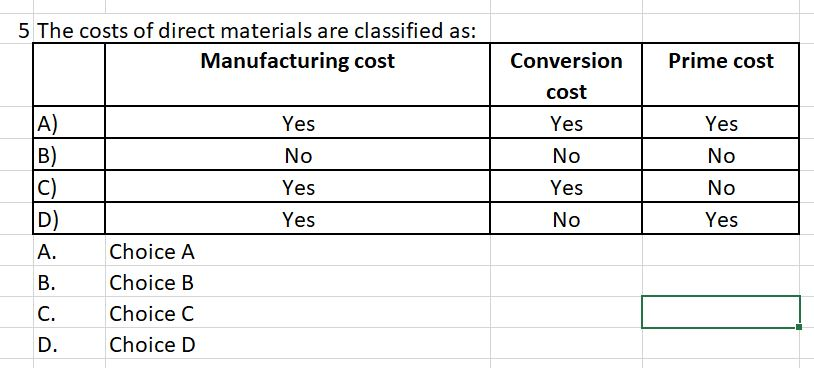

The Costs Of Direct Materials Are Classified As

The relentless pressure on businesses to optimize profitability has thrust the seemingly mundane topic of cost accounting into the spotlight. Misclassifying direct material costs can trigger a cascade of financial misinterpretations, impacting pricing strategies, inventory valuation, and ultimately, a company's bottom line. The ripple effects extend beyond internal bookkeeping, potentially misleading investors and distorting market analyses.

At its core, understanding how the costs of direct materials are classified is vital for accurate financial reporting and sound decision-making. This article delves into the intricacies of direct material cost classification, exploring its impact on financial statements, operational efficiency, and strategic planning. We will examine the generally accepted accounting principles (GAAP) that govern this classification, scrutinize the potential pitfalls of misclassification, and analyze the strategies businesses employ to ensure accurate and compliant cost allocation.

