Temporary Earnings Are Best Characterized As Earnings That

The stock market often feels like a high-stakes poker game, with fortunes made and lost on the turn of a card. But beneath the surface of daily trading volumes lies a more fundamental truth: not all earnings are created equal. Understanding the nuanced difference between sustainable and temporary earnings is crucial for investors seeking long-term gains and financial stability. Misinterpreting a short-term surge as a sign of enduring prosperity can lead to devastating consequences.

At the heart of this issue lies the definition of temporary earnings. They are best characterized as earnings that are unlikely to recur in future periods, stemming from one-time events or unusual circumstances rather than core business operations. This article delves into the complexities of temporary earnings, examining their sources, their impact on investment decisions, and the strategies investors can use to distinguish them from sustainable profits. We’ll explore perspectives from financial analysts and industry experts, drawing on data from reputable organizations to provide a comprehensive understanding of this critical aspect of financial analysis.

Identifying the Roots of Temporary Earnings

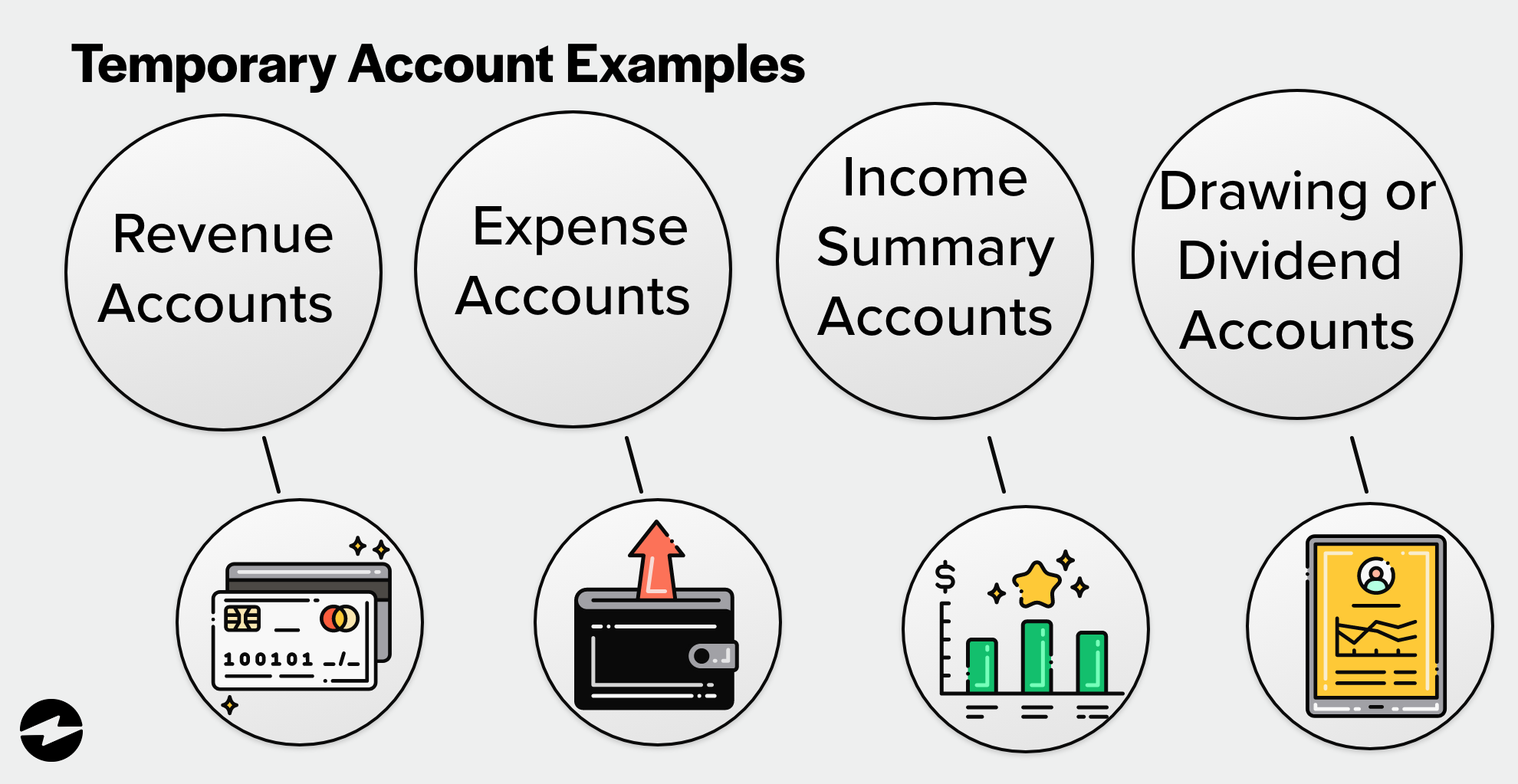

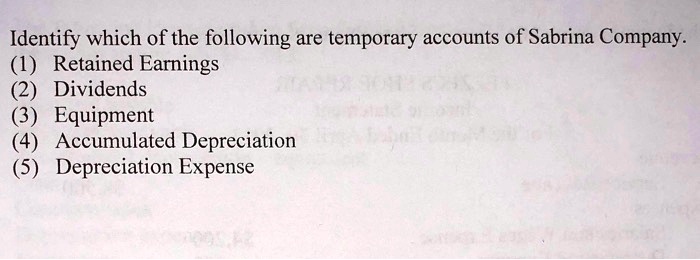

Temporary earnings can arise from a variety of sources. These include asset sales, litigation settlements, accounting changes, and favorable tax adjustments. These events create a one-time boost to a company's bottom line, but they don't reflect the underlying strength of its business model.

Asset sales, for instance, can provide a significant short-term windfall. A company selling a subsidiary or a large piece of real estate might report a substantial gain. However, this gain is unlikely to be repeated in subsequent periods.

Similarly, a large litigation settlement can temporarily inflate earnings. While a legal victory can be positive for a company, it doesn't necessarily indicate an improvement in its long-term profitability.

