The Cost Of Preferred Stock Is Equivalent To The:

Understanding the intricacies of corporate finance is crucial for investors and companies alike. One fundamental concept is the cost of preferred stock, which often parallels other financial metrics but carries its own specific nuances.

This article will delve into what the cost of preferred stock is equivalent to, highlighting its importance in financial decision-making and providing a clear understanding of its implications.

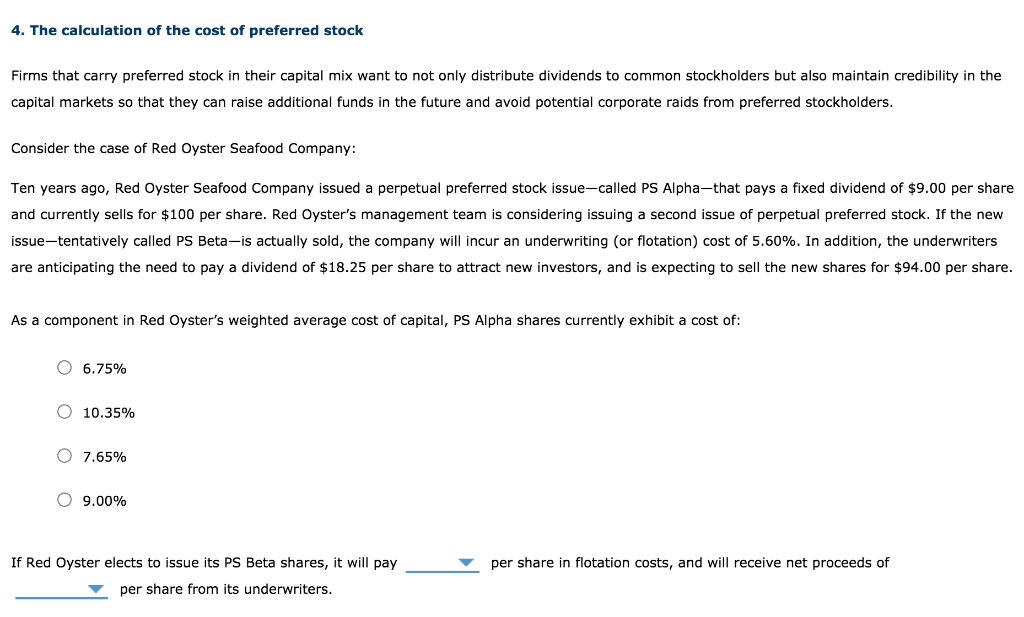

Defining Preferred Stock and Its Cost

Preferred stock represents a class of ownership in a corporation that has a higher claim on assets and earnings than common stock. Unlike common stock, it typically pays a fixed dividend, similar to a bond.

