The Basic Accounting Equation May Be Expressed As

In the high-stakes arena of finance, a single equation underpins the entire system. While complex algorithms and sophisticated software dominate modern financial analysis, the foundational principle remains remarkably simple. The basic accounting equation, a cornerstone of financial reporting, is facing renewed scrutiny amidst evolving economic landscapes.

This seemingly straightforward formula, dictating the balance between a company's assets, liabilities, and equity, is increasingly challenged by the rise of intangible assets, complex financial instruments, and globalization. Understanding the nuances of this equation is more crucial than ever for investors, businesses, and regulators navigating today's intricate financial world. We delve into the enduring relevance, evolving challenges, and future implications of the basic accounting equation.

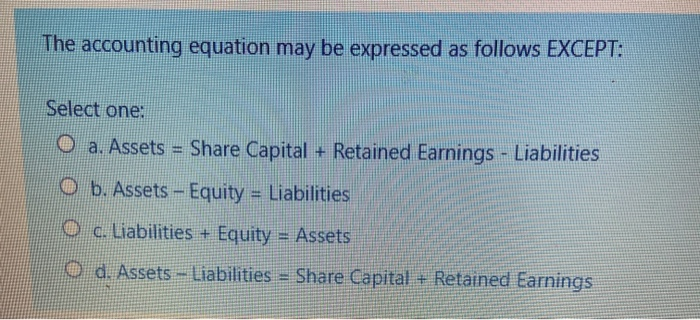

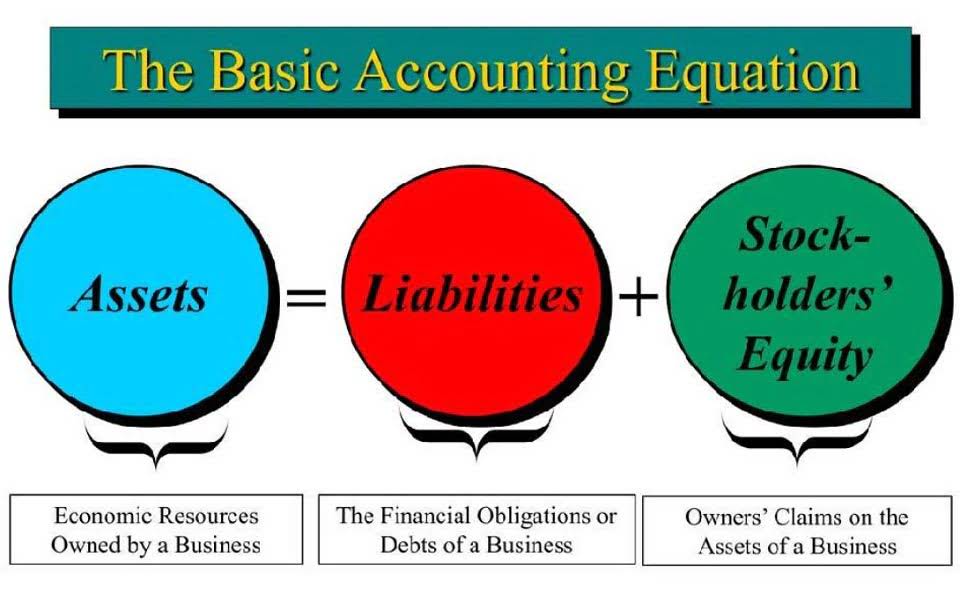

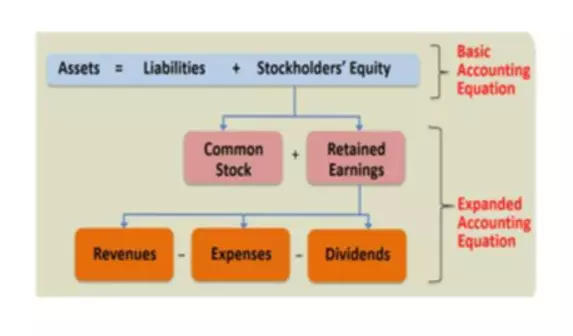

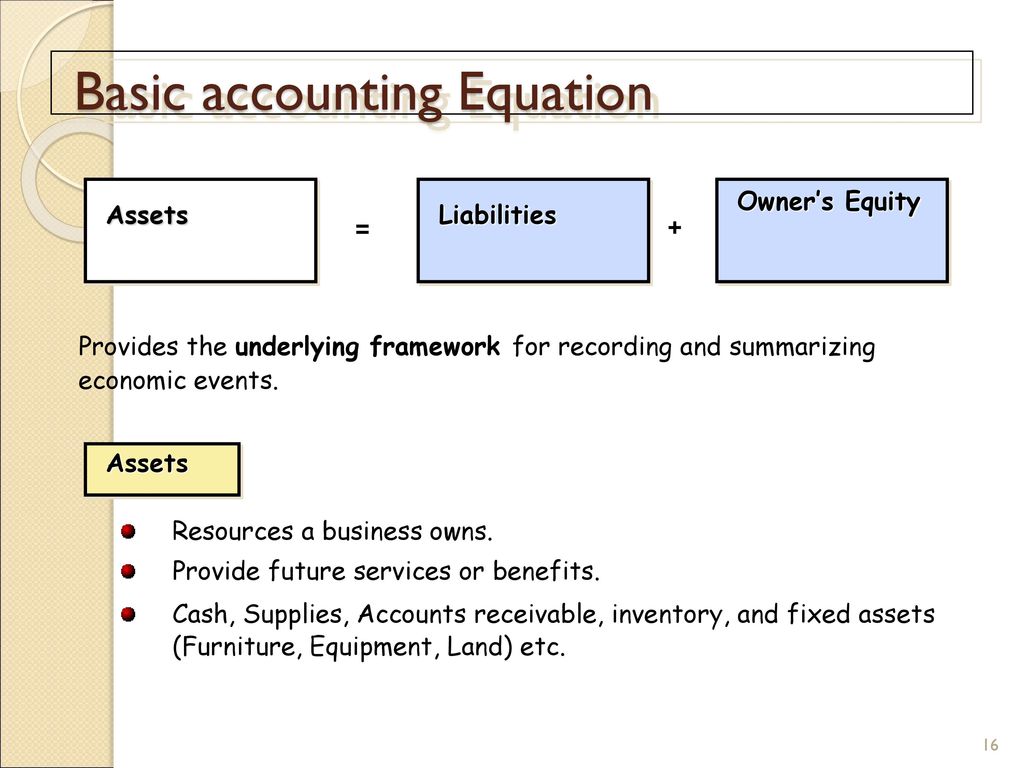

