These Are The Four Stages Of The Business Cycle

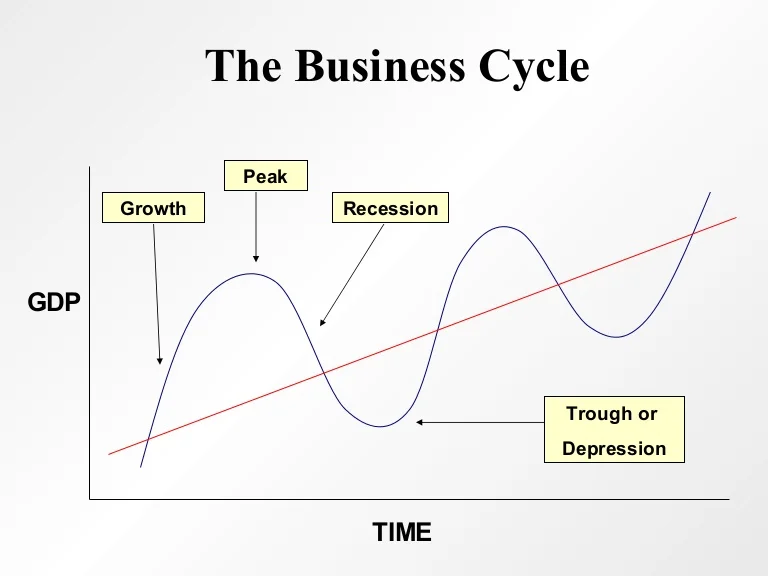

The economy, like the tides, ebbs and flows. Understanding these economic rhythms, known as the business cycle, is crucial for businesses, investors, and individuals alike to make informed decisions.

The business cycle isn't a rigid, predictable timetable, but rather a pattern of economic expansion and contraction. It affects everything from job availability and consumer spending to interest rates and investment opportunities.

