The Mood Of The American Consumer Is Souring

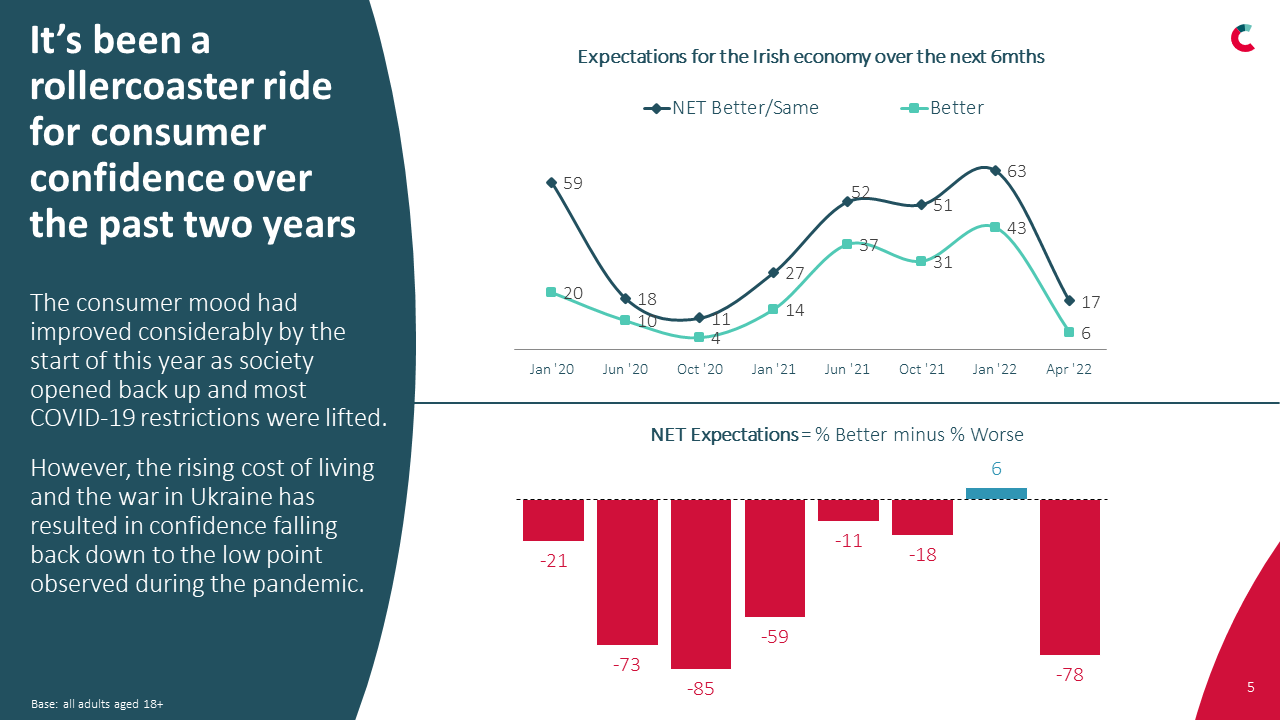

Alarm bells are ringing as new data reveals a rapid decline in American consumer sentiment, signaling potential economic headwinds. Spending habits are shifting, and confidence is waning, raising concerns about future economic stability.

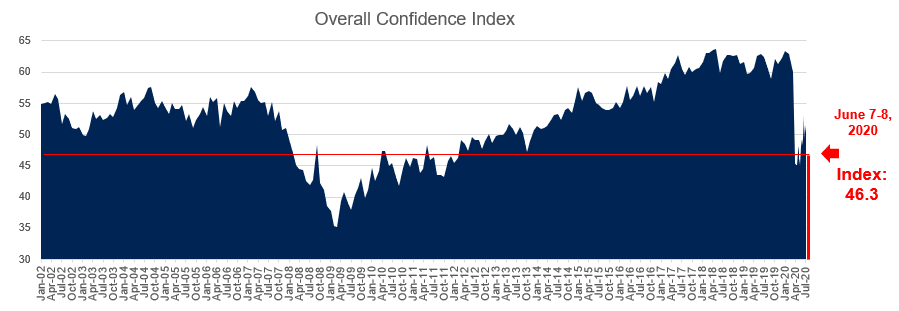

The erosion of consumer confidence, reflected in recent indices and spending reports, suggests a growing unease among Americans about the economy's current state and future prospects. This shift could have significant implications for businesses and the overall economic trajectory.

