The Distribution Of The Number Of Transactions Per Day

The digital age has ushered in an era of unprecedented transaction volumes, reshaping economies and daily life. From online shopping sprees to high-frequency trading, the sheer number of transactions occurring daily is staggering.

However, this deluge of data presents a complex statistical puzzle: what is the actual distribution of the number of transactions per day, and what factors influence its shape?

Understanding this distribution is crucial for everything from infrastructure planning to fraud detection, and economic forecasting.

Understanding Transaction Distribution: A Statistical Deep Dive

At its core, the distribution of transactions per day describes how frequently different transaction volumes occur. It's not simply a matter of finding the average number of transactions; it involves examining the range of values and how often each value appears.

The "nut graf" is this: A deep dive into this distribution reveals significant insights into system stability, potential bottlenecks, and even underlying economic activity, enabling us to predict and manage transaction flows with greater accuracy.

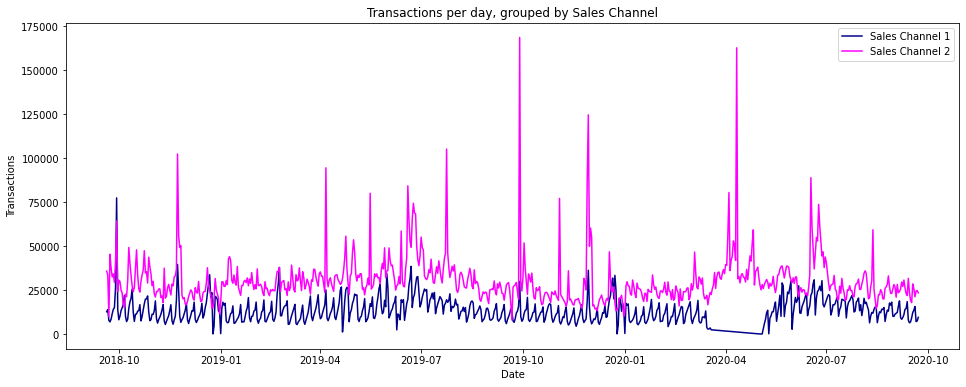

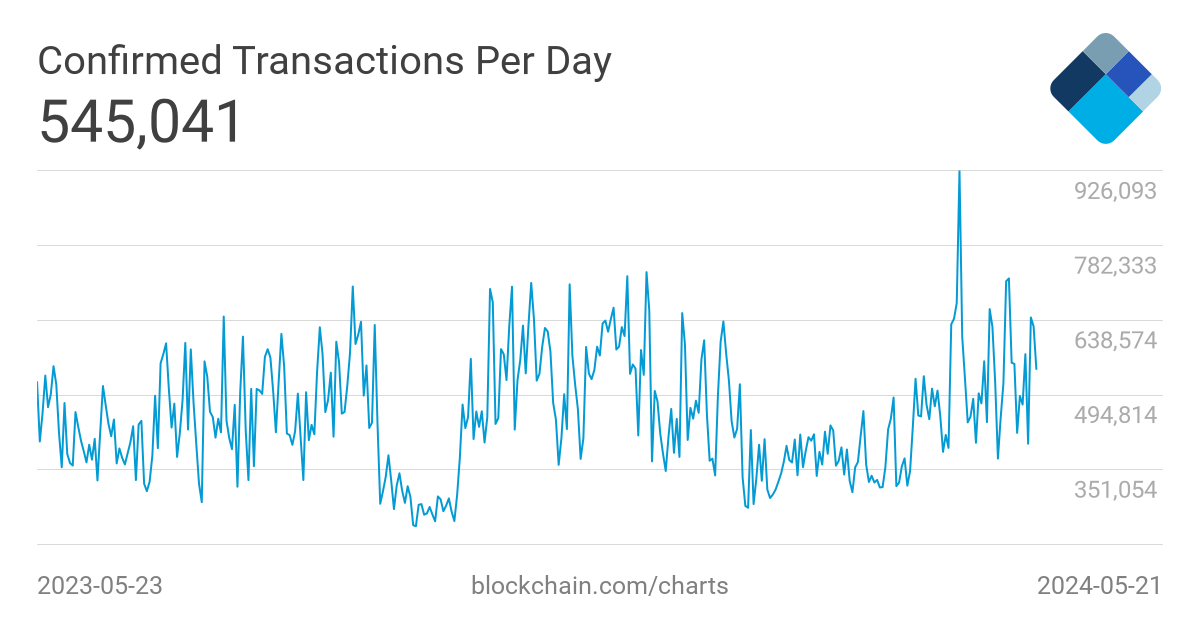

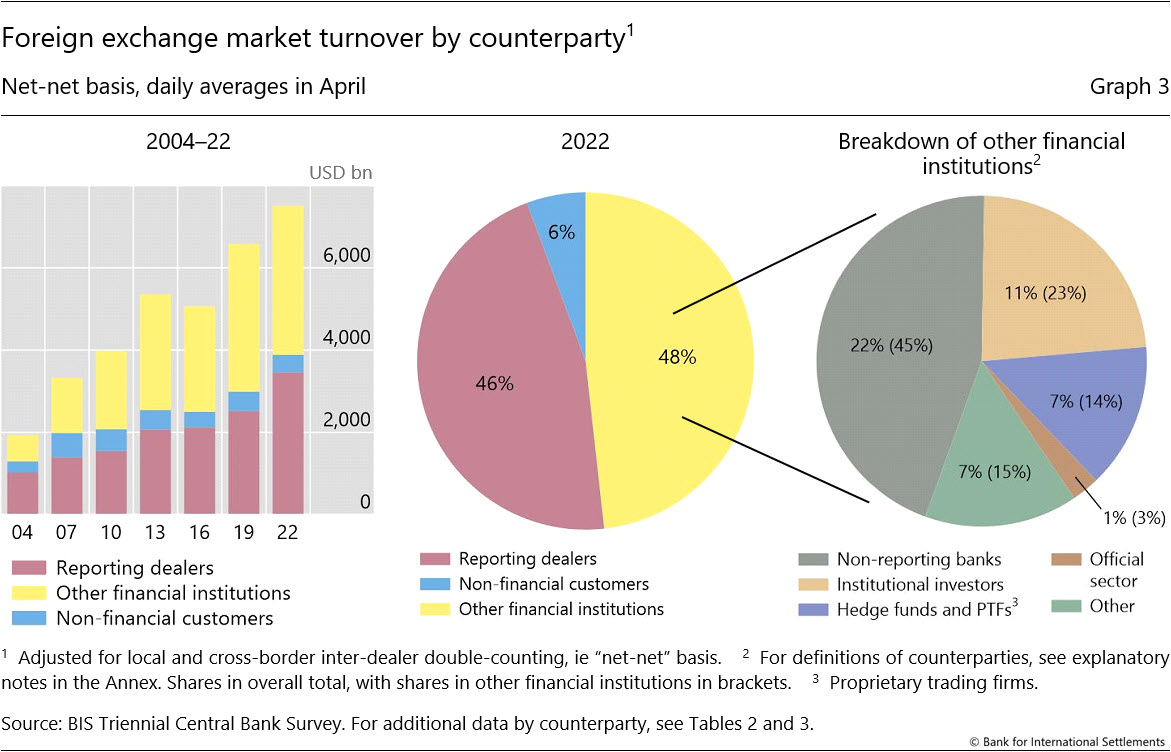

Data from sources like payment processors (such as Visa and Mastercard), stock exchanges (like the New York Stock Exchange), and cryptocurrency networks (like Bitcoin and Ethereum) provide valuable raw information.

