The Level Of Investment In Markets Often Indicates

Market investment levels are a crucial barometer of economic health and future prospects. Fluctuations in investment can signal impending booms, recessions, or shifts in specific sectors, impacting individuals, businesses, and governments alike.

The level of investment in markets often serves as a key indicator of economic sentiment and anticipated growth. This article examines how these investment levels reflect underlying economic conditions, influence market behavior, and potentially impact future societal well-being.

Understanding Investment as an Indicator

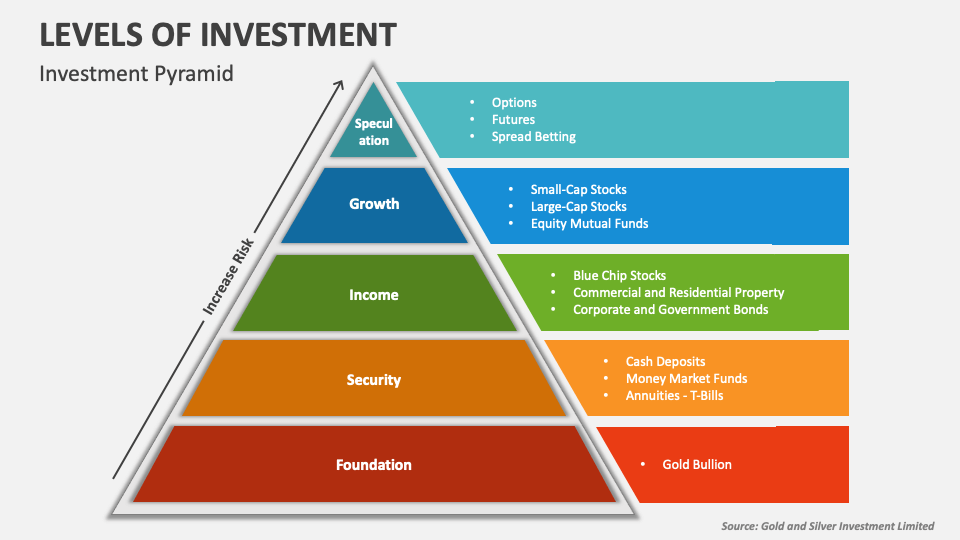

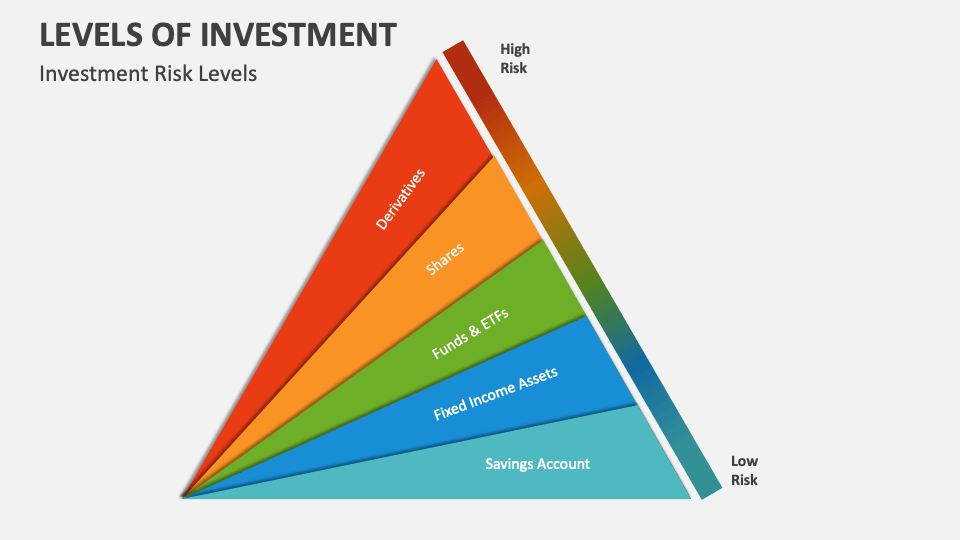

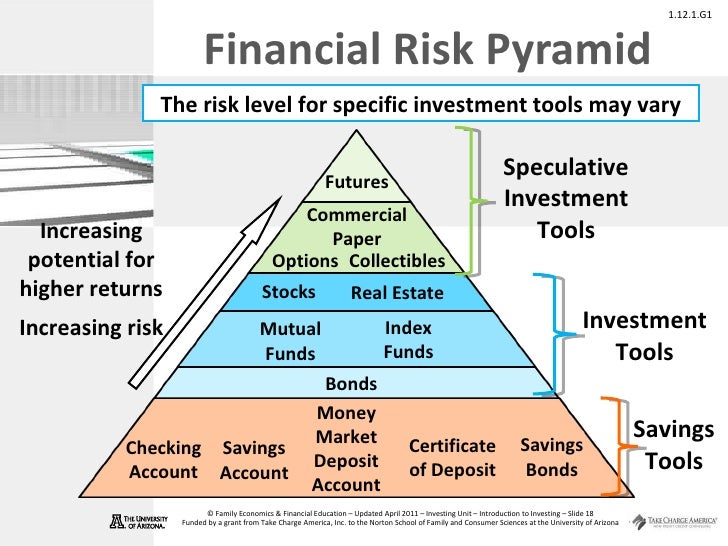

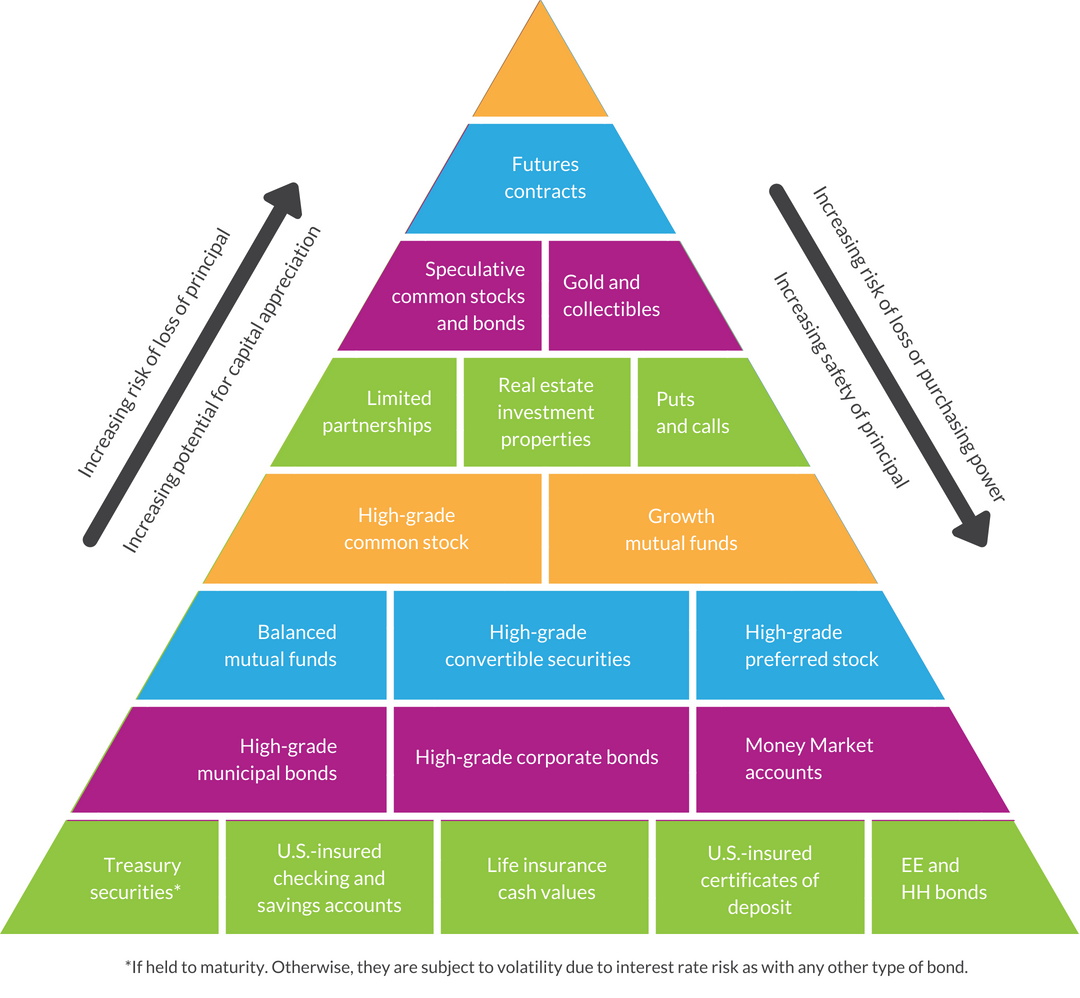

Investment, broadly defined, encompasses the deployment of capital into assets expected to generate future income or appreciation. This can include investments in stocks, bonds, real estate, infrastructure, and even research and development.

