The Number Of Shares Of Issued Stock Equals

Imagine strolling through a bustling marketplace, the air thick with the scent of spices and the cacophony of vendors hawking their wares. Each stall represents a tiny piece of a larger economic ecosystem, and the goods on display, in a way, are like the shares of a company – discrete, measurable units representing ownership and value. The essence of understanding a company's structure often boils down to a single, crucial number: the number of shares of issued stock.

The total number of issued shares reflects the full extent of ownership distributed among investors. This figure, a bedrock of financial analysis, profoundly influences everything from earnings per share calculations to understanding shareholder voting power. By grasping its significance, investors can gain a clearer perspective on a company's financial health and strategic direction.

Understanding Issued Stock: The Basics

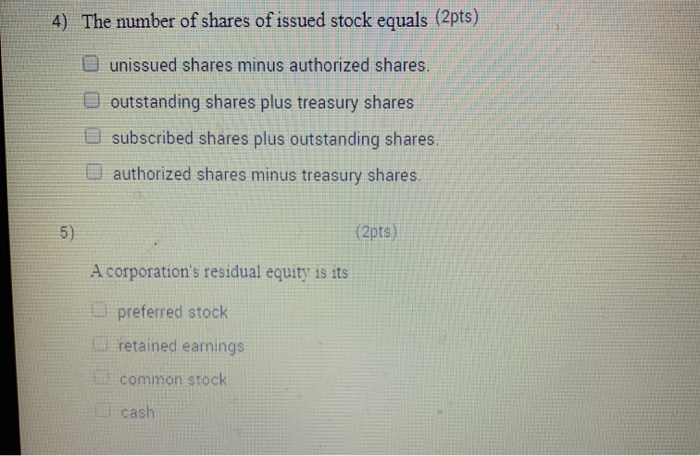

At its core, issued stock represents the portion of a company's authorized shares that have actually been sold to investors. Authorized shares represent the maximum number of shares a company is legally permitted to create and issue, as defined in its corporate charter. Think of it as the total capacity of the company to distribute ownership. However, only a fraction of this capacity is often put into circulation initially.

The difference between authorized shares and issued shares is important. The unissued shares remain within the company’s control and can be used for future fundraising, employee stock options, or other corporate purposes.

Why Does the Number of Issued Shares Matter?

The number of issued shares has a cascading effect on various aspects of a company's operations and valuation. Understanding this number is essential for accurate financial analysis and informed investment decisions. It impacts earnings per share, market capitalization, and even the control dynamics within the company.