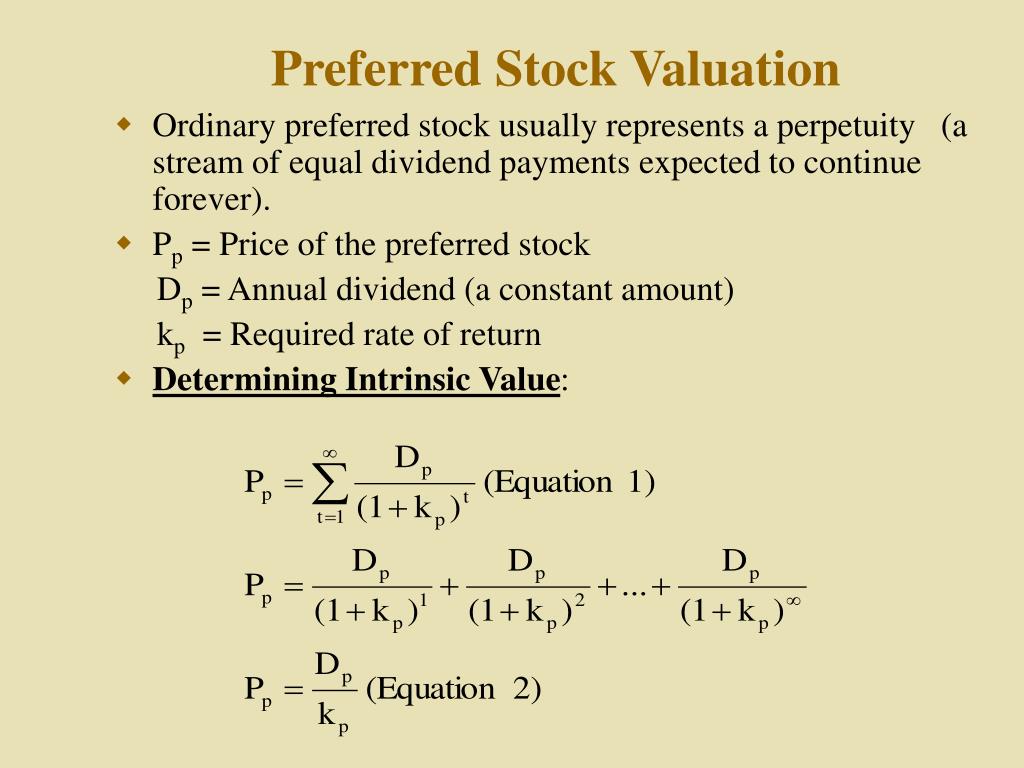

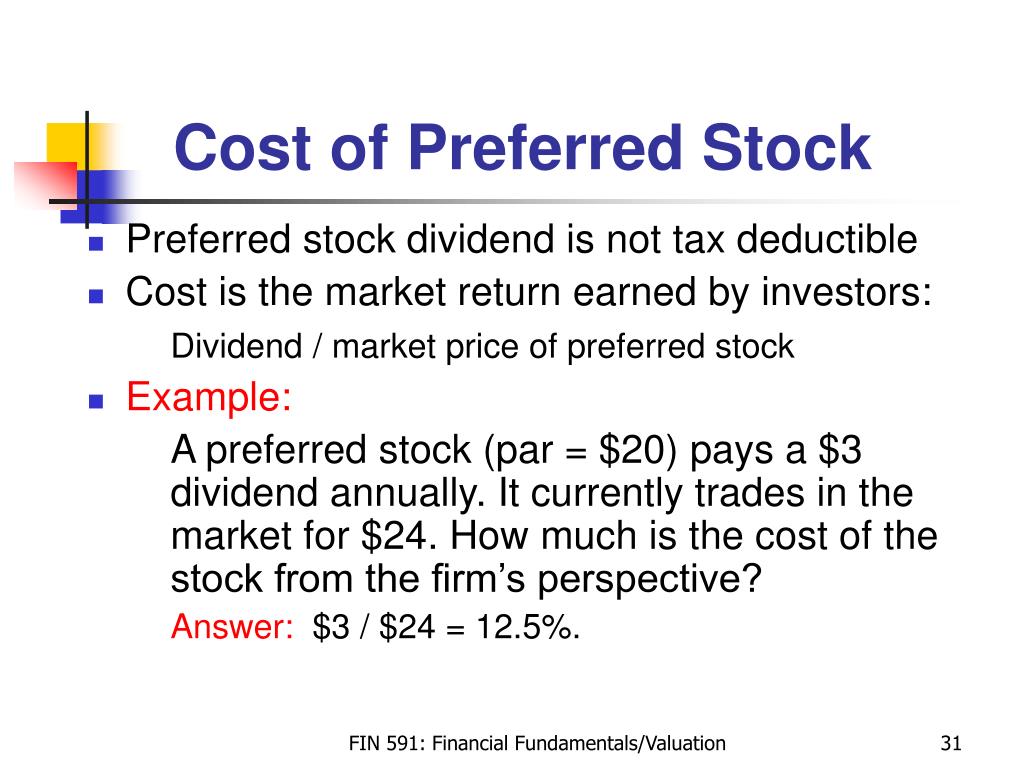

The cost of preferred stock is the rate of return a company must provide to its preferred stockholders to compensate them for taking on the risk of investing in the company's preferred stock.

The Cost of Preferred Stock vs. Other Financial Metrics

The cost of preferred stock is most directly equivalent to the yield to maturity (YTM) of a bond with similar risk characteristics. Both preferred stock and bonds offer fixed income streams to investors.

YTM represents the total return an investor can expect if they hold the bond until it matures, taking into account the bond's current market price, par value, coupon interest rate, and time to maturity.

Why the YTM Analogy? Just as bondholders expect a certain return for the risk they take, preferred stockholders expect a dividend yield that reflects the risk associated with the company issuing the stock.

This yield is calculated by dividing the annual dividend payment by the current market price of the preferred stock.

The cost of preferred stock is essentially the rate of return the company must offer to attract and retain preferred stockholders, mirroring the function of YTM in the bond market.

Cost of Capital and Weighted Average Cost of Capital (WACC)

Another important equivalence is its role within a company's overall cost of capital. The cost of capital represents the minimum rate of return a company must earn on its investments to satisfy its investors.

Preferred stock, along with common stock and debt, contributes to the company's Weighted Average Cost of Capital (WACC). The WACC is the average rate of return a company expects to compensate all its different investors.

The cost of preferred stock directly impacts the WACC. A higher cost of preferred stock increases the WACC, making it more expensive for the company to fund new projects and potentially impacting its profitability.

Implications for Investors and Companies

For investors, understanding the cost of preferred stock is vital for making informed investment decisions. It helps them assess whether the offered dividend yield adequately compensates them for the risk they are taking.

Companies must carefully consider the cost of preferred stock when determining their capital structure. Raising capital through preferred stock may be more attractive than issuing debt in certain situations.

For instance, preferred stock dividends are not tax-deductible, whereas interest payments on debt are. However, preferred stock does not have a mandatory repayment date, which can offer more financial flexibility.

Factors Influencing the Cost of Preferred Stock

Several factors can influence the cost of preferred stock, including the company's credit rating, prevailing interest rates, and the overall market conditions.

A company with a lower credit rating will likely need to offer a higher dividend yield to attract investors, thereby increasing the cost of preferred stock.

Changes in interest rates also affect the cost of preferred stock. When interest rates rise, companies generally need to offer higher dividend yields to compete with other fixed-income investments.

A Human Perspective

Consider the case of a small business owner contemplating issuing preferred stock to fund an expansion. This owner would meticulously analyze the potential dividend yield, comparing it to the prevailing interest rates and the company's risk profile.

They would also assess how this decision impacts their overall cost of capital, weighing the pros and cons against other financing options.

This illustrates how a solid understanding of the cost of preferred stock can empower informed decision-making, ultimately impacting the success and sustainability of a business.

Conclusion

In summary, the cost of preferred stock is functionally equivalent to the yield to maturity of a bond with similar risk. It directly influences a company's WACC and its ability to fund future projects effectively.

For investors, understanding the cost of preferred stock is crucial for assessing investment opportunities and making sound financial decisions. For companies, it's a vital component in determining their capital structure and ensuring financial stability.

:max_bytes(150000):strip_icc()/Preferred-Stock-Final-0b2696b31b744e33b21c40ac913daf0f.jpg)