The High Point Of A Business Cycle Is Called The

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

Imagine a rollercoaster, slowly but surely climbing the tracks. The anticipation builds with each click, the view gets more expansive, and the energy is palpable. Everyone knows what's coming next, that heart-stopping moment before the exhilarating plunge. This feeling, this peak of excitement, mirrors a crucial point in the economic landscape.

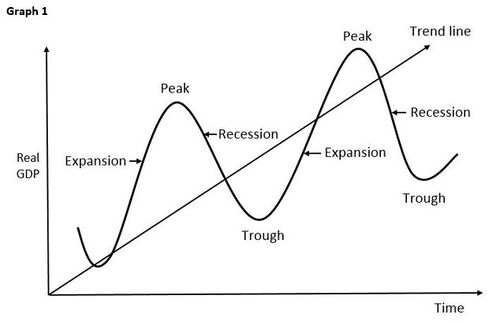

The apex of economic expansion, the highest point in a business cycle, is known as the peak. It's a period characterized by robust economic activity, high employment, and often, inflationary pressures. Understanding this critical juncture is essential for businesses, investors, and policymakers alike, allowing them to anticipate potential shifts and prepare for the inevitable contraction that follows.

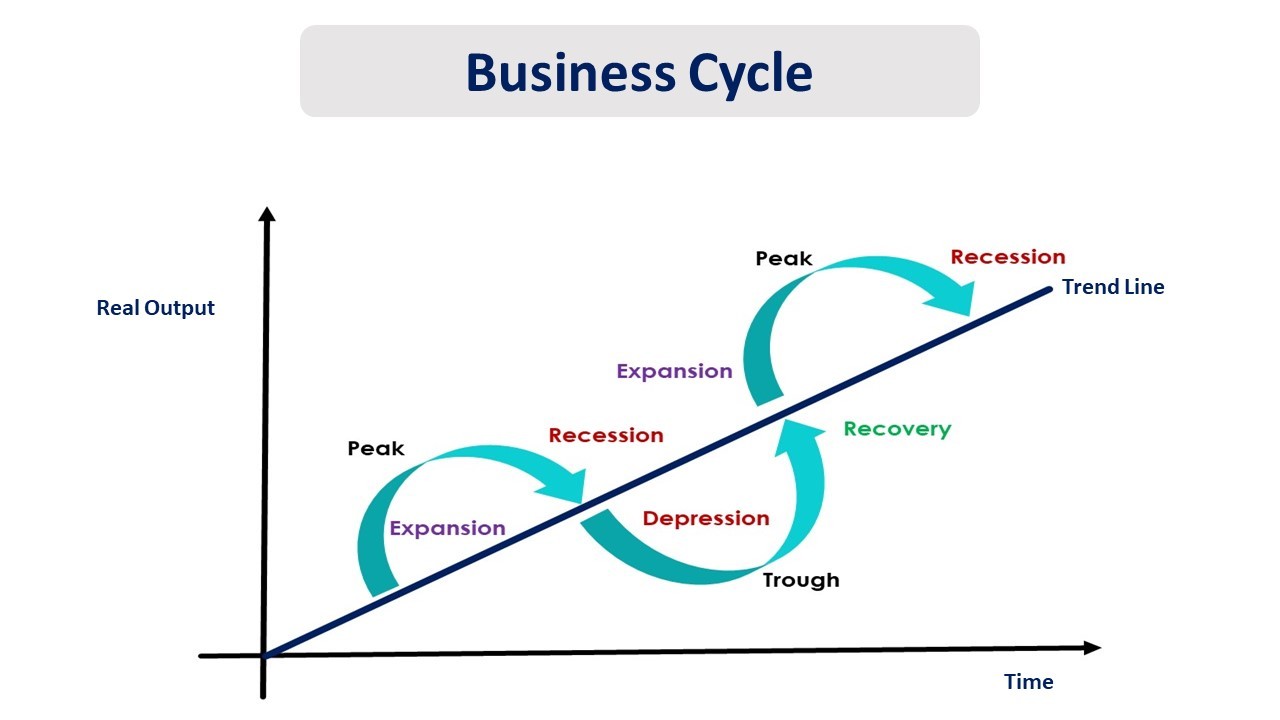

Understanding the Business Cycle

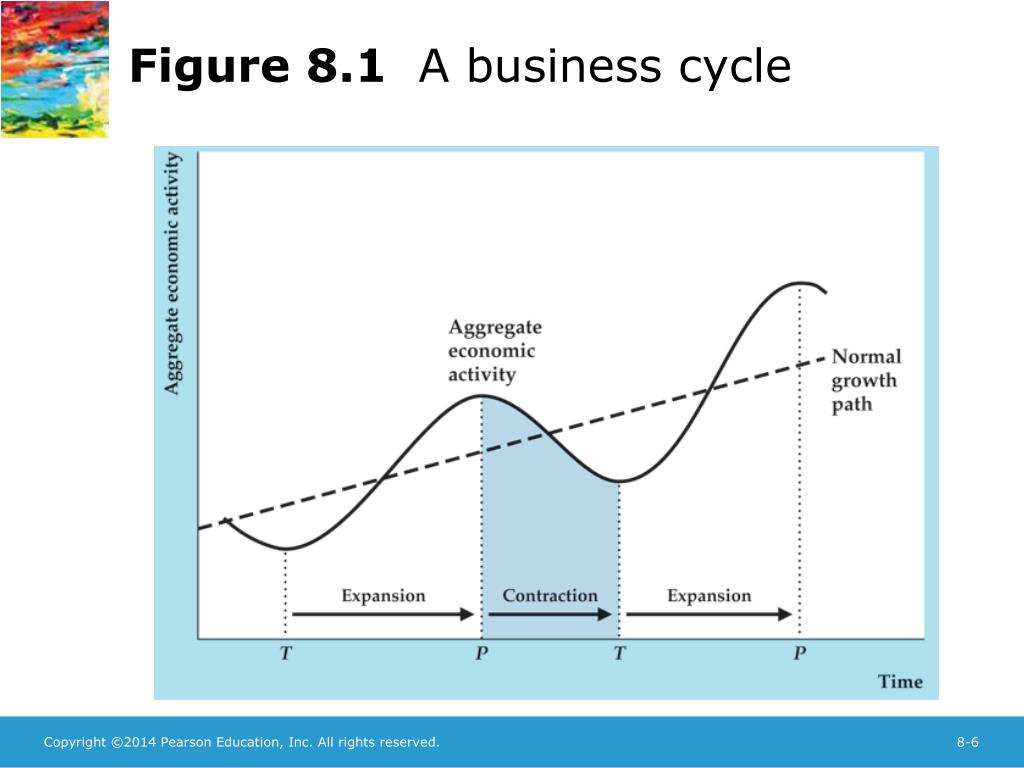

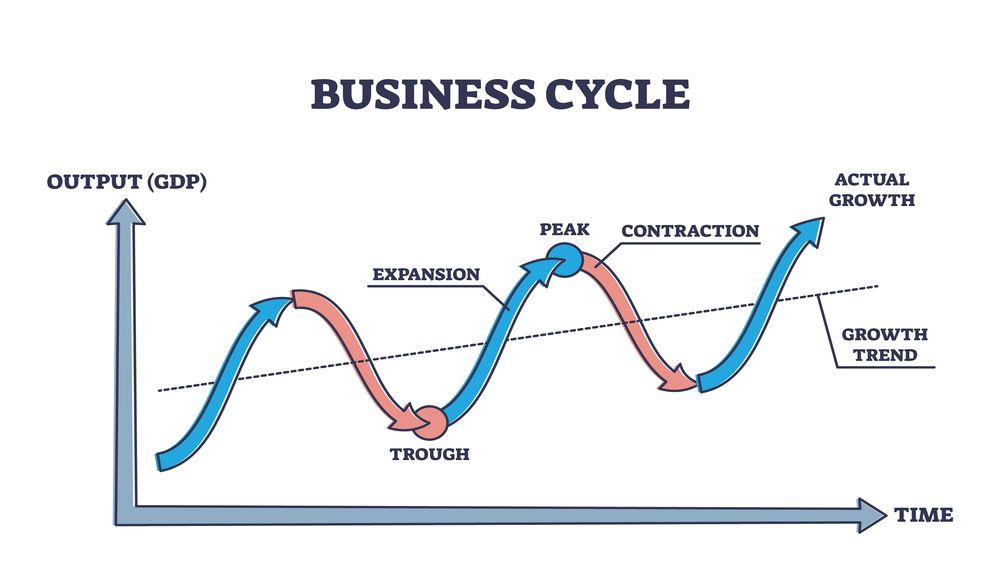

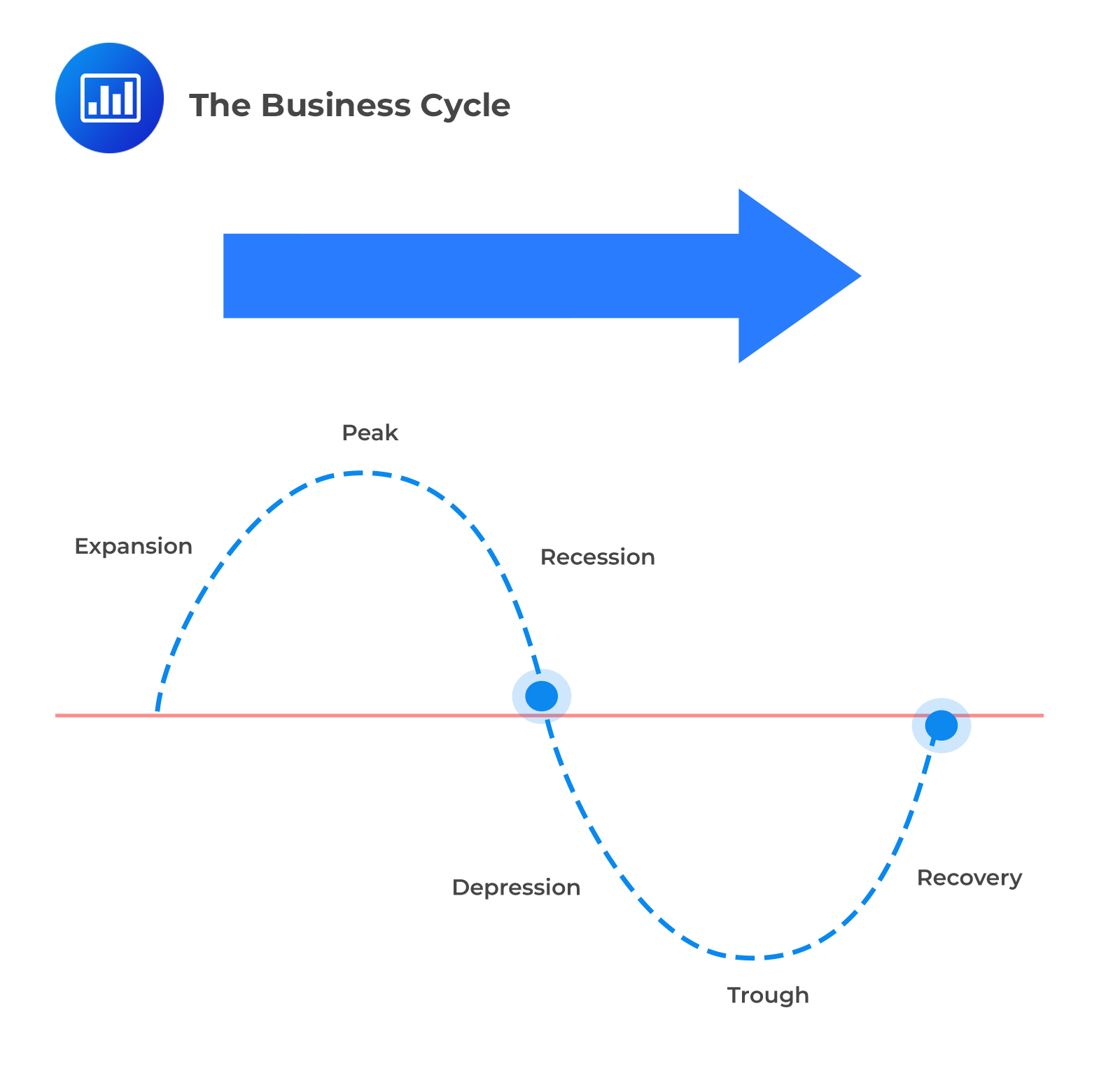

