The Cash Flow On Total Assets Ratio Is Calculated By

Imagine a small bakery, its ovens humming with the promise of warm bread and sweet pastries. The aroma drifts out onto the street, drawing in customers. But behind the inviting facade, the owner worries: are the assets, the ovens, the mixers, the shop itself, truly pulling their weight? Are they generating enough cash to keep the business thriving?

The cash flow on total assets ratio (CFROA) provides crucial insight into this very question. It reveals how efficiently a company uses its assets to generate cash flow, painting a picture of financial health and operational effectiveness.

Understanding the Cash Flow on Total Assets Ratio

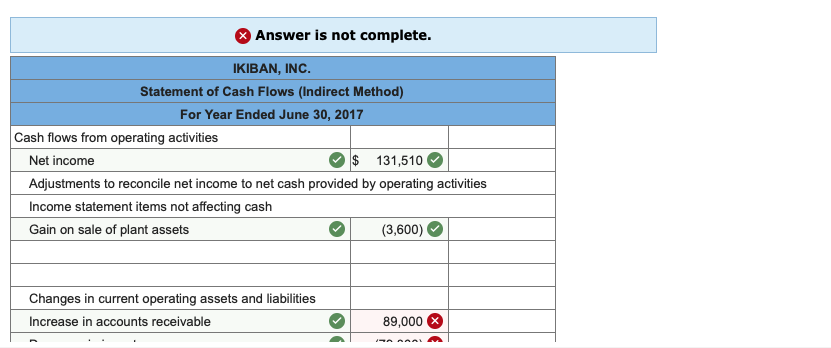

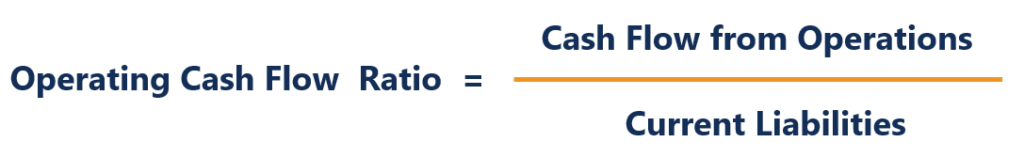

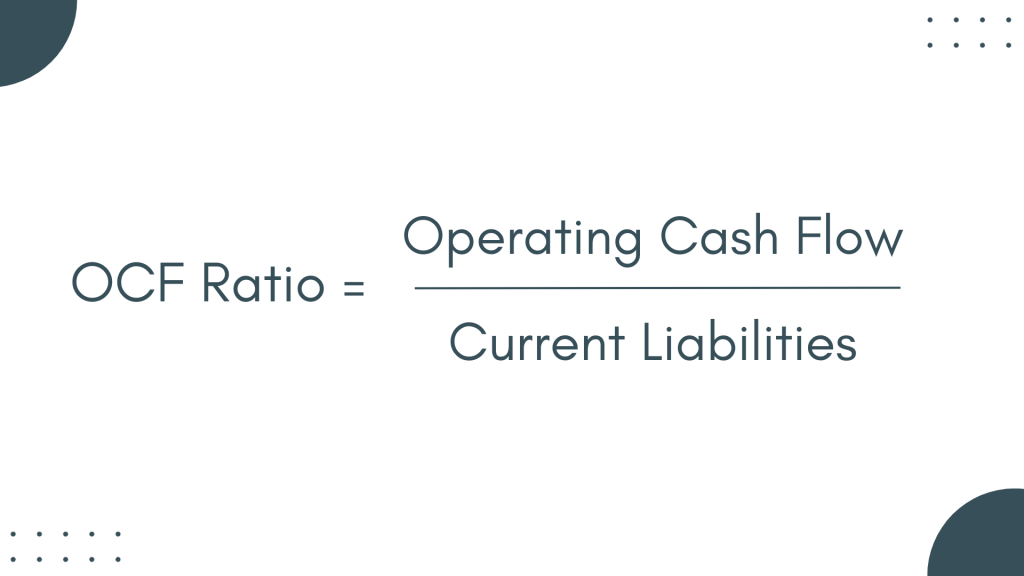

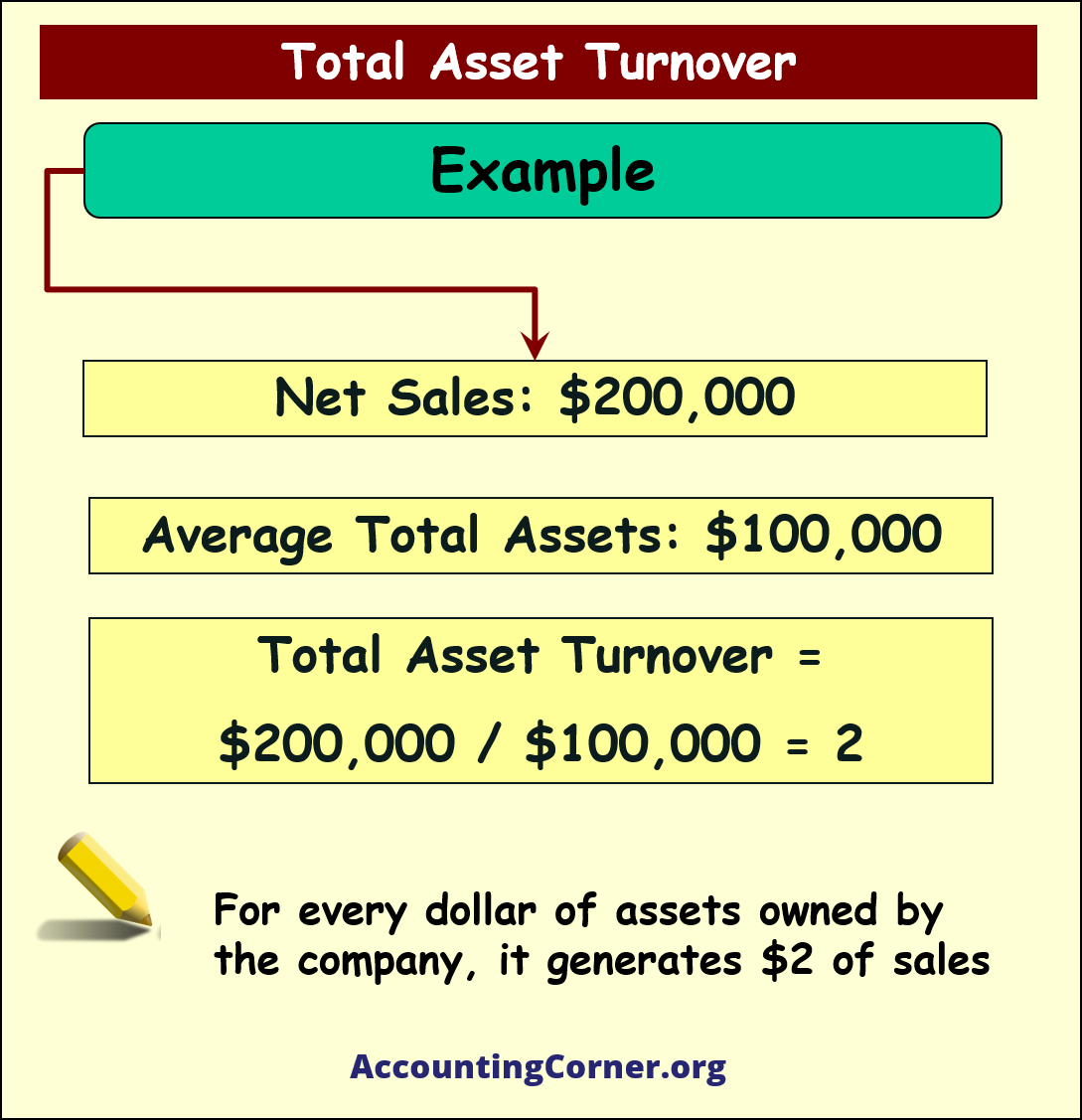

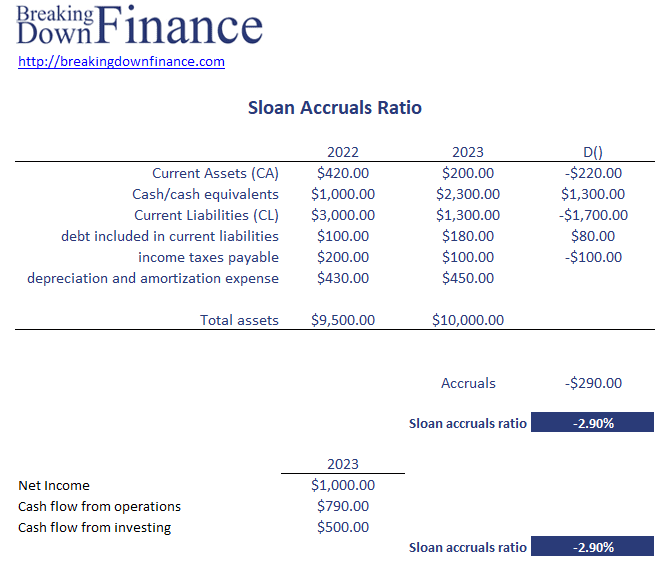

The CFROA is calculated by dividing a company's operating cash flow by its total assets. The resulting percentage indicates the amount of cash generated for every dollar of assets a company possesses.

