The Importance Of Financial Literacy Opening A New Field

A critical gap in education is finally being addressed as financial literacy gains unprecedented traction, signaling a new frontier in personal empowerment and economic stability.

This burgeoning emphasis aims to equip individuals with the essential skills to navigate an increasingly complex financial landscape, fostering informed decision-making and long-term financial well-being.

The Rising Tide of Financial Literacy Initiatives

The push for financial literacy is no longer a niche concern; it's becoming a national imperative. Educational institutions, government agencies, and private organizations are launching comprehensive programs to reach diverse populations.

These initiatives aim to democratize financial knowledge, ensuring that everyone has the opportunity to build a secure financial future.

The urgency stems from alarming statistics revealing widespread financial vulnerability.

The Scope of the Problem

According to a 2023 report by the National Financial Educators Council (NFEC), only 24% of adults demonstrate a basic understanding of financial concepts. This startling figure underscores the need for immediate and widespread intervention.

Furthermore, studies by the FINRA Investor Education Foundation consistently show a significant percentage of Americans struggling with debt management and retirement planning.

These challenges disproportionately impact vulnerable communities, exacerbating existing inequalities.

New Programs and Collaborations

Several states are now mandating financial literacy courses in high schools. For example, starting this year, New Jersey requires all high school students to complete a personal finance course before graduation.

The U.S. Department of the Treasury is also actively supporting community-based financial literacy programs through grants and partnerships. Operation HOPE, a non-profit organization, is expanding its financial literacy workshops across the country, targeting underserved communities.

These workshops cover topics such as budgeting, credit repair, and homeownership.