Common Distribution Patterns

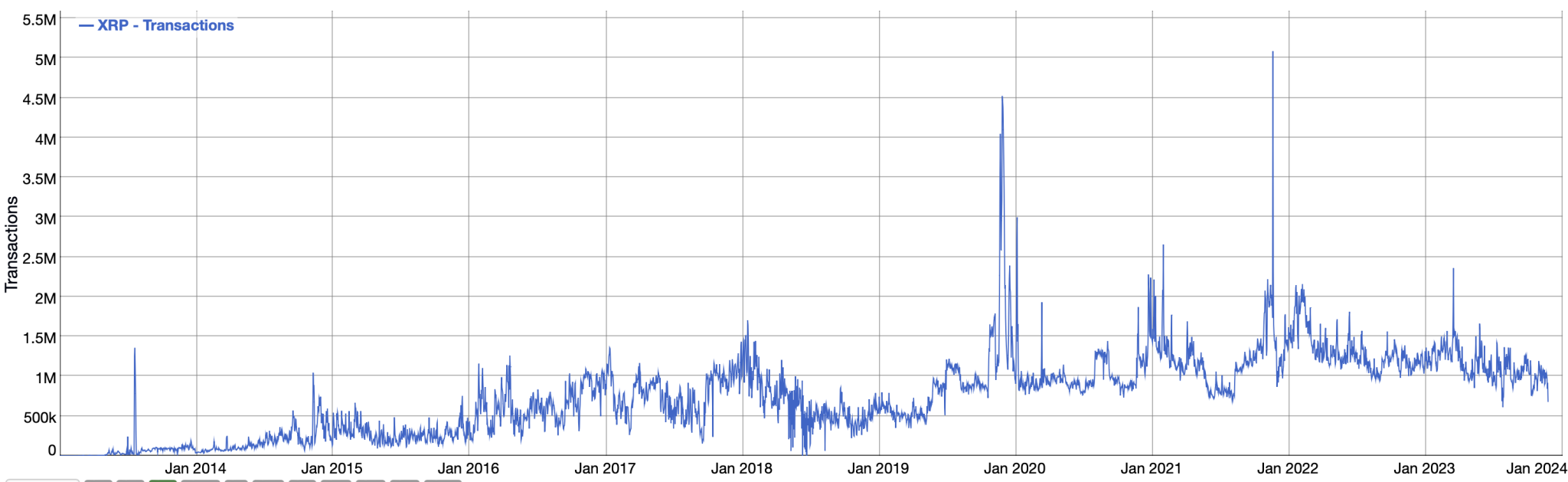

While a perfectly normal (Gaussian) distribution might seem intuitive, the reality is often more complex. Instead, transaction data often exhibits characteristics of a power law or heavy-tailed distribution.

This means that while most days may see a relatively consistent number of transactions, extreme events – like Black Friday sales or sudden market crashes – can lead to exceptionally high transaction volumes that significantly skew the distribution.

These "fat tails" are critical to account for in system design, as they represent the periods when infrastructure is most likely to be stressed.

Consider the impact of a major geopolitical event or a surprise earnings announcement. Such events can trigger a massive spike in trading activity, leading to transaction volumes far exceeding the daily average.

According to data published by the Bank for International Settlements (BIS), sudden shifts in market sentiment can lead to a surge in interbank payments, further illustrating the potential for extreme values in transaction distributions.