Direct Materials: The Building Blocks of Production

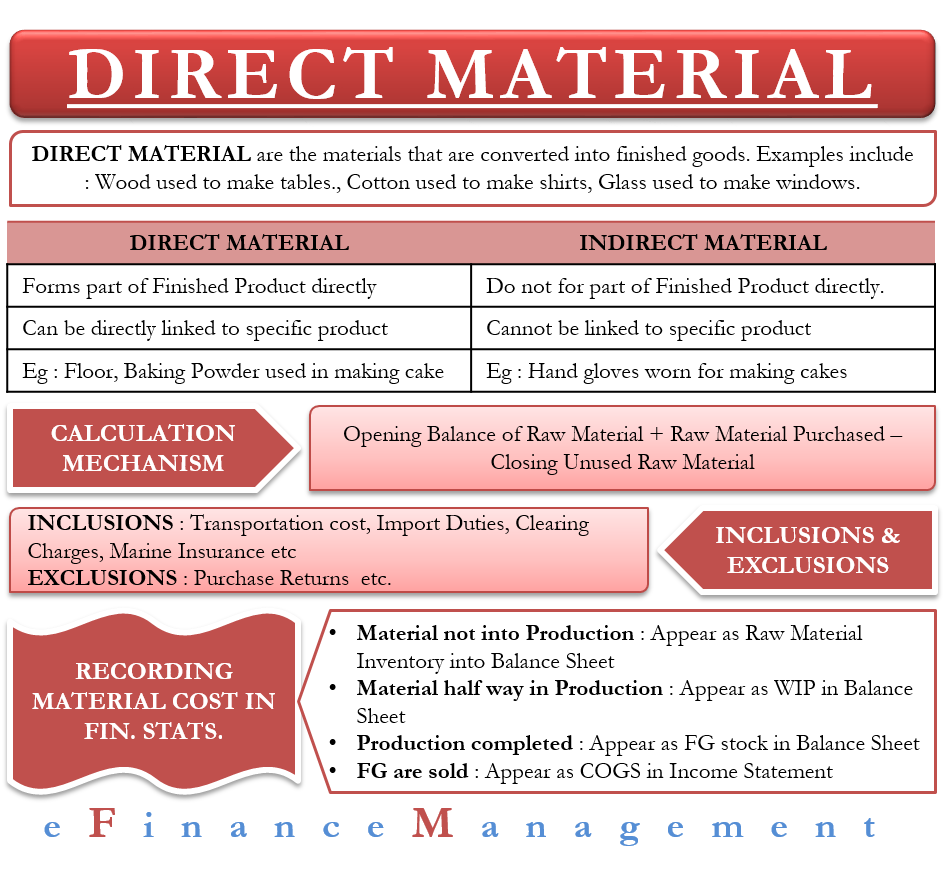

Direct materials are the raw materials, components, and parts that become an integral part of a finished product and can be directly traced to it. These are the tangible ingredients that transform into the goods a company sells.

