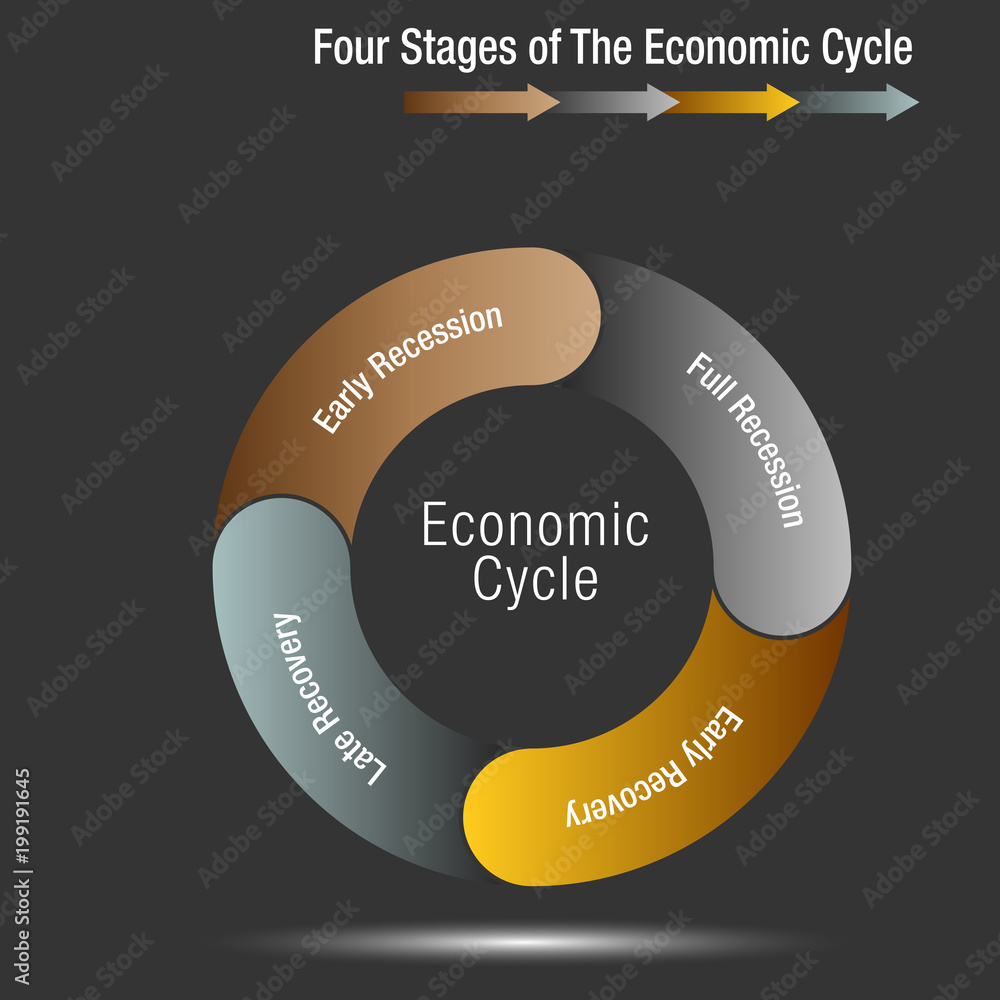

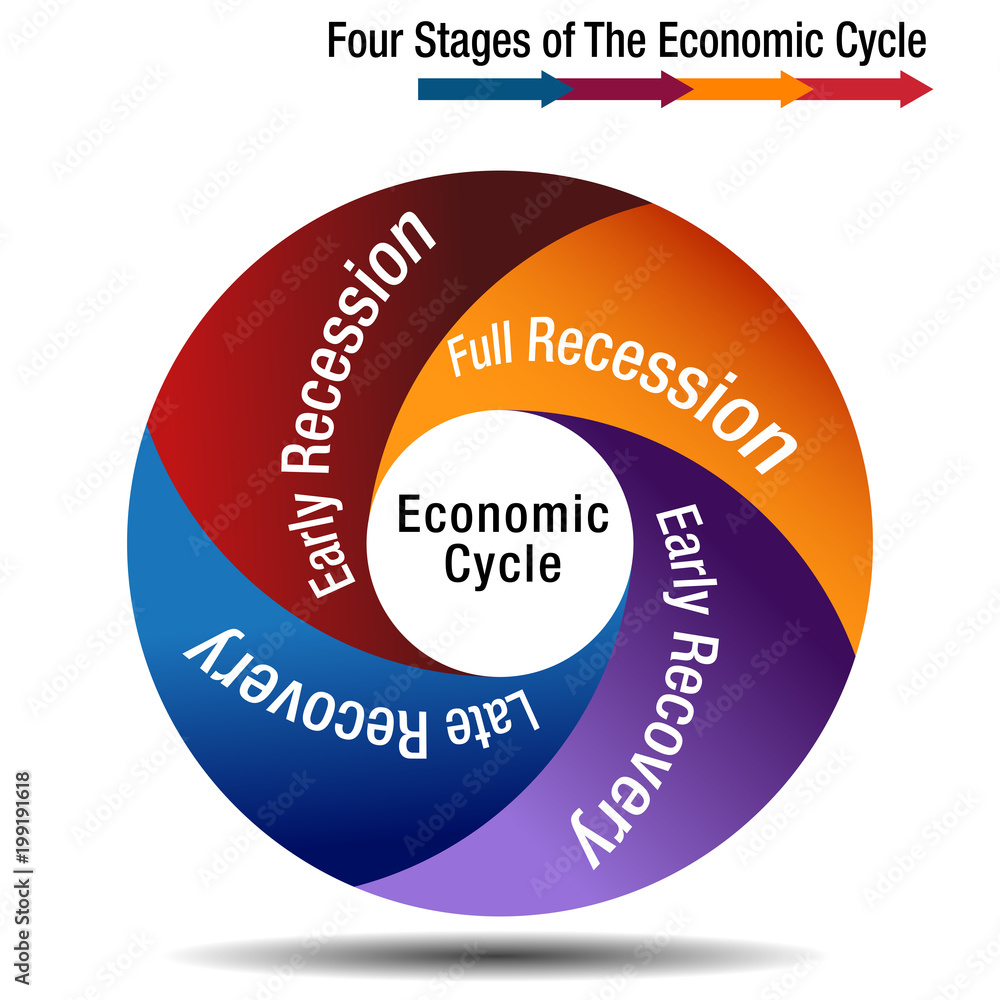

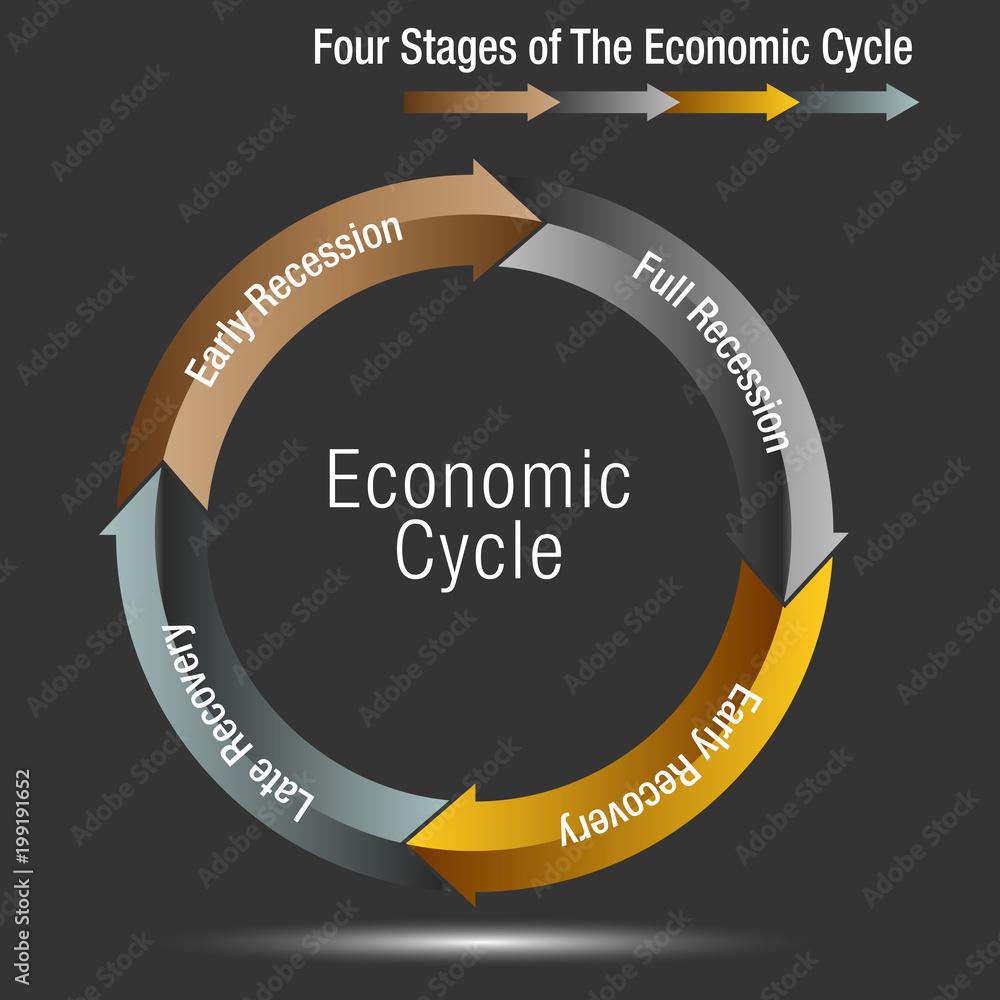

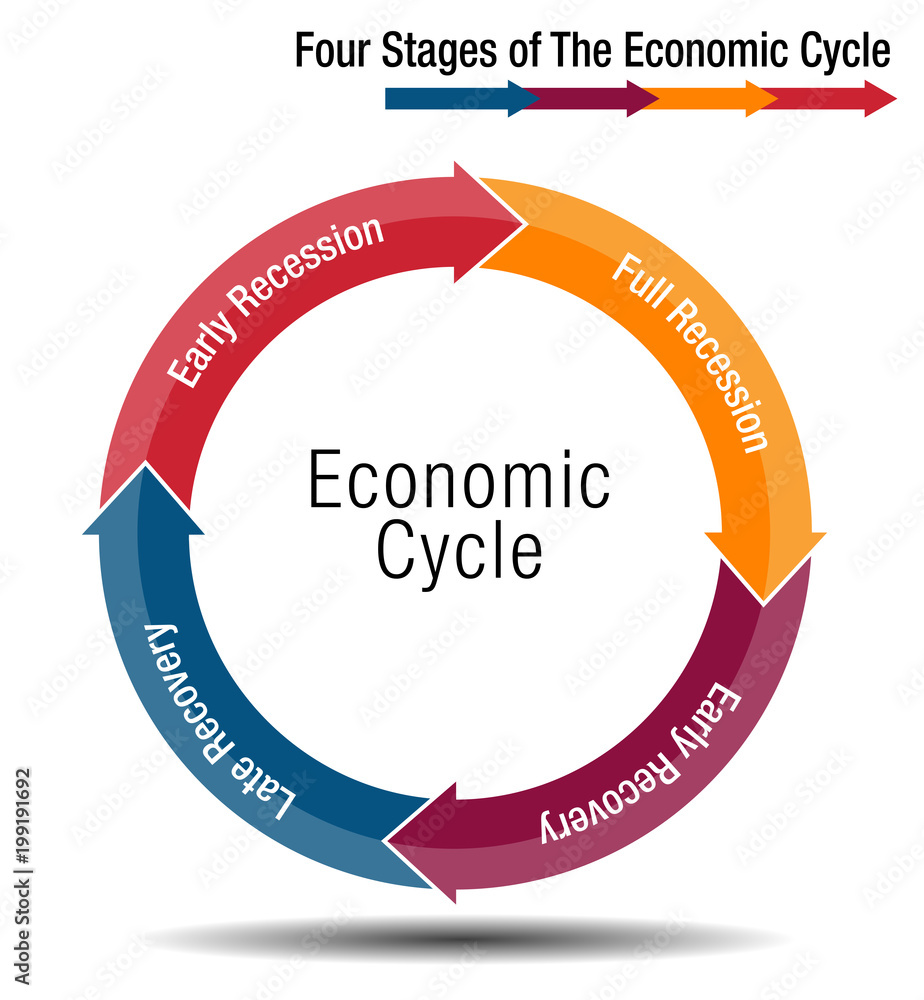

There Are Four Stages In An Economic Recovery

Economic recovery is not a monolith, it unfolds in distinct phases. Understanding these stages is crucial for businesses and individuals to navigate the shifting landscape and make informed decisions.

Economists identify four key stages in a typical economic recovery: initial stabilization, early growth, mid-cycle expansion, and late-cycle slowdown. Each stage presents unique challenges and opportunities, requiring tailored strategies for success.

