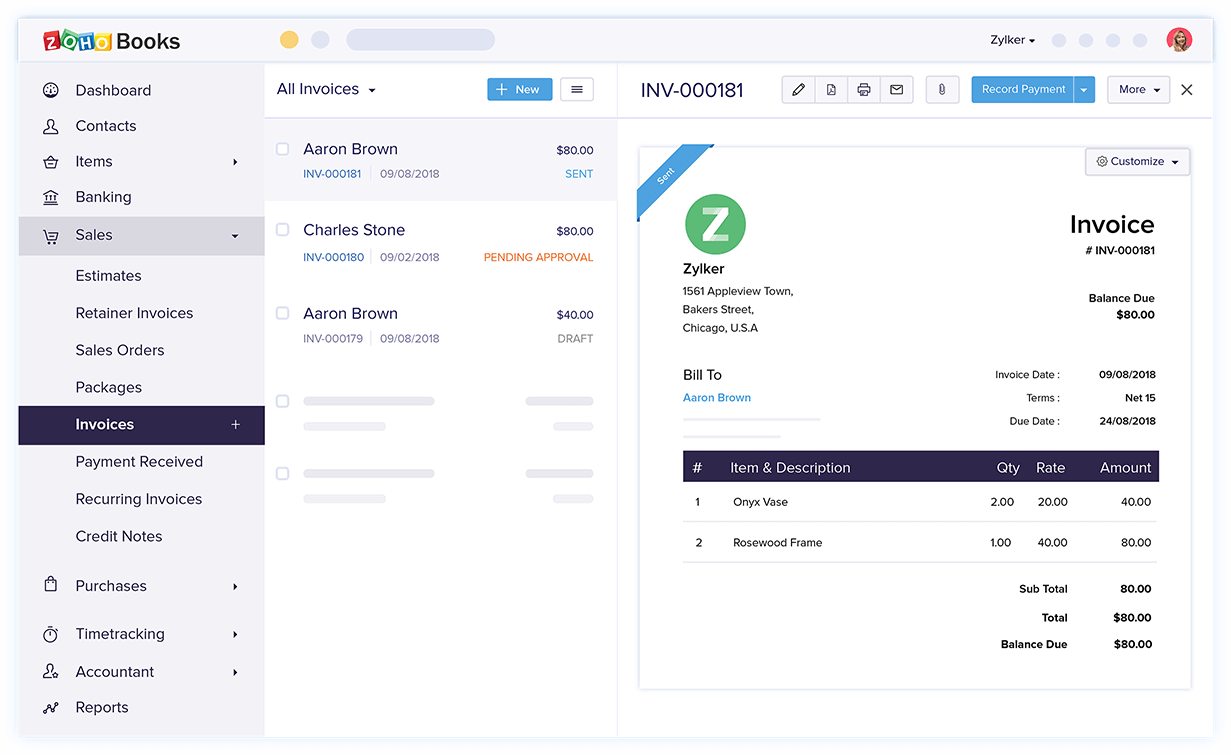

These features often include automated expense tracking, income categorization, invoice management, and real-time financial reporting. Many software packages also integrate seamlessly with other business tools, like point-of-sale systems and bank accounts, streamlining workflows and reducing manual data entry.

Benefits Beyond Simplification

Beyond simply simplifying tax preparation, tax accounting software offers a multitude of benefits for small businesses. It facilitates better financial visibility, enabling owners to make informed decisions based on accurate data.

With real-time insights into cash flow, profitability, and expenses, businesses can identify areas for improvement, optimize spending, and plan for future growth. Accurate records also become invaluable when applying for loans or seeking investment.

Moreover, many tax software packages provide educational resources and support, empowering business owners to understand their tax obligations and take advantage of available deductions and credits. Staying compliant with ever-changing regulations becomes significantly easier with built-in updates and alerts.

Choosing the Right Software

Selecting the right tax accounting software is a crucial decision. It requires careful consideration of factors such as the size and complexity of the business, industry-specific needs, budget, and technical expertise.

Some popular options include QuickBooks Self-Employed, ideal for freelancers and independent contractors, and Xero, known for its user-friendly interface and robust features. FreshBooks is also a popular choice for service-based businesses with strong invoicing needs.

Before committing to a specific platform, it's wise to take advantage of free trials and read reviews from other small business owners. Consider the scalability of the software as your business grows and whether it offers the necessary integrations with other tools you already use.

The investment in tax accounting software is an investment in peace of mind and the financial health of your business. With the right tools and a proactive approach, tax season can transform from a source of stress into an opportunity for strategic planning and growth.

As Sarah continues to fill her bakery with delicious creations, she can now face tax season with a newfound sense of confidence, knowing that her finances are organized and her compliance is secure. The future for small businesses like hers, empowered by technology, looks brighter than ever.

![Tax Accounting Software For Small Business 11 BEST Small Business Accounting Software [TOP SELECTIVE]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2021/01/Small-Business-Accounting-Software.png)