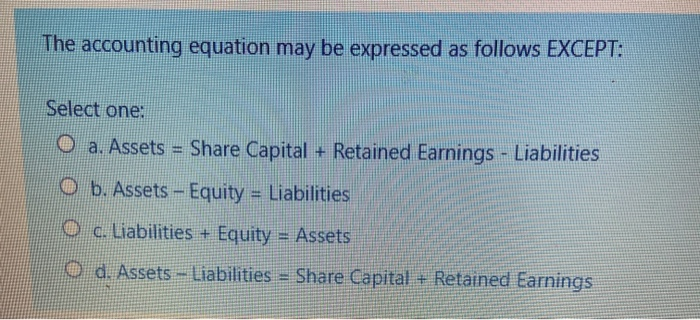

The Accounting Equation May Be Expressed As

Imagine a bustling marketplace, vendors calling out prices, customers haggling, and the steady exchange of goods. But beneath the vibrant chaos, there's a silent, unwavering principle guiding every transaction, ensuring balance and fairness. This principle, in the world of finance, is akin to the foundational law of physics: the accounting equation.

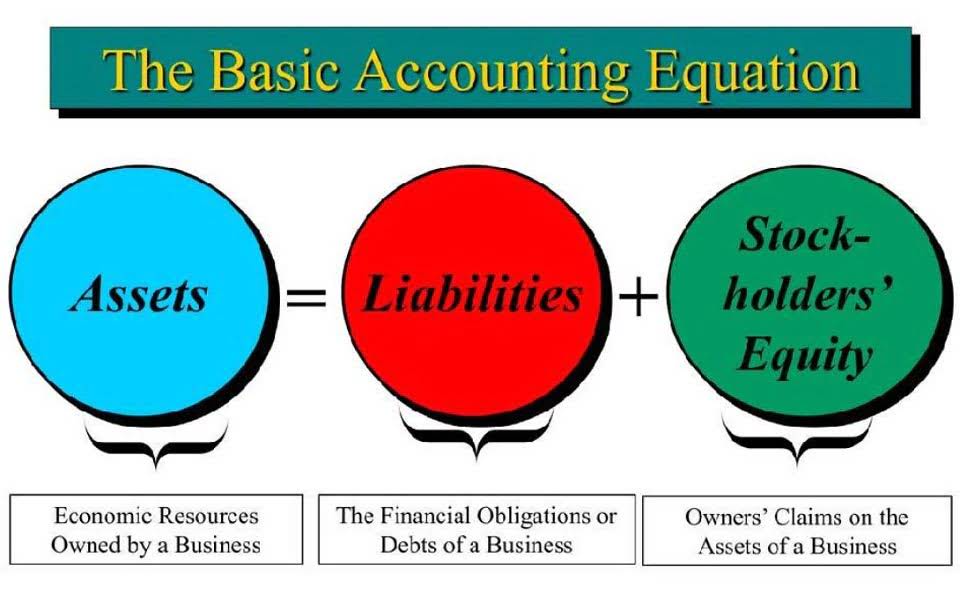

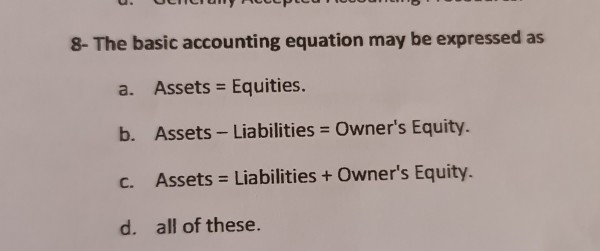

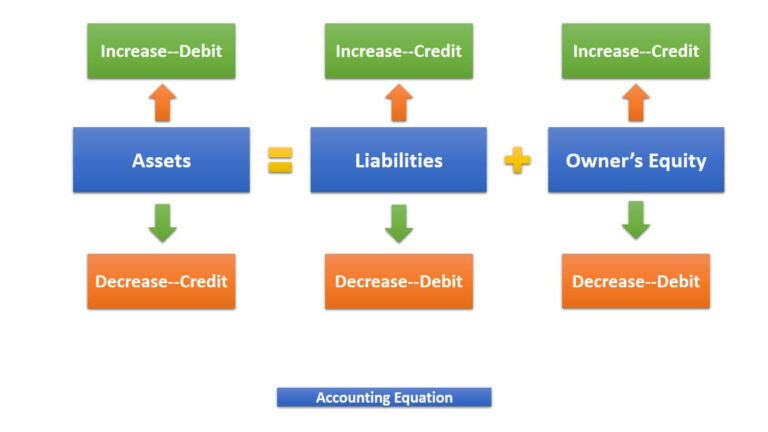

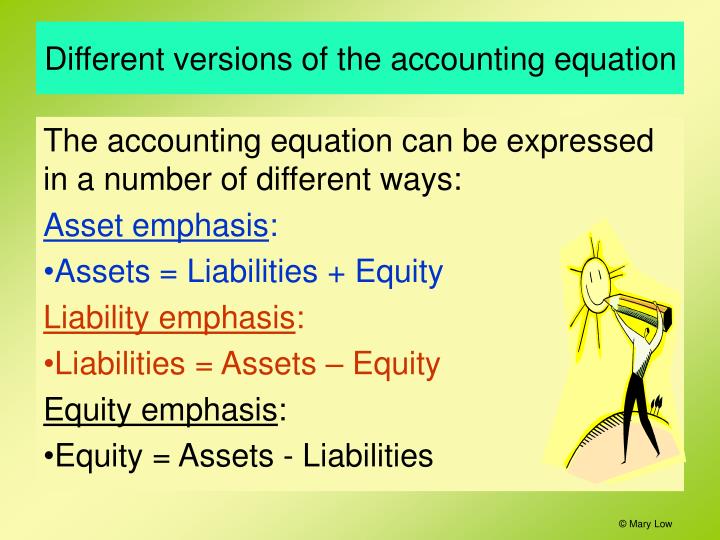

