Tax On Pf Withdrawal After 5 Years India

Recent discussions surrounding the taxation of Provident Fund (PF) withdrawals in India have sparked debate and uncertainty among millions of salaried individuals. The central issue revolves around the potential imposition of taxes on the interest earned on employee contributions to PF accounts after a certain threshold. The proposal, aimed at streamlining tax policies and potentially boosting government revenue, has raised concerns about its impact on long-term savings and retirement planning.

At the heart of the discussion is the government's intent to clarify the tax treatment of PF contributions and withdrawals. The proposed changes seek to bring greater parity between different investment instruments and encourage a more equitable tax regime. However, critics argue that such measures could disincentivize saving for retirement, particularly among middle-class employees who rely heavily on PF as a primary source of financial security after their working years.

Key Details of the Proposed Tax Changes

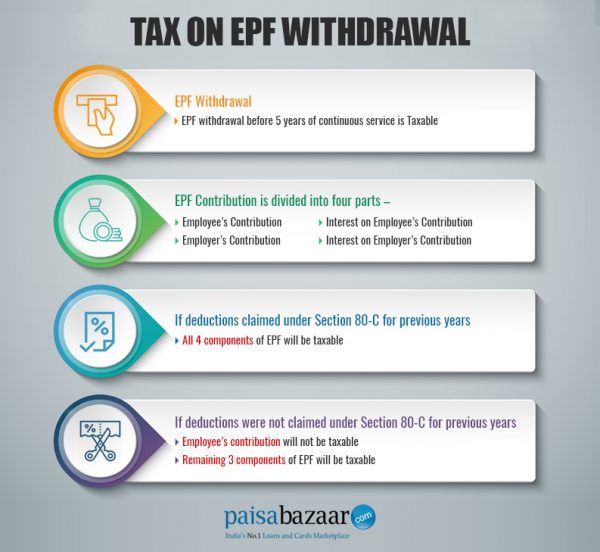

The proposed tax applies specifically to the interest earned on employee contributions exceeding a certain limit, typically above INR 2.5 lakh per year. This threshold is designed to primarily affect high-income earners while minimizing the impact on the majority of PF subscribers. However, the application of this rule and its exact implications are still subjects of interpretation and debate.

The Central Board of Direct Taxes (CBDT), under the Ministry of Finance, is the primary body responsible for formulating and implementing tax policies related to PF withdrawals. Their announcements and circulars are crucial for understanding the nuances of the new tax regime and its potential effects on individuals and organizations alike.

The timing of implementation and the specific mechanisms for calculating and deducting the tax are critical concerns for both employers and employees. Clear guidelines and efficient processes are essential to ensure compliance and minimize administrative burden. Furthermore, consistent communication from the government is necessary to address anxieties and prevent misinformation.

Impact on Employees and Employers

For employees, the primary impact of the tax is a potential reduction in their retirement savings, particularly for those with substantial PF contributions. This could lead to a reassessment of investment strategies and a greater emphasis on alternative retirement planning options. Understanding the net impact on their take-home pay and future savings is crucial for making informed financial decisions.

Employers also face challenges in adapting to the new tax rules. They need to ensure compliance with tax laws, update payroll systems, and provide employees with accurate information about the implications of the new tax regime. Failure to comply with these regulations could result in penalties and legal repercussions.

Expert Opinions and Concerns

Financial experts have expressed mixed opinions on the proposed tax on PF withdrawals. Some argue that it is a necessary step towards creating a more equitable tax system and encouraging diversified investment. Others caution that it could undermine the attractiveness of PF as a long-term savings instrument and discourage responsible financial planning.

“The tax on PF withdrawals could have unintended consequences, particularly for middle-income earners who rely on these savings for retirement,” says Rohit Sharma, a financial advisor. “It’s crucial for the government to carefully consider the impact of these changes and provide adequate support and guidance to those affected.”

Concerns have also been raised about the complexity of the new tax regime and the potential for misinterpretation. Clear and concise communication from the government is essential to address these concerns and ensure that individuals and organizations can navigate the new rules effectively.

The Human Angle: Real-Life Impacts

The story of Anita Devi, a school teacher nearing retirement, exemplifies the real-life impact of the proposed tax changes. She has diligently contributed to her PF account throughout her career, hoping to secure a comfortable retirement. The prospect of a portion of her savings being taxed has caused her considerable anxiety, forcing her to re-evaluate her financial plans and explore alternative sources of income.

Similarly, small business owners who provide PF benefits to their employees are concerned about the administrative burden and compliance costs associated with the new tax regime. They worry that it could discourage them from offering PF benefits to their employees, potentially undermining the social security net for vulnerable workers.

Looking Ahead

The ongoing discussions surrounding the taxation of PF withdrawals highlight the complex interplay between government revenue, individual savings, and social security. As the situation evolves, it is essential for individuals, employers, and policymakers to engage in informed dialogue and collaborate on solutions that promote both fiscal responsibility and financial security.

Ultimately, the success of any new tax regime depends on its fairness, clarity, and effectiveness in achieving its intended objectives. The government must carefully consider the potential consequences of its policies and ensure that they do not disproportionately burden those who rely on PF as a crucial pillar of their retirement planning.