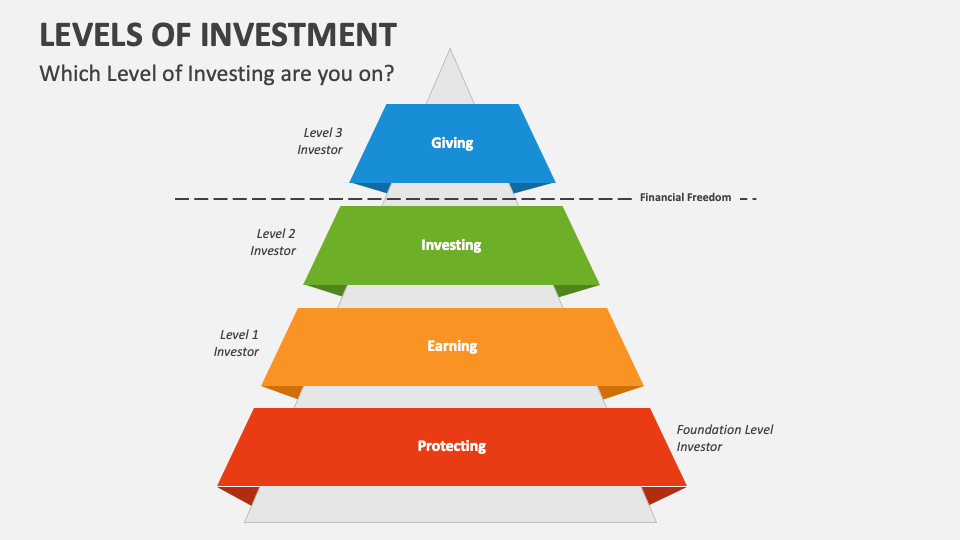

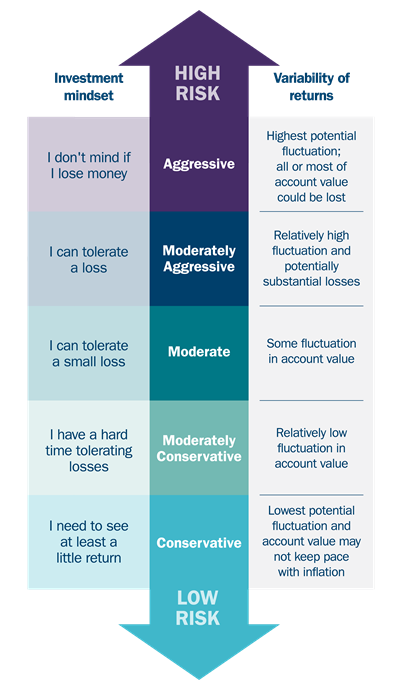

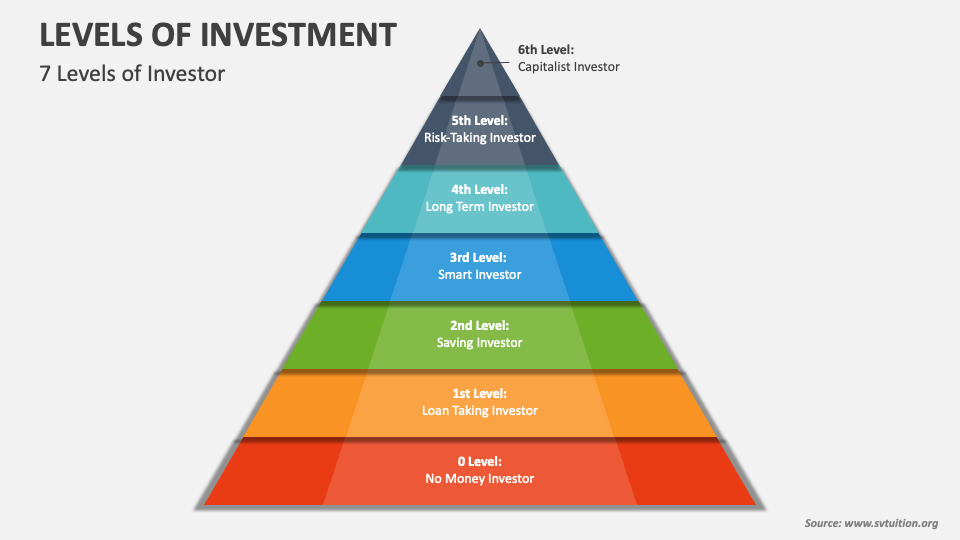

High levels of investment typically suggest a positive outlook, with investors confident in future returns. Conversely, low investment levels can signal uncertainty or pessimism about economic prospects.