Diving into the Data: A Sharp Downturn

The University of Michigan's Consumer Sentiment Index plummeted to 67.4 in May 2024, a significant drop from April's 77.2. This marks the lowest level in six months, according to the latest report released this morning.

This decline underscores a growing sense of pessimism regarding personal finances and the broader economic outlook. The survey highlights concerns about inflation and the overall economic direction of the country.

What is happening? Consumer sentiment is sharply declining, indicating a growing unease among Americans about the economy.

Spending Habits: Pulling Back the Reins

Retail sales figures released by the Commerce Department show a concerning trend. April's retail sales remained stagnant, far below the expected modest increase forecasted by economists.

This slowdown in spending reflects a cautious approach by consumers who are increasingly wary of rising prices and economic uncertainty. Discretionary spending, in particular, is experiencing a noticeable contraction.

How are consumers reacting? They are reducing spending, especially on non-essential items, and expressing less confidence in the economy.

Who Is Feeling the Pinch?

The decline in sentiment is widespread, affecting various demographic groups across the country. However, lower-income households and younger Americans are disproportionately feeling the strain of inflation and economic uncertainty.

According to the Bureau of Labor Statistics, inflation remains stubbornly high, eroding purchasing power, particularly for essential goods and services. This impacts lower-income families the most.

Who is affected? While the impact is broad, lower-income households and younger Americans are feeling it most acutely due to inflation.

Where Is This Happening?

The impact of declining consumer sentiment is being felt across the nation, with some regions experiencing more pronounced effects than others. Areas heavily reliant on consumer spending, like tourist destinations and retail hubs, are particularly vulnerable.

Data suggests that states with higher unemployment rates and greater exposure to specific economic downturns are experiencing the most significant decline in consumer confidence. Local economies are feeling the strain.

Where is this happening? The impact is national, but regions reliant on consumer spending and those with higher unemployment are feeling it more.

Why the Sudden Shift? Inflation and Interest Rates

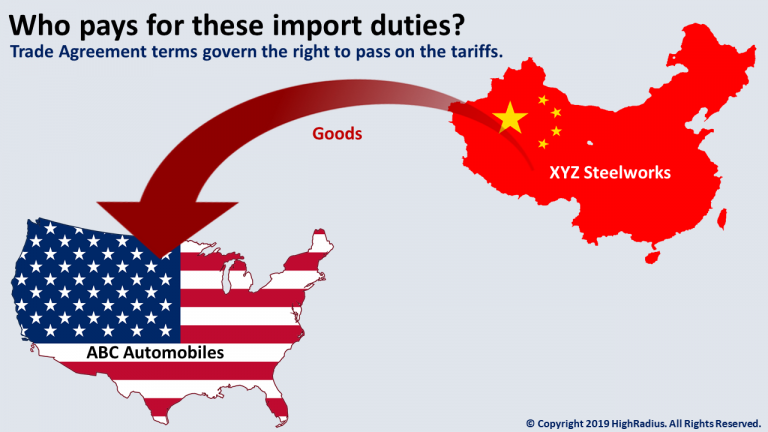

The primary drivers behind the souring mood are persistent inflation and rising interest rates. Consumers are grappling with higher prices for everything from groceries to gasoline, while also facing increased borrowing costs.

The Federal Reserve's efforts to combat inflation by raising interest rates are impacting consumer spending and investment decisions. The increased cost of borrowing is dampening demand.

Why is this happening? Primarily due to persistent inflation and rising interest rates, eroding purchasing power and increasing borrowing costs.

When Did This Shift Begin?

The decline in consumer sentiment began to accelerate in late April and early May 2024. Several economic indicators started to flash warning signs during this period.

Concerns about the overall economic outlook grew following a series of discouraging economic reports. The trend is new.

When did this start? The decline accelerated in late April and early May 2024.

Implications and Next Steps

The weakening consumer sentiment poses a significant risk to economic growth. Businesses may face reduced demand, potentially leading to layoffs and further economic contraction.

Economists and policymakers are closely monitoring these trends, and the Federal Reserve's next moves regarding interest rates will be crucial. Further increases could exacerbate the situation, while premature easing could risk fueling inflation.

The coming weeks will be critical in determining whether this decline is a temporary blip or a sign of a more sustained economic slowdown. Vigilance is key.