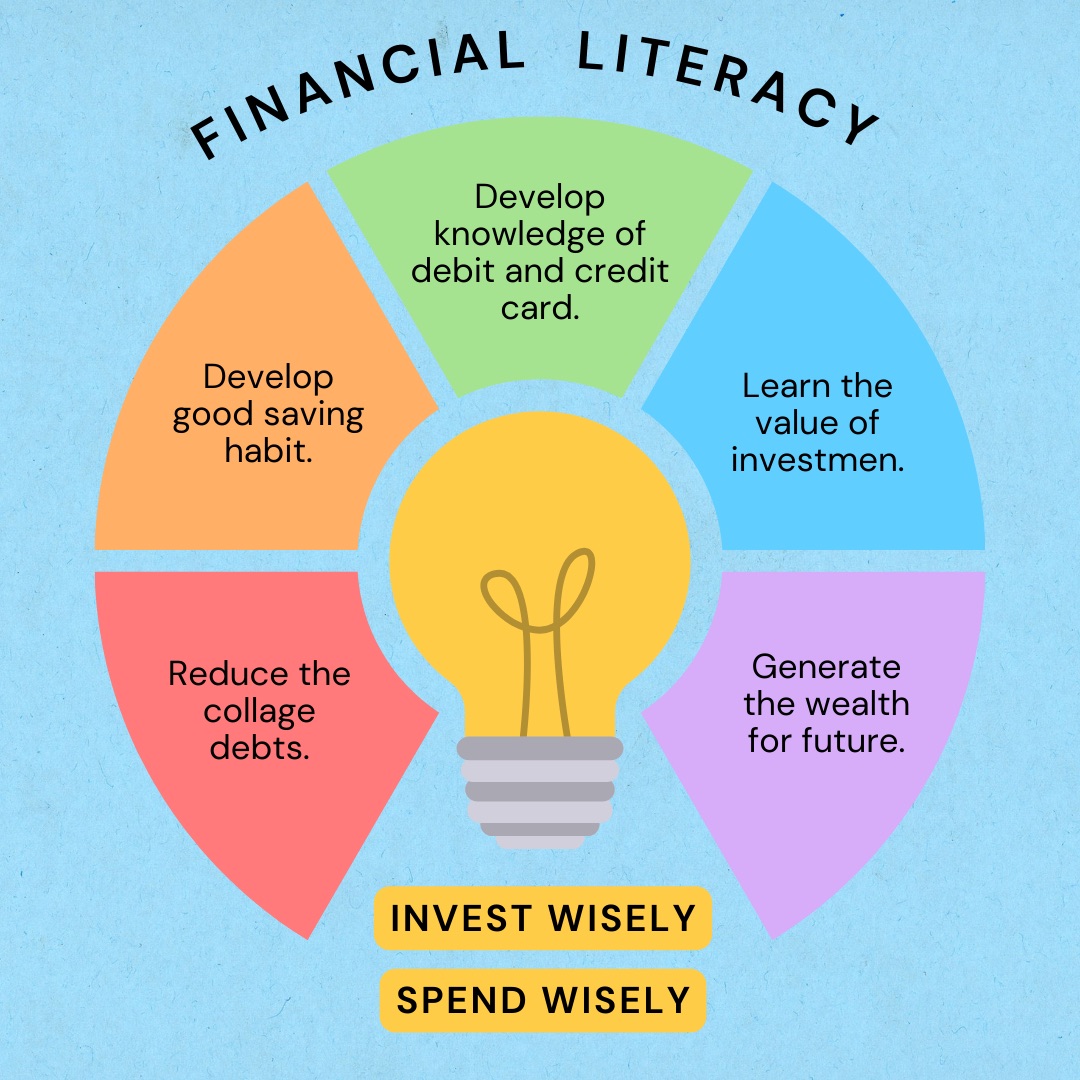

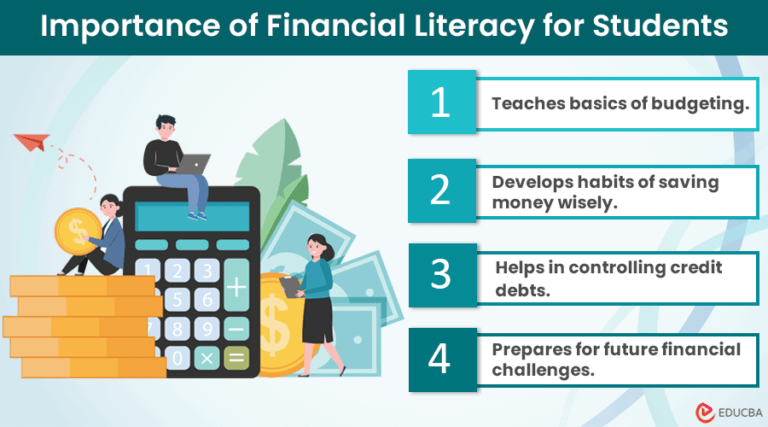

Curriculum and Key Concepts

The core of financial literacy education revolves around several key concepts. These include budgeting and saving, understanding credit scores and debt management, and learning about investing and retirement planning.

Furthermore, new programs are incorporating digital literacy components, equipping individuals to navigate online banking and identify potential scams.

Experts emphasize the importance of early intervention, introducing these concepts to children and adolescents to instill lifelong habits.

The Impact on Individuals and Communities

Improved financial literacy has the potential to transform lives and strengthen communities. By empowering individuals to make informed financial decisions, these programs contribute to reduced debt, increased savings, and greater financial stability.

This, in turn, can lead to improved health outcomes, reduced stress, and increased opportunities for education and career advancement.

Economists predict that a more financially literate population will also drive economic growth and resilience.

Real-Life Success Stories

Maria Rodriguez, a single mother who participated in a financial literacy program in Los Angeles, shared her experience: "Before the program, I was living paycheck to paycheck, drowning in debt. Now, I have a budget, I'm saving for my children's education, and I feel in control of my future."

Similarly, David Chen, a small business owner in Chicago, credits a financial literacy workshop with helping him secure a small business loan and expand his operations. These stories highlight the tangible benefits of financial education.

Their stories emphasize the potential for financial literacy to provide a pathway to economic empowerment for individuals and families.

Addressing Systemic Barriers

While financial literacy education is crucial, experts acknowledge that it is not a panacea. Systemic barriers, such as predatory lending practices and discriminatory financial policies, must also be addressed to create a truly equitable financial system.

Advocates are calling for greater regulation of the financial industry and increased access to affordable financial services for all. The Consumer Financial Protection Bureau (CFPB) is actively working to protect consumers from unfair and deceptive financial practices.

These efforts complement financial literacy initiatives by creating a more level playing field.

The Future of Financial Literacy

The movement toward greater financial literacy is gaining momentum, with ongoing efforts to expand access to education and address systemic barriers. Technology is playing a key role in this evolution.

Innovative online platforms and mobile apps are making financial education more accessible and engaging. These tools provide personalized guidance and interactive learning experiences.

Looking ahead, the focus will be on scaling these initiatives and ensuring that financial literacy education is integrated into all aspects of education and community development.

Next Steps and Ongoing Developments

The Jump$tart Coalition, a leading advocate for financial literacy, is hosting a national conference in Washington, D.C., next month to discuss best practices and strategies for advancing financial education.

Lawmakers are also considering new legislation to support financial literacy initiatives at the federal level. The ongoing developments signal a continued commitment to empowering individuals with the financial knowledge they need to thrive.

Stay tuned for updates as this critical field continues to evolve.

![The Importance Of Financial Literacy Opening A New Field Why Financial Literacy is Important? [10+ Best Usage]](https://zoets.b-cdn.net/wp-content/uploads/2022/12/Why-Financial-Literacy-is-Important-e1672230191618.png)