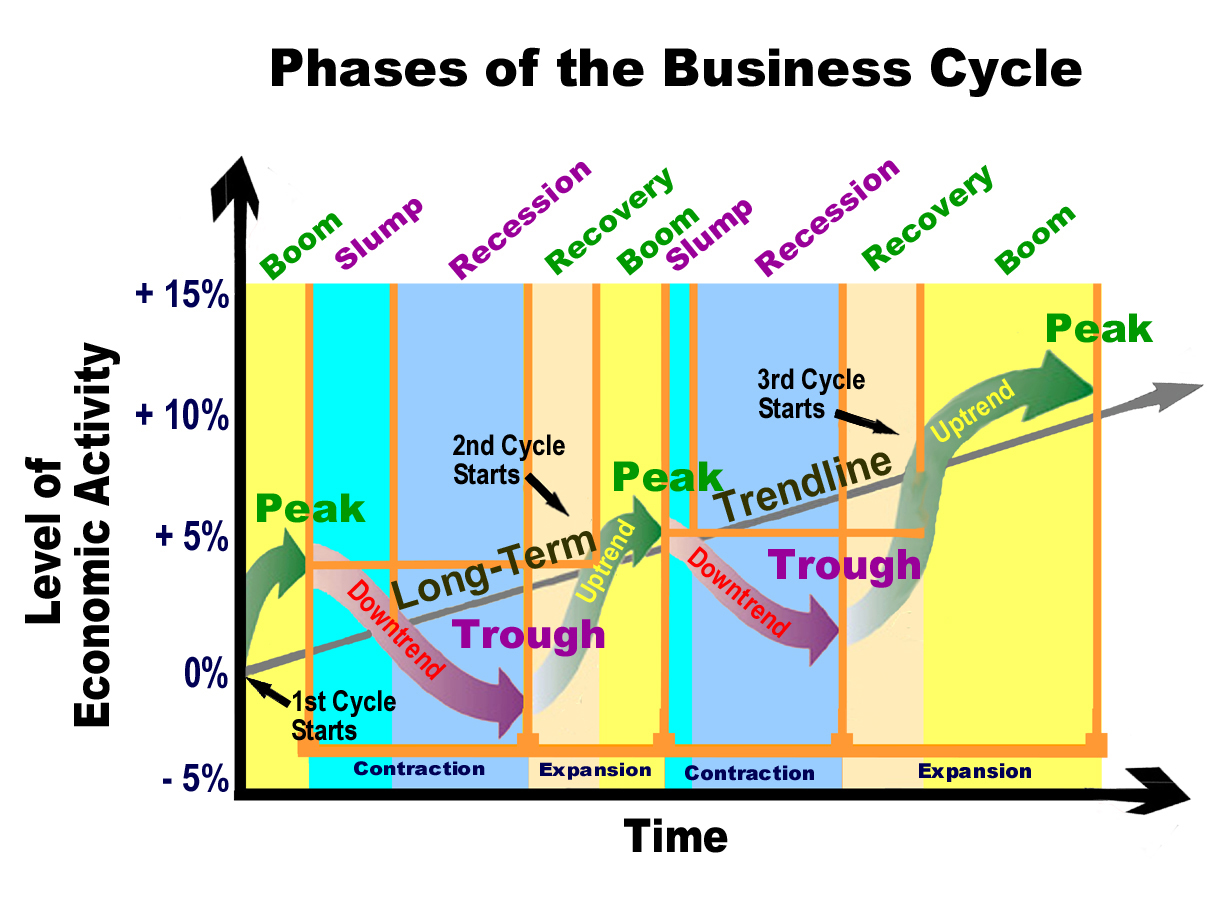

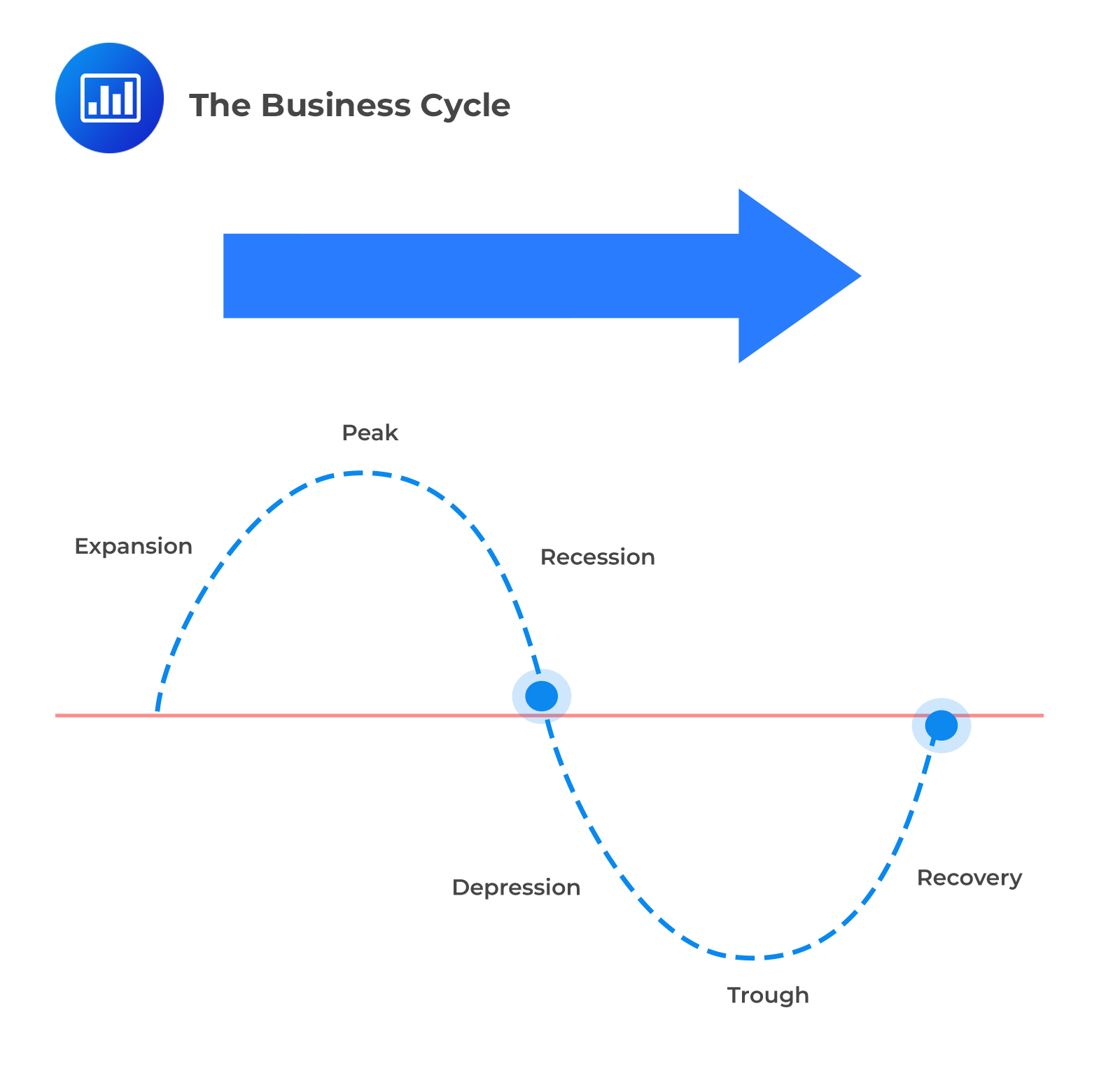

Understanding the Four Stages