This metric offers a clearer view than solely relying on profitability metrics like net income. Net income can be influenced by accounting practices that do not directly reflect cash generation.

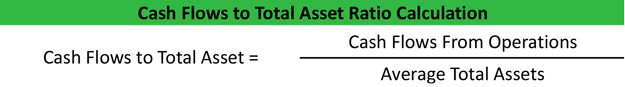

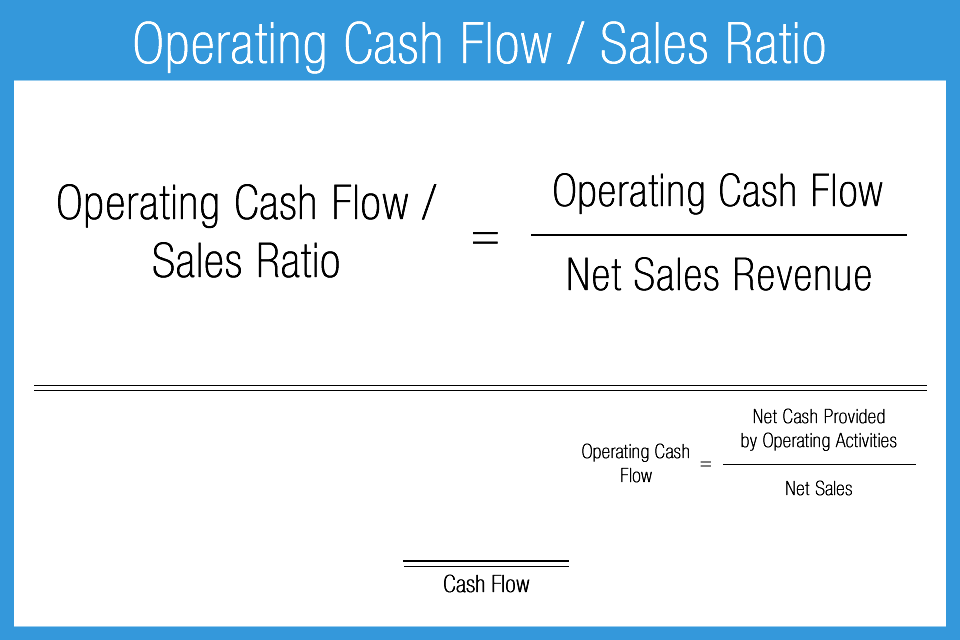

The Formula

The formula is straightforward: Cash Flow on Total Assets = Operating Cash Flow / Total Assets.

