The Largest Expense On A Retailer's Income Statement Is Typically

The razor-thin margins of the retail world are a constant battleground, where success hinges on meticulous cost management. While flashy marketing campaigns and trendy merchandise often steal the spotlight, the real story of a retailer's financial health lies in the careful balance of its income statement. Understanding where the bulk of revenue is allocated is crucial for both investors and industry insiders alike.

This article delves into the often-overlooked giant on a retailer's income statement: the cost of goods sold (COGS). This expense, representing the direct costs of producing or purchasing the merchandise sold, typically dwarfs all other expenses, including salaries, marketing, and rent. We will explore the components of COGS, examine its impact on profitability, and consider strategies retailers employ to manage this critical line item.

Understanding the Cost of Goods Sold (COGS)

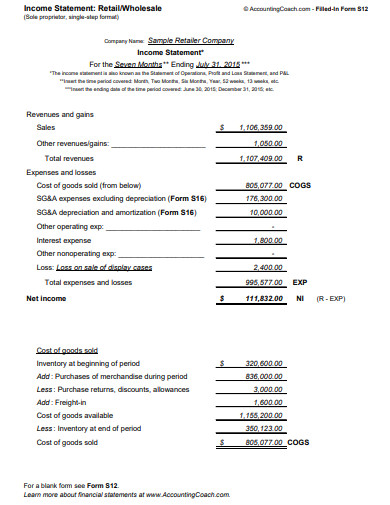

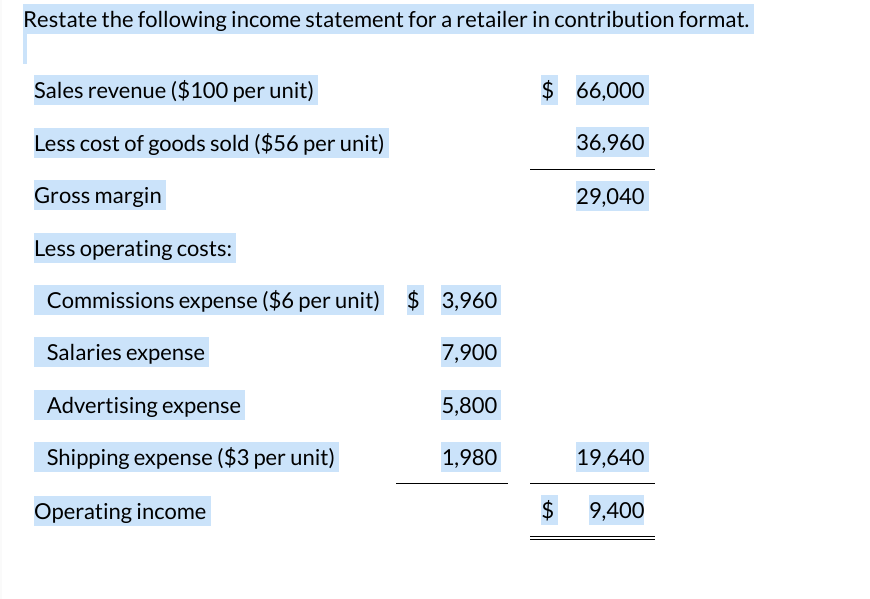

COGS, also known as cost of sales, represents the direct expenses linked to creating and selling a company's products. It encompasses the raw materials, direct labor, and manufacturing overhead involved in production.

For retailers who purchase finished goods for resale, COGS primarily includes the purchase price of the merchandise, plus any associated transportation or storage costs. This figure is a crucial indicator of a retailer's efficiency in sourcing and managing its inventory.

Components of COGS

The specific components included in COGS can vary depending on the type of retailer. For manufacturers, raw materials represent a significant portion of the expense. For retailers reselling goods, the purchase price from suppliers dominates.

Direct labor costs, encompassing wages and benefits for workers directly involved in production or assembly, are crucial for manufacturers. Additionally, manufacturing overhead, encompassing indirect costs like factory rent, utilities, and depreciation of manufacturing equipment, further shapes the COGS.

Importantly, selling, general, and administrative expenses (SG&A), such as marketing, salaries of administrative staff, and rent for corporate offices, are not included in COGS. These are separate operating expenses.