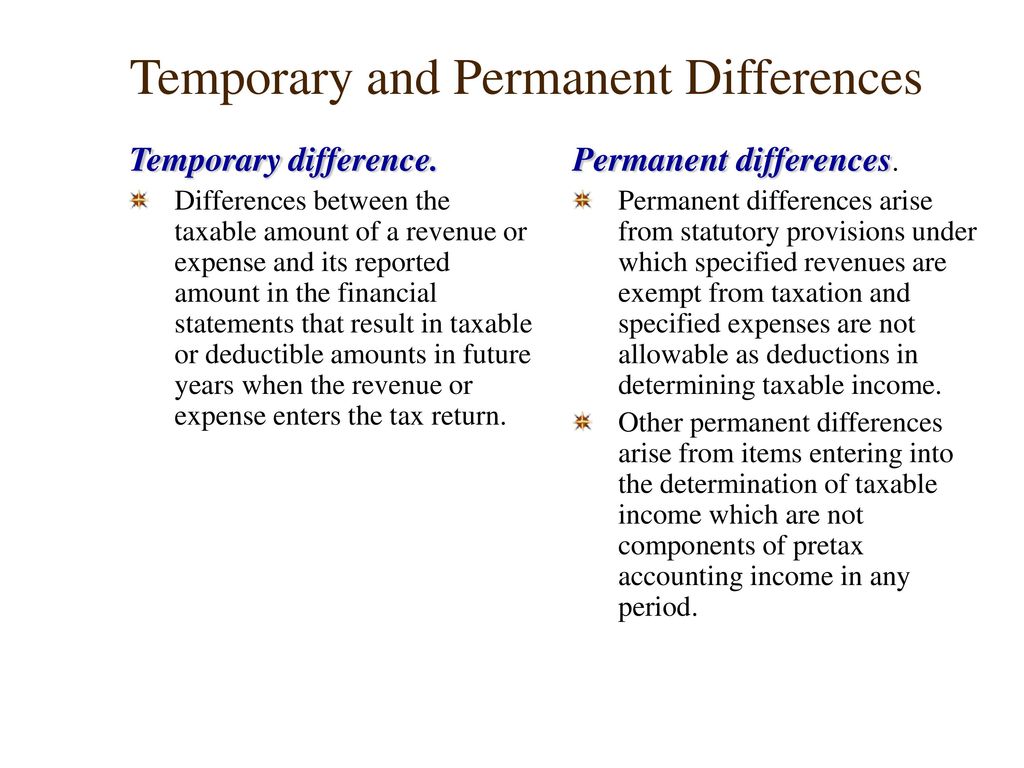

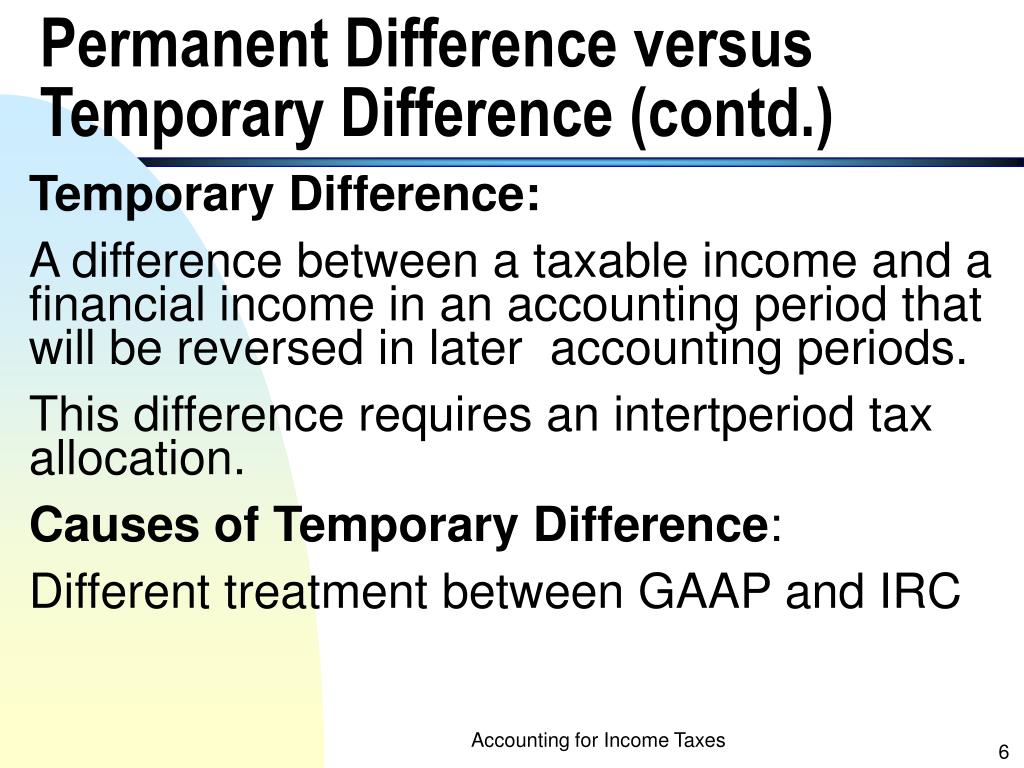

Accounting changes can also lead to temporary earnings fluctuations. For instance, a company switching to a different depreciation method might see a short-term increase in profits. But the underlying economic reality of the business remains the same.

Favorable tax adjustments, such as tax credits or refunds, can provide a one-time boost to earnings. These adjustments are not indicative of the company's ongoing operational performance.

The Impact on Investment Decisions

The misinterpretation of temporary earnings can have serious consequences for investors. Investors may overestimate a company's future potential based on a misleadingly high earnings report. This can lead to inflated stock prices and ultimately, a painful correction when the temporary earnings disappear.

Analysts often use metrics like the price-to-earnings (P/E) ratio to evaluate a company's valuation. If earnings are artificially inflated by temporary factors, the P/E ratio can be misleadingly low. This could lure investors into buying an overvalued stock.

Furthermore, companies themselves may be tempted to manipulate earnings to create a favorable impression. This can involve aggressive accounting practices or delaying expenses to boost short-term profits. These practices can mask underlying weaknesses in the business and ultimately harm investors.

Strategies for Distinguishing Temporary From Sustainable Earnings

Investors need to be vigilant in distinguishing between temporary and sustainable earnings. This requires a deep dive into a company's financial statements and a thorough understanding of its business operations. Examining the cash flow statement is crucial.

Unlike the income statement, the cash flow statement provides a more accurate picture of a company's true financial health. It focuses on the actual cash inflows and outflows of the business, rather than accounting measures that can be manipulated.

Investors should pay close attention to non-recurring items listed in the financial statements. These items, such as asset sales or litigation settlements, are often identified as sources of temporary earnings.

