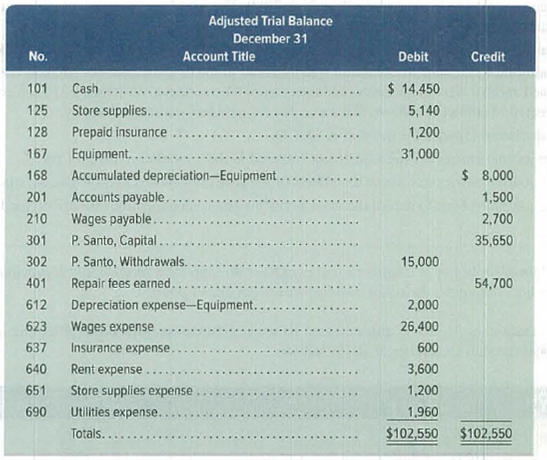

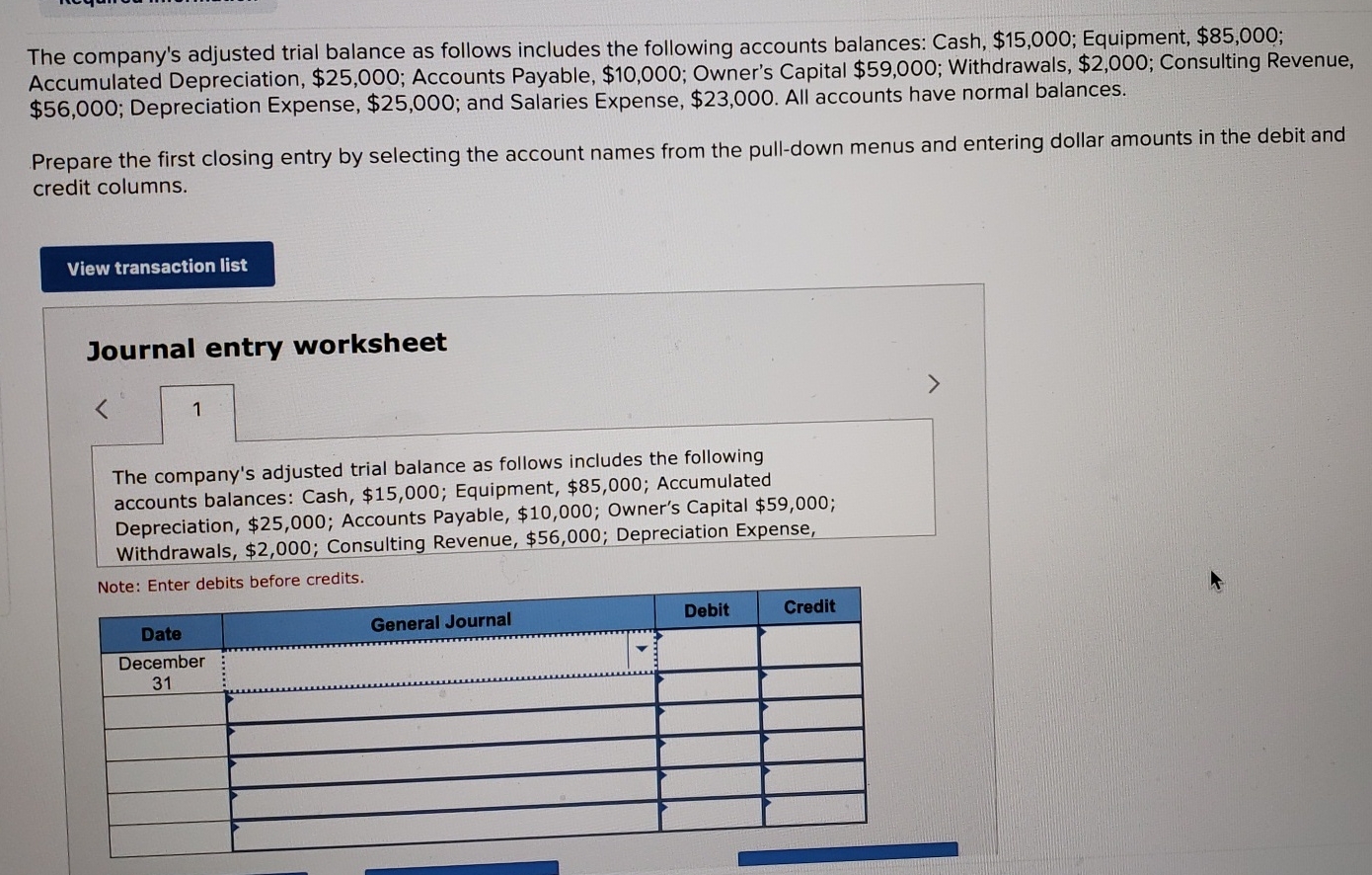

The Company's Adjusted Trial Balance As Follows

Accounting firm Miller & Zois publicly released its adjusted trial balance today, offering a snapshot of the company's financial standing after all necessary adjustments have been made. The release is anticipated to provide stakeholders, including investors and employees, with a clearer understanding of the firm's financial health before the formal preparation of financial statements.

The adjusted trial balance, a key document in the accounting cycle, summarizes all ledger balances after adjustments for accruals, deferrals, and corrections. This release has significance, because it is a crucial step in ensuring the accuracy and reliability of the final financial reports.

Key Findings from the Adjusted Trial Balance

The firm's report revealed a net debit balance of $5,780,000 and a net credit balance of $5,780,000.

These numbers demonstrate that total debits and total credits are equal, as they should be in a properly balanced trial balance. Cash balance totaled $500,000. Accounts Receivable amounted to $750,000.

The balance for Supplies, after adjustments for usage, stands at $50,000. Prepaid Insurance showed a balance of $25,000. The adjusted balance for Equipment totaled $1,500,000 with Accumulated Depreciation of $300,000, resulting in a net book value of $1,200,000.

On the credit side, Accounts Payable amounted to $400,000. Salaries Payable are listed at $75,000. The balance for Unearned Revenue is $25,000.

Common Stock showed a balance of $2,000,000. Retained Earnings totaled $3,000,000. Service Revenue after adjustments stands at $1,500,000.

Expenses include Salaries Expense $800,000. Rent Expense is $150,000 and Depreciation Expense is $100,000. Supplies Expense is $75,000, and Insurance Expense is $25,000.

Impact and Implications

The adjusted trial balance serves as a critical foundation for preparing the income statement, balance sheet, and statement of cash flows. These financial statements offer insights into the company’s profitability, financial position, and cash flow management. Analysts and investors will scrutinize these figures to assess the company’s performance and make informed decisions.