Factors Influencing Transaction Volume

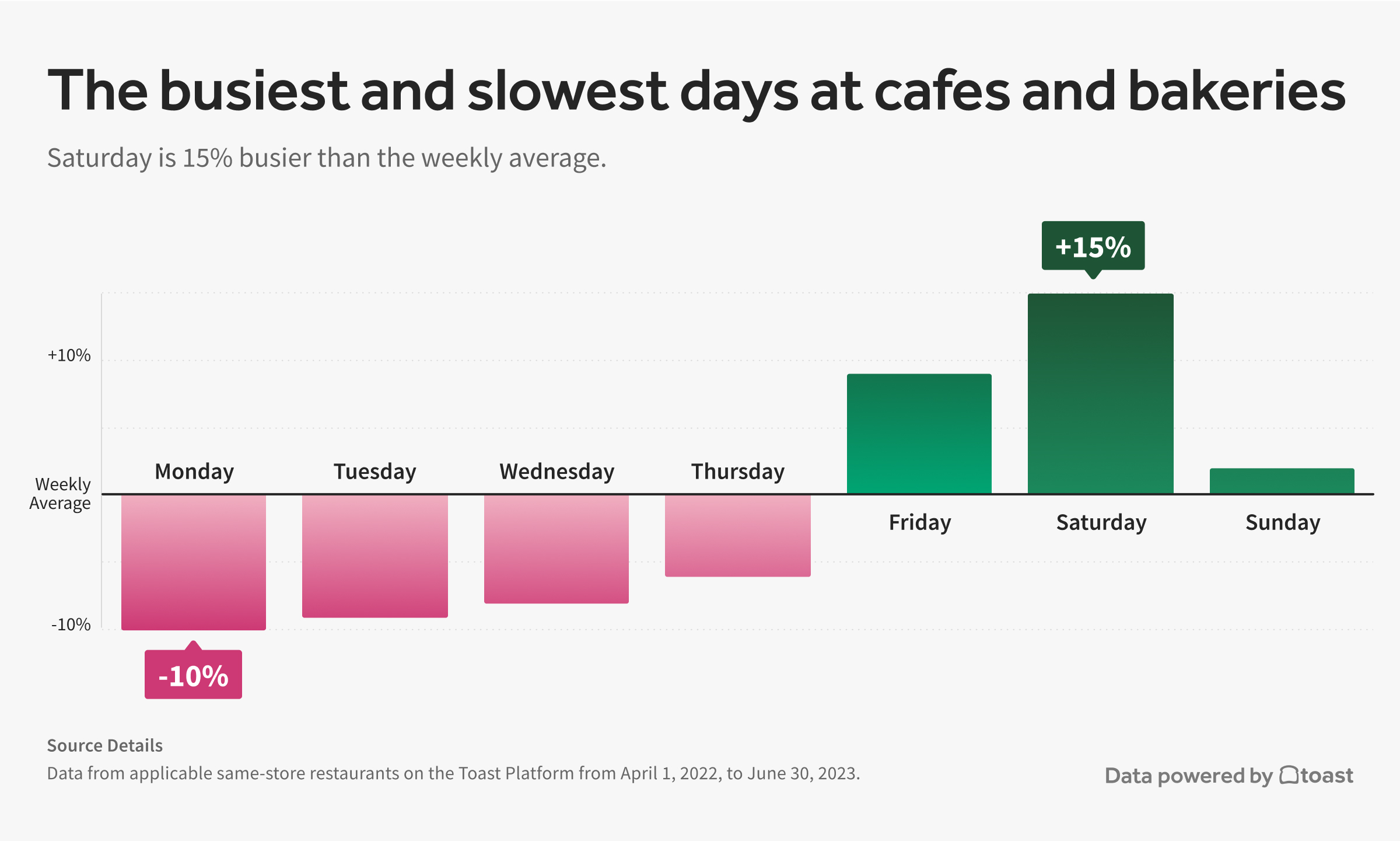

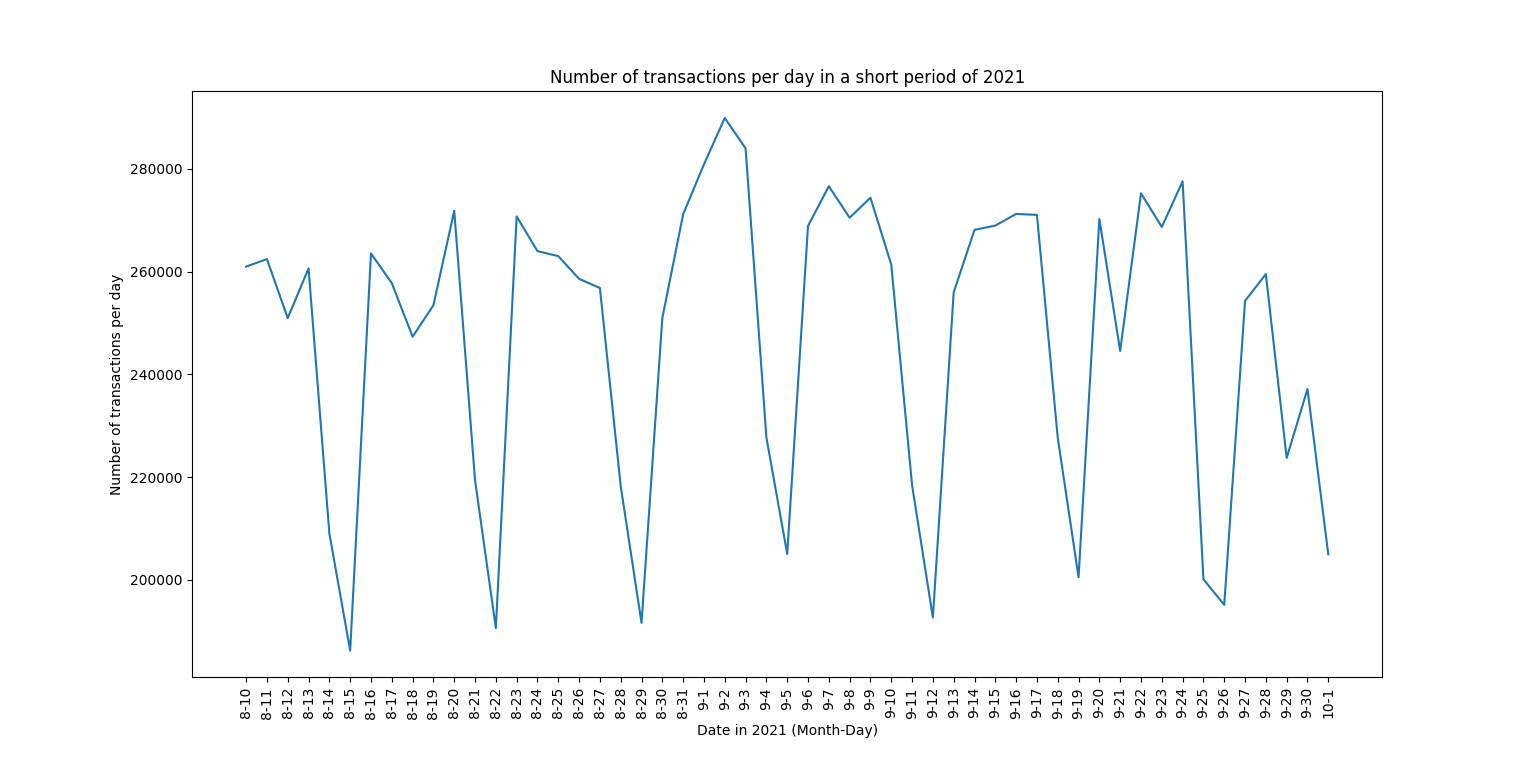

Numerous factors can influence the number of transactions occurring on any given day. Seasonality plays a significant role, with retail transactions peaking during the holiday shopping season.

