The Asset Cost Less Accumulated Depreciation Is The

The relentless march of time, combined with the wear and tear of daily operations, silently erodes the value of a company's most vital possessions. The concept of "The Asset Cost Less Accumulated Depreciation Is The" – essentially, the net book value – underpins critical financial decisions, investment strategies, and even a company's perceived health.

This simple equation, a cornerstone of accounting, dictates how assets are valued on balance sheets, influencing everything from tax liabilities to investor confidence. A miscalculation or misunderstanding can lead to skewed financial reporting, inaccurate performance assessments, and ultimately, detrimental business consequences.

Understanding Net Book Value

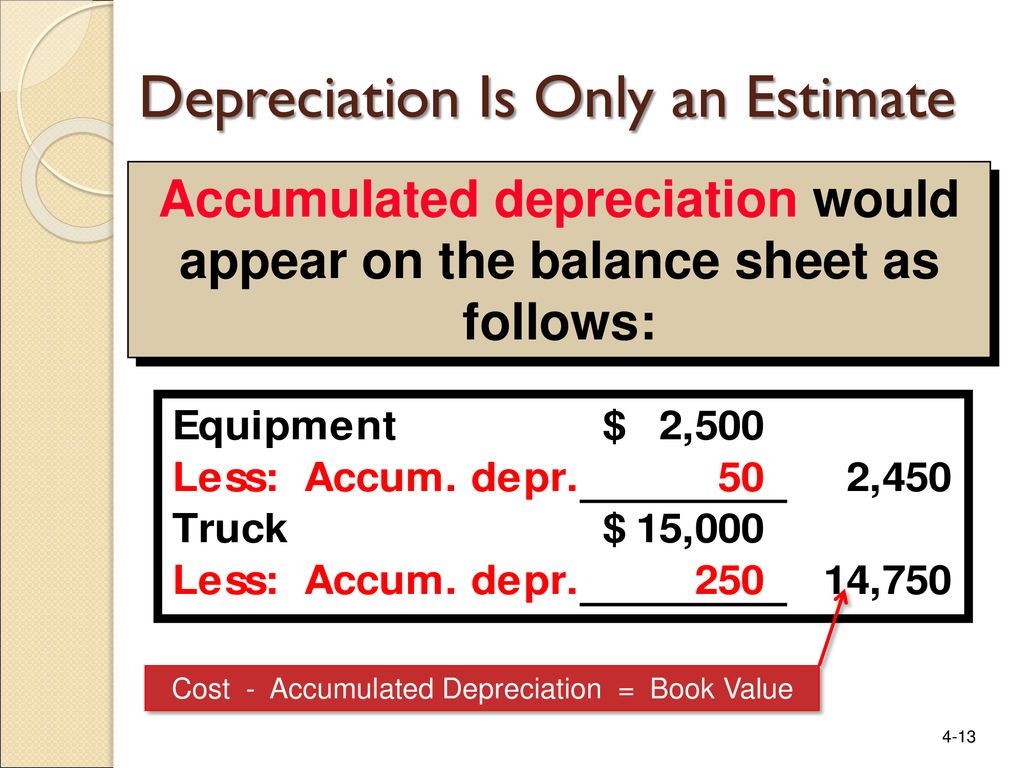

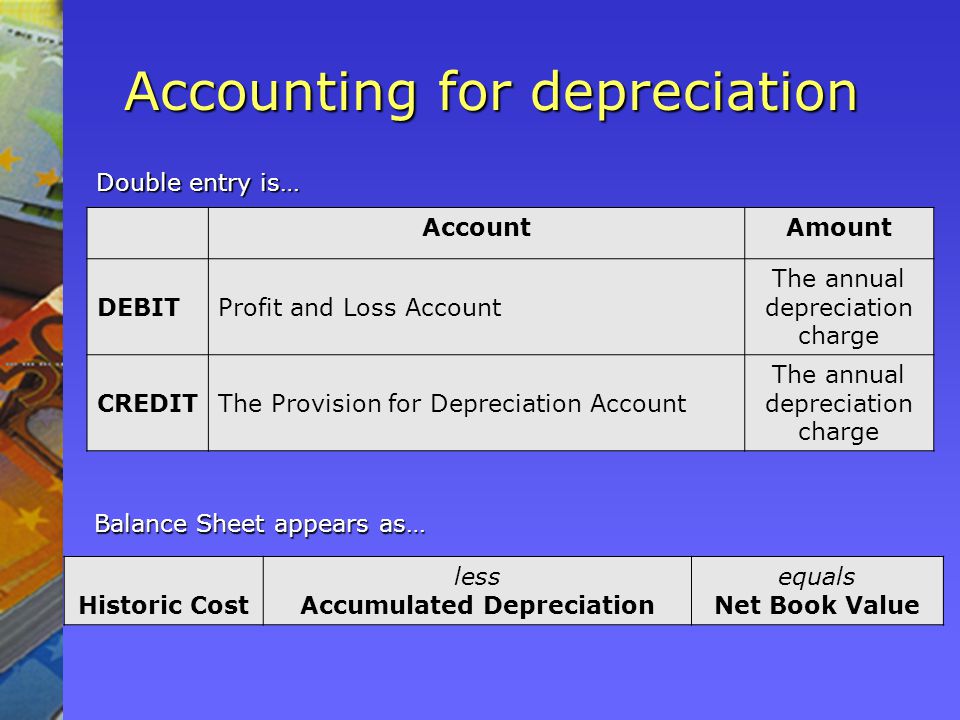

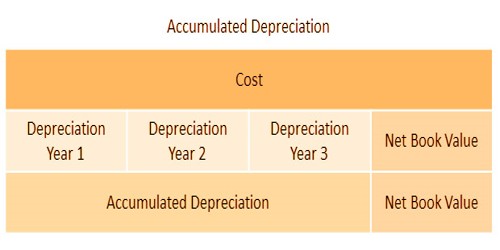

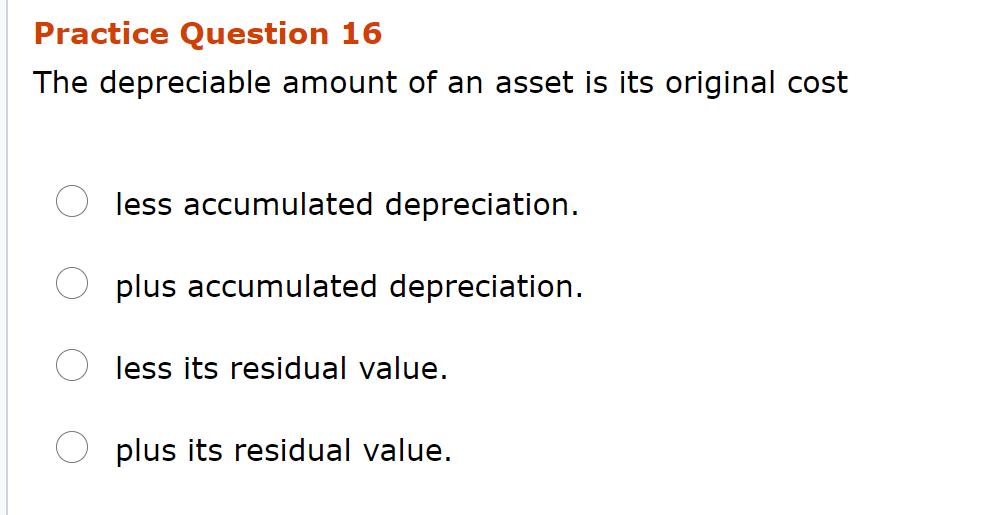

The net book value (NBV), calculated as the original cost of an asset minus its accumulated depreciation, represents the asset's carrying value on a company's balance sheet. It's a critical metric for stakeholders, providing insight into the asset's remaining economic potential. This single number reflects the remaining value of the asset that the company can utilize and benefit from.