Key Indicators and Their Significance

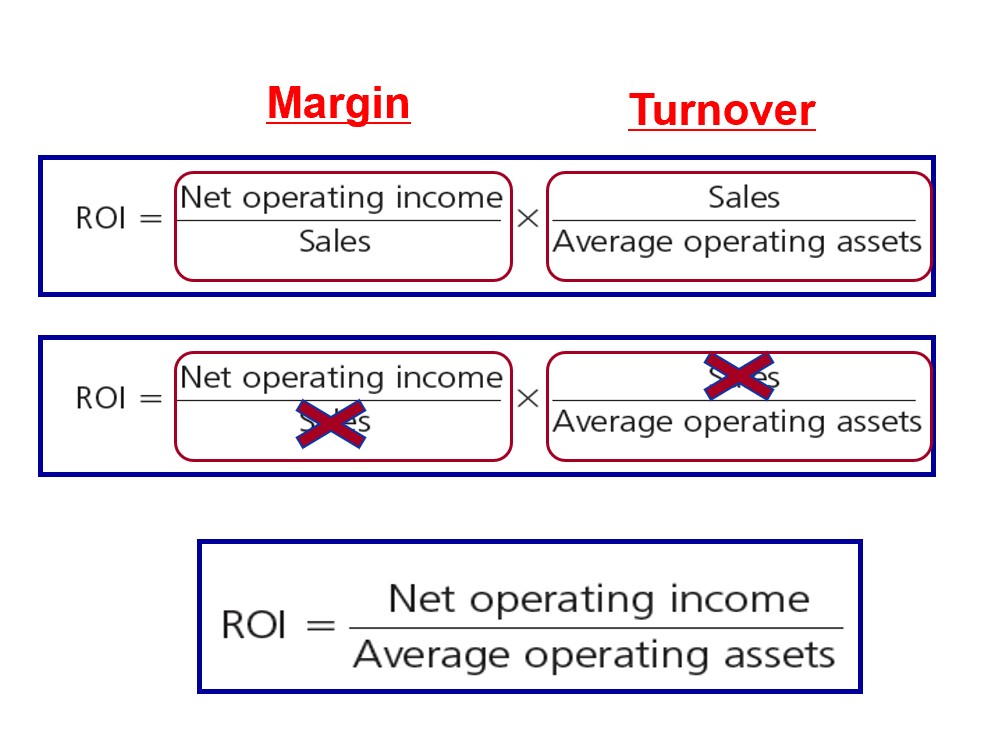

Several key indicators related to investment provide insights into market sentiment. These include foreign direct investment (FDI), capital expenditure (CapEx), and initial public offerings (IPOs).

Foreign Direct Investment (FDI) reflects the confidence of international investors in a country's economic stability and growth potential. Increased FDI often leads to job creation and technological advancement.

Capital Expenditure (CapEx) represents investments by companies in fixed assets like property, plant, and equipment. Rising CapEx often indicates that companies are expanding operations and anticipating future demand.

Initial Public Offerings (IPOs) are a measure of investor appetite for new companies entering the stock market. A surge in IPO activity can suggest a bullish market sentiment and willingness to take risks.

