The Kings Of Scalability 3 Stocks To Buy Now

The ability of a company to rapidly grow and handle increasing demand is a key factor for investors seeking long-term gains. Scalability, the capacity to increase production volume to meet market needs efficiently, has become a crucial metric for assessing a company's future potential.

This article examines three stocks identified by analysts as possessing exceptional scalability, highlighting their business models, growth strategies, and potential for significant expansion. These selections are based on factors like technological innovation, market leadership, and strong financial foundations.

The Rise of Scalable Businesses

In today's fast-paced market, companies that can scale quickly and efficiently gain a significant competitive edge. This ability translates into greater market share, improved profitability, and enhanced shareholder value.

Scalability isn't just about increasing production; it involves optimizing operations, leveraging technology, and adapting to changing market conditions. Businesses with scalable models are better positioned to capitalize on emerging opportunities and navigate economic uncertainties.

Amazon (AMZN)

Amazon, the e-commerce and cloud computing giant, continues to exemplify scalability through its diverse range of services and global infrastructure. Its well-established logistics network and Amazon Web Services (AWS) are designed to handle massive volumes of transactions.

Amazon's focus on technological innovation, including automation and artificial intelligence, enhances its ability to scale its operations. The company's recent investments in delivery drones and expanding its fulfillment network are designed to streamline processes and reduce costs.

"Amazon's ability to consistently innovate and expand its services makes it a top pick for investors looking for scalability," said a market analyst from Morgan Stanley.

Salesforce (CRM)

Salesforce, the leading provider of cloud-based customer relationship management (CRM) software, has built its business on a highly scalable platform. Its software-as-a-service (SaaS) model allows companies to easily scale their CRM capabilities as their customer base grows.

Salesforce's ecosystem of applications and integrations, including acquisitions like Slack and Tableau, provides businesses with a comprehensive suite of tools. This integrated approach creates a powerful platform for managing customer relationships and driving sales growth.

Salesforce continually invests in research and development to enhance its platform and expand its capabilities. This commitment to innovation ensures that its solutions remain relevant and scalable for businesses of all sizes.

Alphabet (GOOGL)