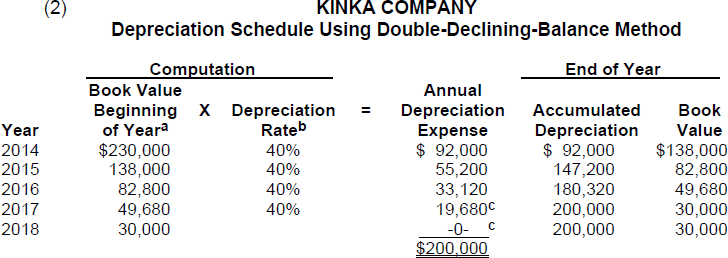

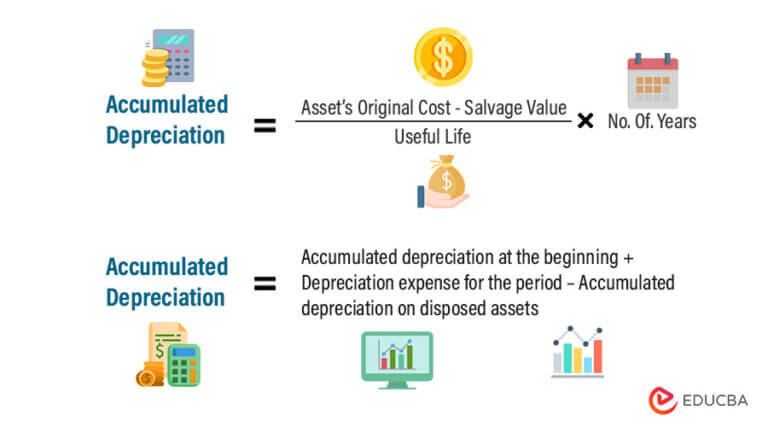

Accumulated depreciation, in turn, is the total amount of depreciation expense recognized for an asset since it was put into service. It's a cumulative figure, growing over time as the asset's value is systematically reduced to reflect its usage and obsolescence. Different depreciation methods are utilized to reflect this gradual decrease in asset value.

Depreciation Methods and Their Impact

The choice of depreciation method significantly impacts the NBV. Straight-line depreciation allocates an equal amount of depreciation expense each year over the asset's useful life. This is the simplest and most common method, resulting in a steady decline in book value.

Accelerated depreciation methods, like double-declining balance, recognize more depreciation expense in the early years of an asset's life. This leads to a faster reduction in NBV initially, reflecting the idea that assets often contribute more to revenue generation when they are newer. This method reflects the reality of decreased efficiency as time goes on.

Units of production depreciation allocates depreciation expense based on the asset's actual usage. If a machine produces fewer units in a particular year, the depreciation expense will be lower, resulting in a slower decline in NBV compared to time-based methods.

Significance of Accurate NBV Calculation

An accurate NBV calculation is paramount for sound financial reporting. It directly affects a company's reported assets, equity, and ultimately, its profitability. Overstating or understating the NBV can mislead investors and creditors, potentially leading to poor investment decisions.

Tax implications are also heavily influenced by the NBV. Depreciation expense is a tax-deductible expense, reducing a company's taxable income. An incorrect NBV, therefore, can lead to inaccurate tax payments and potential penalties. Properly reporting NBV allows for optimized tax benefits.

Moreover, NBV plays a crucial role in asset disposal decisions. When a company sells or disposes of an asset, the difference between the sale price and the NBV determines the gain or loss on disposal. This gain or loss impacts the company's income statement.

Challenges in Determining NBV

Estimating an asset's useful life and salvage value is often a subjective process. These estimations are critical components of depreciation calculations, and inaccuracies can significantly impact the NBV. Technological advancements and market conditions can shorten the useful life of an asset, rendering initial estimates obsolete.

Impairment charges can also complicate NBV calculations. If an asset's fair value falls below its NBV, an impairment loss must be recognized. This immediately reduces the asset's book value to its fair value. Proper recognition and timing are essential for accurate financial representation.

Keeping track of asset additions, disposals, and improvements requires meticulous record-keeping. Poorly maintained records can lead to errors in calculating accumulated depreciation and, consequently, the NBV. Maintaining accurate records are essential for consistent calculation.

Perspectives on NBV: A Balanced View

While NBV is a useful metric, it's crucial to recognize its limitations. It's a historical cost-based measure and may not reflect the current market value of an asset. Market fluctuations can render the NBV a poor reflection of true economic worth.

Some argue that focusing solely on NBV can discourage companies from investing in new assets. The immediate impact of depreciation expense on profitability might deter investments, even if those investments are strategically beneficial. This could hinder long-term growth and innovation.

However, others maintain that NBV provides a conservative and objective measure of asset value. It prevents companies from artificially inflating their asset values based on speculative market conditions. Objectivity is the driving force behind NBV use in many companies.

The Future of Asset Valuation

The increasing prevalence of fair value accounting is challenging the traditional role of NBV. Fair value accounting requires companies to value certain assets at their current market value, rather than historical cost. This offers a more current snapshot of an asset's value.

Technological advancements, such as artificial intelligence and machine learning, are being used to improve asset lifecycle management. These technologies can provide more accurate predictions of asset useful lives and maintenance needs. This enables more accurate deprecation forecasting.

Ultimately, understanding "The Asset Cost Less Accumulated Depreciation Is The" remains essential for any company seeking to manage its assets effectively and report its financial performance accurately. It provides a solid foundation for sound decision-making, even as asset valuation practices continue to evolve. As the business landscape continues to change, NBV will remain a critical concept.