Recent Trends and Analysis

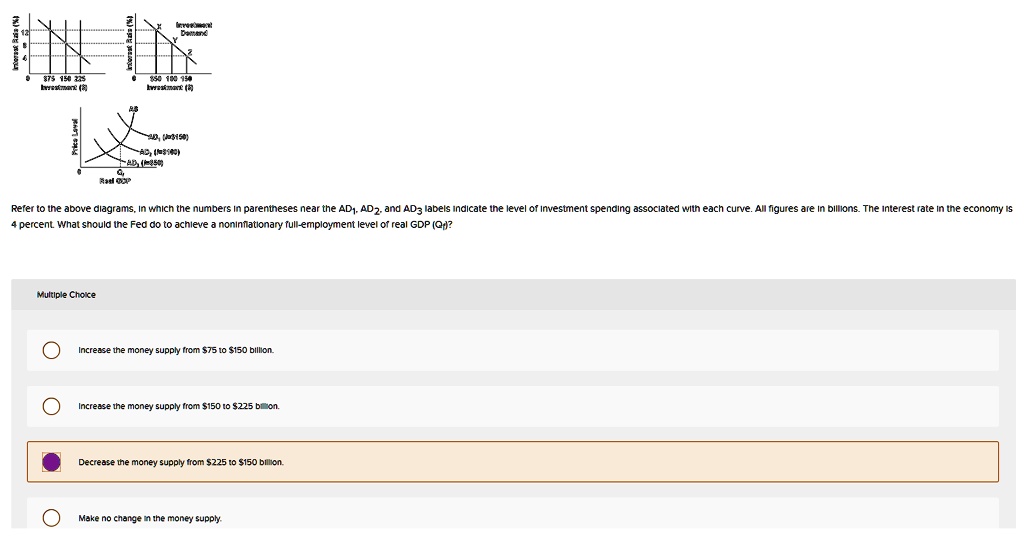

Recent data from organizations like the International Monetary Fund (IMF) and the World Bank indicate a mixed picture regarding global investment. While some sectors have seen robust growth, others have experienced significant declines.

Technology and renewable energy have generally attracted significant investment, driven by innovation and growing demand. However, traditional sectors like fossil fuels have faced headwinds due to environmental concerns and regulatory changes.

Geopolitical uncertainty and trade tensions have also played a significant role in influencing investment decisions. Investors are often cautious about deploying capital in regions with high levels of political or economic instability.

The Impact on Society

The level of investment has profound implications for society as a whole. Increased investment can lead to job creation, higher wages, and improved living standards.

Furthermore, investments in areas like healthcare and education can contribute to long-term societal well-being. Conversely, declining investment can result in job losses, economic stagnation, and reduced opportunities.

"Sustained investment is crucial for driving economic growth and improving the quality of life for citizens," says Dr. Anya Sharma, a leading economist at the Institute for Global Economics.

Case Studies and Examples

Several historical examples illustrate the importance of investment as an economic indicator. The dot-com boom of the late 1990s saw a surge in investment in technology companies, followed by a dramatic bust when the bubble burst.

Similarly, the housing boom of the mid-2000s was fueled by excessive investment in the real estate market, leading to the global financial crisis of 2008. These examples highlight the need for prudent investment decisions and regulatory oversight.

More recently, the rapid growth of China's economy has been driven by massive investments in infrastructure and manufacturing. This has transformed China into a global economic powerhouse but has also raised concerns about overcapacity and environmental sustainability.

Looking Ahead

The future of investment will likely be shaped by several key factors. These include technological advancements, demographic shifts, and climate change.

Investments in artificial intelligence, automation, and biotechnology are expected to grow rapidly, transforming industries and creating new economic opportunities. However, these technologies also raise concerns about job displacement and ethical considerations.

Climate change is also driving significant investment in renewable energy, electric vehicles, and sustainable agriculture. These investments are crucial for mitigating the impacts of climate change and building a more sustainable future.

The Role of Government

Governments play a vital role in shaping the investment landscape. They can create a stable and predictable regulatory environment, invest in infrastructure, and provide incentives for private sector investment.

Furthermore, governments can promote education and training to ensure that the workforce has the skills needed to thrive in a changing economy. Public-private partnerships can also be effective in mobilizing investment for large-scale projects.

Sound fiscal policy and effective governance are essential for attracting investment and fostering sustainable economic growth. Countries with strong institutions and transparent regulatory frameworks tend to attract more investment than those with weak institutions and corruption.

Conclusion

The level of investment in markets is a critical indicator of economic health and future prospects. By monitoring investment trends and understanding their underlying drivers, individuals, businesses, and governments can make more informed decisions and better prepare for the future.

Prudent investment decisions, coupled with sound economic policies, are essential for driving sustainable growth and improving the well-being of society. Ignoring the signals sent by investment levels can lead to missed opportunities or even economic crises.

Therefore, a thorough understanding of investment dynamics is crucial for navigating the complexities of the global economy and building a prosperous future.