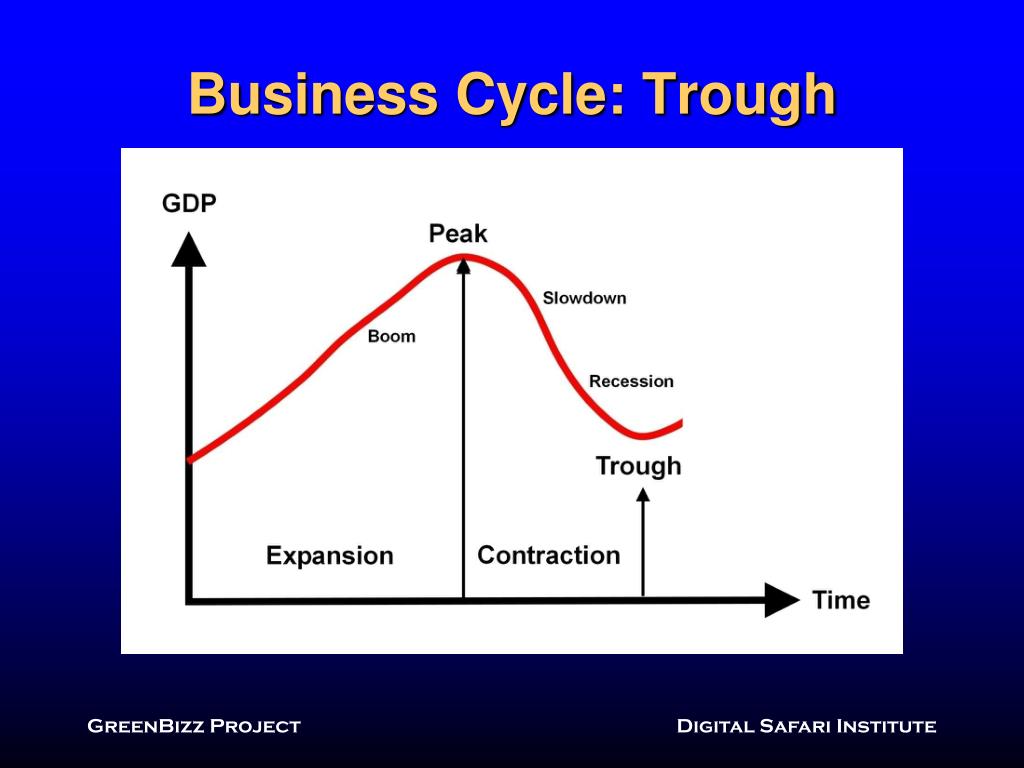

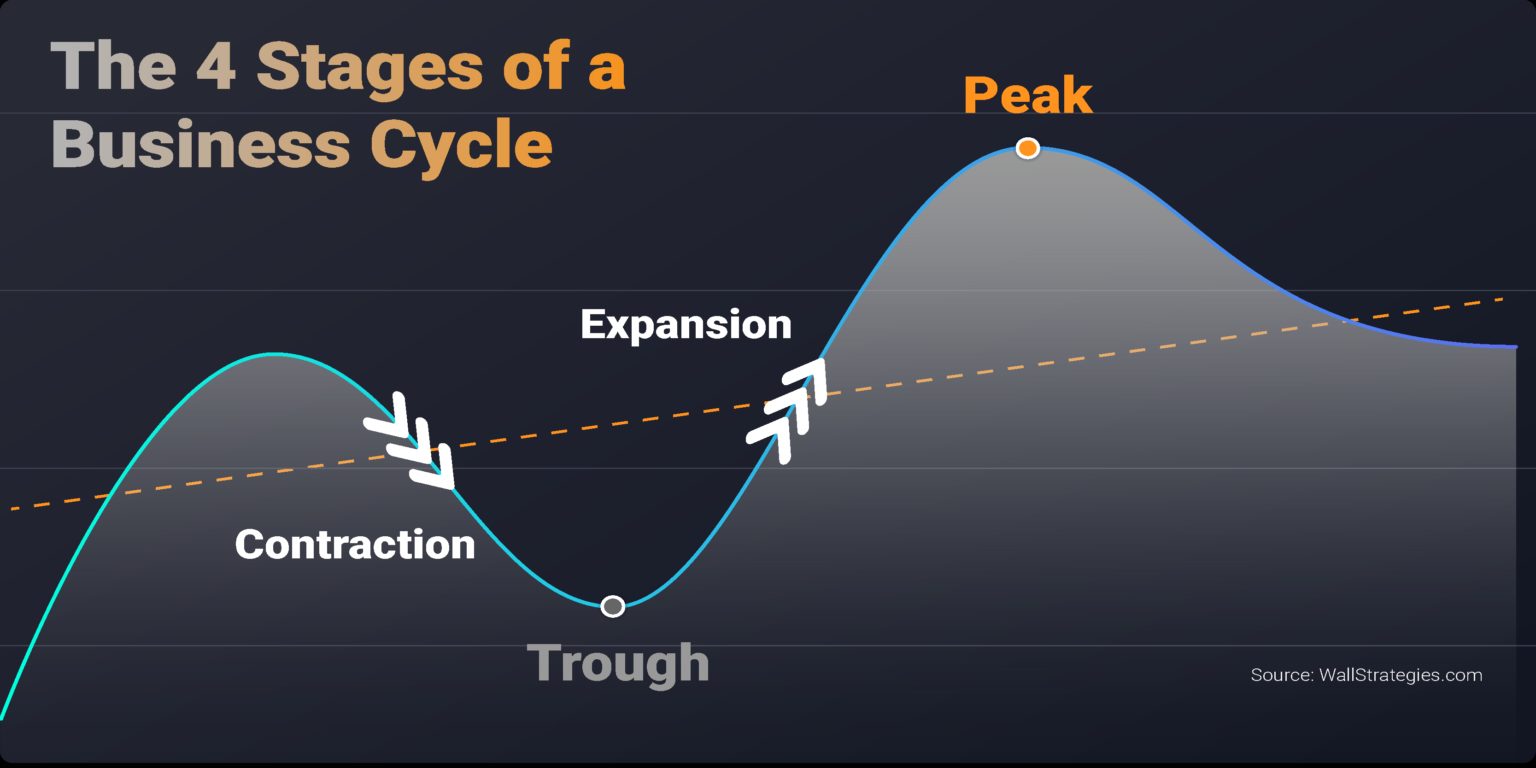

The business cycle is a recurring pattern of expansion and contraction in economic activity. This cycle manifests itself in fluctuations in key economic indicators like gross domestic product (GDP), employment rates, and consumer spending. These cyclical changes are a natural and inherent part of a market economy.

Historically, the study of business cycles has captivated economists for centuries. Early scholars, like Clément Juglar, observed these recurring patterns in the 19th century, laying the groundwork for modern macroeconomic analysis. His work focused on identifying the periods of expansion and contraction that defined the rhythm of economic life.