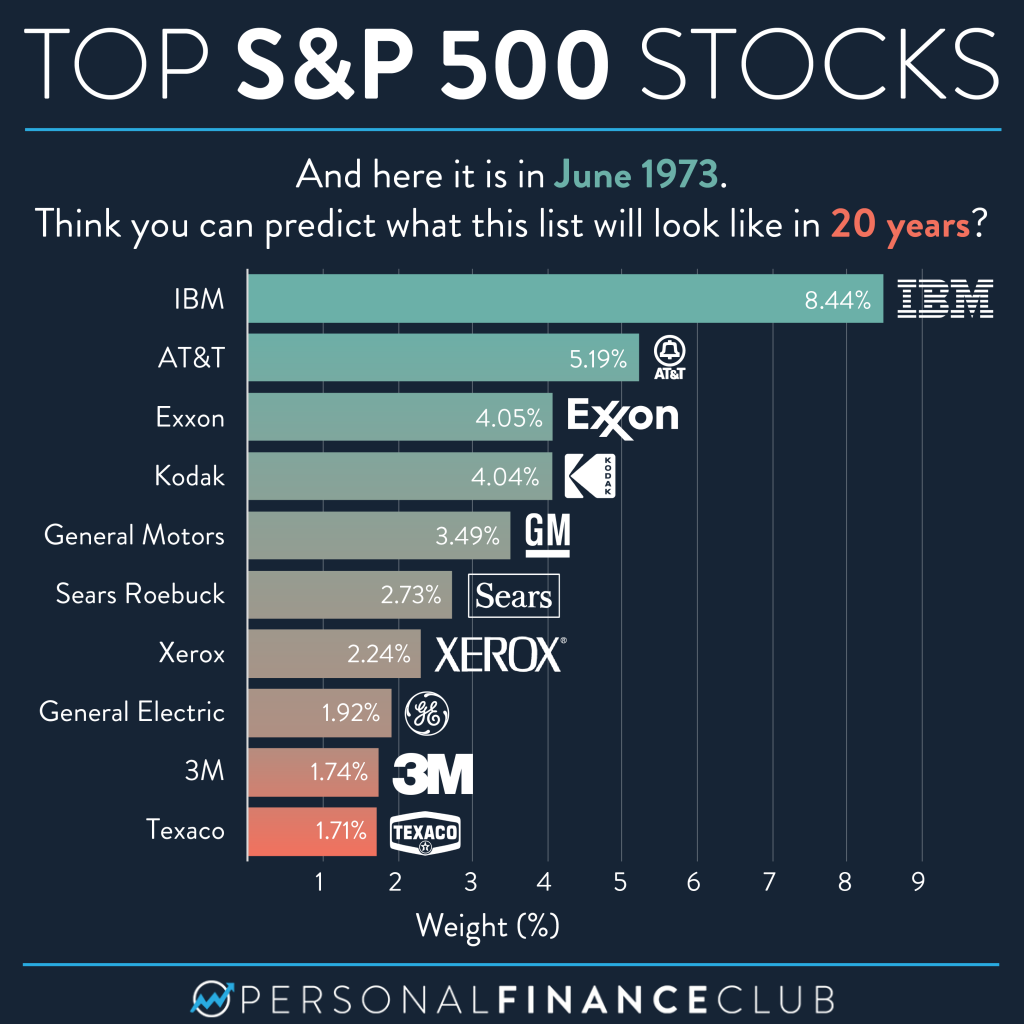

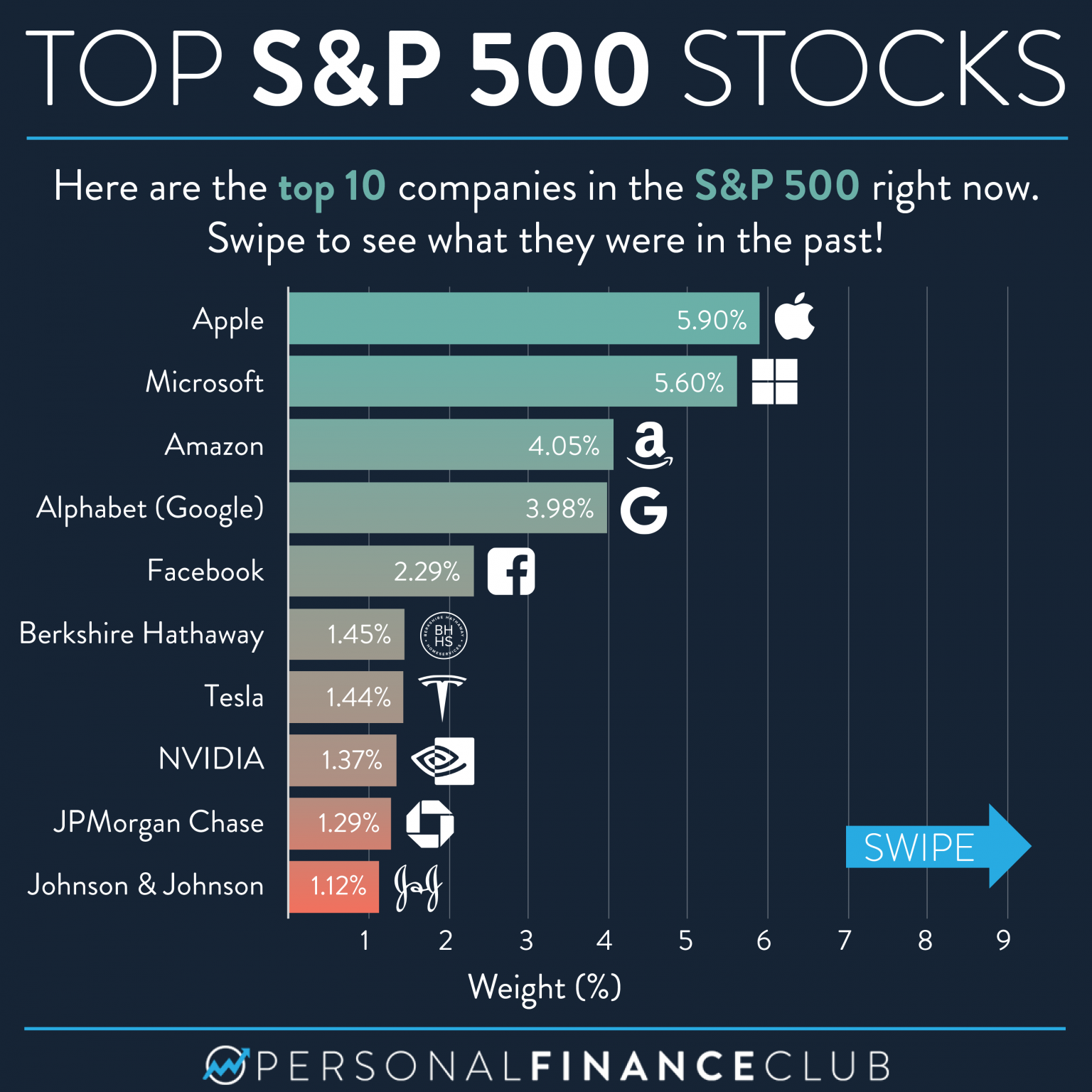

Alphabet, the parent company of Google, benefits from the inherent scalability of its digital advertising and cloud computing businesses. Google's search engine and advertising platform can handle billions of queries and transactions daily.

Google Cloud Platform (GCP), Alphabet's cloud computing division, is rapidly expanding its infrastructure and services to compete with other cloud providers. The investments in data centers, networking, and artificial intelligence give it the capabilities to serve diverse needs.

Alphabet's focus on innovation, including its investments in artificial intelligence and autonomous vehicles, positions it for future growth. Its ability to leverage technology to scale its businesses is a key driver of its long-term success.

Investing in Scalability: A Long-Term Strategy

Investing in companies with high scalability requires a long-term perspective. These businesses often invest heavily in infrastructure, technology, and talent to support their growth.

While there are inherent risks associated with any investment, companies that demonstrate a proven ability to scale their operations are better positioned to generate sustained returns.

Investors should conduct thorough research and consider their risk tolerance before investing in these stocks. Diversification and a disciplined investment strategy are essential for managing risk and maximizing returns.