Comparing a company's earnings over several periods can also reveal trends that might be masked by short-term fluctuations. A consistent pattern of growth in revenue and operating income is a good sign of sustainable earnings. A sudden spike in profits followed by a decline suggests that the earnings may be temporary.

Furthermore, investors should consider the industry in which the company operates. Some industries are more prone to temporary earnings fluctuations than others. For instance, commodity-based industries are often subject to price volatility, which can lead to temporary earnings spikes.

Expert Perspectives and Industry Data

Financial analysts emphasize the importance of focusing on the quality of earnings rather than just the quantity. High-quality earnings are sustainable and predictable, while low-quality earnings are temporary and volatile. The CFA Institute provides resources and guidance for analysts to assess the quality of earnings.

Reports from organizations like Standard & Poor's and Moody's provide insights into the creditworthiness of companies. These ratings agencies analyze companies' financial statements and assess their ability to generate sustainable earnings.

Academic research has also shed light on the impact of temporary earnings on stock prices. Studies have shown that investors tend to overreact to temporary earnings surprises, leading to mispricing in the market.

Looking Ahead: Navigating the Landscape of Earnings Analysis

In today’s complex financial environment, understanding temporary earnings is more critical than ever. As companies continue to adapt to evolving economic conditions, the potential for unusual or one-time gains and losses remains significant.

Investors should prioritize due diligence, carefully scrutinizing financial statements and seeking expert analysis. Employing a long-term investment strategy focused on companies with sustainable business models is a prudent approach.

Ultimately, the key to successful investing lies in discerning the true economic value of a company, not just its short-term earnings performance. The ability to identify and understand temporary earnings is essential for making informed investment decisions and achieving long-term financial goals.

+(credit).jpg)

+Average+wages+of+all+workers+have+gone+up..jpg)