The Four Phases Of The Business Cycle

The relentless ebb and flow of economic activity shapes not just national prosperity, but the daily lives of individuals and businesses worldwide. From Main Street shops to Wall Street giants, every entity feels the impact of the business cycle's unpredictable rhythm.

Understanding this cyclical pattern is crucial for informed decision-making and navigating the complexities of the modern economy.

Understanding the Business Cycle: A Deep Dive

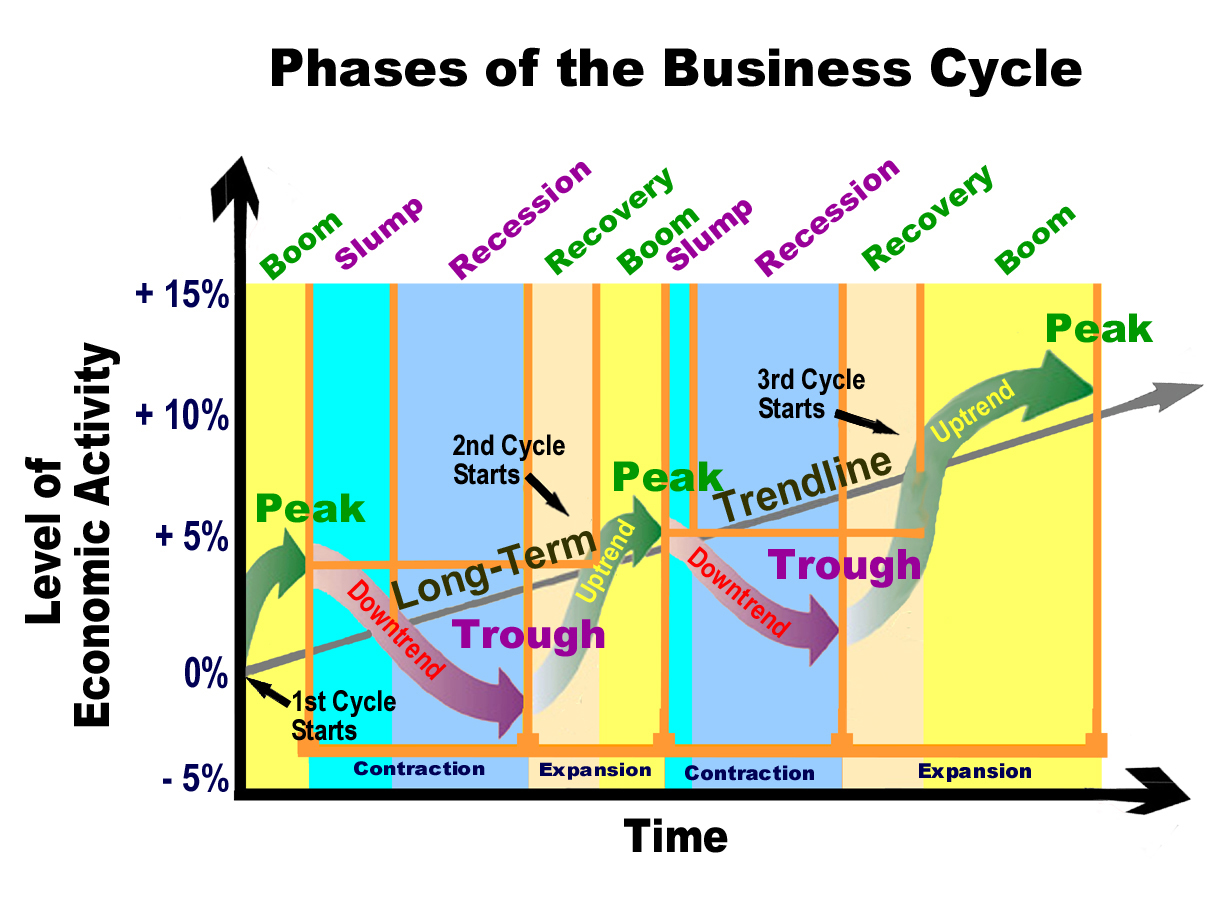

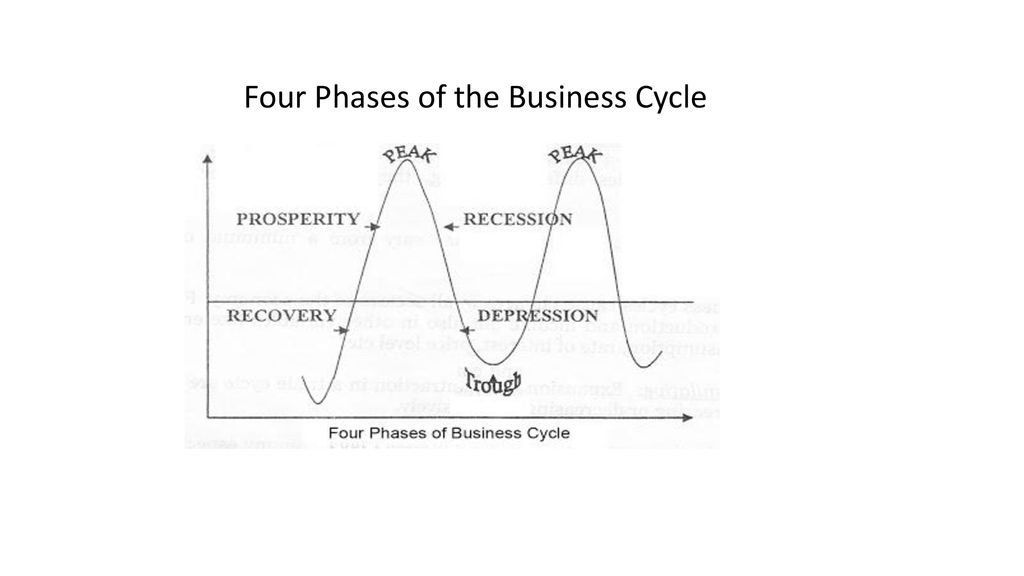