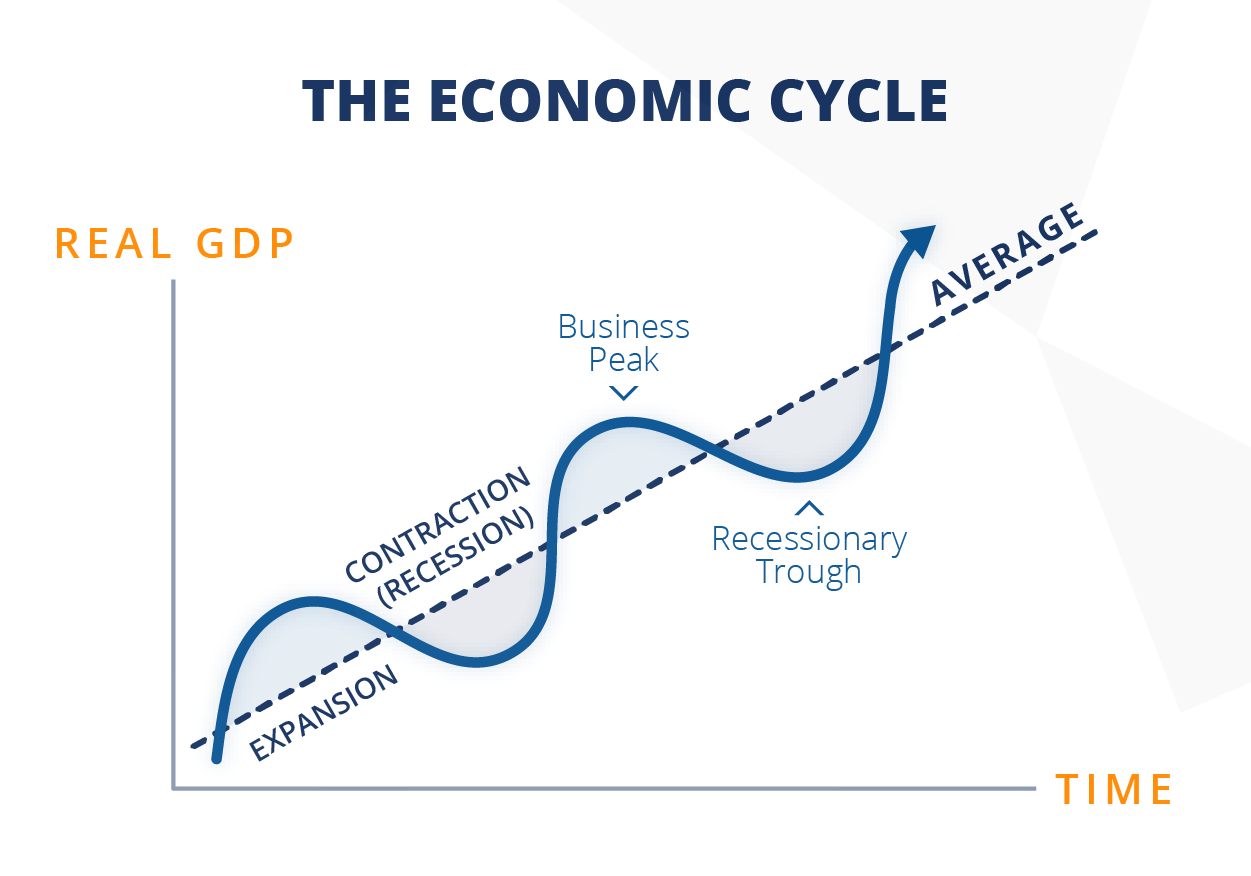

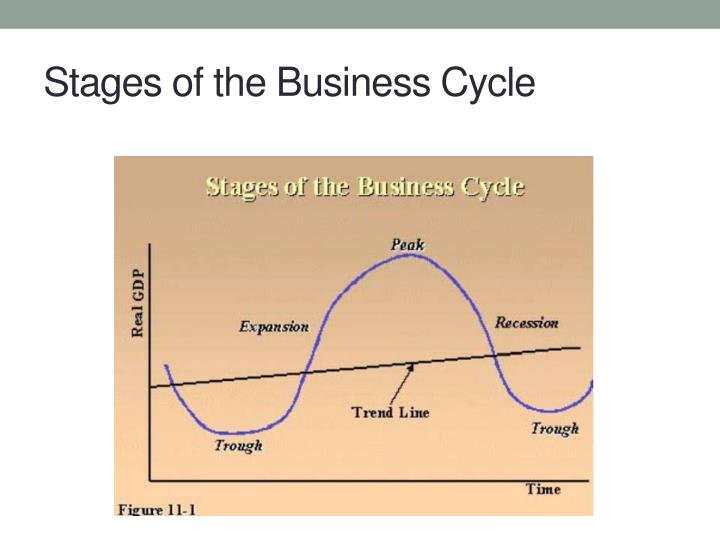

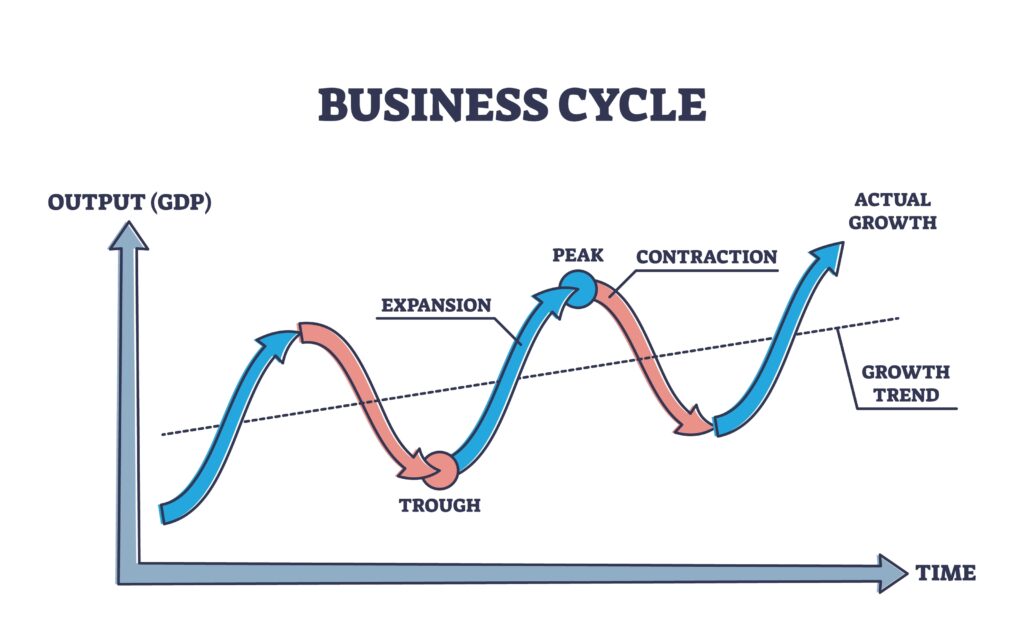