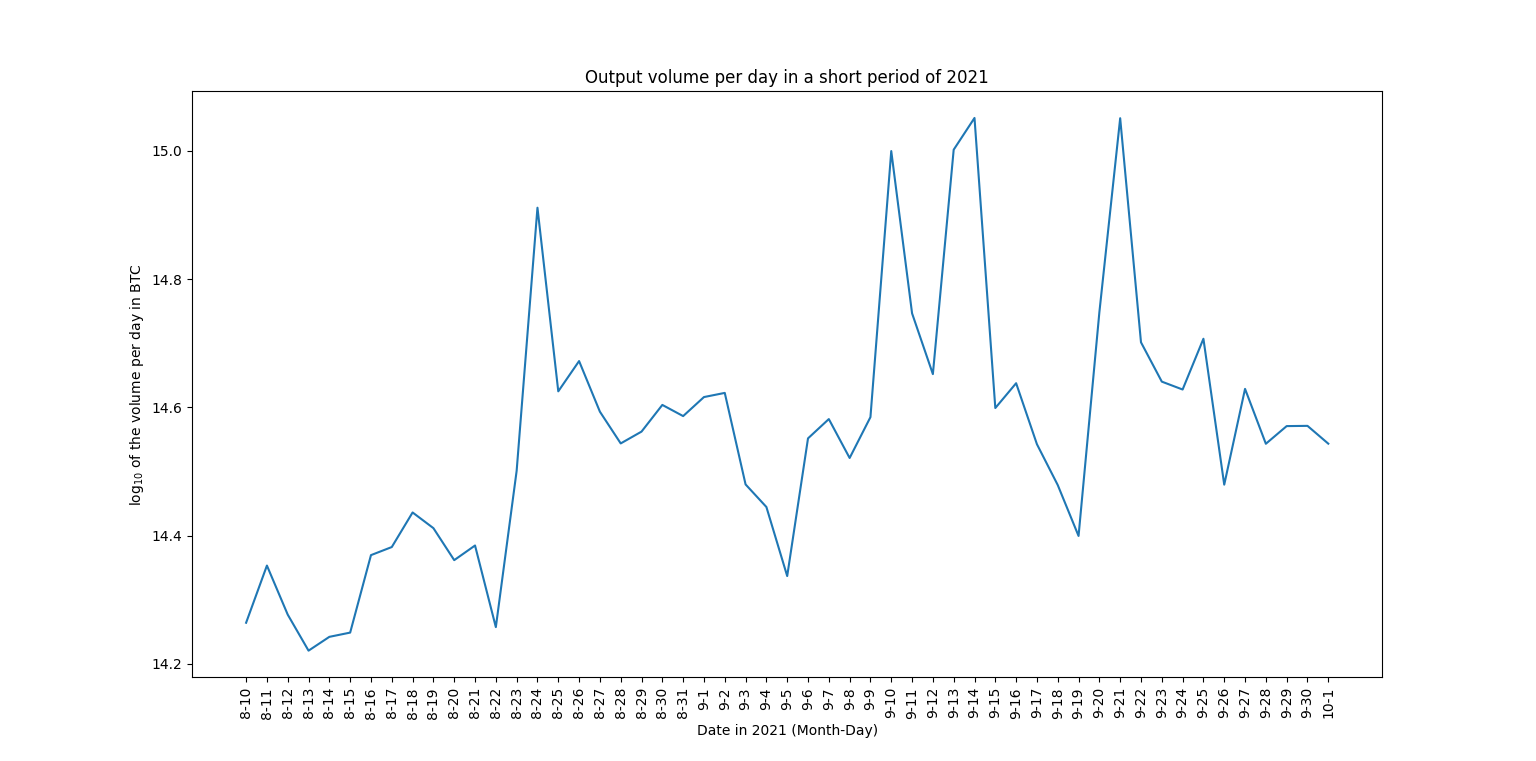

Economic indicators, such as GDP growth and unemployment rates, also have a demonstrable impact. A strong economy generally leads to increased consumer spending and business investment, both of which drive up transaction volumes.

Technological advancements also play a critical role, with the rise of mobile payments and e-commerce platforms leading to a steady increase in the number of daily transactions.

The introduction of a new, highly anticipated product, like the launch of a new smartphone or video game, often creates a temporary surge in transaction volume.

As noted by researchers at the International Monetary Fund (IMF), macroeconomic stability is directly correlated with stable transaction volumes, highlighting the interconnectedness of economic health and payment systems.

Applications of Transaction Distribution Analysis

Understanding the distribution of transactions per day has numerous practical applications. Financial institutions can use this information to optimize their infrastructure and ensure they can handle peak transaction loads.

Fraud detection systems rely on identifying anomalous transaction patterns. A sudden spike in transaction volume from a particular account, for example, might trigger an alert indicating potential fraudulent activity.

Moreover, economists and policymakers can use transaction data as a real-time indicator of economic activity. Analyzing transaction patterns can provide early warning signs of economic downturns or overheating markets.

Retailers use transaction data to refine inventory management, predict demand, and optimize staffing levels. Understanding peak transaction times allows them to better serve customers and avoid stockouts.

Dr. Anya Sharma, a leading expert in financial analytics, argues that analyzing transaction distributions can significantly improve risk management strategies for financial institutions, enabling them to better anticipate and mitigate potential losses.

Challenges and Future Directions

Despite the potential benefits, analyzing transaction distributions also presents several challenges. Data privacy concerns are paramount, as transaction data often contains sensitive personal information.

Ensuring data security and anonymity is crucial to maintaining public trust and complying with regulations. The increasing complexity of payment systems and the proliferation of new transaction channels also pose challenges.

The rise of decentralized finance (DeFi) and blockchain technology adds another layer of complexity, as transactions occur on distributed ledgers that are often outside the direct control of traditional financial institutions.

Future research should focus on developing more sophisticated statistical models that can capture the dynamic nature of transaction distributions. Incorporating external data sources, such as social media sentiment and news feeds, could further improve the accuracy of these models.

Furthermore, developing real-time analytical tools that can monitor transaction distributions and detect anomalies in real-time is essential for preventing fraud and ensuring the stability of payment systems.

Conclusion: Navigating the Transactional Landscape

The distribution of the number of transactions per day is a complex and dynamic phenomenon. Understanding this distribution is essential for a wide range of applications, from infrastructure planning to fraud detection and economic forecasting.

By leveraging data from various sources and employing sophisticated analytical techniques, we can gain valuable insights into the transactional landscape and improve our ability to manage and navigate the digital economy.

As transaction volumes continue to grow and payment systems become more complex, the importance of understanding transaction distributions will only increase, making it a critical area of focus for researchers, policymakers, and industry professionals alike. This understanding is crucial for building a more stable, efficient, and secure financial ecosystem.