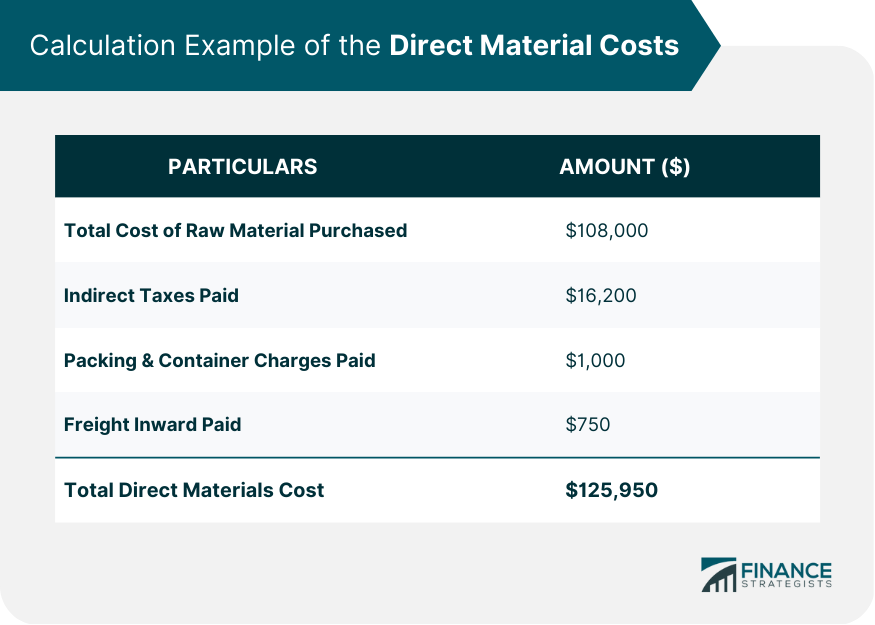

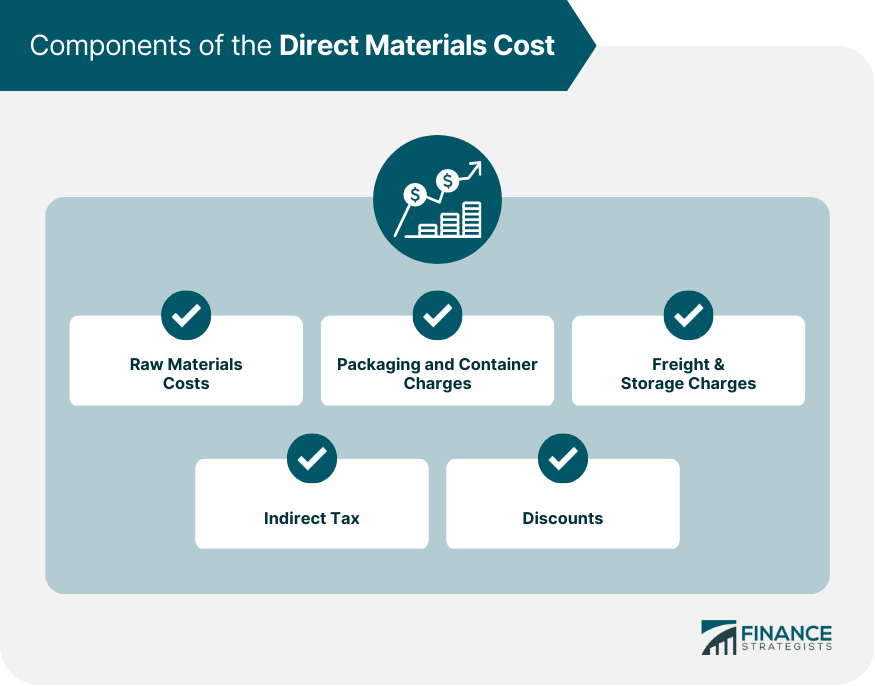

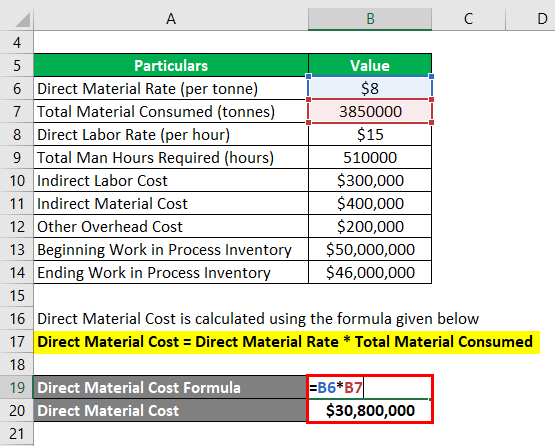

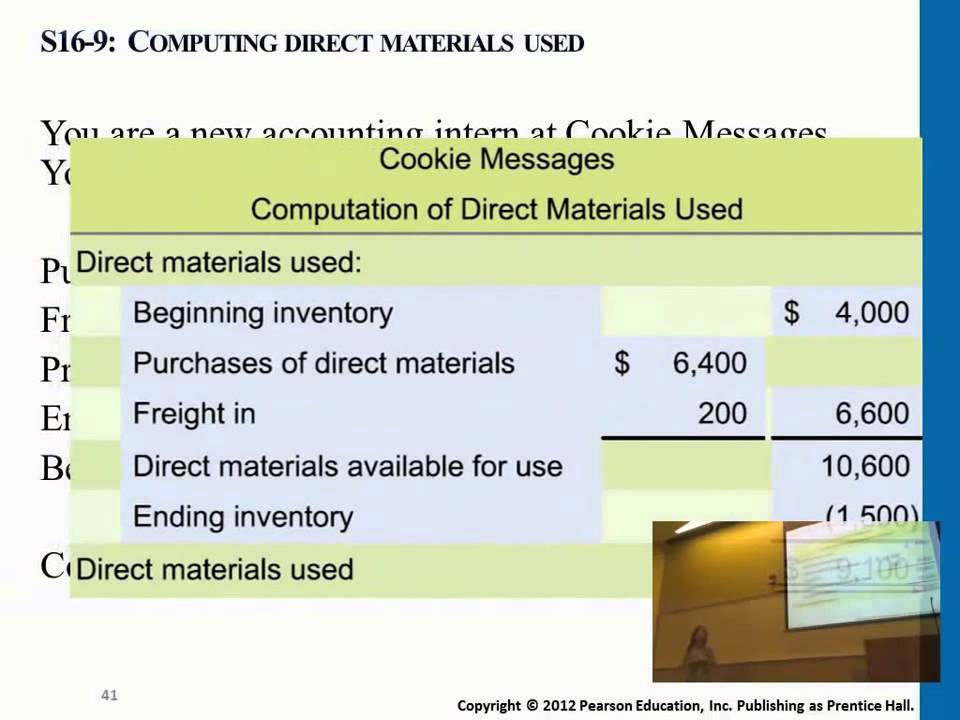

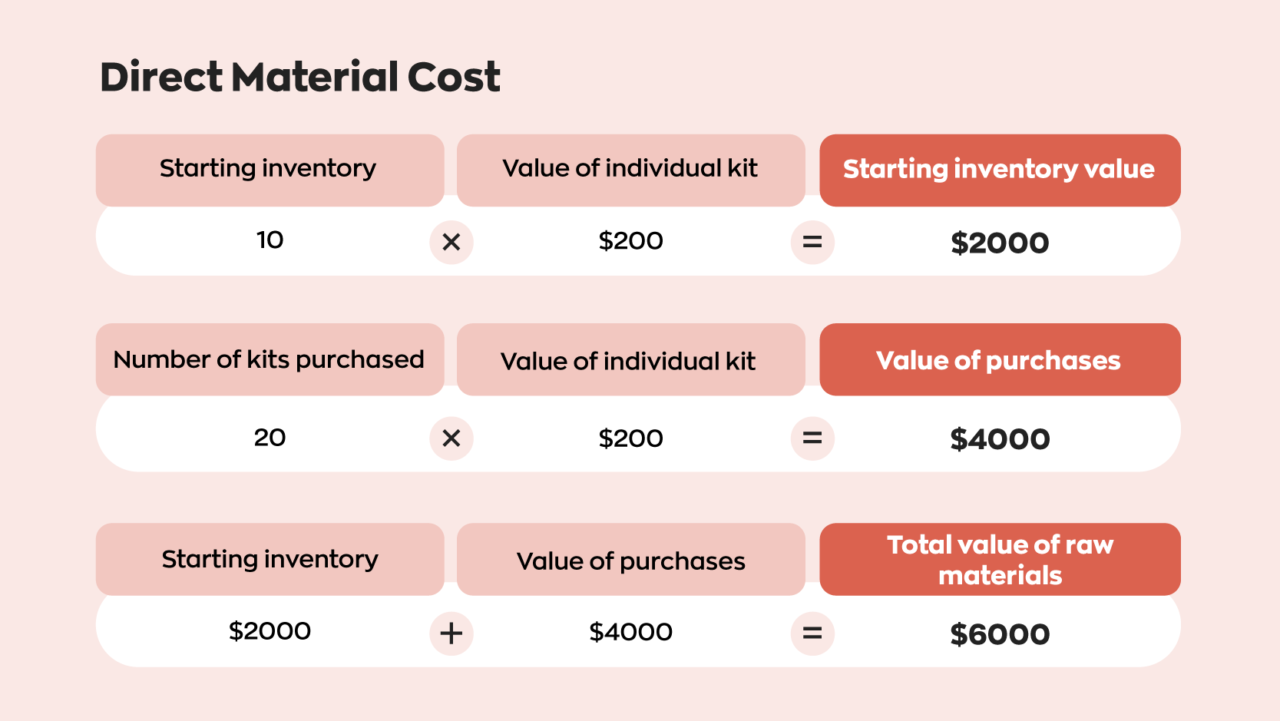

The cost of these materials includes the purchase price, freight charges, insurance during transit, and any other directly attributable costs necessary to get the materials ready for use in production. This contrasts sharply with indirect materials, which are necessary for production but not directly incorporated into the final product.

Accounting for Direct Material Costs

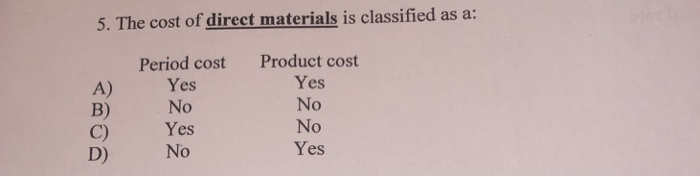

GAAP dictates that direct material costs are treated as a product cost. This means these costs are initially capitalized as inventory on the balance sheet.

Only when the goods are sold does the cost of direct materials become an expense, specifically Cost of Goods Sold (COGS) on the income statement. This matching principle aligns the expense with the revenue it generates, providing a more accurate reflection of profitability.