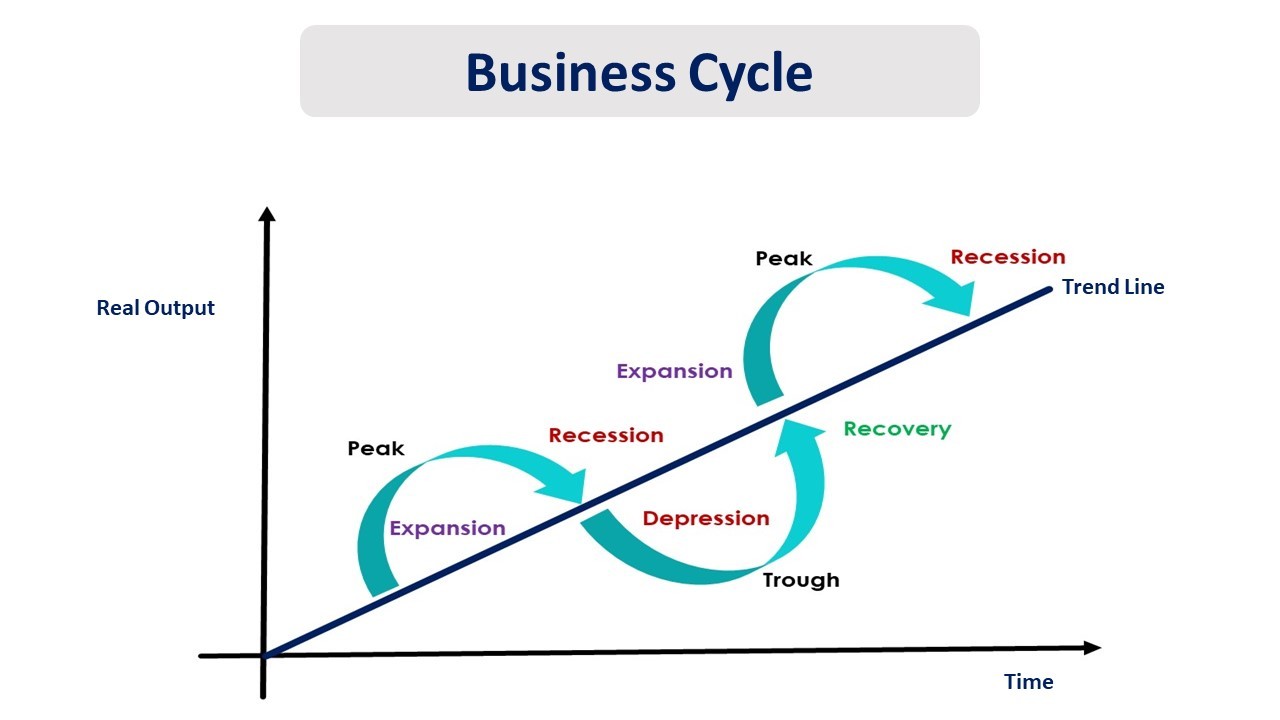

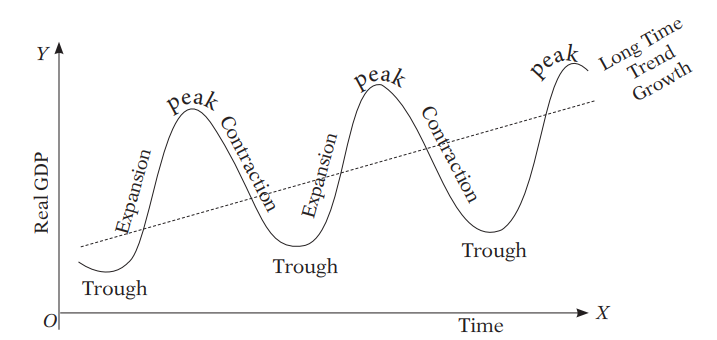

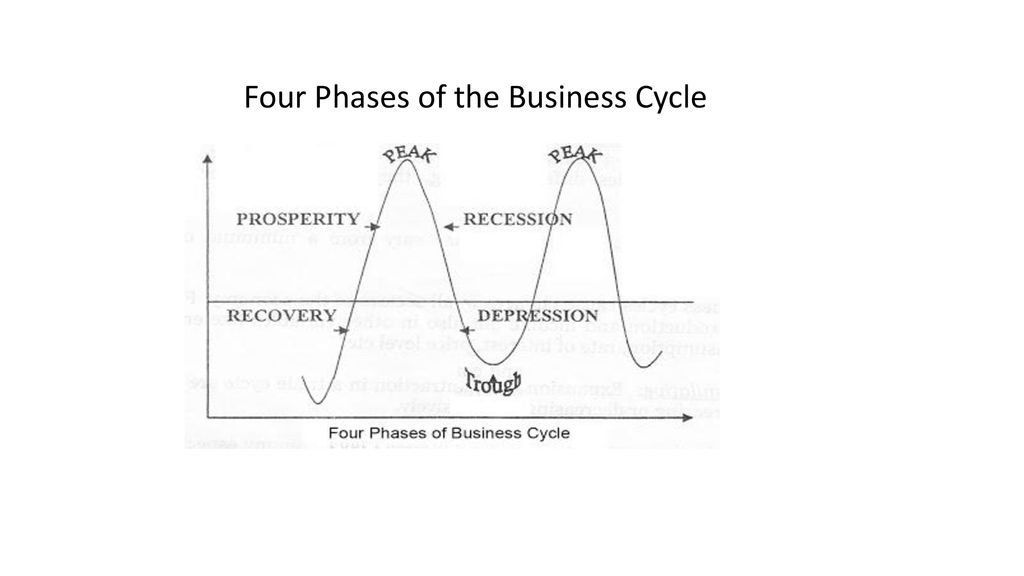