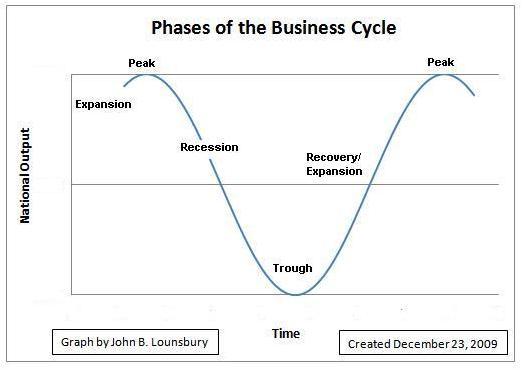

The Anatomy of a Peak

A peak doesn't just happen overnight. It's the culmination of a sustained period of economic growth, where businesses are thriving, consumers are confident, and investments are flourishing. Typically, at the peak, demand is high, and businesses are operating at or near full capacity.

Employment rates are often at their highest during a peak, reflecting the strong demand for labor. However, this period of prosperity can also lead to imbalances, such as rising inflation and asset bubbles. These imbalances can eventually contribute to the subsequent downturn.

Inflation is a key indicator to watch during an expansion. As demand outstrips supply, prices tend to rise. Central banks often respond by raising interest rates to cool down the economy and prevent runaway inflation. This can sometimes be the signal that the economy is about to turn.

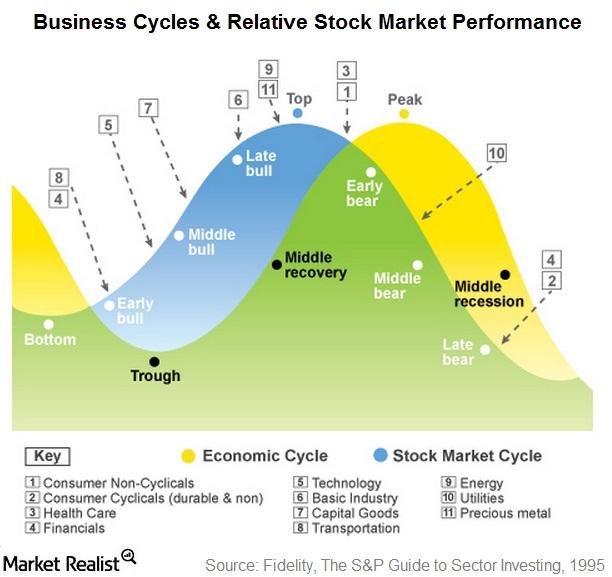

Significance of Identifying the Peak

Recognizing the peak is crucial for informed decision-making. For businesses, it can signal the need to adjust investment strategies and inventory levels. For investors, it may prompt a reassessment of their portfolios and risk tolerance.

Policymakers also rely heavily on understanding the business cycle. They use various tools, such as monetary and fiscal policies, to manage economic growth and mitigate the impact of recessions. Identifying the peak allows them to implement appropriate measures to prevent an over-heating of the economy.

The National Bureau of Economic Research (NBER) is the official arbiter of business cycle dates in the United States. Their meticulous analysis of economic data helps to determine when the economy has reached a peak or a trough, providing valuable information for economic planning and analysis.

Preparing for the Inevitable Downturn

What follows a peak is the contraction phase, often referred to as a recession. It's a period characterized by declining economic activity, rising unemployment, and falling consumer confidence. While recessions can be challenging, they are a natural part of the business cycle.

Prudent financial planning, both for individuals and businesses, becomes even more important as the economy approaches a peak. Building up savings, managing debt, and diversifying investments can help to weather the storm during the subsequent downturn. Remember, understanding the cycles is the key!

Like that rollercoaster approaching the top of the track, the economy's peak represents a moment of both excitement and potential vulnerability. By understanding the dynamics of the business cycle and carefully monitoring key economic indicators, we can better prepare for the twists and turns that lie ahead.

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)