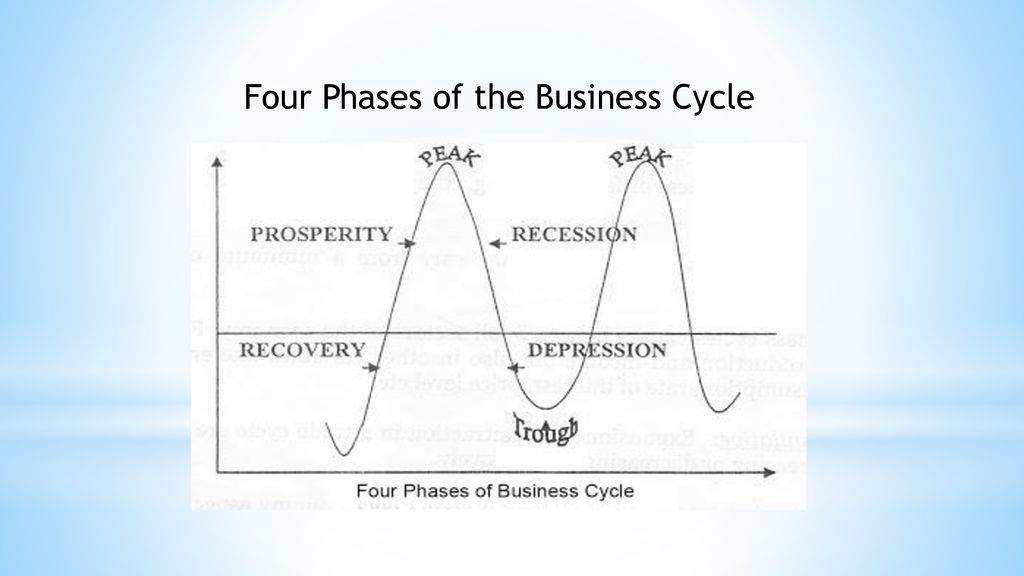

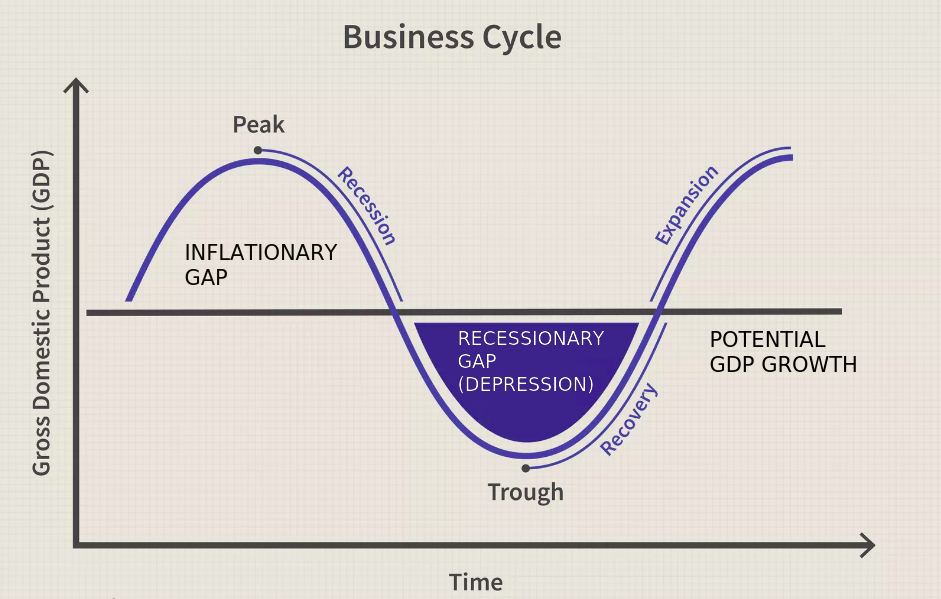

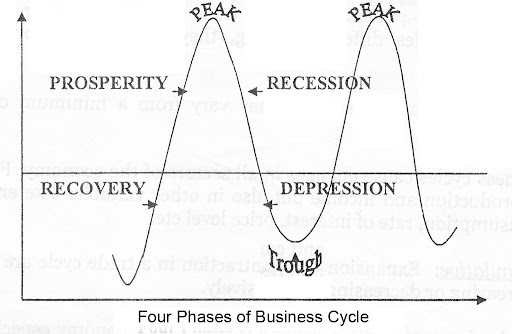

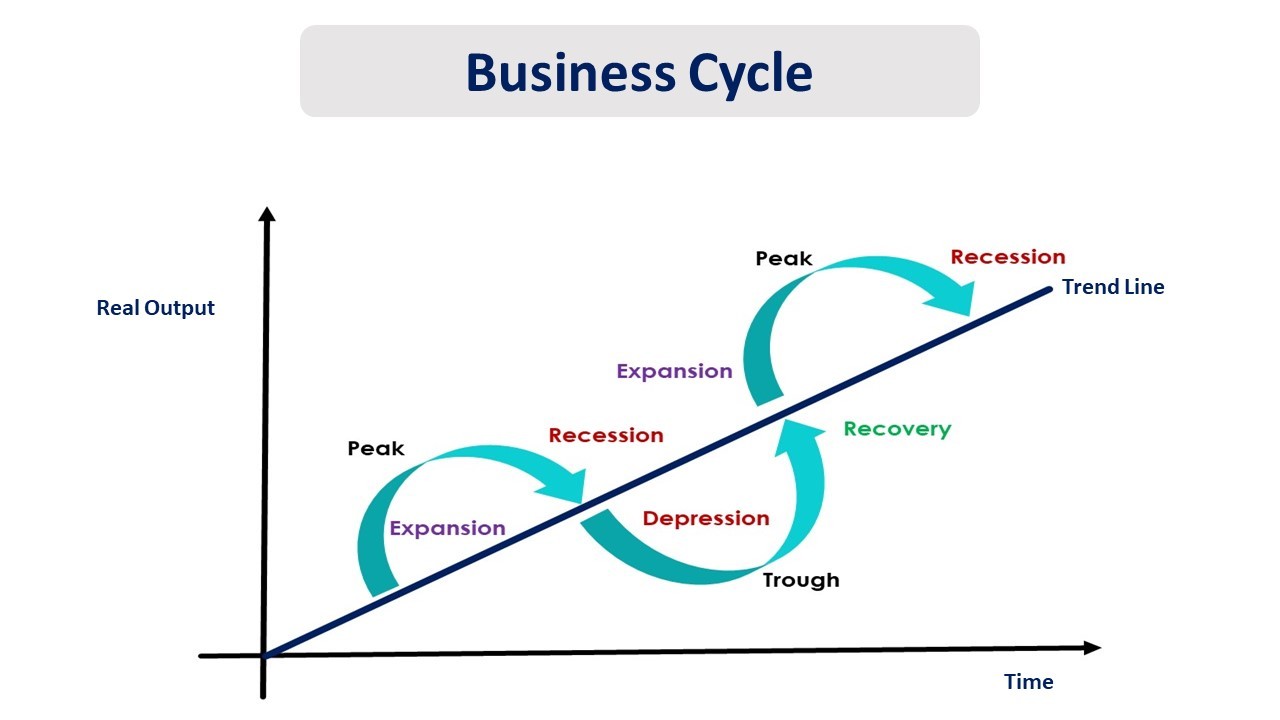

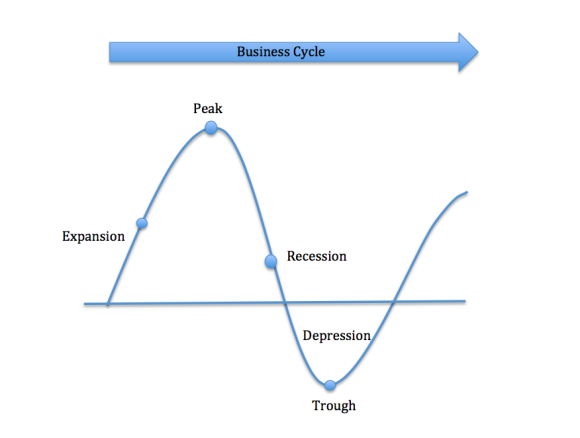

The business cycle, at its core, represents the recurring fluctuations in economic activity over time. It's characterized by periods of expansion and contraction, ultimately influencing employment rates, inflation, and overall economic growth. These phases are not rigid or perfectly predictable, but recognizing them allows for better strategic planning.