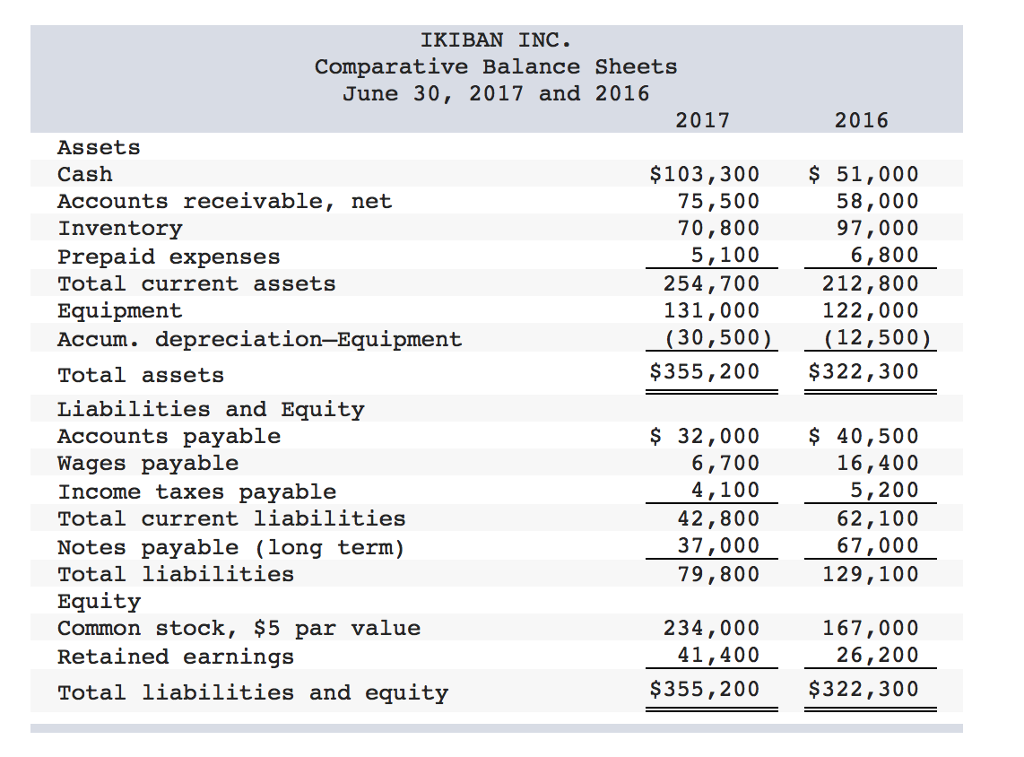

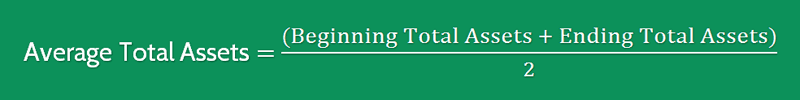

Operating cash flow can be found on the statement of cash flows. Total assets are found on the balance sheet, usually the average of the beginning and ending balance for the period to provide a more representative view.

Why This Ratio Matters

A healthy CFROA suggests a company is adept at turning its investments into liquid cash. This cash can then be used for reinvestment, debt repayment, or rewarding shareholders.

Conversely, a low or declining CFROA could signal inefficiencies in asset management. It could also indicate that the company is struggling to convert sales into actual cash.

The History and Evolution of CFROA

The concept of analyzing cash flow gained prominence in the late 20th century as a more robust measure of financial performance. It addresses the limitations of traditional accounting measures like net income.

Accountants and financial analysts developed various cash flow ratios, including CFROA, to assess the quality of earnings and the effectiveness of asset utilization. These ratios provide stakeholders with a more transparent and reliable picture of a company's financial health.

The rise of sophisticated financial modeling and data analytics has further enhanced the utility of CFROA. It now allows for more accurate comparisons across industries and time periods.

Interpreting the Results: Benchmarking and Context

A higher CFROA is generally preferable, indicating better asset utilization for cash generation. However, interpreting the ratio requires careful benchmarking against industry peers.

Different industries have varying levels of asset intensity. A capital-intensive industry like manufacturing may have a lower CFROA compared to a service-based industry like consulting.

Consider a software company versus a construction company. The software company might have a higher CFROA because it requires fewer physical assets to generate revenue. The construction company needs heavy equipment and real estate, impacting its CFROA.

Factors Influencing CFROA

Several factors can influence a company's CFROA. These include changes in sales volume, efficiency of operations, management of working capital, and investment decisions.

Improved operational efficiency, such as reducing inventory holding costs or speeding up accounts receivable collection, can boost the ratio. Strategic investment in more productive assets can also contribute to a healthier CFROA.

Conversely, poor sales performance or delays in collecting payments can negatively impact cash flow and, consequently, the CFROA.