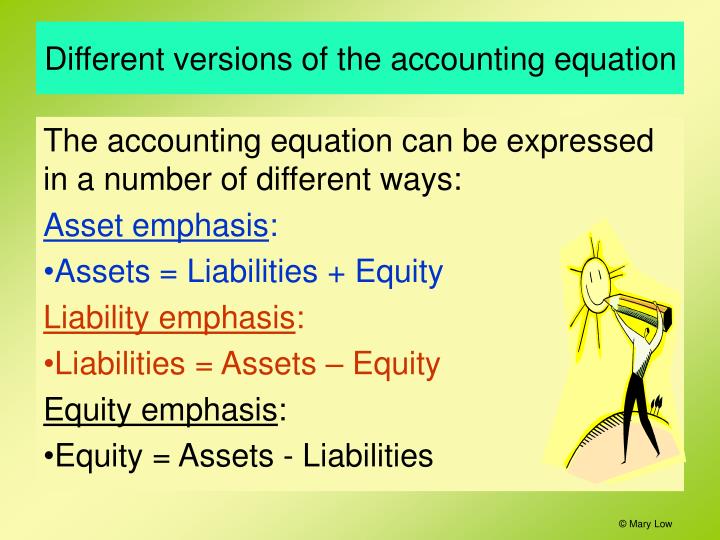

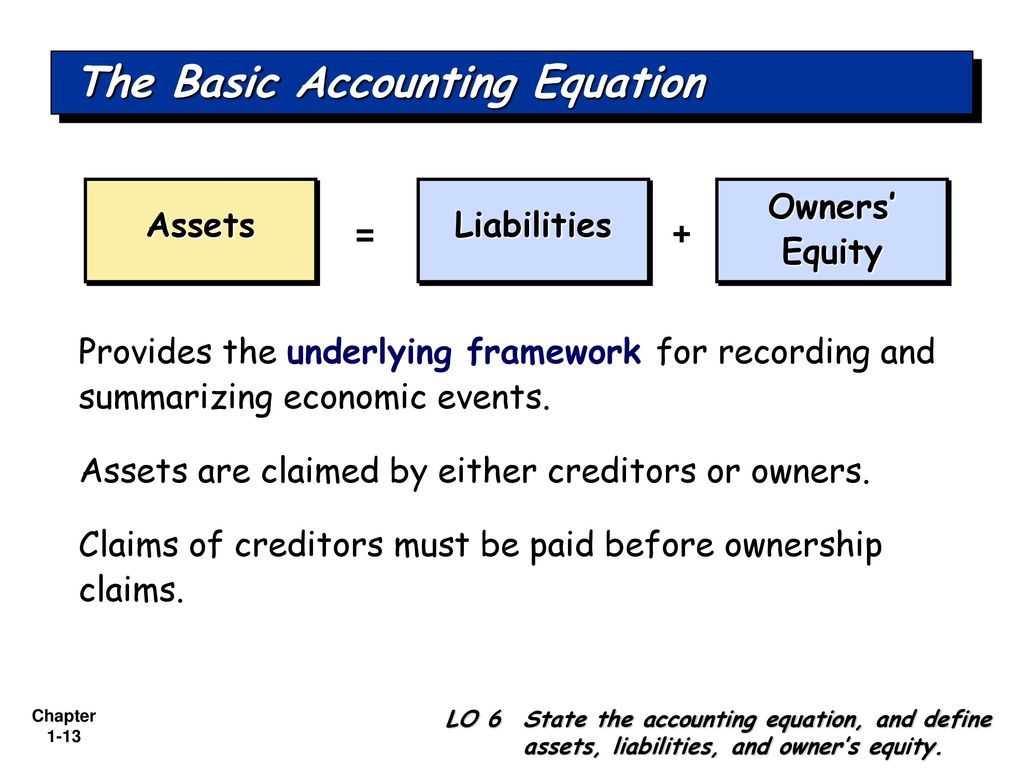

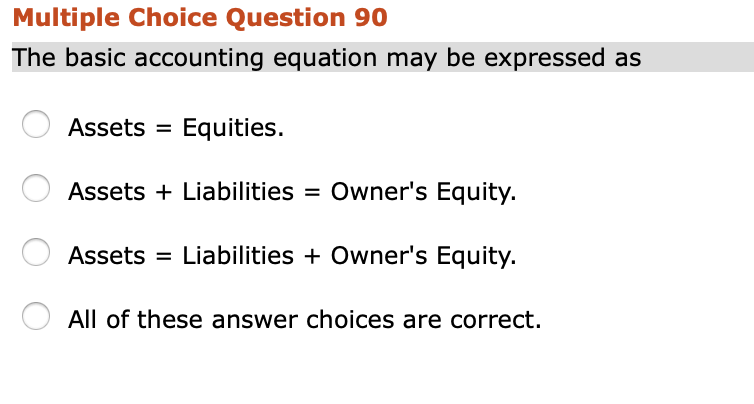

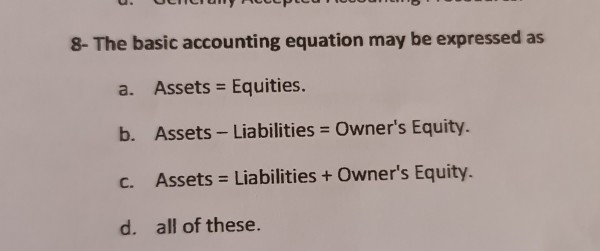

The Fundamental Equation: Assets = Liabilities + Equity

The basic accounting equation, often expressed as Assets = Liabilities + Equity, forms the bedrock of the double-entry bookkeeping system. It dictates that a company's assets, or what it owns, must always equal the sum of its liabilities, what it owes to others, and its equity, the owners' stake in the company.