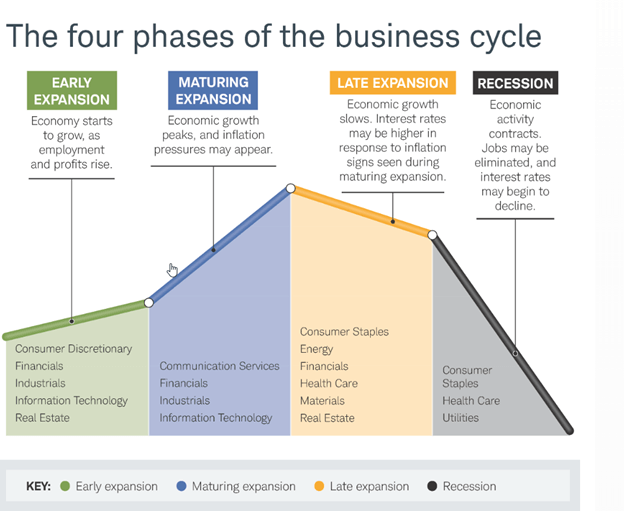

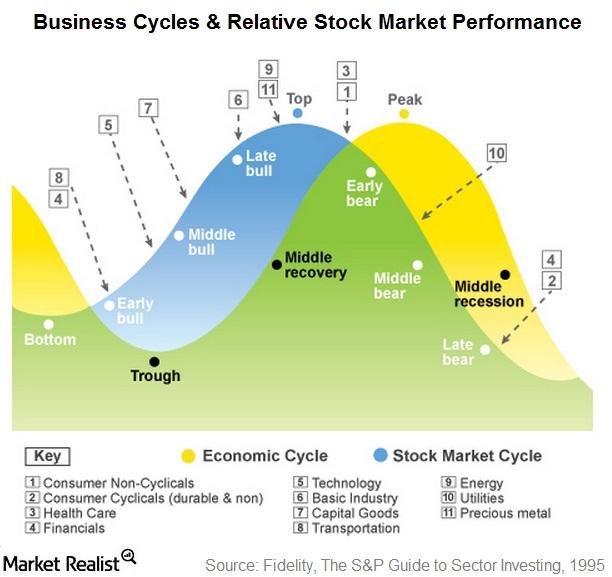

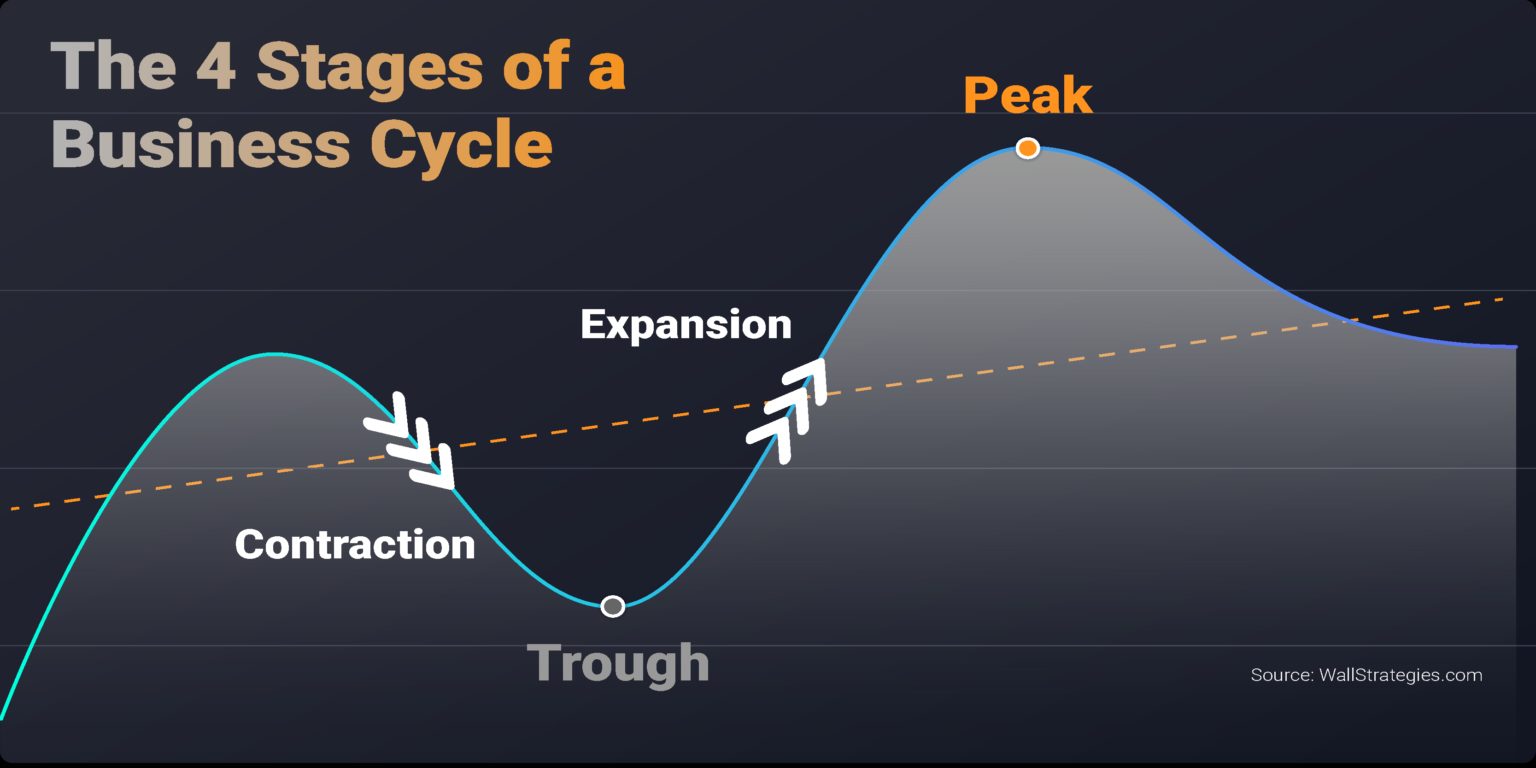

This article will delve into the four distinct phases of the business cycle – expansion, peak, contraction (or recession), and trough – examining their defining characteristics, contributing factors, and potential consequences. We'll explore the interplay of economic indicators and expert opinions to provide a comprehensive understanding of this fundamental concept.

Phase 1: Expansion - The Engine of Growth

The expansion phase is a period of sustained economic growth. During this phase, Gross Domestic Product (GDP) increases, signifying increased production and consumption.

Unemployment rates typically decline, as businesses hire more workers to meet rising demand. Consumer confidence soars, leading to increased spending on both essential and discretionary goods and services.

Investment in new projects and technologies also rises, further fueling economic activity. Low interest rates often support this growth, making borrowing more attractive.

Phase 2: Peak - Reaching the Summit

The peak represents the upper turning point of the business cycle. It signifies the end of the expansion phase and the point at which economic growth begins to slow.

At the peak, economic activity is at its highest level. Resources are often fully utilized, and inflationary pressures may begin to build.

The Federal Reserve, responsible for maintaining price stability, might start to raise interest rates to curb inflation. This can potentially dampen economic activity and signal the approaching contraction phase.

Phase 3: Contraction (Recession) - A Period of Slowdown

A contraction, also known as a recession, is a period of declining economic activity. During this phase, GDP decreases, and unemployment rates rise.

Consumer spending typically declines as confidence wanes and job security becomes uncertain. Businesses may reduce investment and lay off workers, further exacerbating the economic slowdown.

The National Bureau of Economic Research (NBER) is the official arbiter of recession dating in the United States. A commonly cited, though not definitive, rule of thumb is two consecutive quarters of negative GDP growth.

Phase 4: Trough - The Bottoming Out