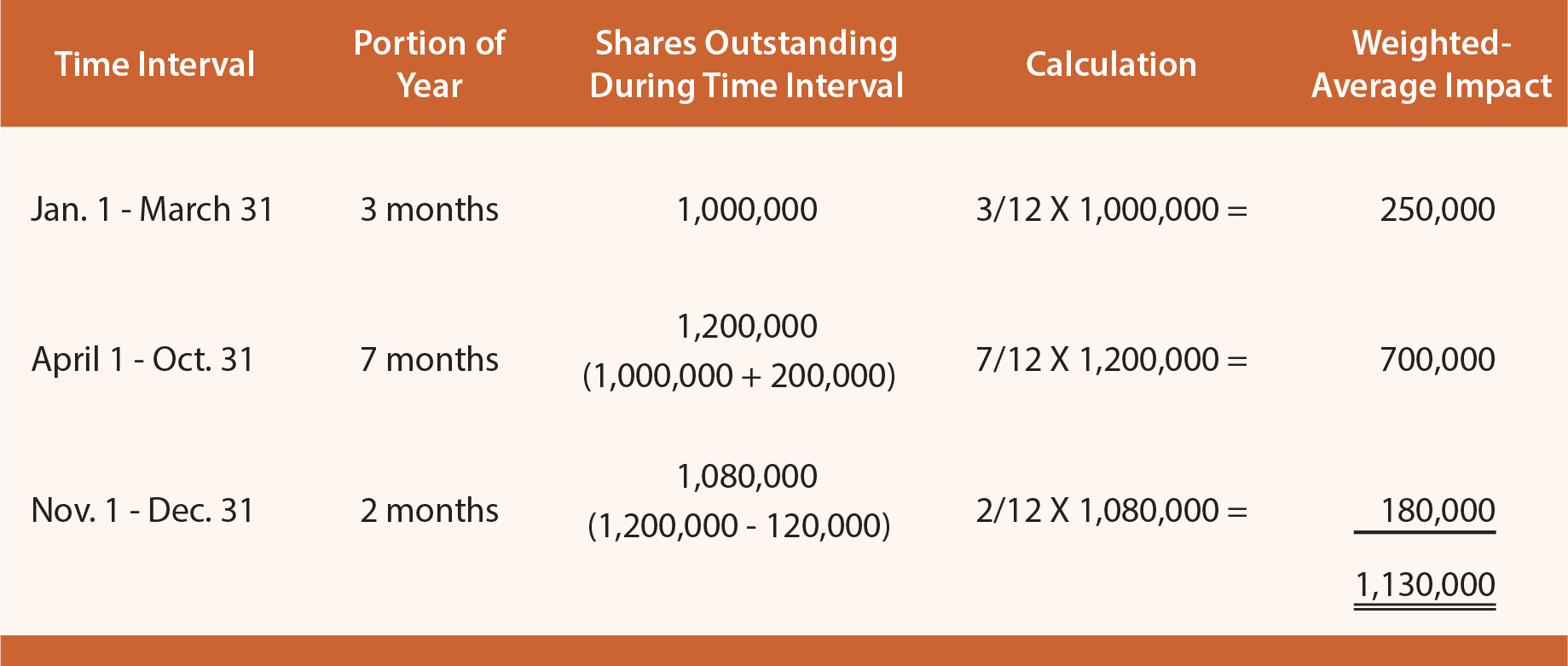

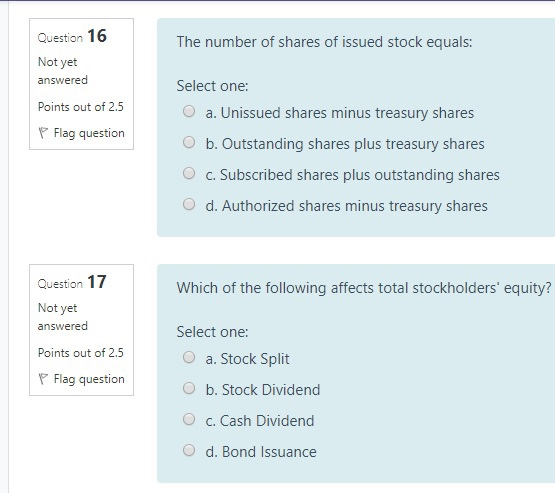

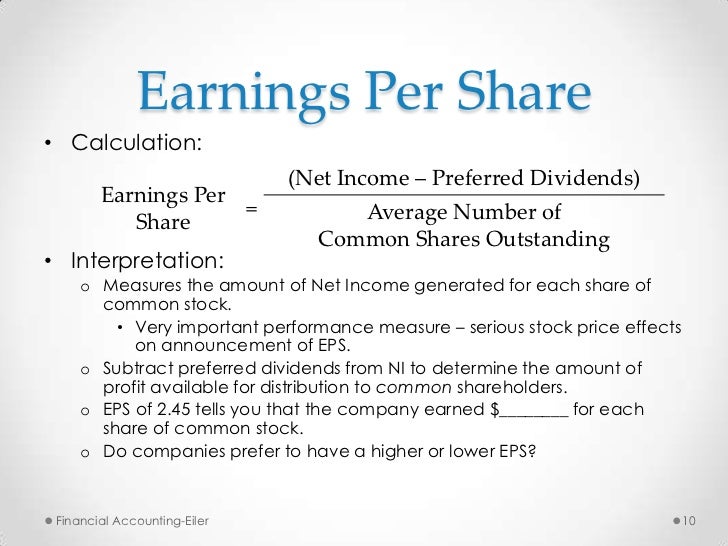

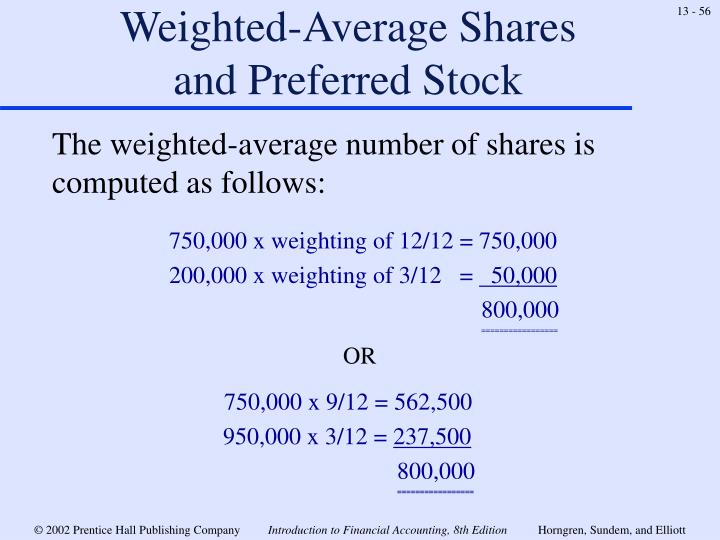

One of the most direct impacts is on earnings per share (EPS). EPS, a widely used metric for evaluating a company's profitability, is calculated by dividing net income by the number of outstanding shares. A higher number of issued shares will, all else being equal, result in a lower EPS.