The Four Stages Unveiled

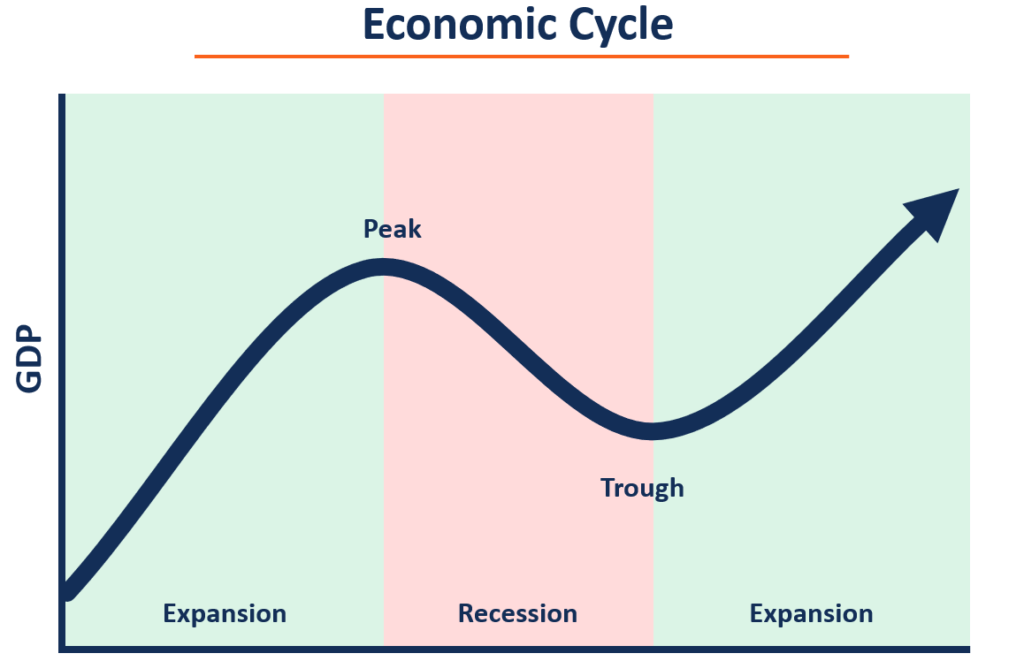

Stage 1: Initial Stabilization

This stage marks the halt of economic decline. Key indicators show a bottoming out, often spurred by government intervention like stimulus packages or interest rate cuts.

Unemployment remains high, but the rate of job losses slows. Consumer confidence begins to tentatively recover, driven by a sense that the worst is over. According to the Bureau of Economic Analysis, during the stabilization phase following the 2008 financial crisis, initial government interventions prevented a complete collapse of the financial system.

Stage 2: Early Growth

The economy shows tangible signs of improvement. Businesses start rehiring, and consumer spending increases moderately.

GDP growth turns positive, albeit often from a low base. Sectors like housing and manufacturing may experience a rebound. Early growth following the COVID-19 pandemic saw a surge in demand for durable goods, pushing manufacturing activity upwards, as indicated by the Federal Reserve's industrial production data.

Stage 3: Mid-Cycle Expansion

This is the strongest phase of the recovery, characterized by robust growth and increasing employment. Businesses invest heavily, and consumer confidence soars.

Inflation may begin to rise, prompting central banks to consider tightening monetary policy. The expansion phase of the late 1990s, fueled by the dot-com boom, saw unemployment rates plummet to historic lows, according to the U.S. Department of Labor.

Stage 4: Late-Cycle Slowdown

Economic growth begins to decelerate. Inflation may persist, even as demand cools down.

Businesses become more cautious, and investment slows. Leading economic indicators, such as the Conference Board's Leading Economic Index, often signal the impending slowdown. This stage is characterized by uncertainty and increased vulnerability to economic shocks.

Navigating the Recovery

Understanding the current stage of the economic recovery is paramount. Businesses need to adapt their strategies accordingly, shifting from cost-cutting during stabilization to aggressive growth during expansion.

Investors should also adjust their portfolios to align with the changing economic environment. Monitoring key economic indicators, such as GDP growth, inflation, and unemployment, is crucial for making informed decisions. The National Bureau of Economic Research (NBER) is the official arbiter of business cycle dating, providing valuable insights into the start and end dates of recessions and expansions.

The current economic landscape remains dynamic. Stay informed, adapt quickly, and seek expert advice to successfully navigate the evolving recovery.

:max_bytes(150000):strip_icc()/phasesofthebusinesscycle-c7cb7a3ce6894e86a3e44d5b0fe4d5e2.jpg)

:max_bytes(150000):strip_icc()/200505_ECRI_WhatIsARecession-5c11ba0a53834638897cdf93f119911a.jpg)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)