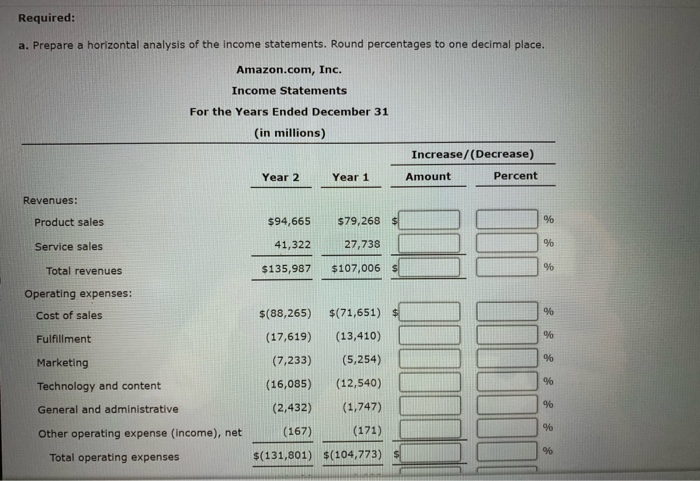

Why COGS Typically Dominates the Income Statement

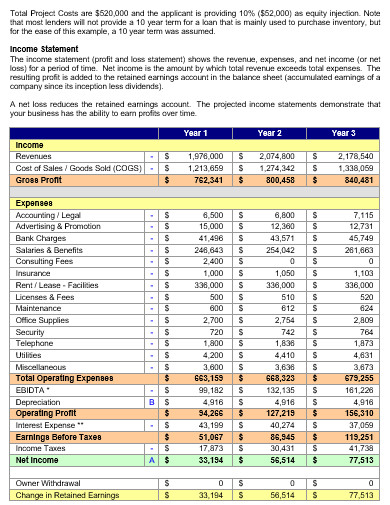

The sheer volume of merchandise that retailers move makes COGS the largest expense. Consider a grocery store: its entire business model revolves around purchasing and selling vast quantities of food items, making the cost of those items the primary driver of its expenses.

The nature of retail, particularly in sectors with low profit margins, necessitates a laser focus on controlling COGS. Even small fluctuations in the purchase price of inventory can have a significant impact on the bottom line. The higher the sales volume, the greater the impact of even small cost increases.

Competition within the retail landscape further exacerbates the importance of managing COGS. Retailers must constantly strive to offer competitive prices while maintaining profitability, a delicate balancing act that requires efficient sourcing and inventory management.