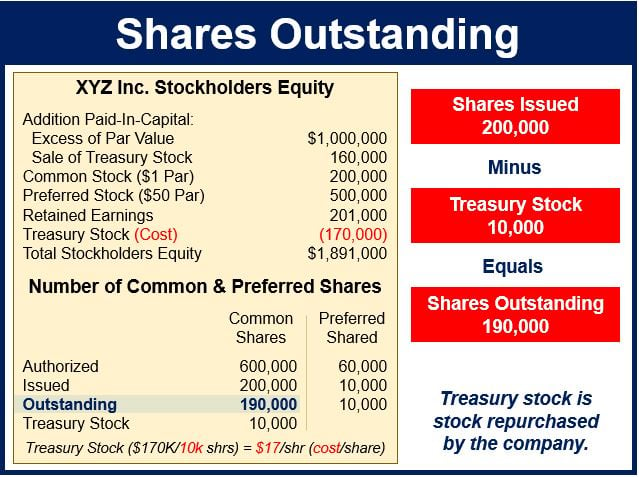

Market capitalization, another critical measure, is determined by multiplying the price per share by the number of outstanding shares. Understanding the impact of issued shares on this metric helps investors assess the overall size and value of the company in the market. Outstanding shares include issued shares that are held by investors, excluding any treasury stock.

Shareholder voting rights are directly tied to the number of shares held. Investors with a larger number of shares have a proportionally larger say in important company decisions, such as electing board members or approving major corporate actions. This can have a significant impact on corporate governance.

Factors Influencing the Number of Issued Shares

The number of issued shares is not static; it can change over time due to various corporate actions. These changes reflect the company's strategic decisions regarding capital structure and ownership distribution. Common events that alter the number of issued shares include initial public offerings, secondary offerings, stock splits, and stock buybacks.

An initial public offering (IPO) marks the first time a company offers shares to the public. This event dramatically increases the number of issued shares and brings in a significant influx of capital. Companies use this capital for expansion, debt repayment, or other strategic initiatives.

Secondary offerings occur when a company issues additional shares after its initial IPO. This can be done to raise further capital or to allow existing shareholders to sell their holdings. Like IPOs, secondary offerings dilute the existing shareholder base and affect EPS.

Stock splits increase the number of shares outstanding by dividing each existing share into multiple shares. This action lowers the price per share, making the stock more accessible to individual investors. Although the number of shares increases, the overall market capitalization remains the same.

Stock buybacks, also known as share repurchases, involve a company buying back its own shares from the open market. This reduces the number of outstanding shares, which can increase EPS and potentially boost the stock price. Buybacks are often seen as a sign that a company believes its stock is undervalued.

Finding the Number of Issued Shares

Fortunately, finding the number of issued shares is relatively straightforward. Public companies are required to disclose this information in their financial reports. These reports are typically available on the company's investor relations website or through the Securities and Exchange Commission (SEC)'s EDGAR database.

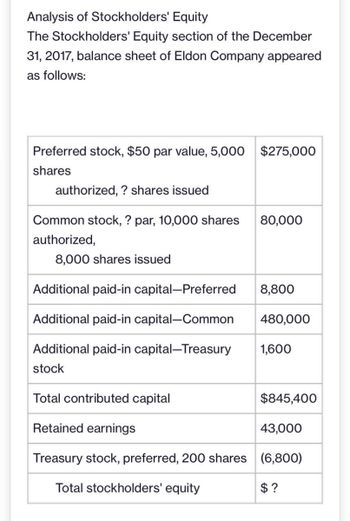

The 10-K annual report is a comprehensive document that provides a detailed overview of a company's financial performance and operations. Look for the section on shareholders' equity or the balance sheet to find the number of issued and outstanding shares. Similarly, the 10-Q quarterly report provides updated financial information throughout the year.

Third-party financial websites like Yahoo Finance and Bloomberg also often provide the number of issued and outstanding shares in their company profiles. These platforms aggregate financial data from various sources, making it easier for investors to access key information.

Real-World Examples

Consider Apple Inc. (AAPL). By examining Apple's most recent 10-K filing, an investor can easily find the number of shares of common stock issued and outstanding. This information, alongside other financial metrics, can be used to evaluate Apple's performance and make informed investment decisions.

Similarly, analyzing the 10-K report of Tesla, Inc. (TSLA) reveals the number of issued shares and helps investors understand the company's capital structure. Changes in the number of issued shares over time can indicate Tesla's strategic direction, such as fundraising efforts or stock-based compensation plans.

Understanding the number of issued shares is paramount for accurate valuation and informed investment decisions. It allows you to better understand the true economic position of a company.

These examples highlight the importance of knowing how to find and interpret the number of issued shares. By regularly monitoring this figure, investors can stay informed about changes in a company's ownership structure and make more strategic investment choices.

Conclusion

The number of shares of issued stock is more than just a number. It's a vital piece of the puzzle that paints a comprehensive picture of a company's financial health and strategic direction. Its relationship to earnings per share, market capitalization, and shareholder voting rights gives you a better understanding of a public entity.

By understanding the nuances of issued stock, investors can move beyond surface-level analysis and gain a deeper appreciation for the complexities of corporate finance. Ultimately, this knowledge empowers them to make more informed and confident investment decisions.

So, the next time you encounter a company's financial report, take a moment to focus on the number of shares of issued stock. It may seem like a small detail, but it holds the key to unlocking a deeper understanding of the company's true value and potential.

.jpg)

.jpg)