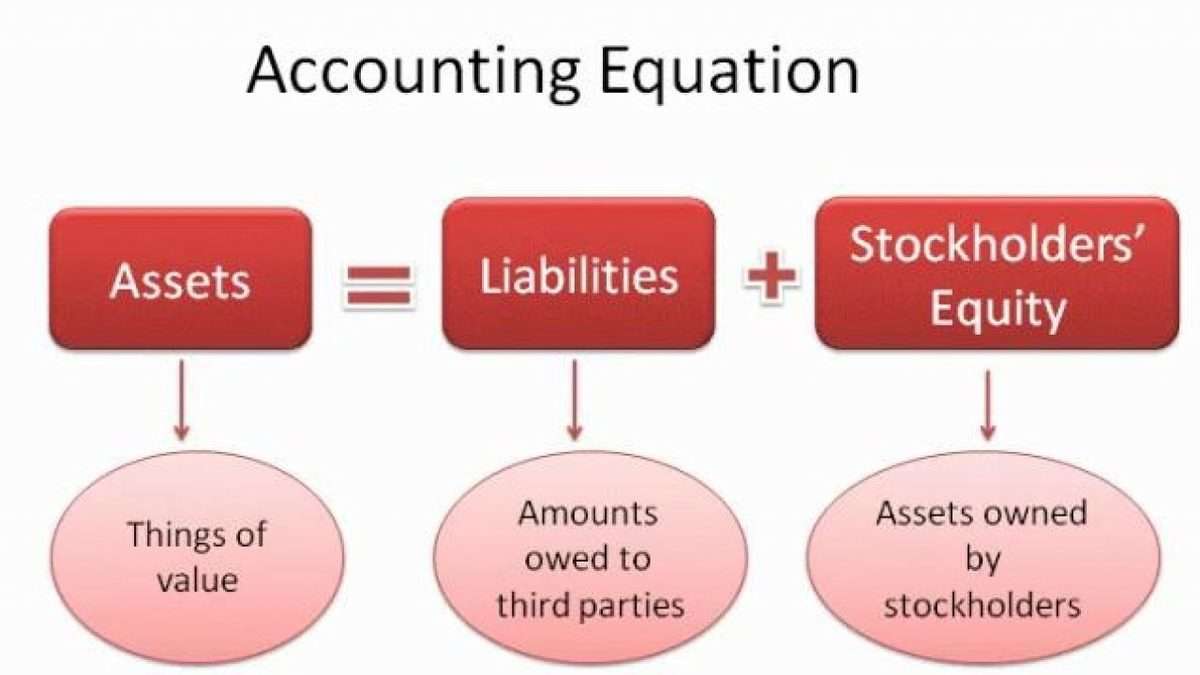

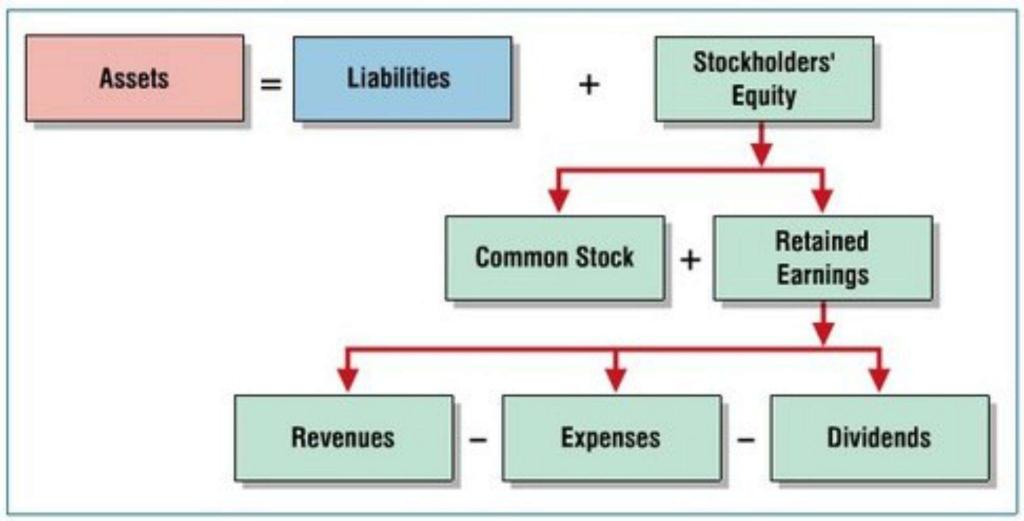

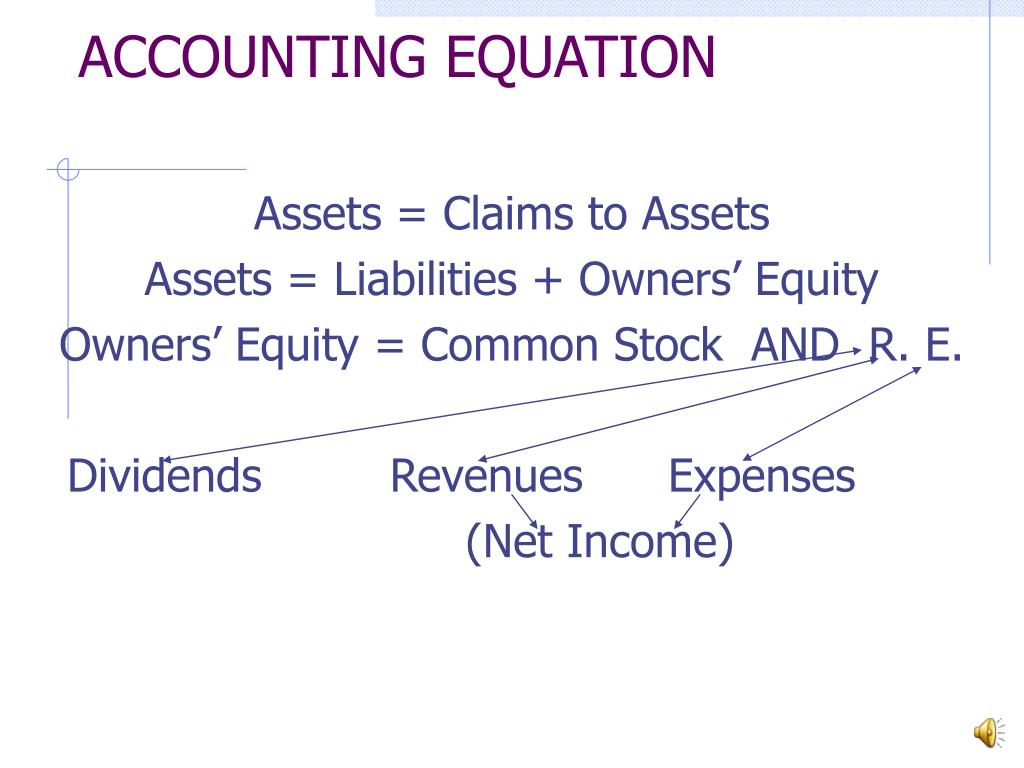

At its core, the accounting equation, often expressed as Assets = Liabilities + Equity, is a simple yet powerful statement of financial equilibrium. This equation provides the bedrock upon which financial statements are built and financial health is assessed.

Understanding the Building Blocks

To truly appreciate the significance of this equation, it’s crucial to understand its individual components. Let's break down each element.

Assets: What a Company Owns

Assets are the resources a company owns or controls that are expected to provide future economic benefits. These can be tangible, like cash, inventory, equipment, and buildings, or intangible, such as patents, trademarks, and goodwill.

Essentially, assets represent everything a company can use to generate revenue or reduce expenses.

Liabilities: What a Company Owes

Liabilities represent a company's obligations to external parties, meaning what the company owes to others. These include accounts payable (short-term debts to suppliers), salaries payable, loans, and deferred revenue.

Liabilities are essentially claims against a company's assets by creditors or lenders.

Equity: The Owners' Stake

Equity, also known as owner's equity or shareholders' equity, represents the residual interest in the assets of an entity after deducting liabilities. In simpler terms, it's the owners' stake in the company.

For a sole proprietorship, this is often referred to as owner's equity; for a corporation, it's shareholders' equity, comprising contributed capital and retained earnings (accumulated profits not distributed as dividends). Equity can be viewed as the net worth of a company.