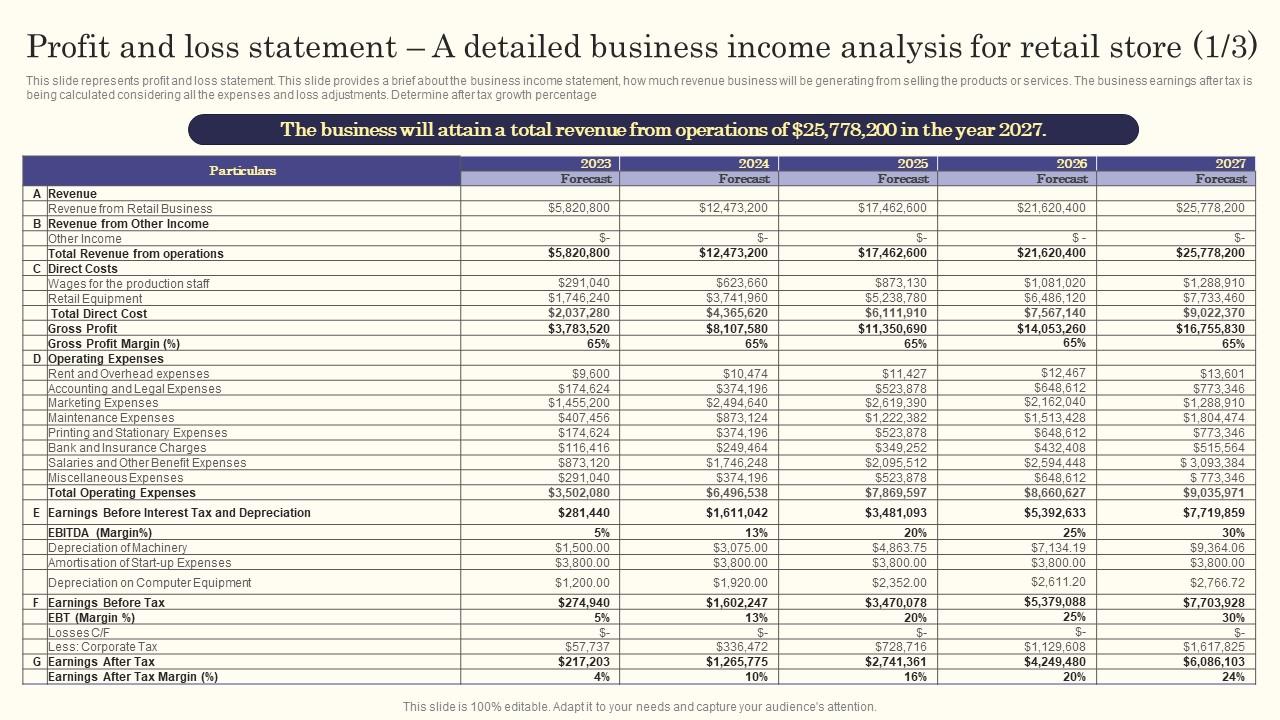

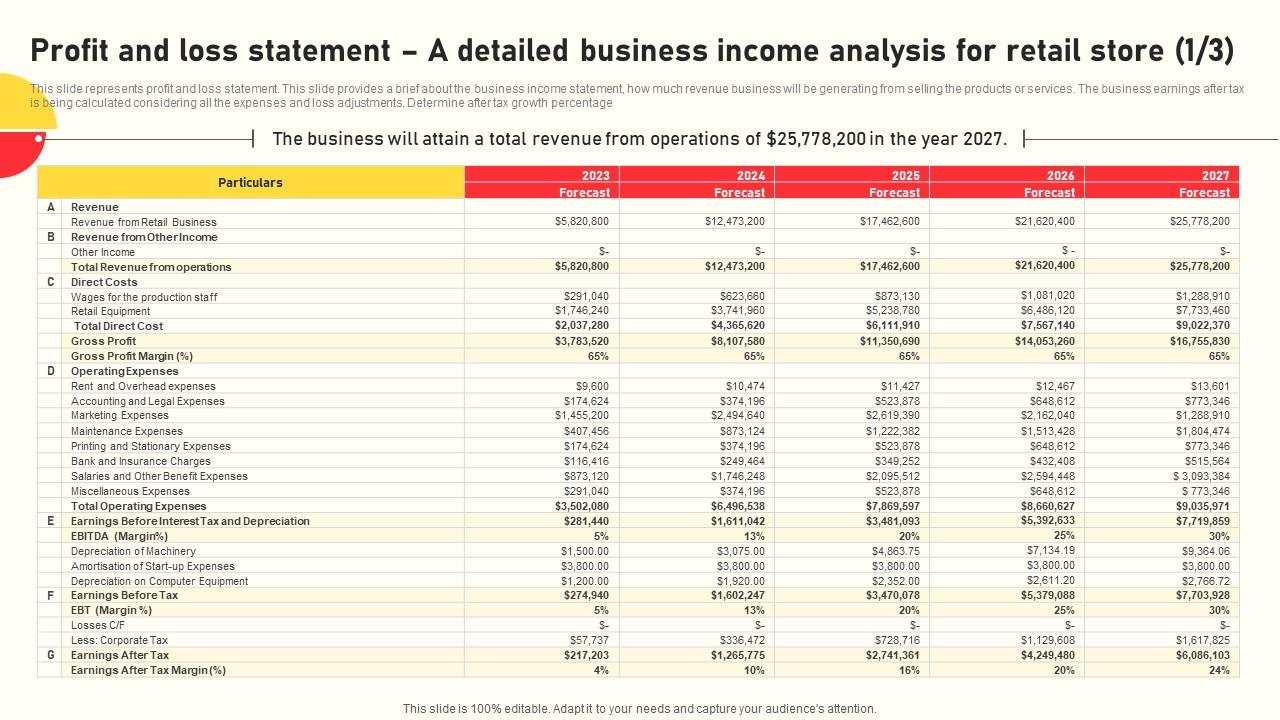

Impact of COGS on Profitability Metrics

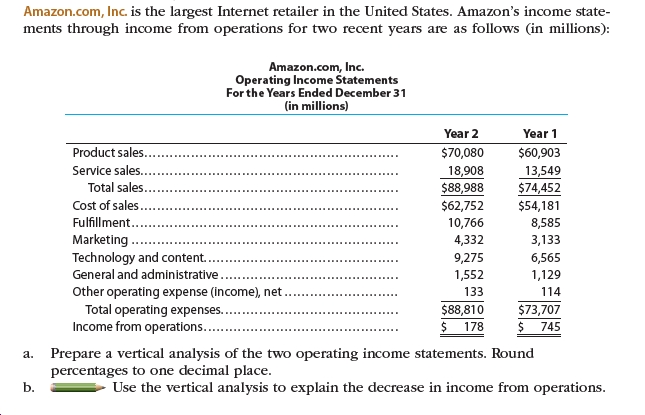

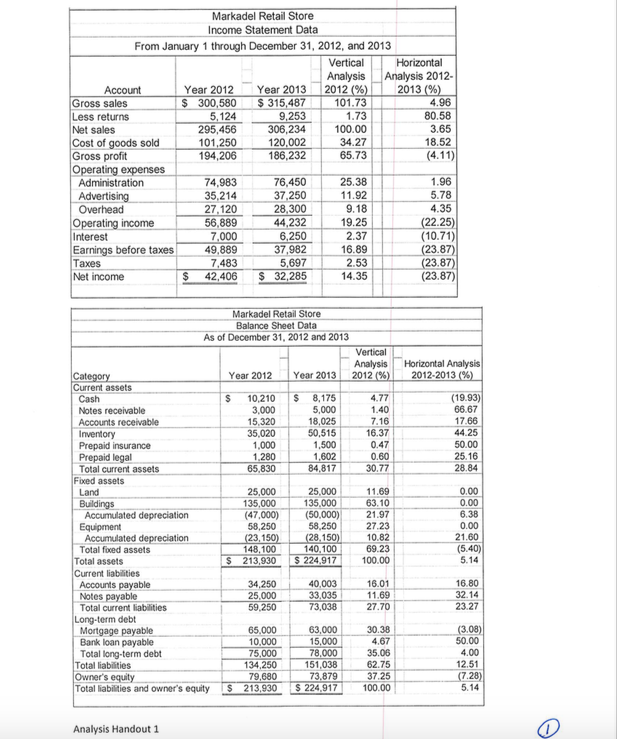

COGS directly impacts key profitability metrics, most notably gross profit. Gross profit is calculated by subtracting COGS from total revenue.

A lower COGS results in a higher gross profit, leaving more funds available to cover operating expenses and generate net profit. Conversely, a higher COGS reduces gross profit, potentially impacting the ability to invest in growth or return value to shareholders.

Furthermore, the gross profit margin, calculated as gross profit divided by total revenue, provides a valuable measure of a retailer's efficiency in converting sales into profit after accounting for the direct costs of goods sold. Investors often scrutinize this metric to assess a retailer's competitive advantage and pricing power.

Strategies for Managing and Reducing COGS

Retailers employ various strategies to effectively manage and reduce COGS. These include negotiating favorable pricing with suppliers, optimizing supply chains, and improving inventory management practices.

Strategic sourcing involves identifying and securing the best possible prices from suppliers, often through bulk purchasing or long-term contracts. This can involve diversifying suppliers or even developing private-label brands to gain greater control over costs.

Efficient supply chain management aims to minimize transportation and storage costs. This includes streamlining logistics, optimizing warehouse locations, and implementing just-in-time inventory systems to reduce holding costs and waste.

Effective inventory management is crucial in minimizing losses due to spoilage, obsolescence, or markdowns. Accurate forecasting, demand planning, and inventory control systems are essential for avoiding stockouts while minimizing excess inventory.

