The Financial Services And Markets Act 2000

The bedrock of the UK's financial system, the Financial Services and Markets Act 2000 (FSMA), has been a subject of intense scrutiny and debate since its inception. From the ashes of fragmented regulatory bodies rose a unified framework intended to foster stability, efficiency, and consumer protection in an increasingly complex financial landscape. But has it truly delivered on its ambitious goals, and is it fit for purpose in the face of rapidly evolving technologies and globalized markets?

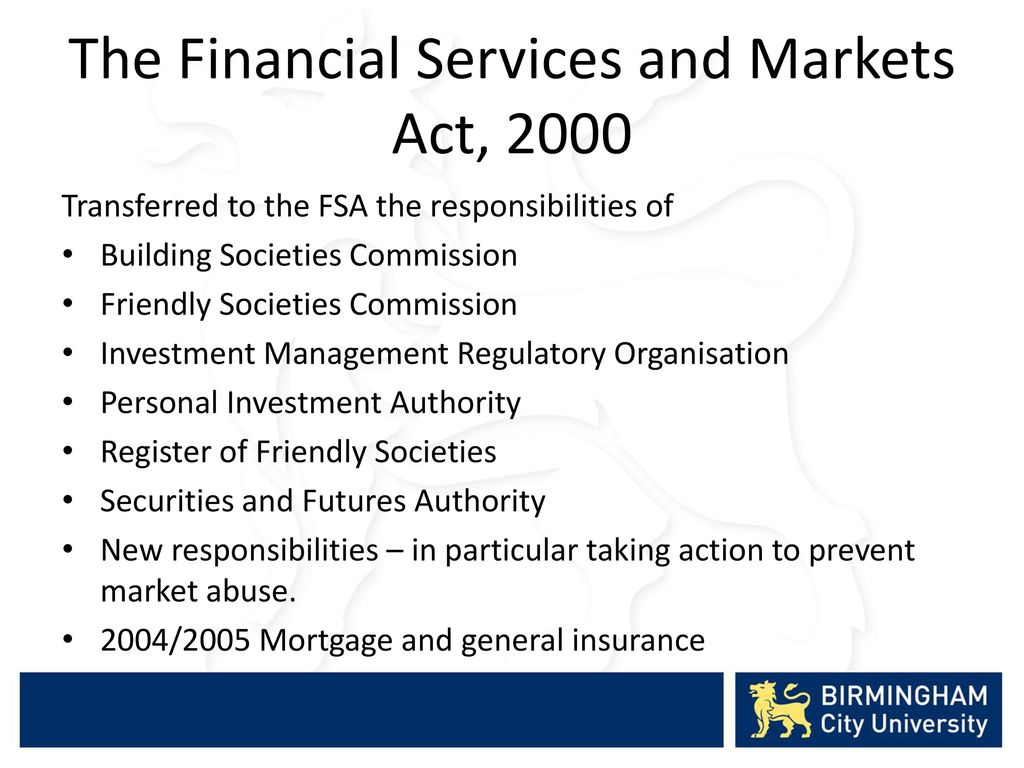

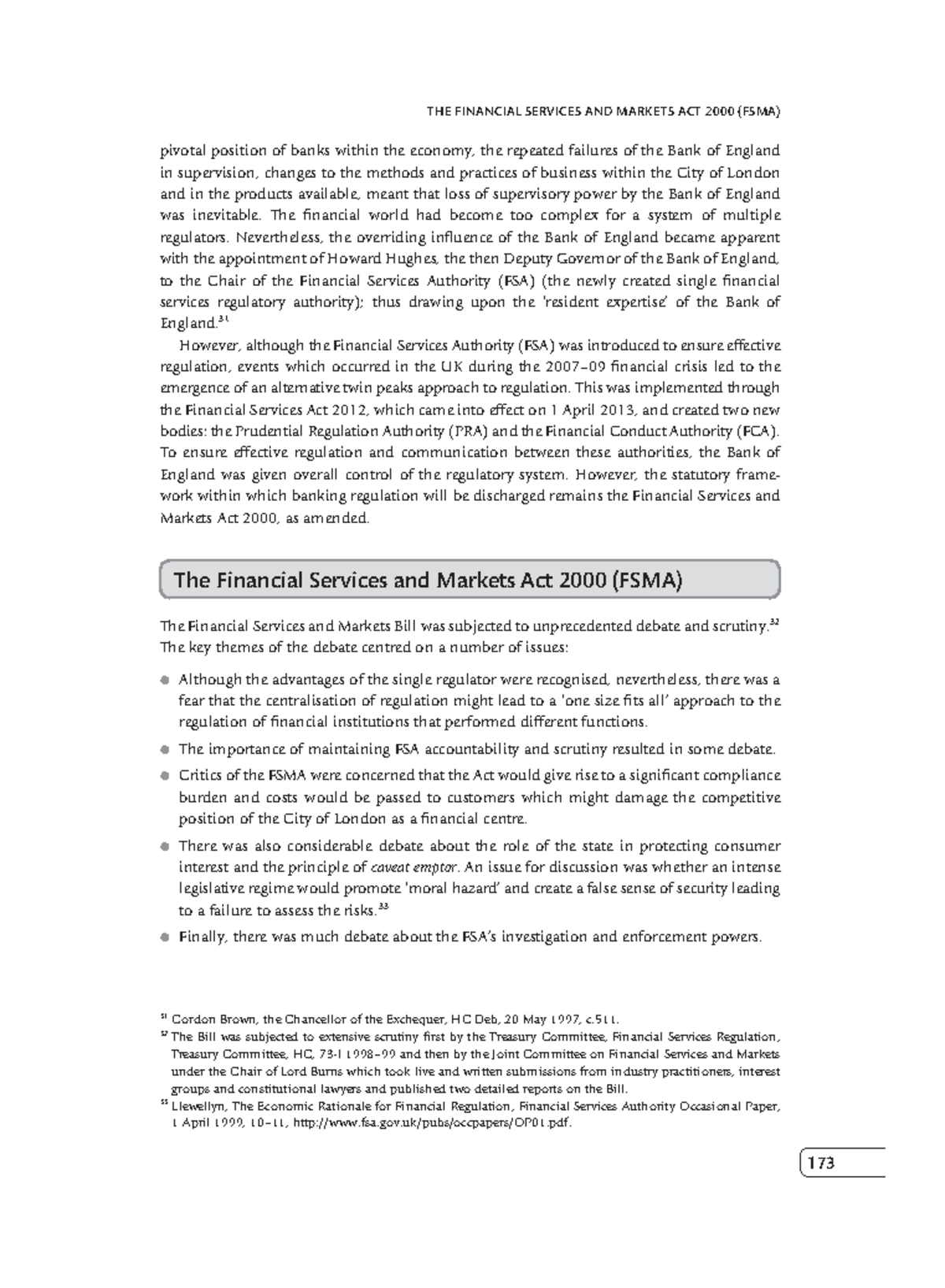

At its core, the FSMA 2000 aimed to modernize and consolidate the UK's financial regulatory structure, transferring powers to the Financial Services Authority (FSA). This pivotal legislation established a principles-based approach to regulation, emphasizing high-level standards and guidance rather than overly prescriptive rules. This shift aimed to promote innovation and flexibility, but also placed a significant burden on firms to interpret and apply these principles effectively.