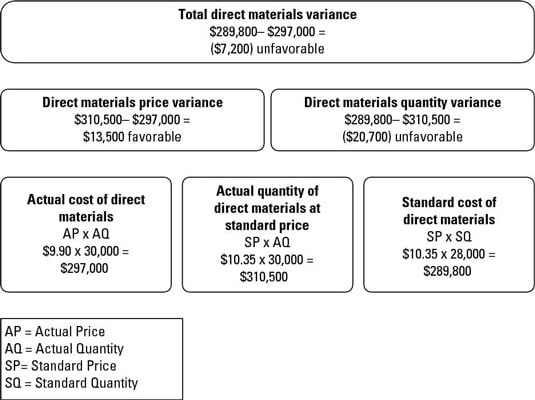

Accurate tracking of direct material costs is crucial for determining the true cost of a product. This information is then used to set appropriate selling prices, analyze profitability margins, and make informed production decisions.

The Pitfalls of Misclassification

Misclassifying direct materials can have significant consequences. Consider a scenario where direct materials are incorrectly classified as indirect costs or period costs.

This would understate the value of inventory on the balance sheet and overstate profits in the current period. Such a misrepresentation could mislead investors and create an inaccurate picture of the company's financial health.

Furthermore, an inaccurate COGS calculation can lead to flawed pricing strategies. A company might unknowingly underprice its products, sacrificing profit margins in the long run.

Examples of Misclassification Errors

Confusing direct materials with indirect materials is a common error. For example, lubricants used in manufacturing equipment are usually considered indirect materials, while the steel used to build a car is a direct material.

Another error involves incorrectly expensing direct materials immediately instead of capitalizing them as inventory. This might occur if a company fails to properly track the usage of materials in production.

Failing to include all relevant costs, such as freight and insurance, in the direct material cost can also lead to inaccuracies. Consistent and accurate accounting procedures are vital to avoid these errors.

Strategies for Accurate Cost Allocation

Implementing a robust cost accounting system is essential for accurate direct material cost classification. This system should clearly define the criteria for distinguishing between direct and indirect materials.

Detailed record-keeping is also crucial. This includes maintaining accurate purchase records, inventory records, and production records.

Many companies use specialized software to track material usage and automatically allocate costs. Such systems reduce the risk of human error and provide real-time visibility into inventory levels and production costs.

The Role of Internal Controls

Strong internal controls are vital to prevent misclassification and ensure the integrity of financial data. These controls should include regular audits of inventory records and cost accounting procedures.

Segregation of duties is also important. This means that the individuals responsible for purchasing materials should not also be responsible for recording material usage.

Regular training for accounting personnel is crucial to keep them updated on GAAP requirements and best practices for cost accounting. This includes emphasizing the importance of accurate material classification and highlighting the potential consequences of errors.

The Impact on Financial Statements

Accurate classification of direct material costs directly impacts key financial statements. The balance sheet reflects the true value of inventory, providing a reliable measure of a company's assets.

The income statement accurately reflects the cost of goods sold, leading to a more accurate determination of gross profit and net income. This is vital for assessing the company's profitability and performance.

The statement of cash flows also benefits from accurate cost accounting. Accurate COGS data provides a clearer picture of the company's cash flow from operations.

Looking Ahead: Adapting to Changing Business Environments

As businesses face increasing complexity and global competition, the importance of accurate cost accounting will only grow. Companies need to adapt their systems to handle new types of materials, complex supply chains, and evolving accounting standards.

Embracing technology, such as cloud-based accounting software and data analytics, can help companies improve accuracy and efficiency in cost allocation. Furthermore, ongoing training and professional development for accounting staff will be essential to keep pace with the changing landscape.

Ultimately, understanding and properly classifying the costs of direct materials is not just a matter of compliance; it's a strategic imperative for long-term success. By prioritizing accuracy and investing in robust cost accounting systems, businesses can unlock valuable insights, optimize profitability, and build a stronger foundation for the future.