The Equation in Action

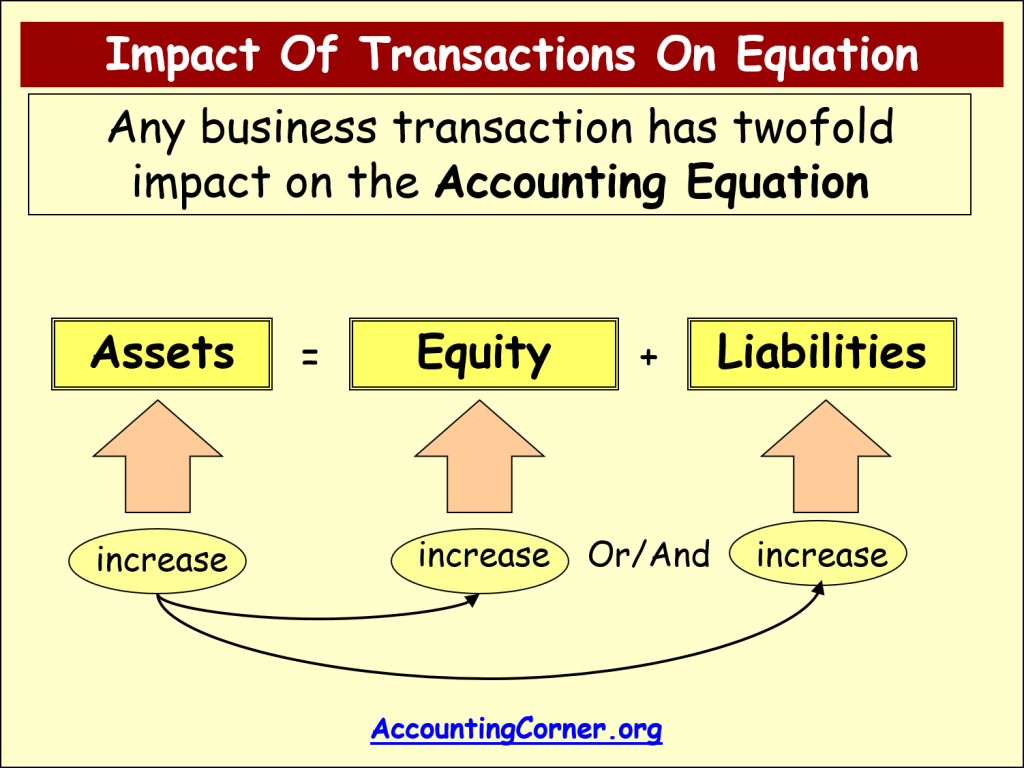

The magic of the accounting equation lies in its constant state of balance. Every transaction, no matter how big or small, must maintain this equilibrium.

For example, if a company purchases equipment for cash, the asset "equipment" increases, while the asset "cash" decreases by the same amount. The total assets remain the same, and the equation remains balanced.

Similarly, if a company takes out a loan, assets (cash) increase, and liabilities (the loan payable) increase, keeping the equation balanced.

Historical Roots and Evolution

The concept of double-entry bookkeeping, the foundation upon which the accounting equation rests, can be traced back to medieval merchants. Luca Pacioli, an Italian mathematician, is often credited as the "father of accounting" for his 1494 publication, "Summa de Arithmetica, Geometria, Proportioni et Proportionalita," which described the double-entry system.

Over centuries, this system evolved, formalizing the relationship between assets, liabilities, and equity into the equation we know today. Standardized accounting principles and regulations, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), have further refined the application of the accounting equation.

Significance in Modern Finance

The accounting equation is far more than just a formula; it's the backbone of financial reporting. Every financial statement, including the balance sheet, income statement, and statement of cash flows, is built upon this fundamental principle.

Analysts, investors, and creditors use the equation to assess a company's financial health, solvency, and overall performance. Ratios derived from the equation, such as the debt-to-equity ratio and the current ratio, provide valuable insights into a company's risk profile.

Furthermore, the equation serves as an internal control mechanism, helping to detect errors and prevent fraud. If the accounting equation is not in balance, it signals a potential problem that requires investigation.

Practical Applications

The accounting equation isn't just for accountants. Business owners, managers, and even individuals can use it to gain a better understanding of their financial position.

For example, a small business owner can use the equation to track their assets (cash, equipment, inventory), liabilities (loans, accounts payable), and equity (their investment in the business). This information can help them make informed decisions about pricing, financing, and investment.

Individuals can also apply the equation to their personal finances. By understanding their assets (savings, investments, property), liabilities (mortgages, loans, credit card debt), and equity (net worth), individuals can gain a clearer picture of their financial health and plan for the future.

The Equation in a Changing World

Even with the rise of digital technologies and complex financial instruments, the accounting equation remains remarkably relevant. While the ways businesses operate and report their financials are constantly evolving, the basic principle of maintaining balance between assets, liabilities, and equity remains constant.

New accounting standards and regulations may emerge to address emerging issues like cryptocurrency or digital assets, but the core principle of the accounting equation will continue to anchor the financial landscape.

Conclusion

The accounting equation, Assets = Liabilities + Equity, is more than just a formula; it is a fundamental truth in the world of finance. It reflects the inherent balance that must exist within any economic entity.

From small businesses to multinational corporations, from personal finances to complex financial instruments, this equation provides a framework for understanding, analyzing, and managing financial resources. Its enduring relevance underscores its importance as a cornerstone of financial literacy and sound financial management.

By grasping the core principles behind this seemingly simple equation, anyone can gain a deeper appreciation for the intricacies of finance and empower themselves to make more informed financial decisions.