Key Provisions and Objectives

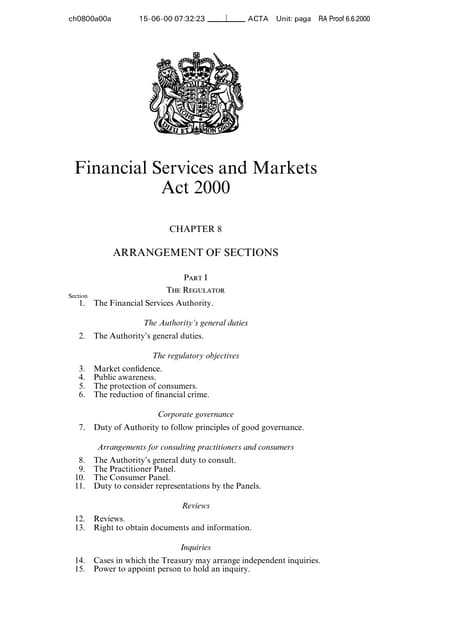

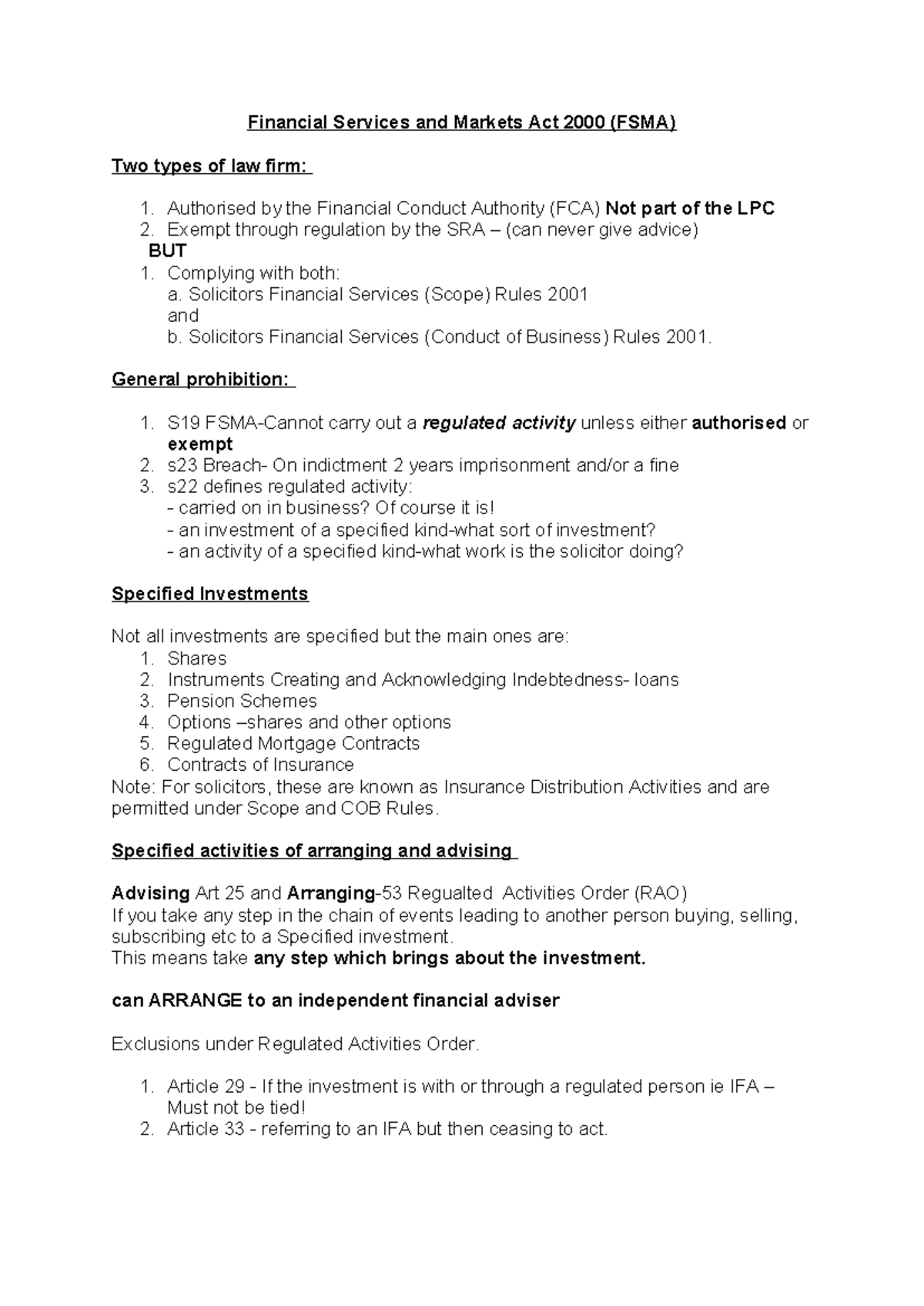

The FSMA 2000 introduced several key provisions designed to achieve its overarching objectives. A crucial element was the creation of a single regulator, the FSA, later replaced by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). This split aimed to separate conduct regulation from prudential supervision, addressing concerns about potential conflicts of interest and improving regulatory focus.