This equation reflects the fundamental principle that every transaction affects at least two accounts, ensuring the accounting equation remains balanced. Assets represent the resources a company controls, such as cash, accounts receivable, inventory, and equipment.

Liabilities, on the other hand, represent obligations to external parties, including accounts payable, loans, and deferred revenue. Equity is the residual interest in the assets of the entity after deducting all its liabilities; it represents the owners' claim on the business.

The Significance of Balance

The accounting equation's unwavering balance serves as a critical check on the accuracy of financial records. Any imbalance signals an error in recording transactions, prompting further investigation and correction. This inherent control mechanism makes the equation invaluable for maintaining the integrity of financial reporting.

Investors rely on the balanced equation to assess a company's financial health and stability. Understanding the relationship between assets, liabilities, and equity allows investors to gauge a company's leverage, solvency, and overall risk profile.

Lenders, too, utilize the equation to evaluate a company's ability to repay its debts. A high debt-to-equity ratio, for instance, could indicate a higher risk of default. Regulators like the Securities and Exchange Commission (SEC) use the equation as a basis for auditing and ensuring compliance with accounting standards.

Challenges in a Modern Context

While the basic accounting equation remains fundamentally sound, its application in today's complex financial environment faces several challenges. One significant challenge arises from the increasing importance of intangible assets.

These include brand reputation, intellectual property, and customer relationships, which are often difficult to accurately value and record on the balance sheet. Critics argue that the equation, primarily focused on tangible assets, may not fully capture the true value of companies with substantial intangible assets.

Another challenge stems from the proliferation of complex financial instruments, such as derivatives and securitized assets. These instruments can be difficult to classify and measure, leading to potential inconsistencies in the application of the accounting equation. As stated by Dr. Anya Sharma, Professor of Accounting at the University of Chicago Booth School of Business, "The increasing complexity of financial instruments requires a more nuanced interpretation of the accounting equation."

Globalization further complicates the equation due to variations in accounting standards across different countries. International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), while converging, still exhibit differences that can affect the reported values of assets, liabilities, and equity.

Alternative Perspectives and Interpretations

Some argue for a more dynamic interpretation of the accounting equation, emphasizing its role in analyzing financial performance over time. Rather than focusing solely on the balance sheet at a single point in time, they advocate using the equation to track changes in assets, liabilities, and equity across multiple reporting periods.

This approach allows for a more comprehensive understanding of a company's financial trajectory and its ability to generate value. Other proposals suggest incorporating non-financial metrics into the accounting equation to provide a more holistic view of a company's performance. These metrics might include customer satisfaction, employee engagement, and environmental impact.

However, integrating non-financial data presents significant challenges in terms of standardization and verifiability. "While incorporating non-financial metrics is an interesting idea," notes Robert Johnson, a Certified Public Accountant (CPA), "it is crucial to maintain the objectivity and reliability of financial reporting."

The Future of the Accounting Equation

Despite the challenges, the basic accounting equation is unlikely to be replaced as the foundation of financial reporting. Its simplicity and inherent logic remain powerful tools for understanding and analyzing financial information. However, adapting the equation to better reflect the complexities of the modern business environment is crucial.

This might involve developing more sophisticated methods for valuing intangible assets, standardizing the accounting treatment of complex financial instruments, and enhancing international harmonization of accounting standards. Furthermore, the integration of technology, such as artificial intelligence and blockchain, could play a role in improving the accuracy and efficiency of financial reporting, thereby strengthening the relevance of the accounting equation.

Moving forward, accountants, auditors, and regulators must collaborate to ensure that the basic accounting equation continues to serve as a reliable and relevant tool for promoting transparency and accountability in the global financial system. Its enduring power lies in its simplicity, but its continued relevance depends on its adaptability.