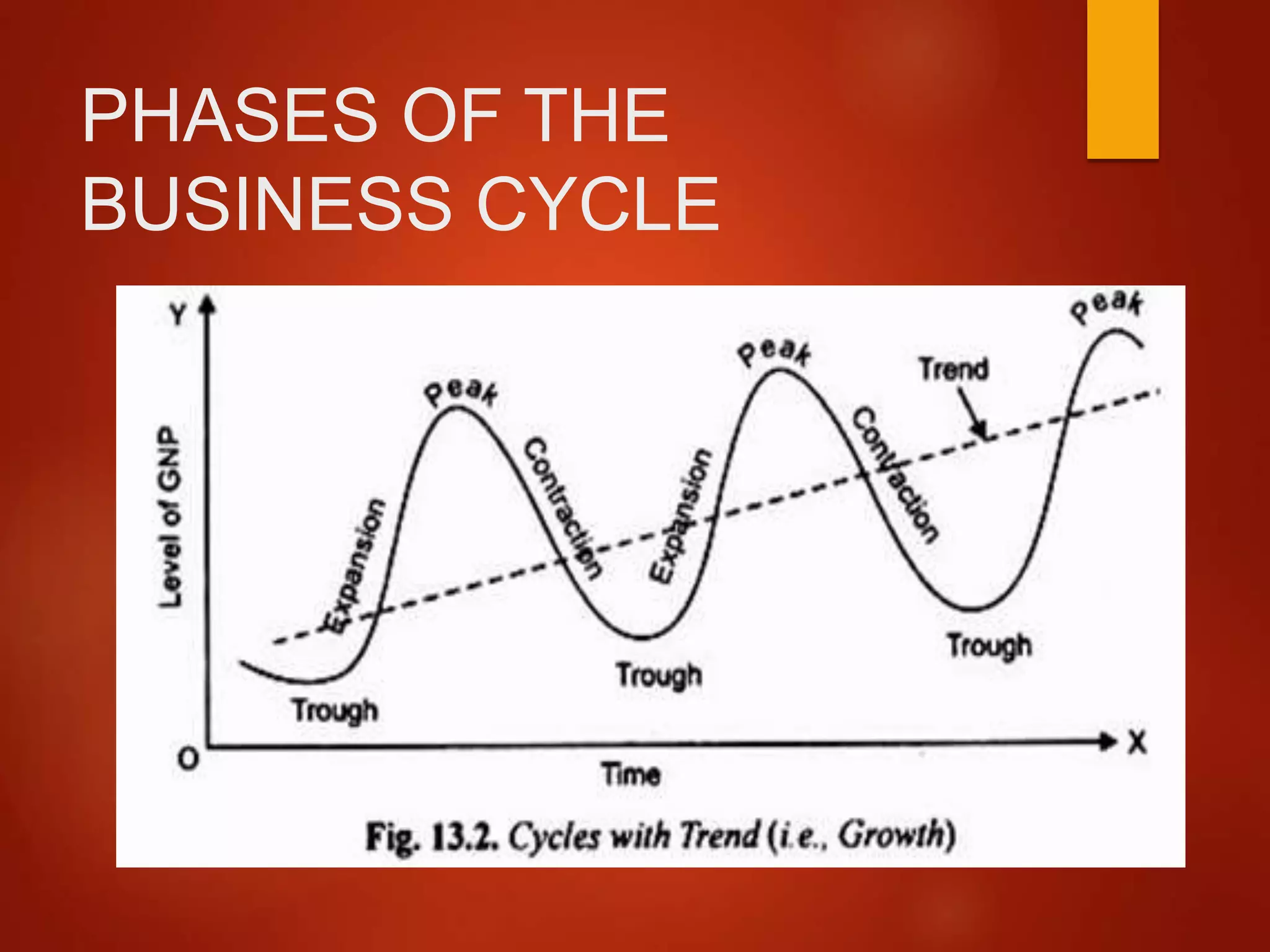

Economists generally agree that the business cycle consists of four distinct stages: expansion, peak, contraction, and trough. Each stage presents unique characteristics and challenges.