Technology also plays a crucial role. Many retailers are adopting sophisticated analytics tools to forecast demand more accurately and optimize inventory levels. These systems use data to predict consumer behavior and ensure the right products are in the right place at the right time.

Beyond the Numbers: Ethical Considerations

While reducing COGS is essential for profitability, retailers must also consider the ethical implications of their sourcing practices. Pressures to lower costs can sometimes lead to exploitation of labor or environmentally damaging practices.

Consumers are increasingly demanding that retailers operate ethically and sustainably. Companies that prioritize ethical sourcing and sustainable practices can build brand loyalty and enhance their reputation, mitigating potential long-term risks associated with unethical cost-cutting measures.

Therefore, retailers must strike a balance between cost efficiency and ethical responsibility, ensuring that their efforts to manage COGS do not come at the expense of human rights or environmental sustainability.

The Future of COGS Management in Retail

The retail landscape is constantly evolving, and the importance of effective COGS management will only continue to grow. E-commerce, changing consumer preferences, and global economic uncertainties are creating new challenges and opportunities for retailers.

Artificial intelligence (AI) and machine learning are poised to revolutionize supply chain management, enabling retailers to predict demand with greater accuracy and optimize logistics in real-time. These technologies can help to reduce waste, minimize transportation costs, and improve overall efficiency.

Ultimately, the retailers that thrive in the future will be those that can effectively leverage technology, build strong supplier relationships, and prioritize ethical and sustainable sourcing practices. Mastering COGS management is no longer just a matter of profitability; it is a matter of survival in an increasingly competitive and dynamic retail environment.