The firm's relatively strong cash position and healthy retained earnings suggest financial stability. However, the level of accounts receivable will likely be examined to determine the effectiveness of the firm’s credit and collection policies. The company's performance in controlling operating expenses will also be examined.

Stakeholders are encouraged to review the complete financial statements once they are released. This will provide a more comprehensive view of the firm's financial health and operating performance. The adjusted trial balance, while informative, is only one piece of the puzzle.

Expert Commentary

Dr. Anna Lee, Professor of Accounting at State University, commented on the release: "The adjusted trial balance is a vital internal control mechanism. It ensures that debits equal credits before the preparation of the financial statements. This is important in preventing errors and maintaining the integrity of the financial reporting process."

Lee further added, "The level of detail provided in the adjusted trial balance allows stakeholders to perform a preliminary assessment of the company’s financial performance. It can also point to areas that warrant further investigation." She emphasized the importance of comparing the current adjusted trial balance with those of previous periods to identify trends and potential issues.

Looking Ahead

Miller & Zois is expected to release its complete financial statements within the coming weeks. The Securities and Exchange Commission (SEC) requires companies to file audited financial statements on a regular schedule. Investors are encouraged to consult the official filings with the SEC for the most accurate and up-to-date information.

The company has a responsibility to its stakeholders to maintain transparency and accountability in its financial reporting practices. The accurate and timely release of financial information contributes to building trust and confidence in the company's management and operations.

The release of the adjusted trial balance represents a significant step in that process. Moving forward, stakeholders will be keen to observe how the company’s performance evolves in the future.