Expansion: Growth and Optimism

The expansion phase is characterized by economic growth, increasing employment, rising consumer confidence, and expanding business investments. Gross Domestic Product (GDP) is on the rise, signaling a healthy economy.

During this period, companies are more likely to hire new employees and invest in new technologies, leading to increased productivity and profitability.

Interest rates may begin to rise as demand for credit increases, but the overall sentiment remains positive.

Peak: The Turning Point

The peak represents the highest point of economic activity in the cycle. It's the moment before the economy begins to slow down.

At the peak, economic growth typically reaches its maximum potential, and inflationary pressures may start to build. Resources may become scarce and labor markets tight.

This stage often signals a shift in economic policy, with central banks potentially intervening to curb inflation through higher interest rates.

Contraction: Slowdown and Uncertainty

The contraction phase, also known as a recession, is marked by a decline in economic activity. GDP shrinks, unemployment rises, and consumer spending decreases.

Businesses may cut back on investments and lay off employees to reduce costs. This creates a vicious cycle, as decreased consumer spending further weakens the economy.

According to the National Bureau of Economic Research (NBER), the official arbiter of recessions in the United States, a recession is "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

Trough: The Bottom and Recovery

The trough represents the lowest point of economic activity in the cycle. It marks the end of the contraction phase and the beginning of a new expansion.

At the trough, economic indicators are at their lowest, and consumer confidence is generally weak. However, this is also the point where the seeds of recovery are sown.

Government policies, such as lower interest rates or fiscal stimulus, may be implemented to stimulate economic growth. Businesses may begin to slowly increase production and hiring in anticipation of a future upturn.

The Impact on You

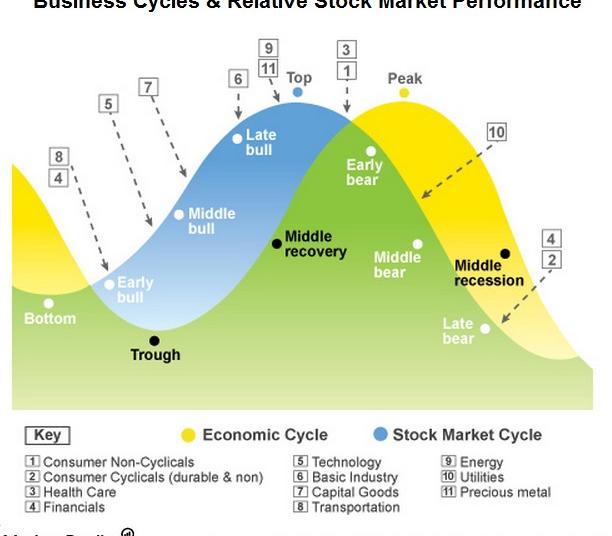

Understanding the business cycle can help individuals make better financial decisions. For example, during an expansion, it may be a good time to invest in the stock market or purchase a home.

Conversely, during a contraction, it may be prudent to reduce debt and build up savings. Staying informed about the current stage of the business cycle can empower individuals to navigate economic uncertainties and make informed decisions about their financial futures.

"The business cycle is a recurring pattern, but each cycle is unique. Understanding its underlying forces can help businesses and individuals prepare for the future," said Dr. Anya Sharma, a leading economist at the Institute for Economic Forecasting.

Looking Ahead

Predicting the precise timing and duration of each stage of the business cycle remains a challenge. Numerous factors, including government policies, global events, and technological innovations, can influence the economy's trajectory.

However, by monitoring key economic indicators and understanding the underlying dynamics of the business cycle, businesses and individuals can better anticipate and prepare for the economic shifts that lie ahead. Recognizing these patterns allows for proactive adaptation and more informed planning.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)