The trough represents the lower turning point of the business cycle. It signifies the end of the contraction phase and the point at which economic activity begins to recover.

At the trough, economic activity is at its lowest level. Unemployment remains high, and consumer sentiment is subdued.

However, this phase also sets the stage for the next expansion. Government intervention, such as fiscal stimulus packages or monetary policy easing, may be implemented to stimulate demand and kickstart the recovery process.

As the economy begins to stabilize, businesses may start to cautiously reinvest, and consumers may gradually regain confidence.

Navigating the Cycle: Expert Perspectives

Economists often debate the causes and predictors of the business cycle. Some emphasize the role of monetary policy, arguing that interest rate adjustments can significantly influence economic activity.

Others focus on fiscal policy, highlighting the impact of government spending and taxation on aggregate demand. Still, others look to external shocks like geopolitical events or technological disruptions.

According to John Maynard Keynes, government intervention can play a crucial role in stabilizing the economy during periods of recession.

Conversely, proponents of laissez-faire economics argue that minimal government intervention allows the market to self-correct more efficiently.

"The business cycle is an inherent feature of capitalism, and attempts to eliminate it may ultimately be counterproductive," – according to a statement by Friedrich Hayek.

Looking Ahead: The Cycle Continues

The business cycle is an inherent feature of market economies. While its precise timing and magnitude remain unpredictable, understanding its phases is crucial for investors, businesses, and policymakers alike.

Monitoring key economic indicators, such as GDP growth, unemployment rates, and inflation, provides valuable insights into the current phase of the cycle. By recognizing these patterns, stakeholders can make more informed decisions to mitigate risks and capitalize on opportunities.

Ultimately, the cycle will continue, presenting both challenges and prospects for future economic growth and stability. Vigilance and adaptability remain key to navigating its inevitable twists and turns.

.png)

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)