The Act established a statutory framework for the authorization and supervision of financial firms. This included setting minimum capital requirements, imposing conduct of business rules, and providing enforcement powers to address misconduct. The regime also sought to enhance consumer protection through measures such as the Financial Ombudsman Service (FOS) and the Financial Services Compensation Scheme (FSCS).

The Principles-Based Approach

One of the defining characteristics of the FSMA 2000 was its adoption of a principles-based approach to regulation. Rather than providing detailed rules for every conceivable scenario, the FSA, and later the FCA, issued high-level principles that firms were expected to adhere to. This approach was intended to be more flexible and adaptable to changing market conditions, allowing firms to innovate without being constrained by rigid rules.

However, the principles-based approach has also been criticized for its ambiguity and lack of clarity. Some argue that it places an undue burden on firms to interpret and apply the principles, leading to uncertainty and potential compliance risks. Others contend that it gives regulators too much discretion in enforcement actions, potentially creating unfair or inconsistent outcomes.

Impact and Evolution

The FSMA 2000 has had a profound impact on the UK's financial landscape. It has contributed to a more stable and resilient financial system, particularly following the 2008 financial crisis. The Act has also enhanced consumer protection, providing redress mechanisms for those who have been mis-sold financial products or services.

However, the Act has also faced criticism for its perceived shortcomings. Some argue that the FSA's light-touch regulatory approach prior to the financial crisis contributed to the build-up of systemic risks. Others contend that the post-crisis regulatory reforms, including the creation of the FCA and PRA, have created a more complex and burdensome regulatory environment.

The Post-Crisis Reforms

In the wake of the 2008 financial crisis, the FSMA 2000 underwent significant reforms. The FSA was abolished and replaced by the FCA and PRA, each with distinct responsibilities. The FCA was tasked with regulating the conduct of financial firms and protecting consumers, while the PRA was responsible for the prudential supervision of banks, insurers, and other systemically important institutions.

These reforms aimed to address the perceived weaknesses in the pre-crisis regulatory framework. They sought to enhance regulatory focus, improve accountability, and strengthen the UK's ability to prevent and manage future financial crises. However, the reforms have also been criticized for increasing the complexity and cost of regulation.

Challenges and Future Directions

The FSMA 2000 continues to face significant challenges in a rapidly evolving financial landscape. The rise of fintech, the increasing globalization of financial markets, and the ongoing threat of cybercrime pose new and complex regulatory challenges. Addressing these challenges will require ongoing adaptation and innovation on the part of regulators and firms alike.

One key challenge is striking the right balance between promoting innovation and managing risks. Regulators must foster an environment that encourages innovation while also ensuring that new technologies and business models are appropriately regulated to protect consumers and maintain financial stability. This requires a flexible and adaptable regulatory framework that can keep pace with technological advancements.

Brexit and the Future of UK Financial Regulation

Brexit has also created significant uncertainty for the future of UK financial regulation. The UK is no longer bound by EU financial regulations and has the freedom to set its own regulatory standards. This presents both opportunities and risks. The UK could potentially simplify and streamline its regulatory framework, making it more attractive to financial firms. However, it also risks creating regulatory divergence from the EU, which could hinder cross-border financial activity.

The government has stated its intention to maintain high regulatory standards while also promoting competitiveness and innovation. The Financial Services and Markets Act 2023, is the latest reform, intending to reshape the UK's financial services sector post-Brexit. It's clear that the future of UK financial regulation will be shaped by the need to balance these competing objectives.

Looking ahead, the FSMA 2000, and its subsequent iterations, must adapt to remain relevant and effective. This includes embracing new technologies, fostering closer collaboration between regulators and firms, and promoting a culture of ethical behavior and responsible innovation. Ultimately, the success of the UK's financial regulatory framework will depend on its ability to strike the right balance between stability, efficiency, and consumer protection.

.jpg)