Real-World Examples

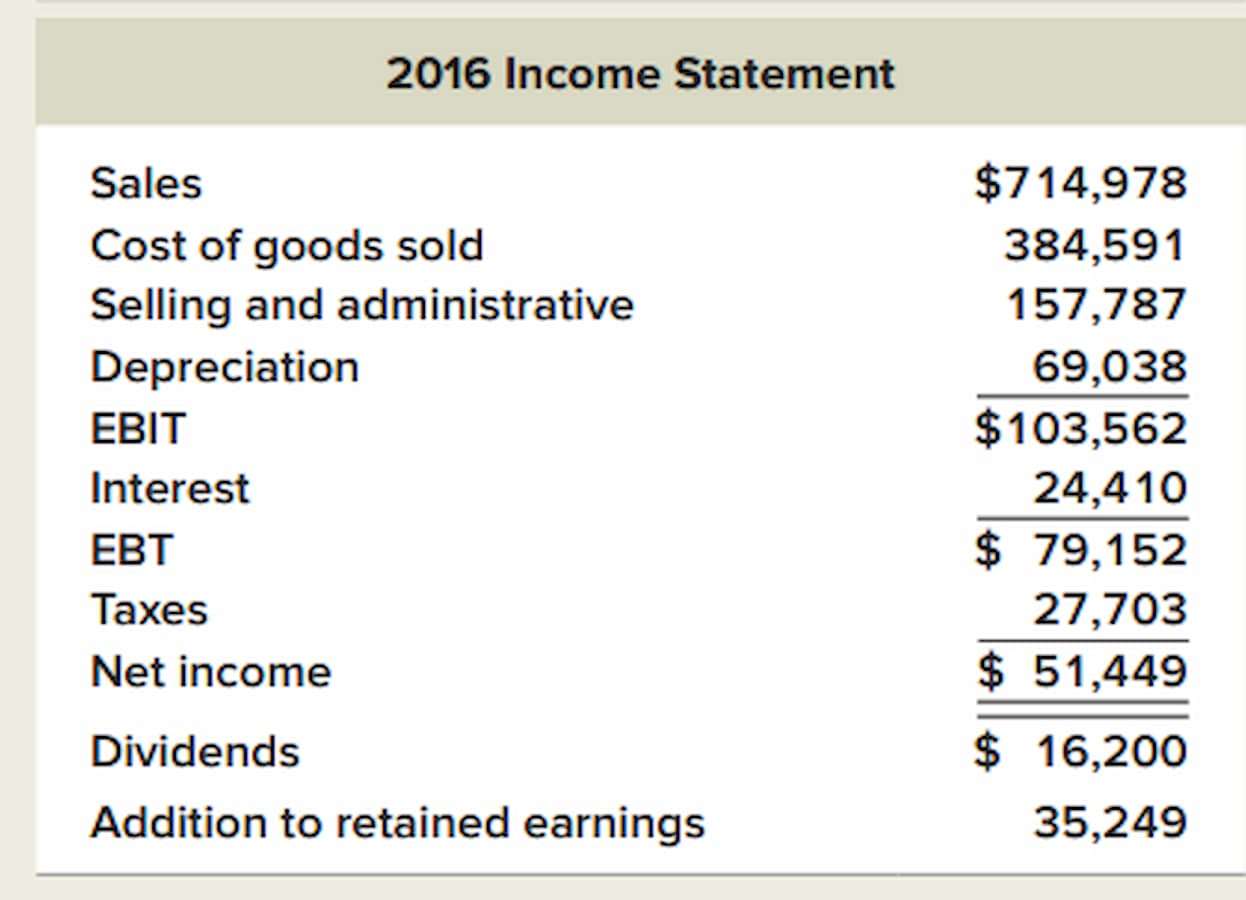

Let's examine two fictional companies: "TechSolutions" and "BuildCorp." TechSolutions, a software company, reports operating cash flow of $5 million and total assets of $10 million. This gives them a CFROA of 50%.

BuildCorp, a construction firm, reports operating cash flow of $2 million and total assets of $20 million, resulting in a CFROA of 10%. Although TechSolutions' CFROA is significantly higher, it's important to consider that BuildCorp operates in a capital-intensive industry.

Comparing them directly without considering industry context would be misleading. The key is to benchmark BuildCorp against its competitors in the construction sector.

Limitations and Considerations

While CFROA offers valuable insights, it's essential to be aware of its limitations. The ratio is a snapshot of a company's financial performance during a specific period.

It may not reflect long-term trends or future performance. Unusual events, such as one-time asset sales or acquisitions, can distort the ratio.

Furthermore, different accounting methods for calculating depreciation or valuing assets can impact the comparability of CFROA across companies. Analysts should carefully examine the underlying financial statements and footnotes.

The Future of CFROA: Technology and Analytics

The future of CFROA analysis lies in the integration of advanced technologies and data analytics. Artificial intelligence and machine learning can identify patterns and anomalies in cash flow data.

This allows for more sophisticated forecasting and risk assessment. Real-time data streams and dashboards can provide stakeholders with up-to-the-minute insights into a company's cash-generating ability.

This creates opportunities for proactive decision-making and improved asset management. Ultimately, technology can unlock the full potential of CFROA as a powerful tool for financial analysis.

Conclusion

The cash flow on total assets ratio is a critical metric for assessing a company's financial health and operational efficiency. It shows how effectively a company uses its assets to generate cash.

While it is vital to understand its context and limitations, the CFROA provides crucial insight for investors, creditors, and management alike.

As we move forward in an ever-evolving financial landscape, a deep understanding of this ratio will remain invaluable for making sound financial decisions and securing sustainable business growth. Just like that baker meticulously managing their ovens and mixers, a strong grasp of CFROA allows us to nurture a healthy, thriving financial ecosystem.

:max_bytes(150000):strip_icc()/cash-asset-ratio_final-9c2d7a05c4e848628966d24740debd73.png)